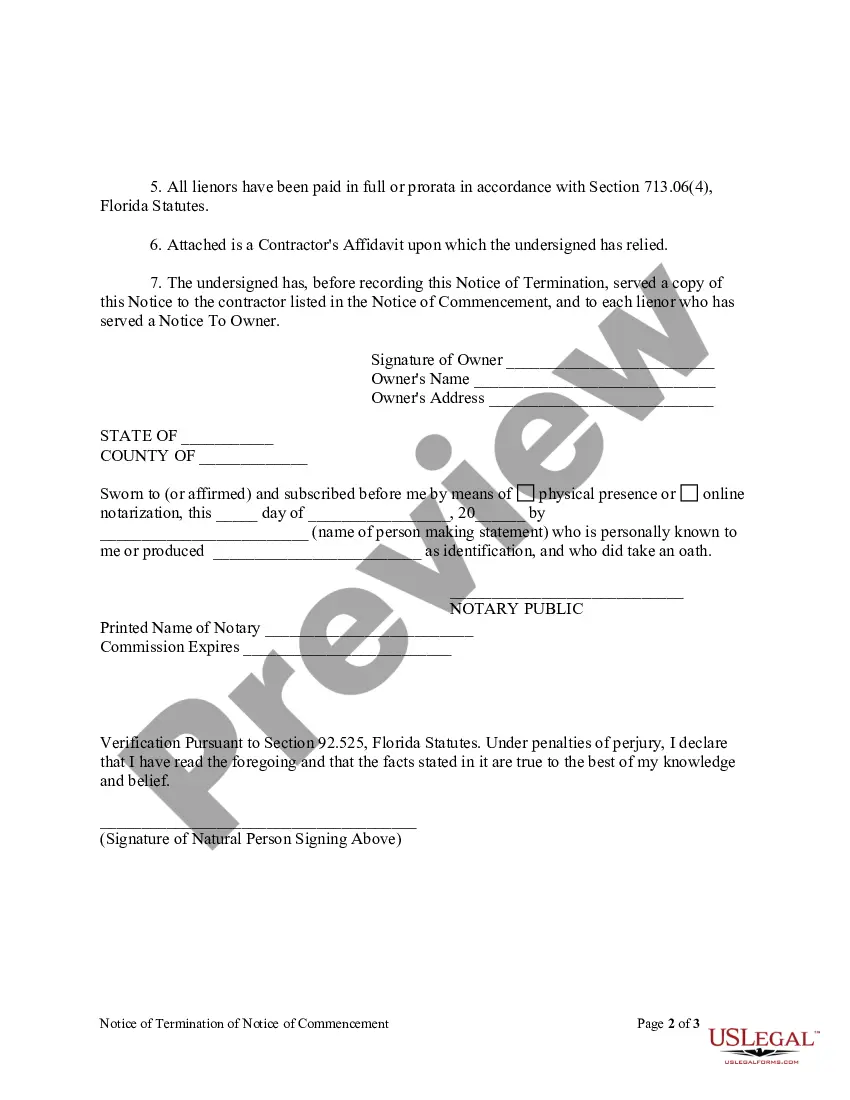

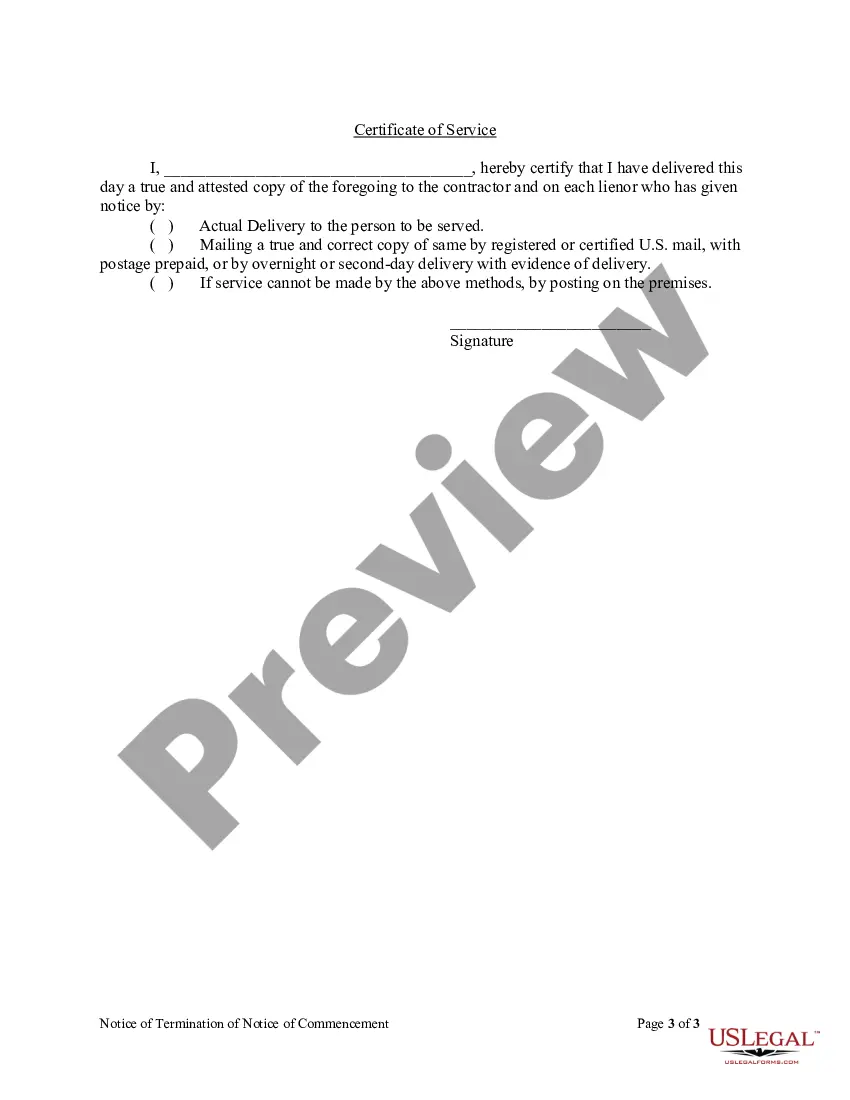

An individual owner may terminate the period of effectiveness of a notice of commencement by executing, swearing to, and recording a notice of termination.

Notice Of Commencement Lee County

Description

How to fill out Florida Notice Of Termination Of Notice Of Commencement Form - Construction - Mechanic Liens - Individual?

Managing legal documents can be intimidating, even for experienced experts.

If you require a Notice Of Commencement Lee County but lack the time to seek the correct and latest version, the process may be challenging.

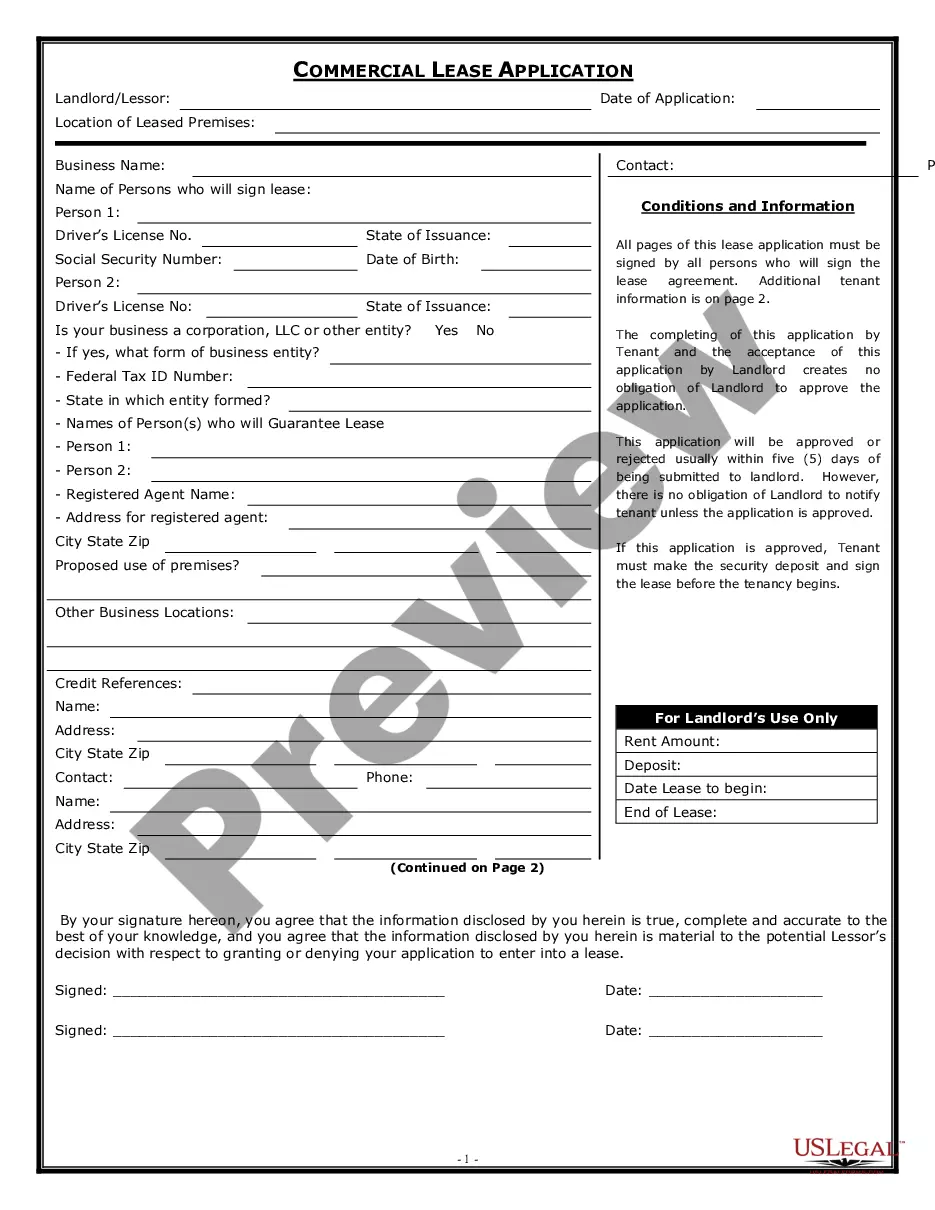

US Legal Forms addresses all your needs, ranging from personal to corporate paperwork, in one convenient platform.

Utilize sophisticated tools to complete and manage your Notice Of Commencement Lee County.

Here are the steps to follow once you’ve located the required form: Ensure it is the correct document by previewing and reading its description, confirm that the template is valid in your state or county, select Buy Now when ready, choose a subscription plan, pick your desired format, and Download, fill out, sign, print, and send your document. Experience the extensive US Legal Forms online library, endorsed by 25 years of expertise and trustworthiness. Transform your everyday document management into a streamlined and user-friendly experience today.

- Gain entry to a wealth of articles, guides, books, and resources aligned with your circumstances and requirements.

- Save time and effort in locating the necessary documents by leveraging US Legal Forms’ advanced search and Review feature to find and obtain the Notice Of Commencement Lee County.

- For existing members, Log In to your US Legal Forms account, search for the document, and download it.

- Visit the My documents tab to review the documents you’ve previously saved and organize your folders as desired.

- If you’re new to US Legal Forms, register for an account to gain unlimited access to the library’s advantages.

- An extensive online form library could revolutionize the way individuals deal with these matters effectively.

- US Legal Forms stands as a leading provider of online legal forms, boasting over 85,000 state-specific legal documents accessible at any time.

- With US Legal Forms, you can access an array of legal and business forms tailored to your state or county.

Form popularity

FAQ

A lien is a claim or legal right against assets that are typically used as collateral to satisfy a debt. A creditor or a legal judgment could establish a lien. A lien serves to guarantee an underlying obligation, such as the repayment of a loan.

Examples of a purchase-money security interest lien include a first mortgage on a home, a car loan, and situations in which the seller finances the purchase of property, such as furniture, through a credit agreement. Non-purchase-money security interest liens.

What is a Lien? The term lien refers to a legal claim or legal right which is made against the assets that are held as collaterals for satisfying a debt. A lien can be established by a creditor or a legal judgement. The purpose of the lien is to guarantee an underlying obligation such as the repayment of the loan.

The mortgage, or deed of trust as it's called in some states, is the legal instrument that creates a lien on your property. This gives the lender the right to foreclose on your property should you not satisfy the terms of the loan agreement. It creates a security interest in the property on behalf of the lender.

A contractor's lien (often known as a mechanic's lien, or a construction lien) is a claim made by contractors or subcontractors who have performed work on a property, and have not yet been paid.

What is the deadline to file the lien? A claimant must record a lien within 120 days from the date the claimant last furnished services or materials. Once a lien is recorded, the claimant must send a copy of the lien to the property owner within 10 days.

The lien must be recorded within one hundred twenty days (120) days after the contractor last completed work or provided materials at the property. The lien needs to be recorded with the register of deeds in the county where the property is located.

The most common type of lien is a first mortgage, which gives the lending bank the first lien to the property. The property is used as security for the repayment of the loan down the road, and the lien remains on record until the loan is paid off.