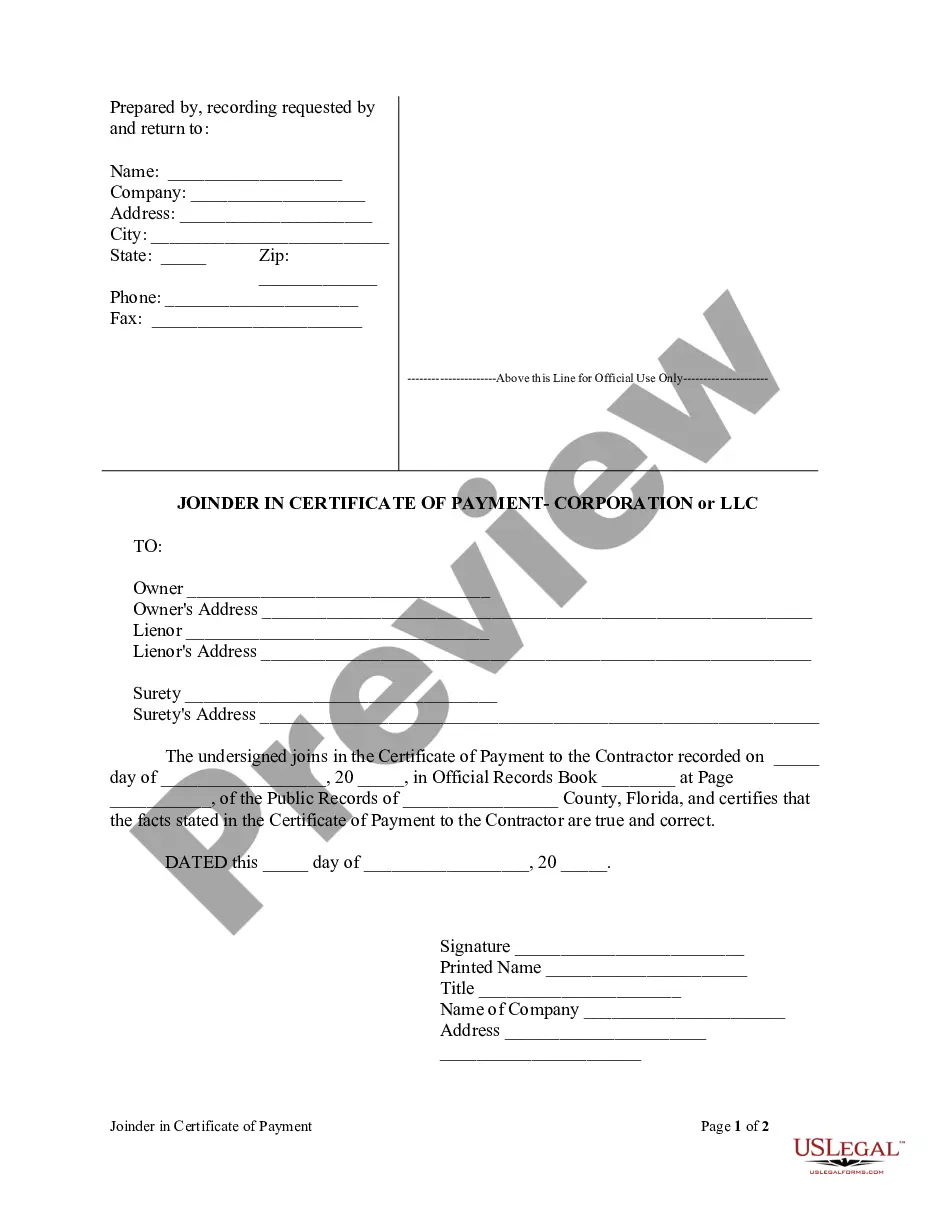

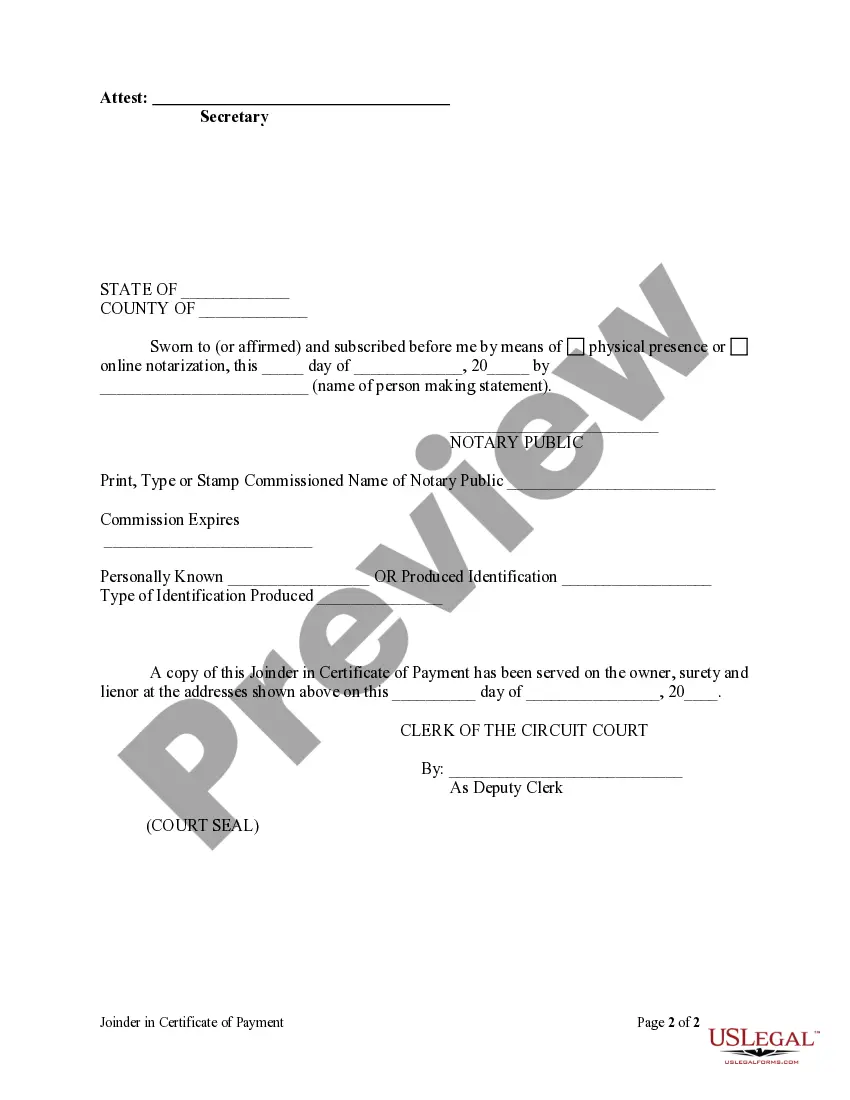

This Joinder In Certificate of Payment form is a letter, or notice from a corporation or LLC to the Owner, Surety and Lienor stating that there has been a payment made. This is certified to be true and correct in front of a Notary Public. This form is available in both Word and Rich Text formats.

Certificate Of Payment Form For Pensioners

Description

How to fill out Certificate Of Payment Form For Pensioners?

What is the most reliable service to acquire the Certificate Of Payment Form For Pensioners and other recent versions of legal documents.

US Legal Forms is the answer! It boasts the largest collection of legal forms for every circumstance.

If you don't have an account with our library yet, follow these steps to create one: Form compliance check. Before obtaining any template, ensure it aligns with your usage requirements and your local regulations. Review the form description and utilize the Preview option if available. Alternative document search. If there are any discrepancies, make use of the search bar on the page header to find a different template. Click Buy Now to select the appropriate one. Account registration and subscription acquisition. Choose the most suitable payment plan, Log In or create a new account, and pay for your subscription using PayPal or credit card. Document downloading. Select the format you wish to save the Certificate Of Payment Form For Pensioners (PDF or DOCX) and click Download to obtain it. US Legal Forms is an excellent option for anyone facing legal documentation needs. Premium users can benefit even more, as they can complete and electronically sign previously saved files anytime using the built-in PDF editing tool. Try it out today!

- Each template is skillfully crafted and verified for conformity with federal and state regulations.

- They are organized by region and state, making it easy to find the necessary one.

- Experienced users simply need to Log In to the platform, verify their subscription status, and click the Download button next to the Certificate Of Payment Form For Pensioners to obtain it.

- After saving, the template will remain accessible for future use under the My documents section of your profile.

Form popularity

FAQ

You can obtain the W-4P form from the IRS website or your pension plan administrator. This form is often available in download format, making it easy to fill out and submit. Remember, using this certificate of payment form for pensioners assists in the correct withholding of federal income tax from your retirement payments, simplifying your tax responsibilities.

If you do not fill out the W-4 form, your pension payer will likely withhold taxes at the default rate, which might not match your tax liability. This could lead to insufficient withholding, resulting in a tax bill when you file your returns. To avoid unexpected financial burdens, consider using the certificate of payment form for pensioners to accurately manage your withholding.

You should submit the W-4R form to the payer of your pension or retirement plan. This can include your employer or the financial institution responsible for your pension payments. By providing this certificate of payment form for pensioners, you communicate your withholding preferences effectively, ensuring accurate tax deductions from your payments.

The IRS form that pertains to pension income is typically Form 1099-R. However, pensioners may also use other forms, such as the certificate of payment form for pensioners, to specify how they'd like their taxes withheld from their payments. Understanding and utilizing these forms helps ensure that pension payments are properly reported and taxed.

The primary purpose of a W-4 form is to inform your employer or pension payer about your tax withholding preferences. For pensioners, completing this certificate of payment form for pensioners is crucial to ensure the right amount of federal tax is withheld from benefits. This prevents underpayment or overpayment of taxes, helping you maintain better financial control.

The W-4V form, or Voluntary Withholding Request, is used by pensioners to instruct payers to withhold federal income tax from their pension payments. By filling out this certificate of payment form for pensioners, individuals ensure a portion of their benefits covers tax liabilities, reducing the chance of a tax bill at year-end. It provides a proactive approach to managing tax obligations while receiving pension income.

You can obtain the W-4P form directly from the IRS website or through your pension plan administrator. Many financial institutions and tax preparation services also provide copies of this form. Always ensure you are using the latest version to comply with current regulations. For more streamlined assistance, consider utilizing the Certificate of payment form for pensioners to guide you through the paperwork.

The primary tax document you'll receive for pension income is the Form 1099-R. This document summarizes your pension distributions and indicates how much tax was withheld. It is vital for reporting your income accurately on your tax return. Utilizing the Certificate of payment form for pensioners can further clarify your situation and help ensure appropriate documentation.

Yes, pension payments typically generate a Form 1099-R, which you should receive from your pension plan administrator. This form details the total distributions you received and any taxes withheld during the year. It is an important document when filing your tax return. If you encounter any complications, the Certificate of payment form for pensioners offers a helpful resource.

Completing the W-4P form requires you to provide information about your identity, pension plan, and your desired withholding preferences. Start by filling in your personal details, including your name and Social Security number. Then, indicate how much tax you want withheld from your pension payments. If you need guidance, consulting resources or using the Certificate of payment form for pensioners can simplify this process.