Payment For Construction Loan

Description

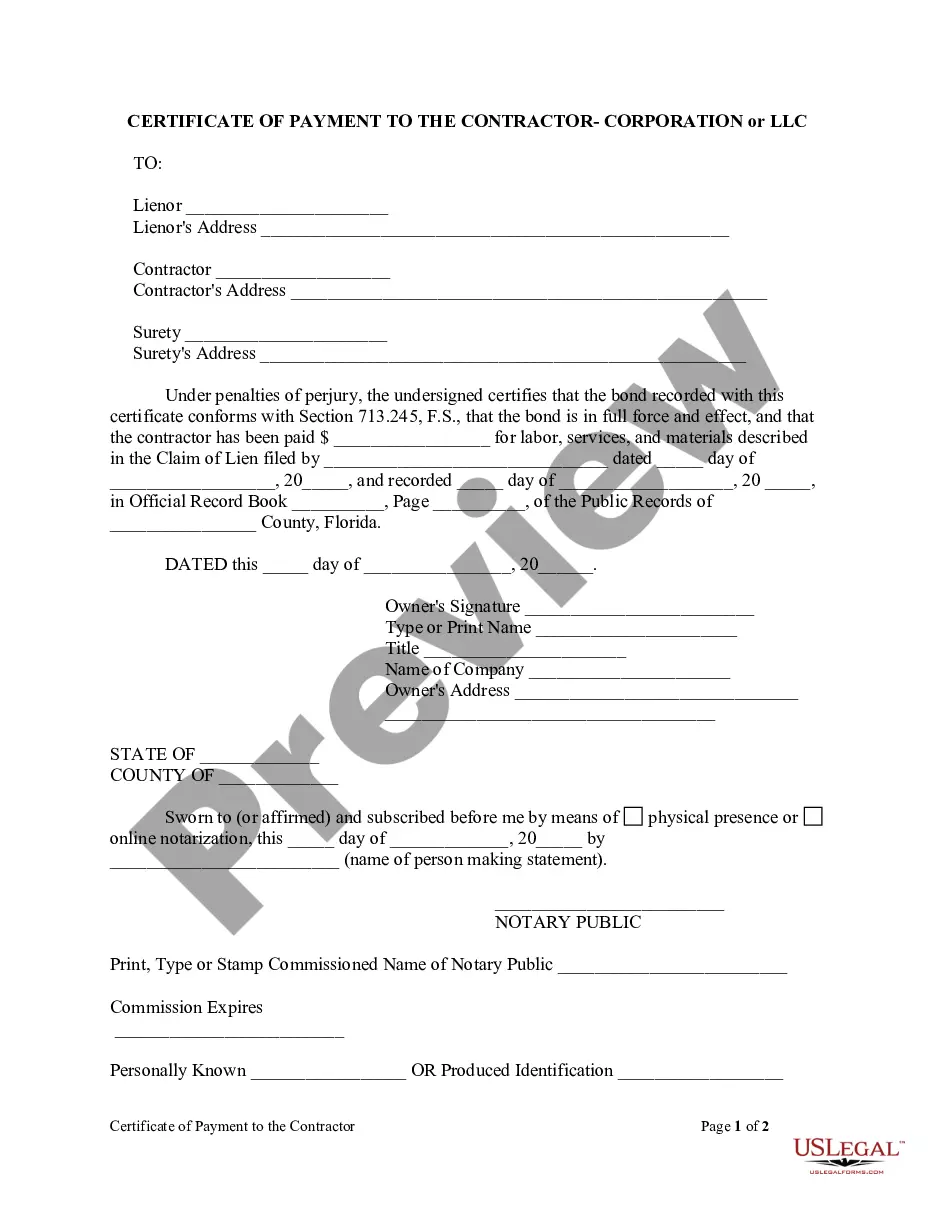

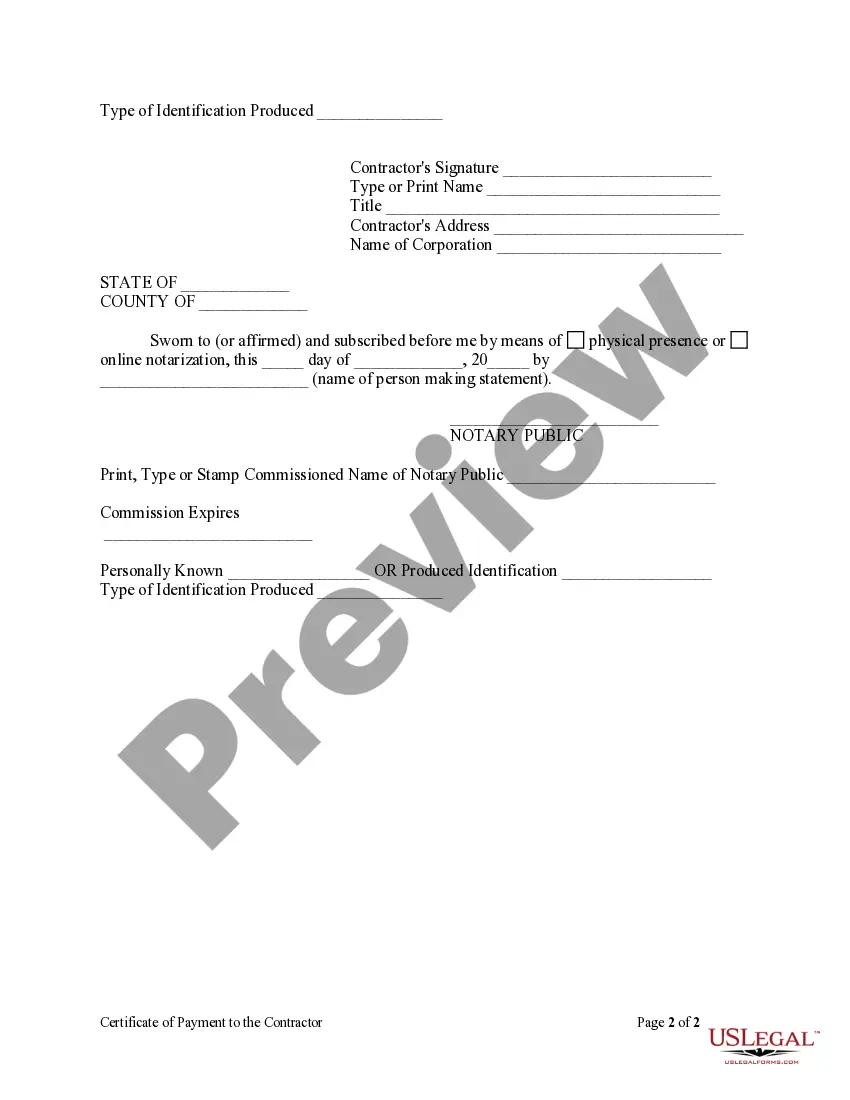

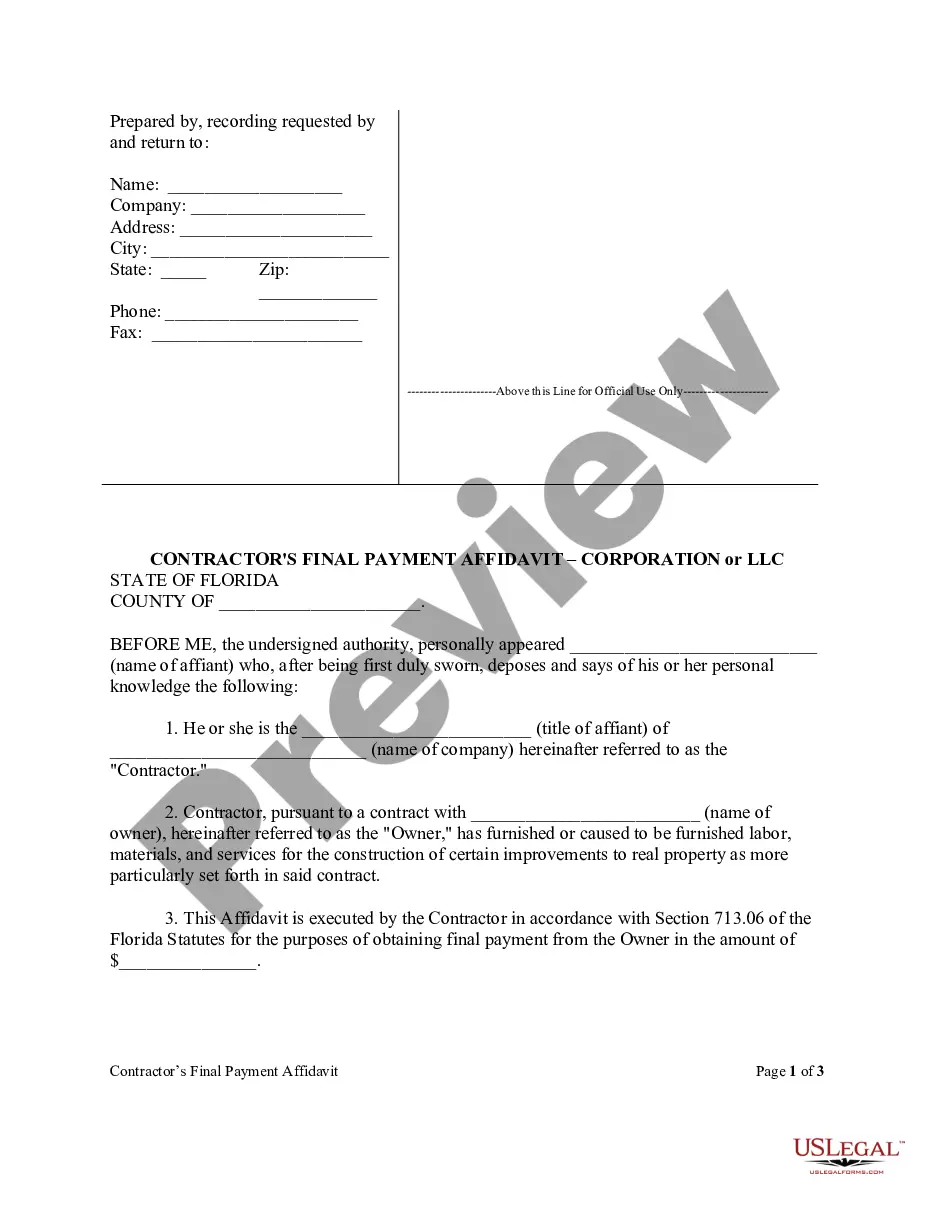

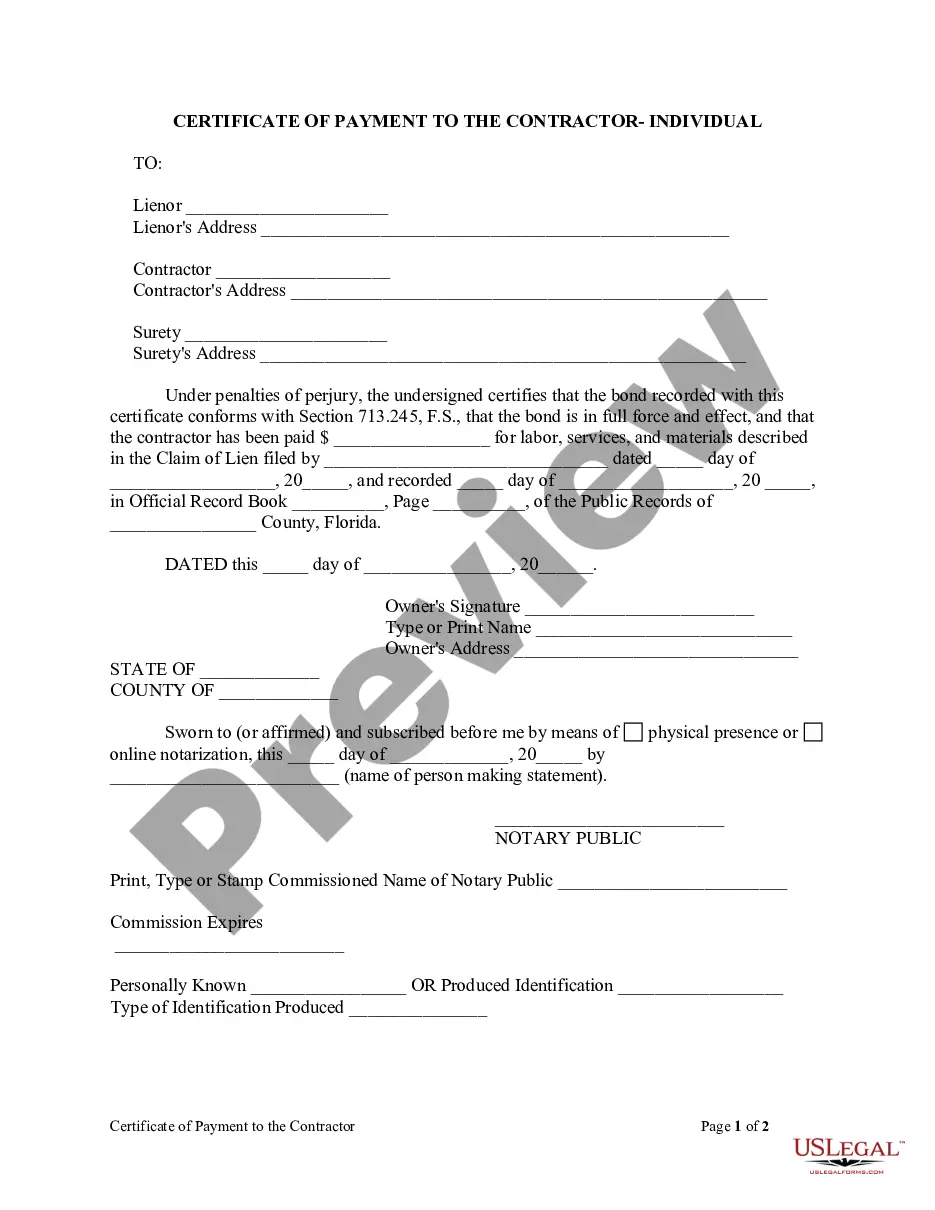

How to fill out Florida Certificate Of Payment To Contractor Form - Construction - Mechanic Liens - Corporation Or LLC?

Bureaucracy requires precision and exactness.

Unless you handle filling out documents like Payment For Construction Loan daily, it can lead to some misunderstanding.

Selecting the correct example from the outset will ensure that your document submission proceeds smoothly and avert any issues of resending a file or repeating the same task from the start.

If you are not a subscribed user, finding the needed example will require a few additional steps: Locate the template using the search field.

- You can always find the suitable example for your documentation in US Legal Forms.

- US Legal Forms is the largest online repository of forms that contains over 85 thousand examples across various subject matters.

- You can obtain the most current and appropriate version of the Payment For Construction Loan by simply searching it on the platform.

- Locate, save, and store templates in your account or verify with the description to make sure you have the correct one on hand.

- With an account at US Legal Forms, you can accumulate, store in one location, and navigate the templates you save for quick access.

- When on the website, click the Log In button to authenticate.

- Then, proceed to the My documents page, where your document history is maintained.

- Browse through the description of the forms and save those you need at any time.

Form popularity

FAQ

Payment for construction loans involves a structured process designed to keep everything on track. Typically, lenders release funds in stages, known as draws, as the construction progresses. You, as the homeowner, will need to provide documentation of the completed work for each stage before receiving the corresponding payment. Using a platform like US Legal Forms can simplify the application process and help guide you through the necessary paperwork.

The lender will loan you a percentage of the appraised value of the home. So, for instance, if the home is appraised to be worth $500,000, they will loan you $500,000 x (95% as an example) = $475,000. The down payment will be your construction costs less the loan amount.

During construction, interest-only payments are commonly made on the balance of the money you've drawn. The loan is designed to pay the contractors and subcontractors in regular installments based on how much of the work has been completed at each stage of construction.

A construction loan is used during the building phase and is repaid once the construction is completed. A borrower will then have their regular mortgage to pay off, also known as the end loan. Not all lenders offer a construction-to-permanent loan, which involves a single loan closing.

During construction, interest-only payments are commonly made on the balance of the money you've drawn. The loan is designed to pay the contractors and subcontractors in regular installments based on how much of the work has been completed at each stage of construction.

If you want to do the monthly mortgage payment calculation by hand, you'll need the monthly interest rate just divide the annual interest rate by 12 (the number of months in a year). For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% (0.04/12 = 0.0033).