Notice Of Intent To Lien In Florida

Description

Form popularity

FAQ

In Florida, filing a lien without a Notice to Owner can lead to significant complications. The Notice to Owner is a critical step that helps establish your right to lien. If you skip this step, your ability to enforce the lien may be compromised. Understanding the process, including the role of the Notice of intent to lien in Florida, ensures that you protect your interests effectively.

A registered agent in Florida must be a resident or a registered business entity authorized to conduct business in the state. This agent serves as the official point of contact for legal documents and should have a physical address in Florida. It's important for businesses, especially those involved in construction and liens, to know how the Notice of intent to lien in Florida can impact their operations and timelines.

To obtain a Florida Contractors license, you must meet several criteria. First, you need to demonstrate relevant experience in construction, often requiring a combination of education and work history. You'll also need to pass the necessary exams to prove your knowledge. Lastly, understanding the Notice of intent to lien in Florida is crucial, as it helps protect your rights when dealing with contracts and construction projects.

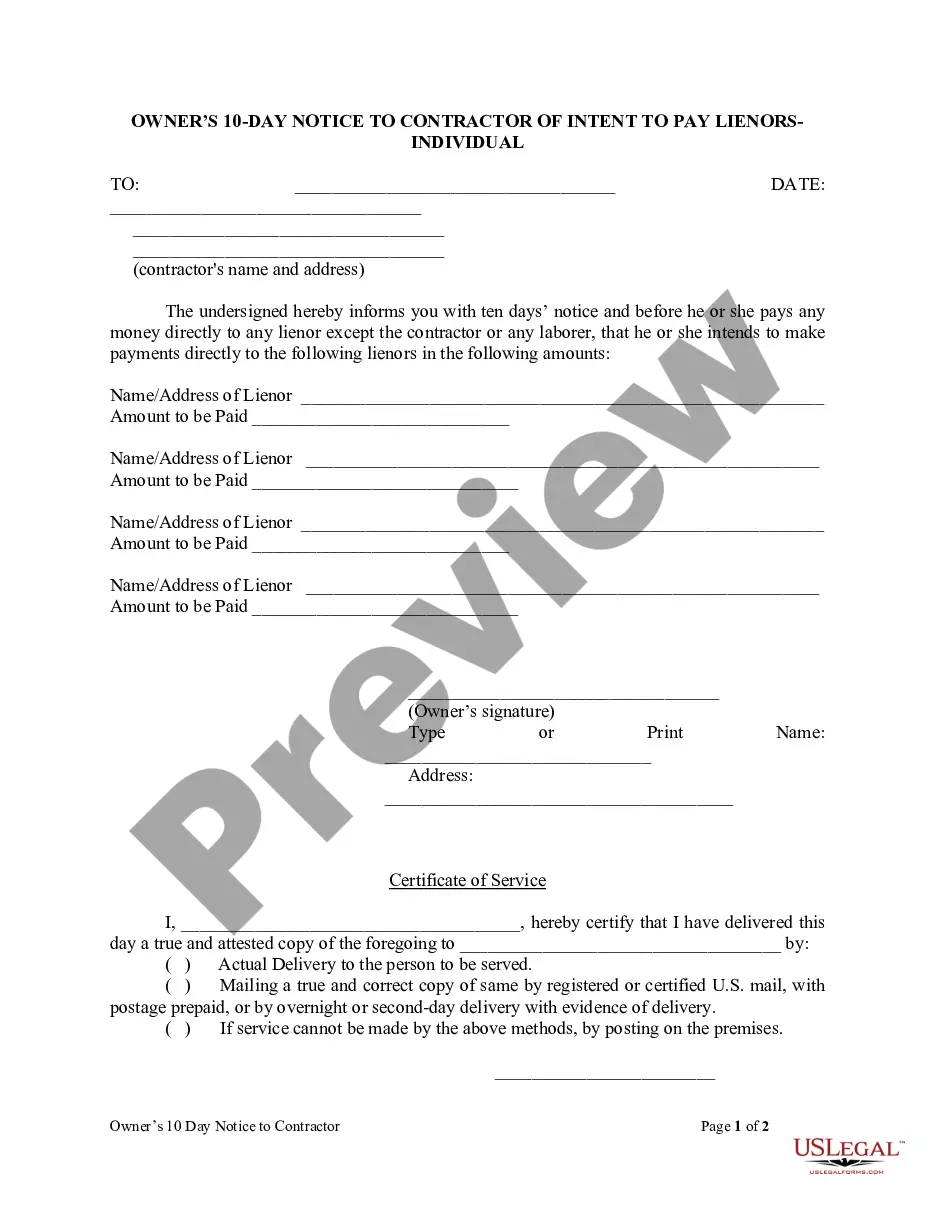

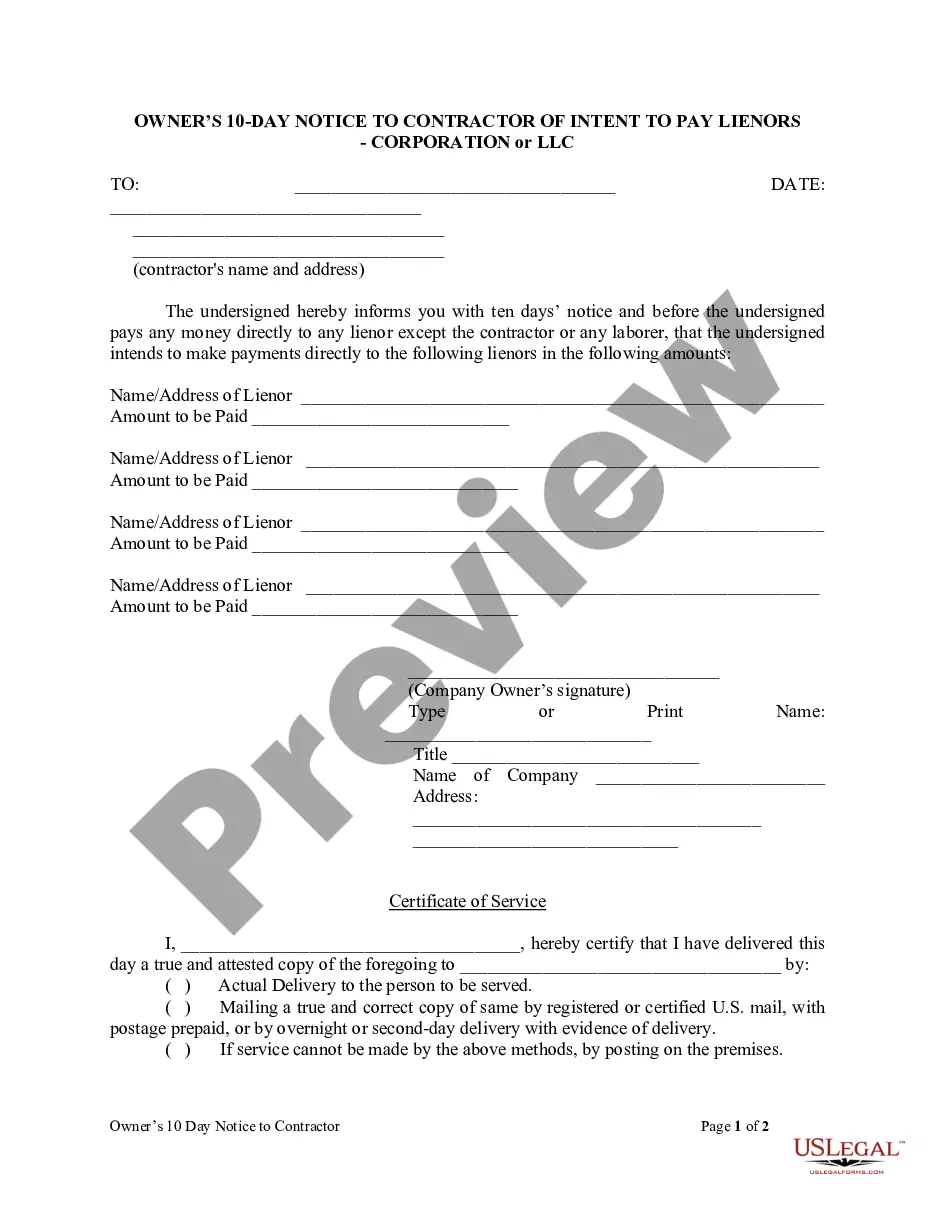

To file a lien in Florida, you must prepare a Notice of Intent to Lien, which includes specific information such as the property owner's details, the creditor's information, and a description of the debt. After the document is completed, you must file it with the county clerk and provide proper notice to the property owner. Utilizing services like US Legal Forms can simplify this process, providing you with the necessary forms and guidance to ensure compliance with Florida law.

In Florida, you generally have one year from the date the debt becomes due to file a Notice of Intent to Lien. This timeframe is crucial for ensuring that your rights are protected. If you miss this deadline, you may lose your ability to file a lien and recover the owed amount, so timely action is essential.

Yes, it is possible for someone to file a lien against your property without your prior knowledge in Florida. When a creditor files a Notice of Intent to Lien in Florida, they can do so without notifying the property owner first. To protect yourself, it is important to regularly check your property records and stay informed about any claims against your property.

A lien in Florida functions as a legal claim against a property in response to unpaid debts. Once a lien is properly filed, typically following the issuance of a Notice of Intent to Lien in Florida, it provides the lienholder the right to seek payment through the property when the owner attempts to sell or refinance. This process ensures subcontractors and suppliers receive compensation for the services provided. Understanding how a lien operates can empower you to make informed decisions regarding property contracts.

The NTO process, or Notice to Owner process in Florida, involves notifying the property owner of potential liens against their property. It serves as a critical step for contractors and suppliers wishing to safeguard their rights to payment. Filing a Notice of Intent to Lien in Florida under this process ultimately reinforces your position in the event of unpaid services. Familiarizing yourself with this process ensures you navigate the complexities of liens efficiently.

In Florida, lien rules involve strict adherence to statutory requirements, including deadlines for filing and notice provisions. The Notice of Intent to Lien in Florida must be delivered before you file a lien, ensuring the property owner is aware of your intention. Additionally, liens generally must be filed within a certain period after the completion of work or the delivery of materials. Understanding these rules is crucial for protecting your rights.

A lien can be declared invalid in Florida for several reasons, such as failure to provide proper notice or filing it too late. If the Notice of Intent to Lien in Florida is not issued within the applicable time frame, the lien may be unenforceable. Inaccurate information in the lien or non-compliance with legal requirements can also invalidate it. Regularly reviewing your documentation and staying informed about legal stipulations is vital.