Payment Bond Claim Form

Description

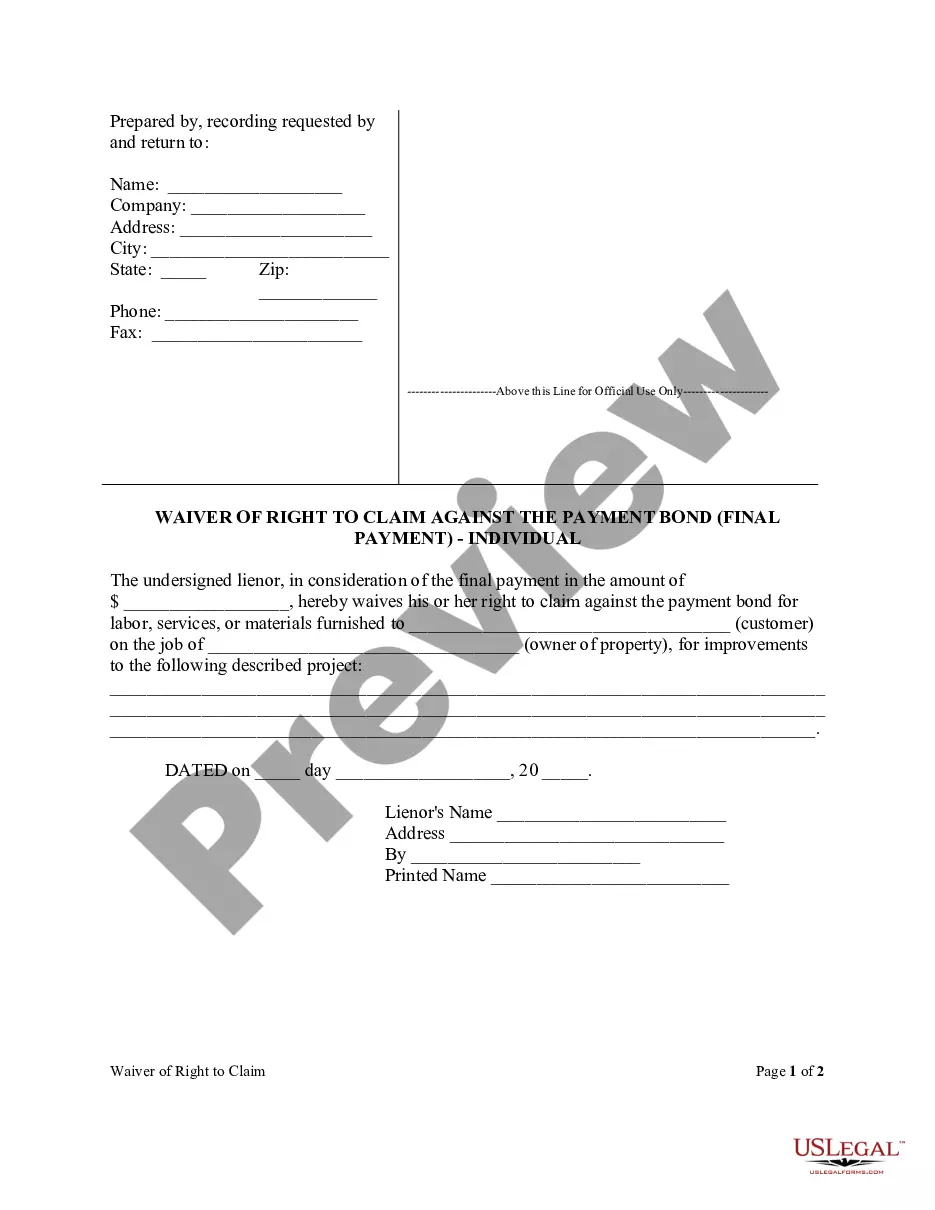

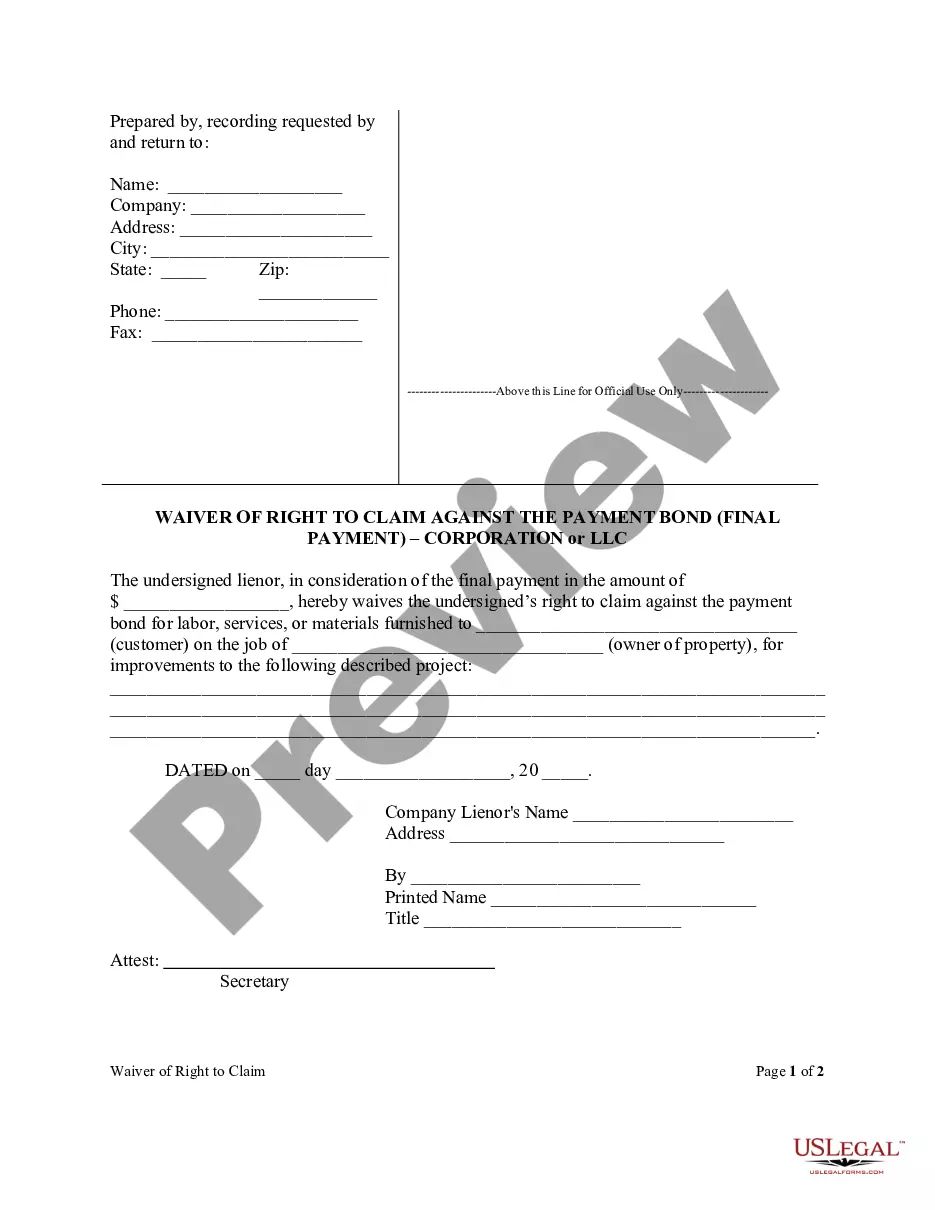

How to fill out Florida Waiver Of Right To Claim Against The Payment Bond (Final Payment) - Individual?

When you are required to submit a Payment Bond Claim Form that adheres to your local jurisdiction's rules, there can be numerous options to choose from.

There’s no need to scrutinize every form to ensure it fulfills all the legal requirements if you are a US Legal Forms subscriber.

It is a trustworthy resource that can assist you in obtaining a reusable and current template on any topic.

Acquiring expertly crafted official documents becomes simple with US Legal Forms. Additionally, Premium users can take advantage of the powerful built-in features for online document modification and signing. Try it out today!

- US Legal Forms is the largest online directory with a collection of over 85k ready-to-use documents for both business and personal legal situations.

- All templates are confirmed to comply with each state's laws.

- Therefore, when you download the Payment Bond Claim Form from our site, you can be assured that you possess a valid and contemporary document.

- Retrieving the necessary template from our platform is incredibly straightforward.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can access the My documents tab in your profile and get the Payment Bond Claim Form whenever needed.

- If it's your first time using our website, please follow the instructions below.

- Review the recommended page and verify it for alignment with your needs.

Form popularity

FAQ

Obtaining a payment bond involves several steps, including assessing your eligibility and preparing project-related documents. You should reach out to a qualified surety provider who can assist in completing the Payment bond claim form. This form is vital in ensuring that you meet the bonding requirements for your project.

To obtain a payment bond, you can start by contacting a surety agent or insurance company that specializes in bonds. They will guide you through the process, which includes providing necessary documentation and information about the project. Once you have completed the Payment bond claim form, the surety will evaluate your application.

Filing a claim on a surety bond requires you to complete the Payment bond claim form accurately. Start by collecting all necessary documentation, including the contract and evidence of the claim. Submit your completed claim along with supporting documents to the surety company to initiate the claims process.

Payment bonds address risks related to non-payment for labor and materials in construction projects. They protect project owners and contractors by ensuring that subcontractors and suppliers receive their due payments. By using a Payment bond claim form, parties can file a claim in case of payment disputes.

To make a claim against a performance bond, you typically need to gather relevant documents that support your claim. This includes the original contract, any receipts related to the work, and correspondence that demonstrates the breach. Once you have everything prepared, complete the Payment bond claim form and submit it to the surety company for processing.

To put a claim on a surety bond, begin by checking the bond terms and conditions to understand your rights. Next, complete the payment bond claim form, detailing the reasons for the claim and the amount requested. Submit this form to the surety company along with any supporting documentation. If you need assistance, consider using uslegalforms, which offers resources to guide you through the claim process.

To fill out a performance bond, start by gathering the necessary project information, including contract details and parties involved. You will need to include the project owner’s name, the description of work, and the bond amount required. Following this, complete the payment bond claim form accurately to ensure your claim can be processed efficiently if needed. Using a streamlined platform like uslegalforms can simplify this process.

A common example of a surety bond claim occurs when a contractor fails to complete a project as agreed. In such cases, the project owner can file a payment bond claim form to recover losses. This process ensures that stakeholders receive compensation for the contractor's failure to fulfill their contractual obligations. Thus, the surety company steps in to cover the financial loss.

The process of obtaining a surety bond begins with the principal applying for the bond through a surety company. The company assesses the principal’s financial stability and project details. Once approved, the surety issues the bond, providing a guarantee that obligations will be met. If these obligations are not fulfilled, a payment bond claim form can be submitted to claim the bond amount.

To make a surety bond claim, you must first gather relevant documentation, such as the payment bond itself and invoices related to unpaid work. Next, you fill out the payment bond claim form, detailing the nature of your claim and supporting your request with evidence. Once you submit this form to the surety company, they will review your claim and determine its validity. With uslegalforms, you can find comprehensive templates and guidance to ensure you complete this process smoothly.