Claim Against Bond Form

Description

How to fill out Claim Against Bond Form?

There's no longer any need to squander time looking for legal documents to adhere to your local state statutes.

US Legal Forms has gathered all of them in one location and improved their accessibility.

Our platform provides over 85k templates for any business and personal legal situations organized by state and area of application. All forms are expertly drafted and verified for accuracy, so you can trust in obtaining an up-to-date Claim Against Bond Form.

Click Buy Now next to the template name when you locate the appropriate one. Select the desired pricing plan and register for an account or Log In. Complete your subscription payment with a credit card or via PayPal to proceed. Choose the file format for your Claim Against Bond Form and download it to your device. Print your form to fill it out manually or upload the sample if you prefer to edit online. Creating formal documentation under federal and state regulations is quick and easy with our platform. Try out US Legal Forms today to maintain your paperwork in order!

- If you are acquainted with our service and already possess an account, ensure your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all saved documents whenever necessary by accessing the My documents tab in your profile.

- If you've never utilized our service before, the procedure will require a few additional steps to complete.

- Here's how new users can obtain the Claim Against Bond Form from our catalog.

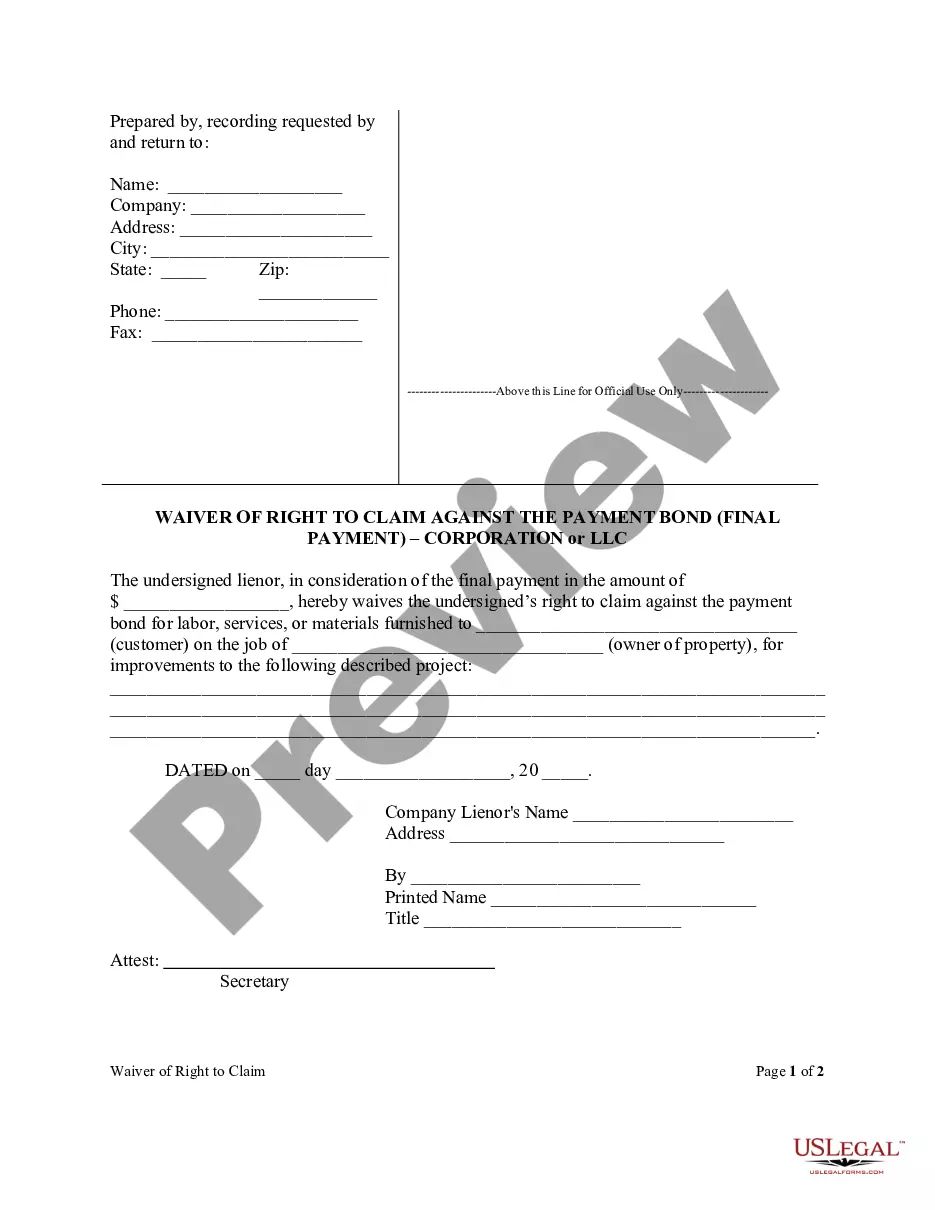

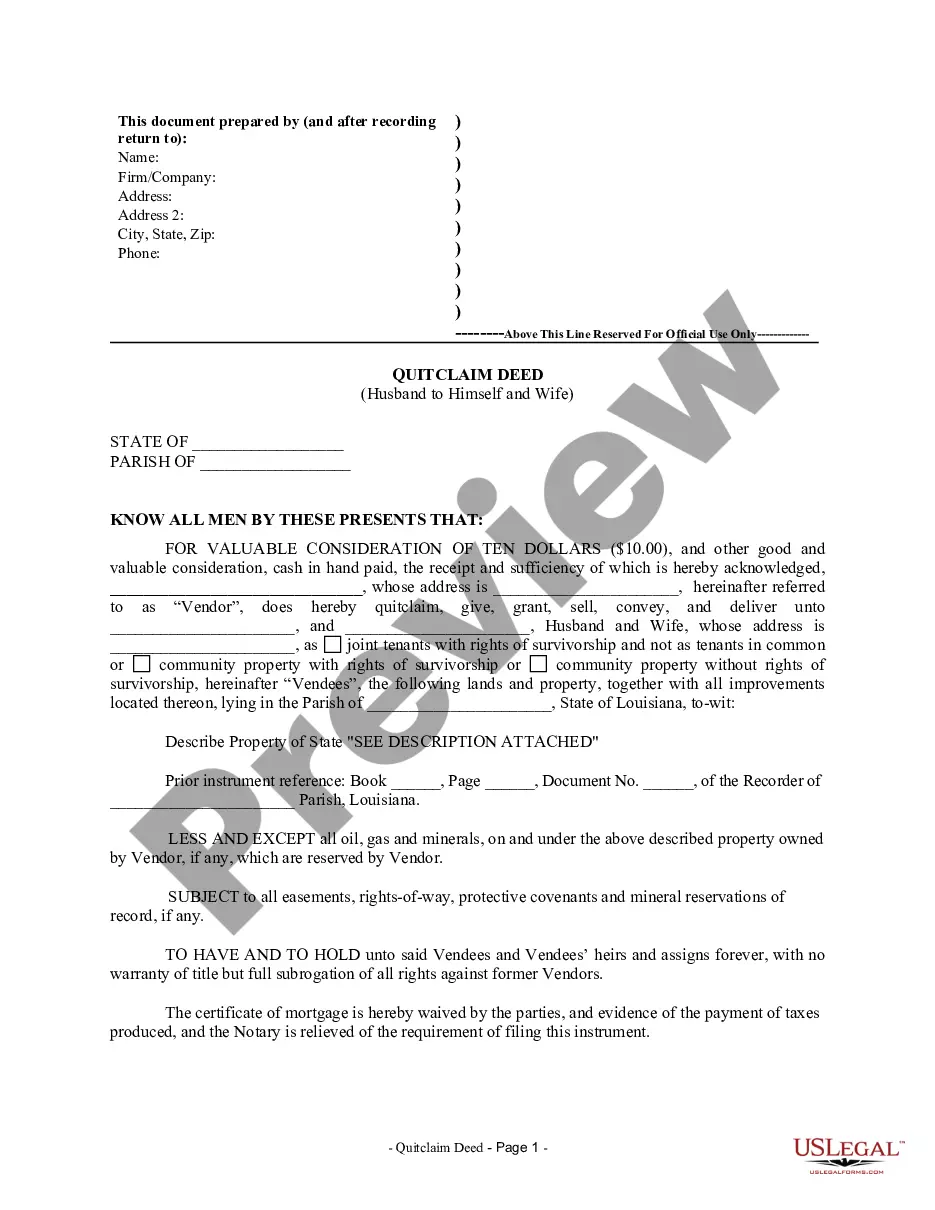

- Examine the page content closely to confirm it includes the template you require.

- To do this, utilize the form description and preview options if available.

- Use the Search field above to find another template if the current one does not suit you.

Form popularity

FAQ

The process of a surety bond begins with the principal applying for the bond through a surety company. The surety company assesses the applicant’s creditworthiness and business practices. Once approved, the principal pays a premium, and the bond is issued, which holds the surety responsible if the principal fails to meet their obligations. This process is streamlined with services like US Legal Forms, making it easier to navigate and understand the necessary steps.

To fill out a bond request form, start by gathering essential information such as the bond amount, the parties involved, and the specific reasons for the bond. Provide accurate details to ensure clarity and avoid delays. Once you have completed the form, review it for any errors before submitting. Utilizing a user-friendly platform like US Legal Forms can simplify this process by offering pre-made templates for your bond request.

A real example of a bond includes a construction performance bond, which guarantees that a contractor will complete a project according to the contract terms. If the contractor defaults, the project owner can file a claim using a claim against bond form. This bond provides financial security, ensuring that necessary funds are available to either complete the project or compensate the owner for their losses.

Claiming a bond means that a party is seeking compensation for financial losses resulting from another party's failure to meet contractual obligations. This process involves filing a claim against bond form, which notifies the surety of the breach. The surety then investigates the claim and, if valid, compensates the claimant according to the bond terms.

To put a claim on a surety bond, start by collecting all necessary documentation to support your claim, such as contracts and correspondences. Next, complete the claim against bond form with all required information accurately. Submit the form to the surety company, ensuring you follow their specific procedures and keep a copy for your records.

A bid bond claim can happen when a contractor wins a project but refuses to perform after winning the bid. If this occurs, the owner can submit a claim against the bid bond using a claim against bond form. This enables the owner to recover expenses related to re-bidding the project, ensuring they are not financially burdened by the contractor's negligence.

Bond claims arise when one party alleges that another party has not met their contractual obligations, leading to financial loss. These claims enable the injured party to seek restitution through the surety bond. When a claim is filed, the surety company investigates the situation and decides on the validity of the claim based on the claim against bond form submitted.

An example of a surety bond claim could involve a contractor failing to complete a project on time. If the contractor cannot fulfill their obligations, the project owner can use a claim against bond form to seek compensation from the bonding company. This process ensures that the project owner receives the funds necessary to complete the project, upholding the integrity of the contract.

To make a claim against a performance bond, you first need to gather relevant documents, including your contract and proof of non-performance. Next, fill out the required claim against bond form, clearly stating the details of the claim. Submit this form to the surety bond company in compliance with their procedures and keep copies of all correspondence for your records.

Enforcing a performance bond requires a clear understanding of the bond's terms and the reasons for enforcement. Begin by seeking any unpaid amounts through the claim against bond form, documenting your claims thoroughly. If the surety company does not fulfill their obligations, consider legal action to pursue enforcement. A knowledgeable attorney can assist in navigating the enforcement process and ensuring your rights are protected.