Conditional Final Lien Waiver Form

Description

Form popularity

FAQ

A lien is a legal right or interest that a lender has in a borrower's property, granted until the debt obligation is satisfied. In many cases, property owners use a conditional final lien waiver form to release any claims against their property after payments have been made. This form protects both the payer and the contractor, ensuring that once payment is made, the contractor cannot assert any further claims. Understanding liens and how a conditional final lien waiver form works helps maintain financial security in property transactions.

To remove a lien in Illinois, you’ll typically need to provide proof that the underlying obligation has been satisfied, such as full payment. You may then file a release of lien, which is a formal document declaring that the lien is no longer valid. Utilizing a conditional final lien waiver form can simplify this process since it confirms that payment has been made. For accurate guidance, consider exploring resources on the US Legal Forms platform, which offers templates and tools to assist you in these matters.

A conditional waiver of lien in Illinois is a document used to release a contractor's lien rights as long as the promised payment is made. This legal form serves as a tool to protect both the contractor and property owner, ensuring that the contractor maintains their right to file a lien if payment is not received. When using a conditional final lien waiver form, it is vital to ensure that the waiver explicitly states the conditions under which the lien rights would be released. This clarity helps prevent misunderstandings down the road.

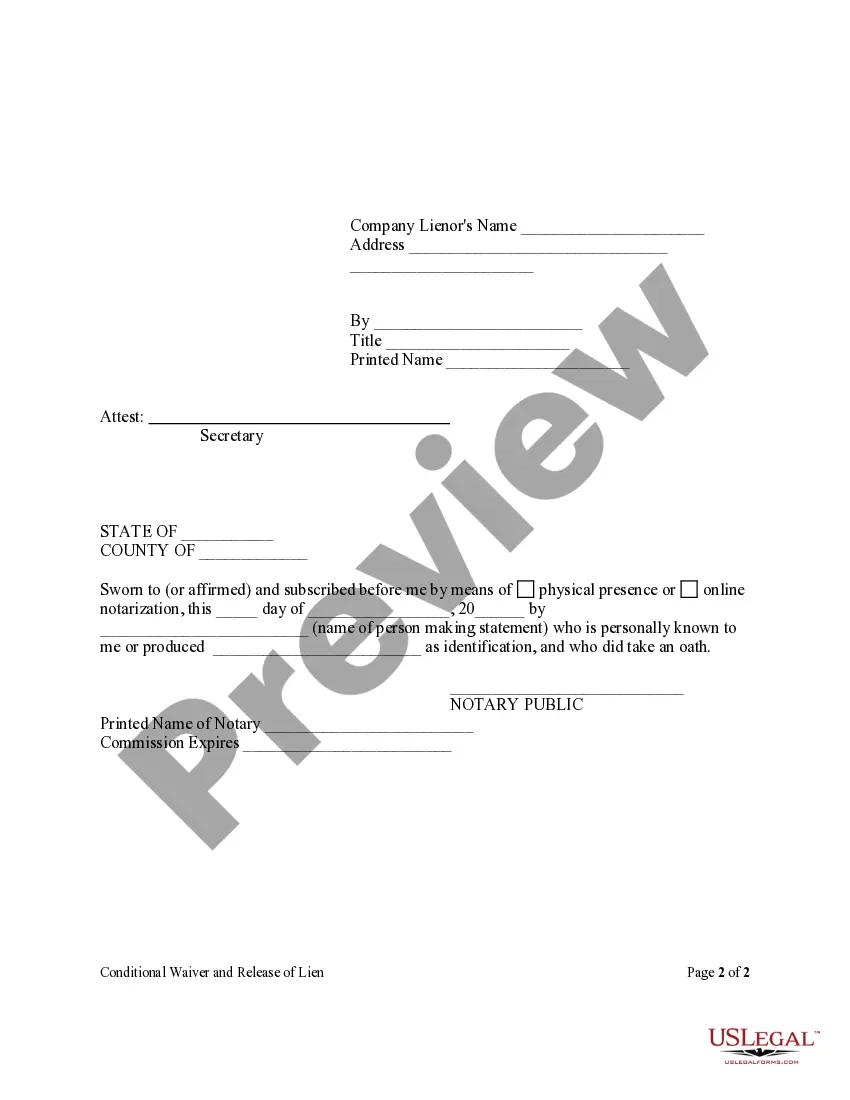

To fill out a conditional final lien waiver form, start by clearly identifying the parties involved, including the contractor, subcontractor, and property owner. Next, provide detailed information about the project, including its location and the amount being released. Without missing any crucial details, accurately state the payment information and make sure to sign and date the form. This process helps ensure that everyone agrees on the terms and protects your rights.

The waiver of lien refers to the voluntary relinquishment of a contractor's right to file a lien against a property for unpaid work. This document serves as a protective measure for property owners, facilitating clear communication regarding payment obligations. Generally, waivers come in various forms, including unconditional and conditional versions. Utilizing a conditional final lien waiver form ensures that all parties are aligned and protected during and after a project.

A conditional waiver of lien is a legal document that allows a contractor to waive its right to a lien, contingent upon the receipt of payment. Essentially, it protects the contractor until they have confirmed payment, allowing them to proceed with their work without worry. Understanding when and how to use a conditional waiver is crucial for maintaining smooth financial operations in any construction project. A conditional final lien waiver form captures this agreement effectively.

A final conditional lien waiver in Texas is a document that contractors sign, indicating they relinquish their lien rights only upon receiving final payment. This waiver protects property owners while assuring contractors that they will not face claims on the property, should payment be processed correctly. In the realm of construction, this form often serves as a safety net for all parties involved. Implementing a conditional final lien waiver form can facilitate smooth transactions.

The Texas Property Code section that governs conditional lien waivers is Title 4, Chapter 53. This section outlines the requirements and conditions for lien waivers, ensuring that both contractors and property owners understand their rights. It is vital for anyone involved in construction to familiarize themselves with this code to avoid complications. For clarity and compliance, using a conditional final lien waiver form is highly recommended.

In Illinois, a final conditional waiver of lien is a document that allows contractors to waive their lien rights once they confirm receipt of final payment. This waiver ensures that once payment is processed, the contractor cannot claim a lien on the property. It serves as a safeguard for property owners, reducing the risk of future claims. A conditional final lien waiver form is often utilized to formalize this transaction.

In Florida, a conditional waiver and release on final payment is a document used by contractors to acknowledge receipt of payment while reserving their right to claim a lien if the payment is not honored. Essentially, it protects both parties by ensuring that the contractor will not enforce a lien as long as payment has cleared. These forms streamline construction transactions and maintain trust throughout the payment process. Using a conditional final lien waiver form can help clarify expectations.