Advance Payment Bond Format

Description

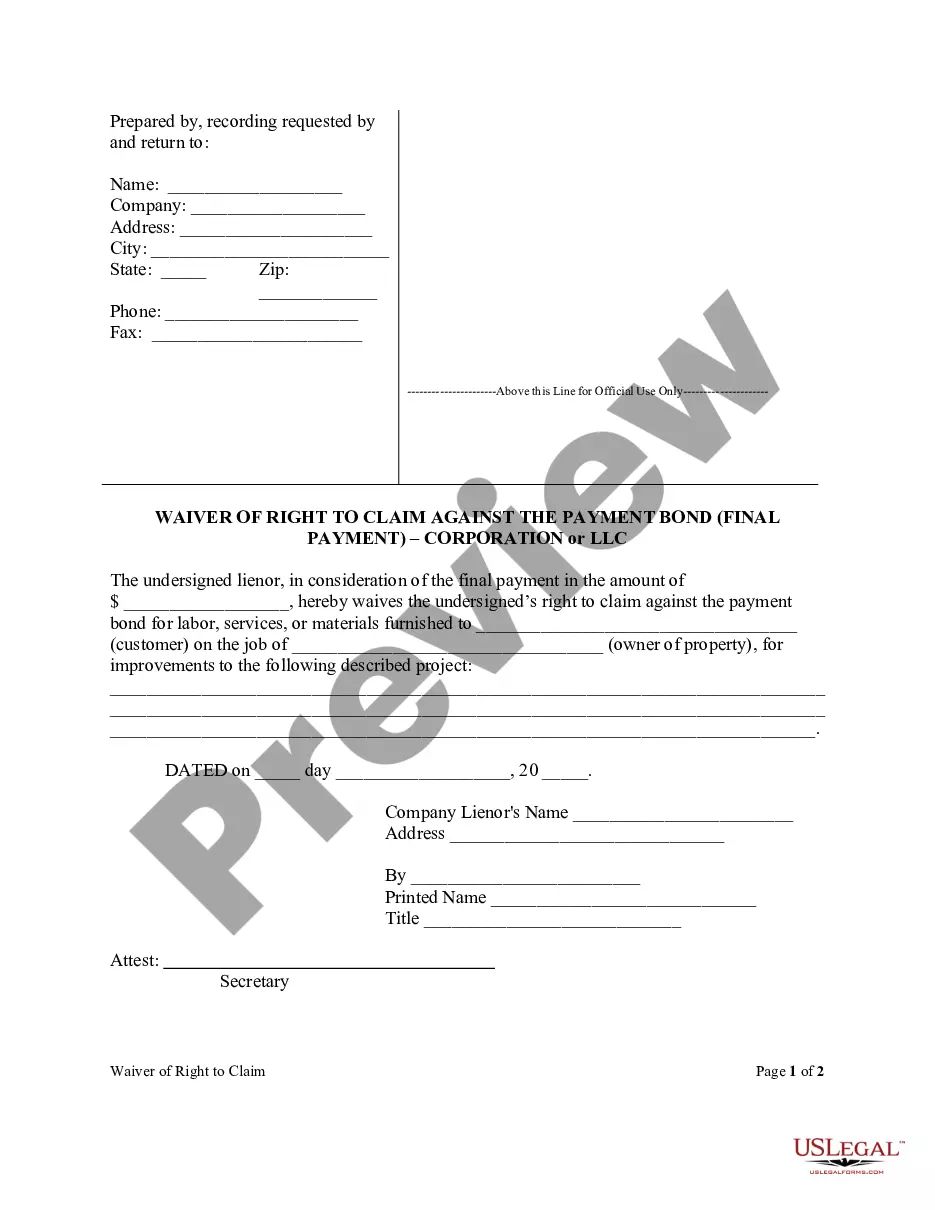

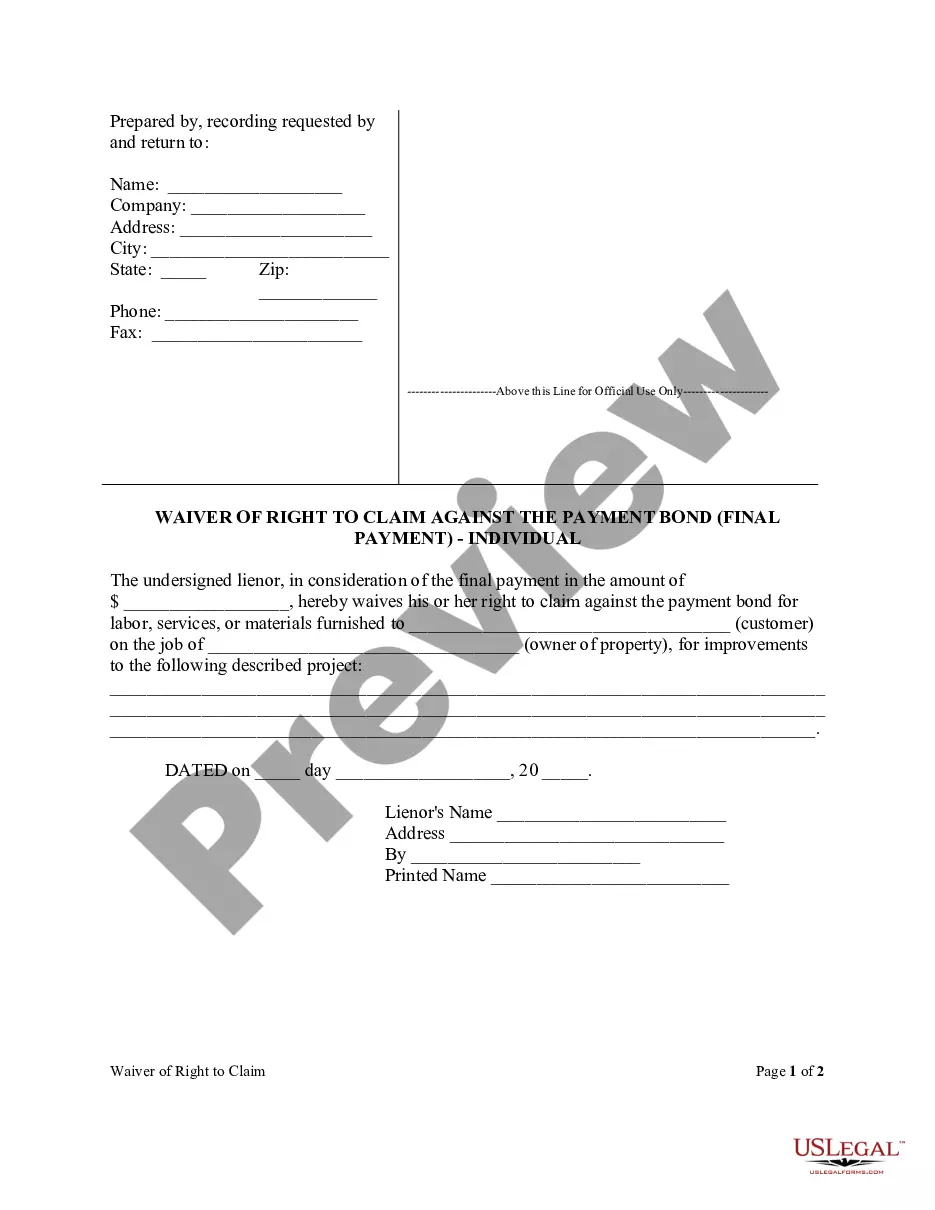

How to fill out Florida Waiver Of Right To Claim Against The Payment Bond (Final Payment) - Corporation Or LLC?

Engaging with legal paperwork and processes can be a lengthy addition to your schedule.

Advance Payment Bond Template and similar forms usually require you to locate them and navigate the best methods to fill them out correctly.

As a result, if you are managing fiscal, legal, or personal issues, utilizing a comprehensive and accessible online library of documents will be highly beneficial.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific documents and a range of resources designed to help you finalize your paperwork swiftly.

Is this your first time using US Legal Forms? Sign up and create a free account in just a few minutes, and you will gain access to the document library along with the Advance Payment Bond Template. Then, follow the instructions below to complete your document: Ensure you have identified the correct form by utilizing the Review feature and examining the form details.

- Explore the collection of relevant documents available with just one click.

- US Legal Forms provides you with state- and county-specific forms available for download at any time.

- Enhance your document management processes with a premium service that enables you to prepare any form in minutes without extra or concealed charges.

- Simply Log In to your account, find Advance Payment Bond Template, and download it instantly from the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

Guaranteed advances refer to payments made before the completion of work, ensuring suppliers or contractors have the funds they need to start a project. These advances are often secured by performance bonds. Knowing the advance payment bond format allows you to better understand how these guarantees function within contractual obligations.

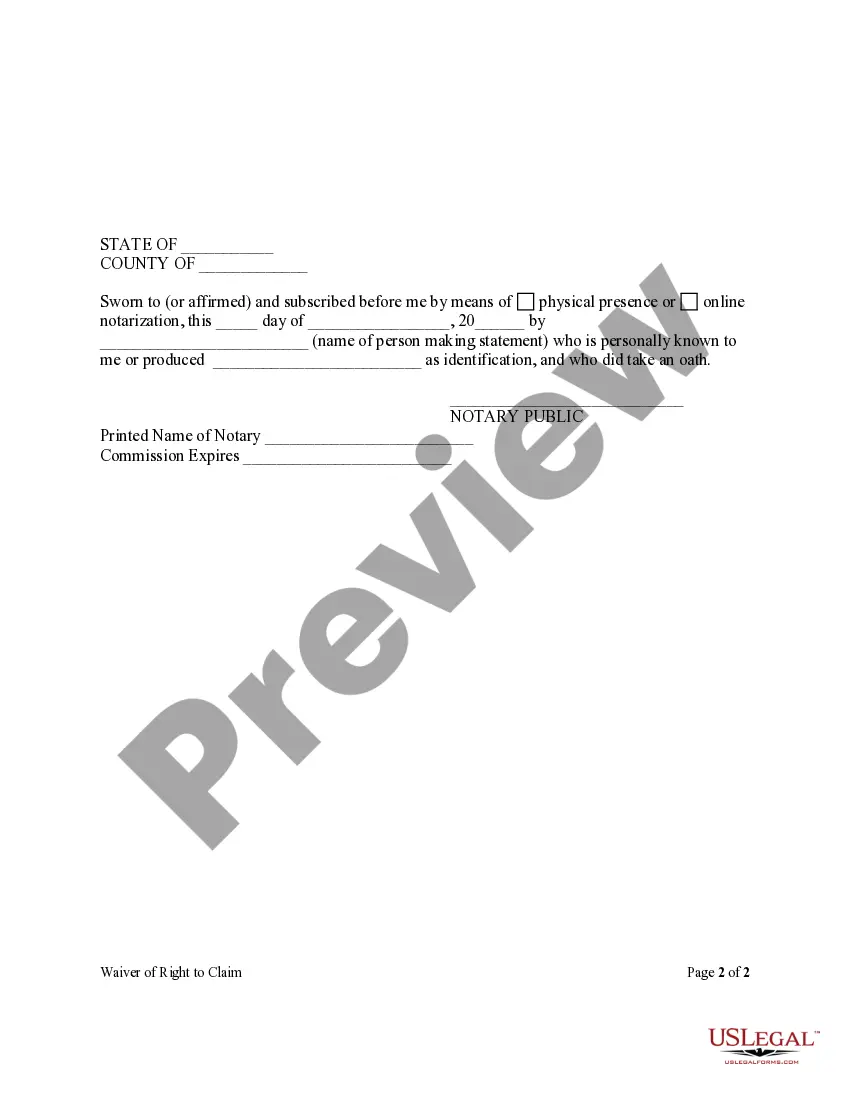

Filling out a performance bond requires a few essential steps. Typically, you provide details about the parties involved, project specifications, and the amount of the bond. Ensure you follow the advance payment bond format to meet legal requirements and submit the bond correctly to protect your investment.

An Advance Payment bond, commonly known as an AP bond, protects buyers when they make upfront payments to contractors or suppliers. This bond ensures that if the contractor fails to deliver as promised, the buyer can recover their advance payment. Understanding the advance payment bond format helps you navigate contract agreements effectively.

Yes, you can often make payments on your bond depending on the terms outlined in your advance payment bond format. Many providers offer flexible payment options, allowing you to make partial payments or set up a payment plan if necessary. It's advisable to contact your bond issuer to discuss your options. US Legal Forms can help you understand the payment structure and provide the necessary documents to facilitate this process.

An example of a payment bond is one posted by a general contractor prior to starting work on a construction project, ensuring payment to all subcontractors and suppliers. If the contractor defaults, the bond guarantees that these parties will still receive their due amounts. Knowing the advance payment bond format helps in crafting such bonds correctly to protect everyone involved. For reliable templates, visit uslegalforms, where you can find various payment bond examples.

The primary difference lies in their purpose: a performance bond guarantees that a contractor will complete the project as specified, whereas an advance payment bond secures the return of any upfront payments if the contractor fails to meet their obligations. Both bonds serve to protect the project owner but cover different aspects of the contractor's performance. When you use the right advance payment bond format, you can clearly distinguish between these two types of bonds, ensuring you have the right protections in place.

An advance payment guarantee is a commitment ensuring that the contractor will return any advance payments if they do not fulfill their contract. For instance, if a contractor receives a deposit for materials but fails to deliver, the advance payment guarantee secures the funds for the project owner. Using an effective advance payment bond format can clarify this obligation, reducing the risk of disputes during project execution. This safeguard enhances confidence between parties.

The project owner or the entity that requires the bond, known as the obligee, holds the payment and performance bond. This bond protects them in case the contractor fails to meet their obligations. By using an advance payment bond format, you ensure all critical terms are clearly defined, safeguarding the interests of all parties involved. Thus, you achieve peace of mind while focusing on project completion.

To obtain a payment and performance bond, you need to contact a surety company or an insurance provider specializing in bonding. They will guide you through the process, which typically involves providing financial documents and project details. You can use the advance payment bond format provided by platforms like uslegalforms to ensure all necessary information is included. Once approved, the bond is issued, assuring your project complies with required standards.