Limited Liability Company With Example

Description

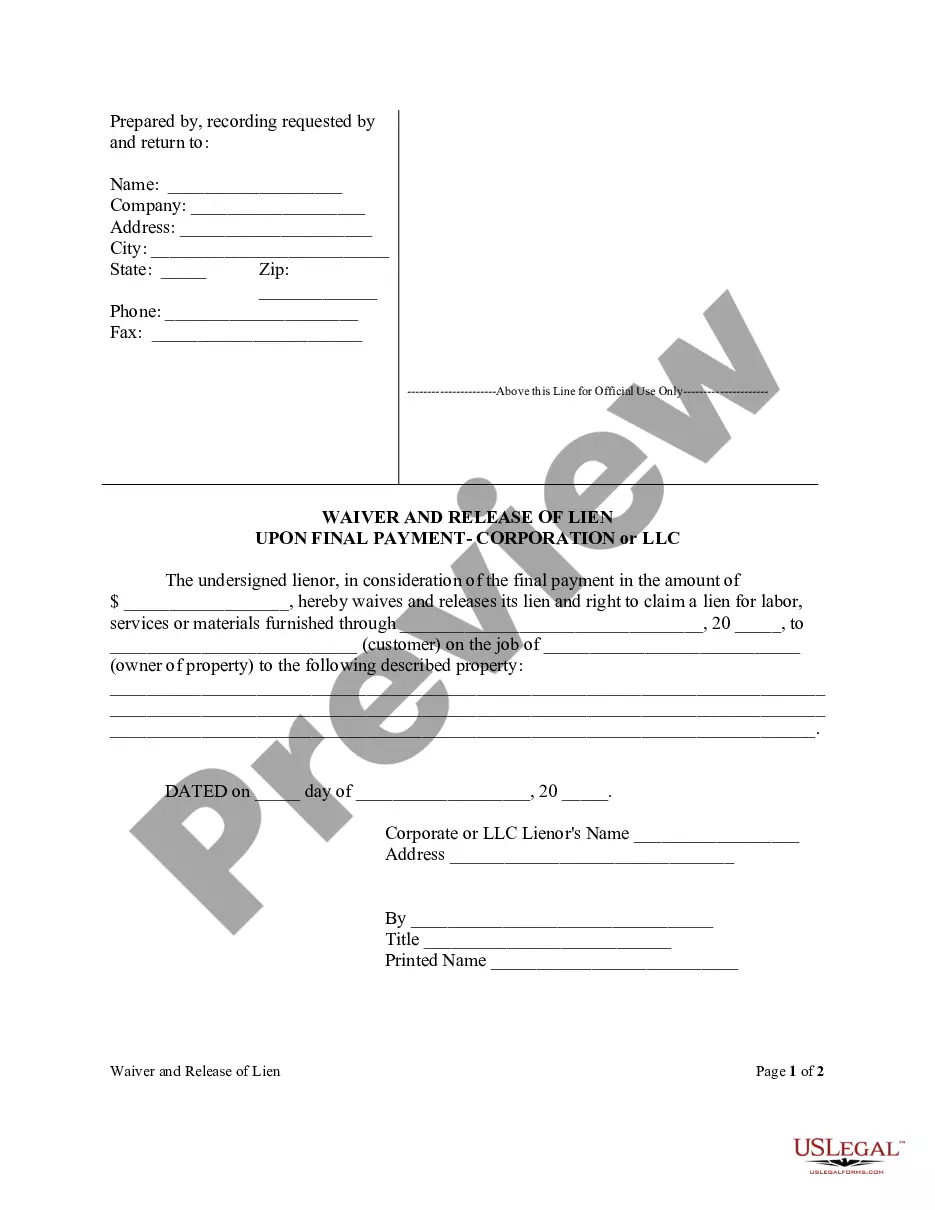

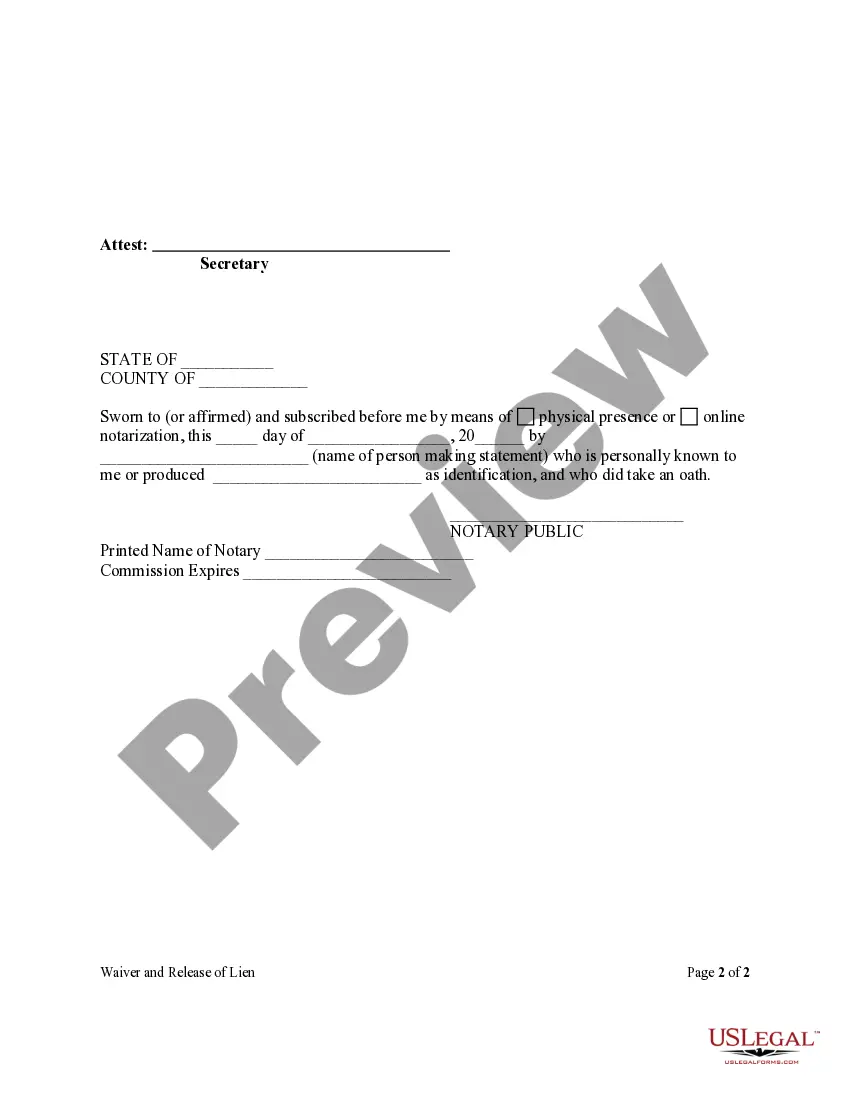

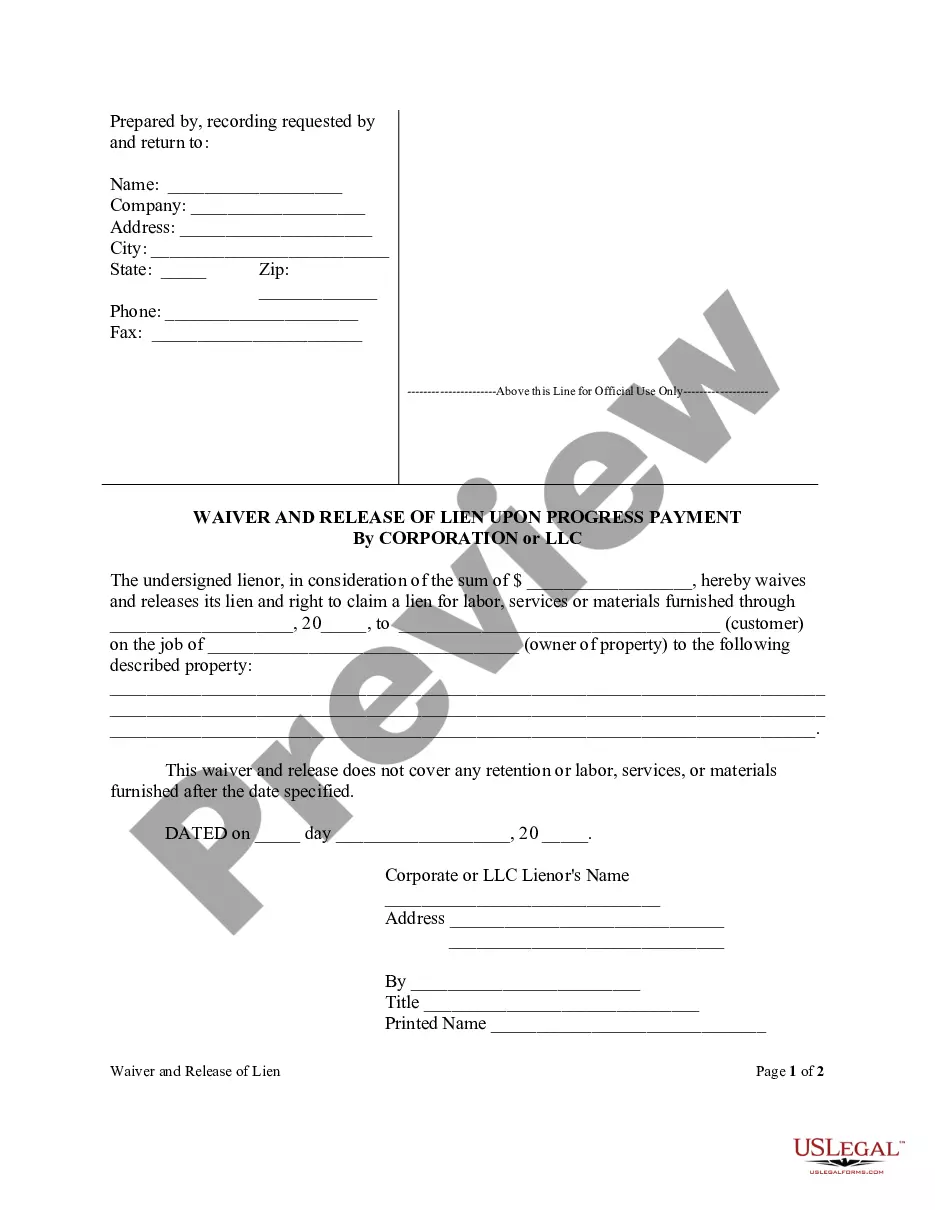

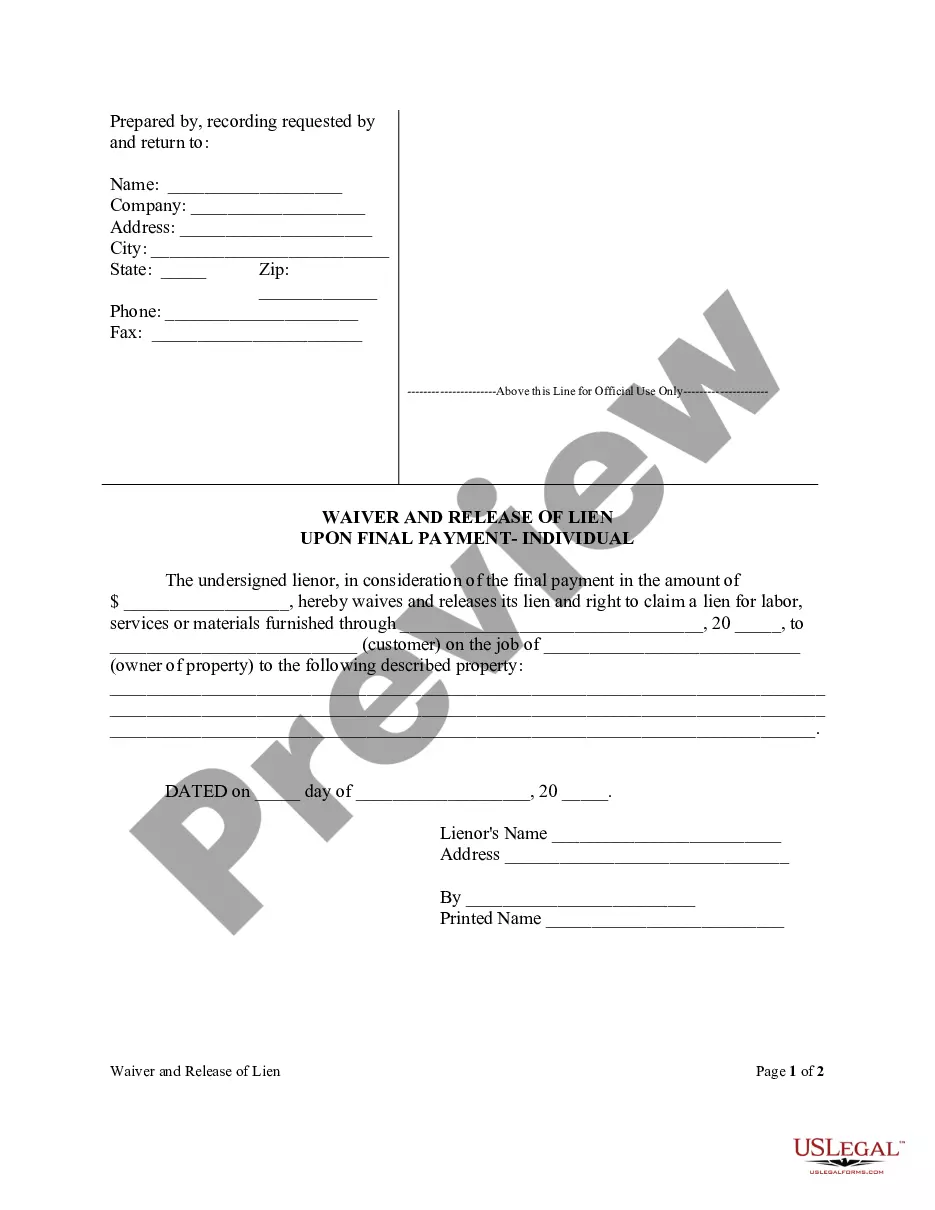

How to fill out Florida Waiver And Release Of Lien Upon Final Payment Form - Construction - Mechanic Liens - Corporation Or LLC?

- Log in to your US Legal Forms account if you are a returning user. Make sure your subscription is active; if not, renew it as needed.

- If you're a new user, start by reviewing the form description and Preview mode to ensure you select the correct document that aligns with your jurisdiction.

- Use the Search tab to find an alternative template if your initial choice doesn't meet all requirements.

- Once you find the appropriate document, click on the Buy Now button and select a subscription plan that works for you. Create an account for full access.

- Complete the purchase by entering your payment details or using PayPal for convenience.

- Finally, download the form to your device. You can access your saved documents in the My Forms section of your profile anytime.

With US Legal Forms, you benefit from a comprehensive collection of over 85,000 customizable legal forms and direct access to premium expertise, ensuring that your documents are accurate and valid.

Don't let legal paperwork hold you back—start using US Legal Forms today to take control of your LLC formation!

Form popularity

FAQ

Amazon does not have an LLC structure; rather, it is a company organized as a corporation. However, individual sellers on the Amazon platform can register their businesses as LLCs for liability protection and tax benefits. Understanding the implications of an LLC in various business models is crucial for successful operations.

No, Amazon is not an LLC; it is a publicly traded corporation. The corporate structure allows Amazon to operate on a larger scale and to manage its extensive business operations efficiently. Individuals considering forming a business should explore the differences between corporations and limited liability companies before making a choice.

Many types of businesses use a limited liability company structure, including small businesses, startups, and professional practices. For instance, freelance consultants often choose to operate as LLCs to protect their personal assets. This type of structure is favorable due to its simplicity and flexibility in management.

Amazon is a corporation, officially known as Amazon, Inc. This corporate structure allows Amazon to have shareholders and raise funds through the sale of stocks. It differs from a limited liability company in terms of regulatory requirements and operational flexibility.

A limited company, like a limited liability company (LLC), limits the financial liability of its owners. For example, a small family-owned restaurant can operate as an LLC, protecting the owners' personal assets from business debts. This structure is beneficial for those wanting to reduce personal risk.

Google operates under the parent company Alphabet Inc., which is a corporation, not a limited liability company. While Google does provide various services commonly associated with LLCs, it maintains a corporate structure to support its expansive operations. Therefore, businesses should carefully consider the differences when choosing their structure.

Apple is a corporation, specifically a publicly traded company. Unlike a limited liability company, which often has simpler management structures, Apple operates under a more complex corporate governance. This setup allows Apple to raise capital through stock markets and attract a wide range of investors.

Yes, you can file your limited liability company by yourself without the need for legal assistance. However, keep in mind that understanding the specific requirements can save you time and prevent mistakes. Using an online platform like USLegalForms can simplify the process by providing the necessary documents and guidance to help you form your limited liability company efficiently. With the right resources, you can confidently navigate the setup of your LLC on your own.

When you refer to a limited liability company in writing, use the abbreviation 'LLC' after the company name. This signifies its legal structure and helps distinguish it from other types of business forms. For instance, if your business is named ‘Doe Designs,’ it should be written as ‘Doe Designs LLC’ for clarity and legal recognition. Always remember to maintain proper formatting to ensure compliance with your state’s guidelines regarding a limited liability company.

To form a limited liability company, you need to start by choosing a unique name that complies with state regulations. Next, you must file Articles of Organization with your state’s Secretary of State office. Additionally, it's wise to create an operating agreement, which outlines the management structure and operational guidelines of your limited liability company. For example, when you choose a name like 'Smith Ventures LLC', you’ve successfully initiated the process of writing a limited liability company.