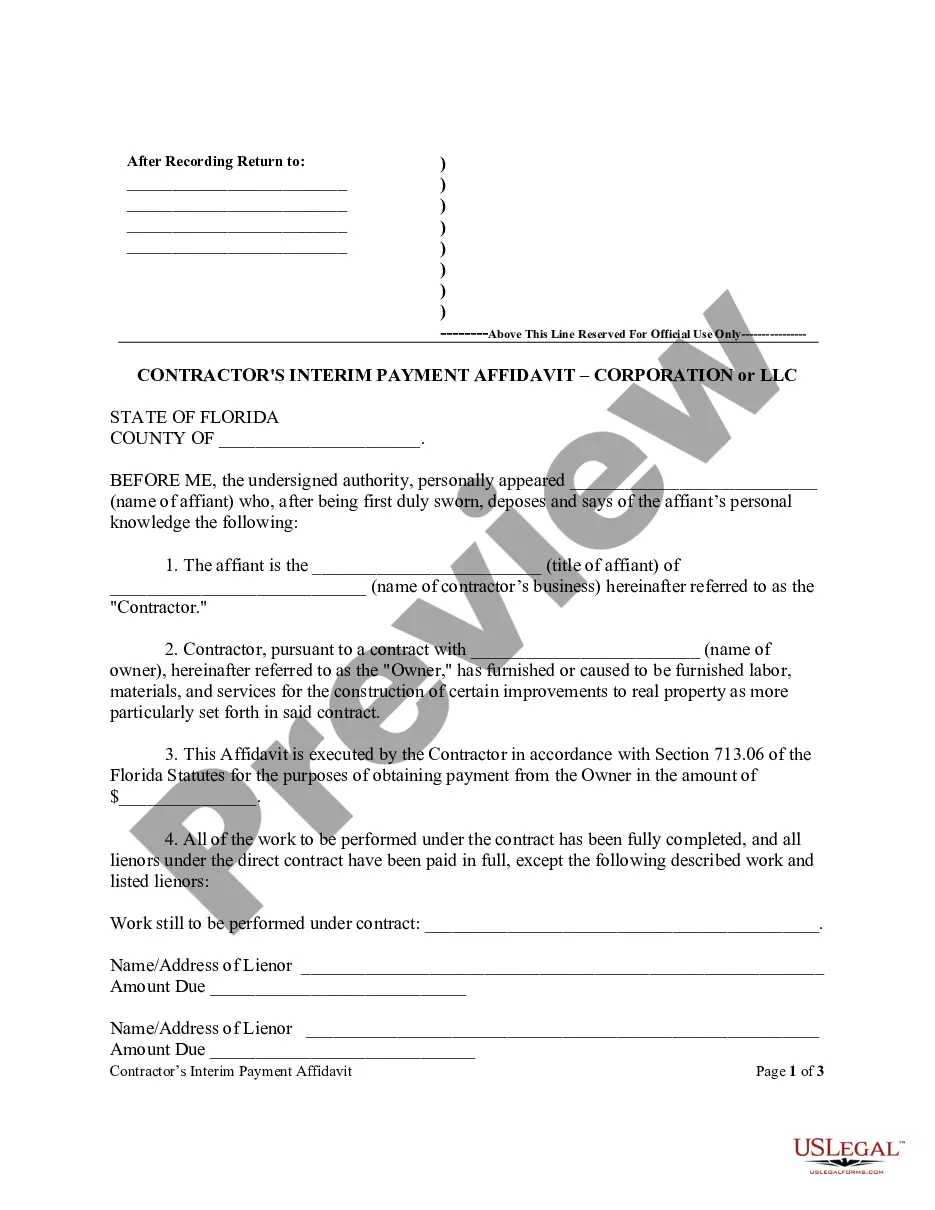

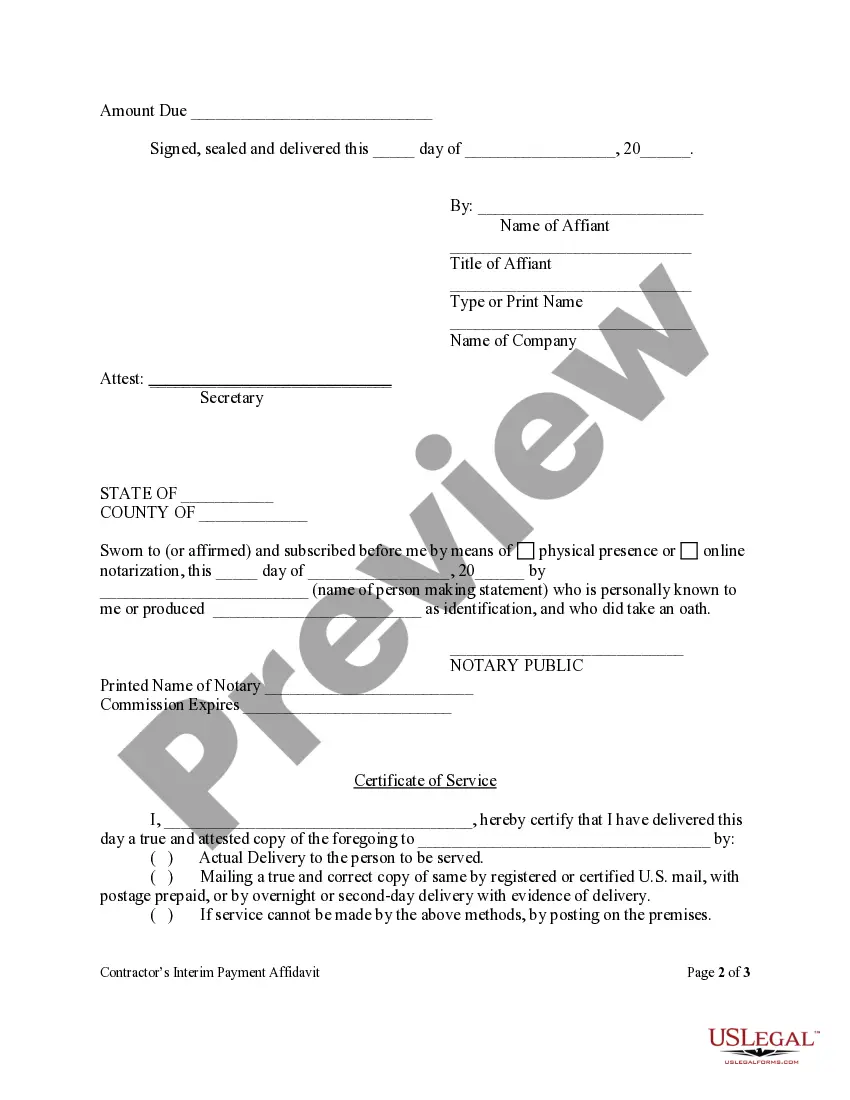

This Contractor's Interim Payment Affidavit is for use by a corporation or limited liability company who has furnished or caused to be furnished labor, materials, and services for the construction of certain improvements to real property, for the purposes of obtaining payment from the owner. This form also states that all of the work to be performed under the contract has been fully completed, and all lienors under the direct contract have been paid in full, except the lienors listed in the form.

Florida Payment Corporation Forms

Description

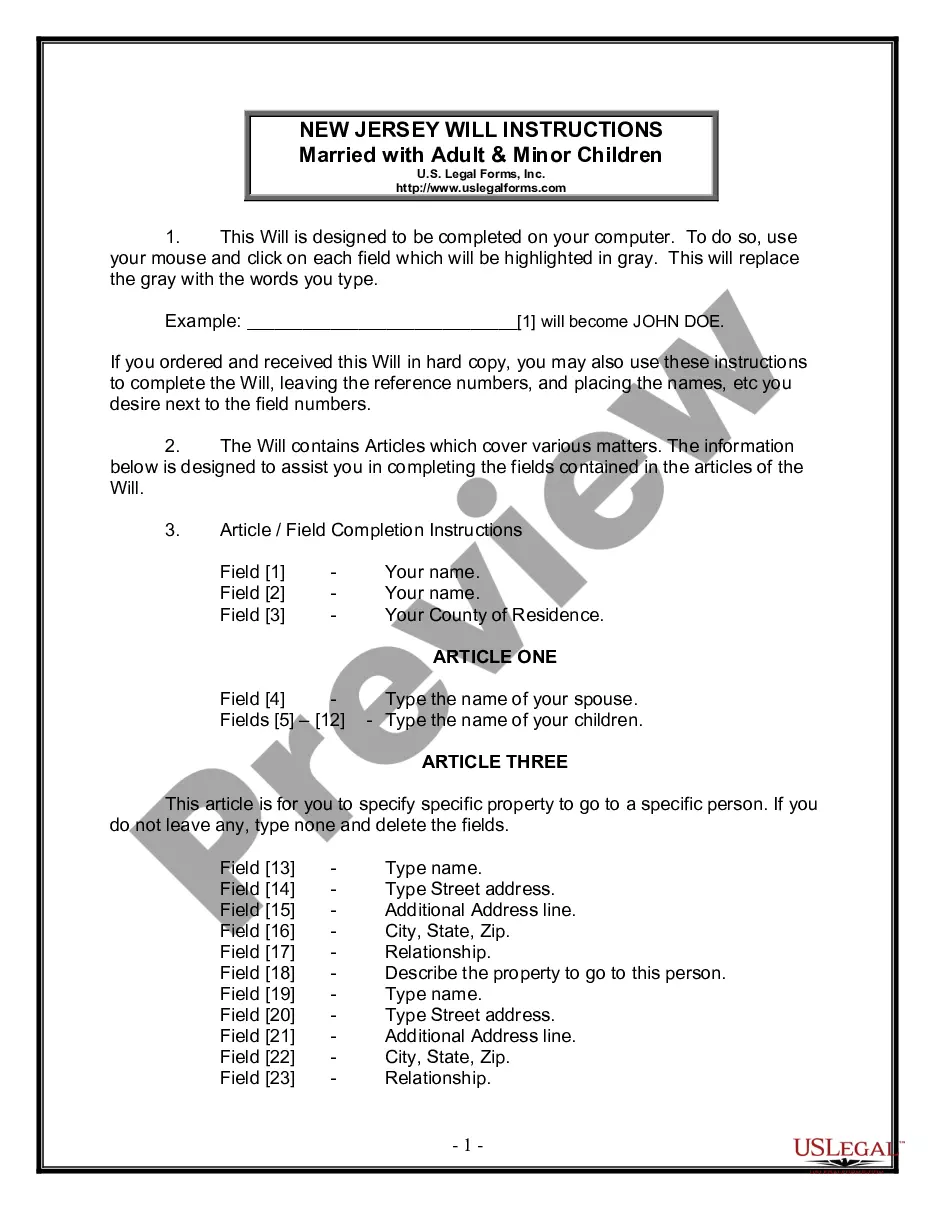

How to fill out Florida Payment Corporation Forms?

Individuals frequently link legal documentation with a matter that is intricate and manageable solely by a specialist.

In a certain sense, this is accurate, as preparing Florida Payment Corporation Forms requires significant knowledge in relevant fields, encompassing state and municipal laws.

Nevertheless, with US Legal Forms, the process has become simpler: pre-prepared legal documents for any personal and commercial circumstance tailored to state regulations are gathered in a single online directory and are now accessible to all.

All templates in our collection are reusable: once acquired, they remain stored in your profile. You can access them anytime you require through the My documents section. Explore all the benefits of utilizing the US Legal Forms platform. Enroll today!

- Examine the content of the page carefully to confirm it fulfills your requirements.

- Review the form description or validate it through the Preview feature.

- Find another example using the Search bar in the header if the previous form does not meet your needs.

- Press Buy Now after identifying the suitable Florida Payment Corporation Forms.

- Select a pricing plan that aligns with your requirements and finances.

- Establish an account or Log In to move to the payment section.

- Settle your subscription using PayPal or your credit card.

- Choose the format for your document and click Download.

- Print your file or upload it to an online editor for a faster completion.

Form popularity

FAQ

If you have elected to be treated as an S Corporation, you must file Form 1120S for federal purposes and Florida's corresponding payment corporation forms. This is necessary even if there are no income taxes owed at the state level. Filing these forms ensures compliance with Florida law and allows you to take advantage of various tax benefits.

In Florida, the due date for corporate tax returns is typically the 15th day of the fourth month after the end of your fiscal year. For most businesses following the calendar year, this means returns are due by April 15. Be sure to complete the necessary Florida payment corporation forms by this date to avoid penalties.

Yes, the Florida exemption for corporate income tax allows businesses to exclude the first $50,000 of income. This exemption can be beneficial for new companies, helping them retain more earnings. To take advantage of this exemption, it’s essential to file the correct Florida payment corporation forms accurately and on time.

Maintaining an LLC in Florida requires several key steps. First, you need to file an annual report to keep your business in good standing. Additionally, it’s important to keep your records updated and comply with relevant regulations, which can be facilitated by using Florida payment corporation forms. Platforms like uslegalforms can assist you in ensuring that you meet all necessary requirements and deadlines.

Yes, an LLC in Florida generally needs to file a tax return. However, if you are a single-member LLC, you may not need to file a separate tax return since the IRS treats it as a disregarded entity. When filing your taxes, ensure you use the correct Florida payment corporation forms, as these can help simplify your tax obligations and avoid potential penalties.

A Florida partnership must file a Florida partnership return if it conducts business within the state and generates income. This includes reporting the partnership's gains, losses, and distributions to partners. When looking for guidance, the Florida payment corporation forms can offer structured assistance for your filing obligations.

Florida form F-1120 must be filed by corporations doing business in Florida, including C Corporations and S Corporations opting to file. This form is important for reporting both income and corporate taxes owed to the state. By properly utilizing Florida payment corporation forms, you streamline your filing process and maintain compliance.

Yes, if you are conducting business in Florida, you are generally required to file business taxes. This applies to various business structures, including LLCs and corporations. To help ensure you follow the correct procedures, consider consulting available Florida payment corporation forms, which provide clear guidance.

Various entities must file a Florida tax return, including corporations and partnerships operating in the state. If your business generates income above certain thresholds, you should file. Familiarizing yourself with Florida payment corporation forms can assist in navigating these requirements efficiently.

If you operate as an S Corp in Florida, you are required to file a state tax return. This includes submitting any necessary forms and documentation to report your corporation's financial activities. Utilizing Florida payment corporation forms simplifies this process and ensures you remain compliant with state requirements.