Form Mechanic Llc Blank For Sale

Description

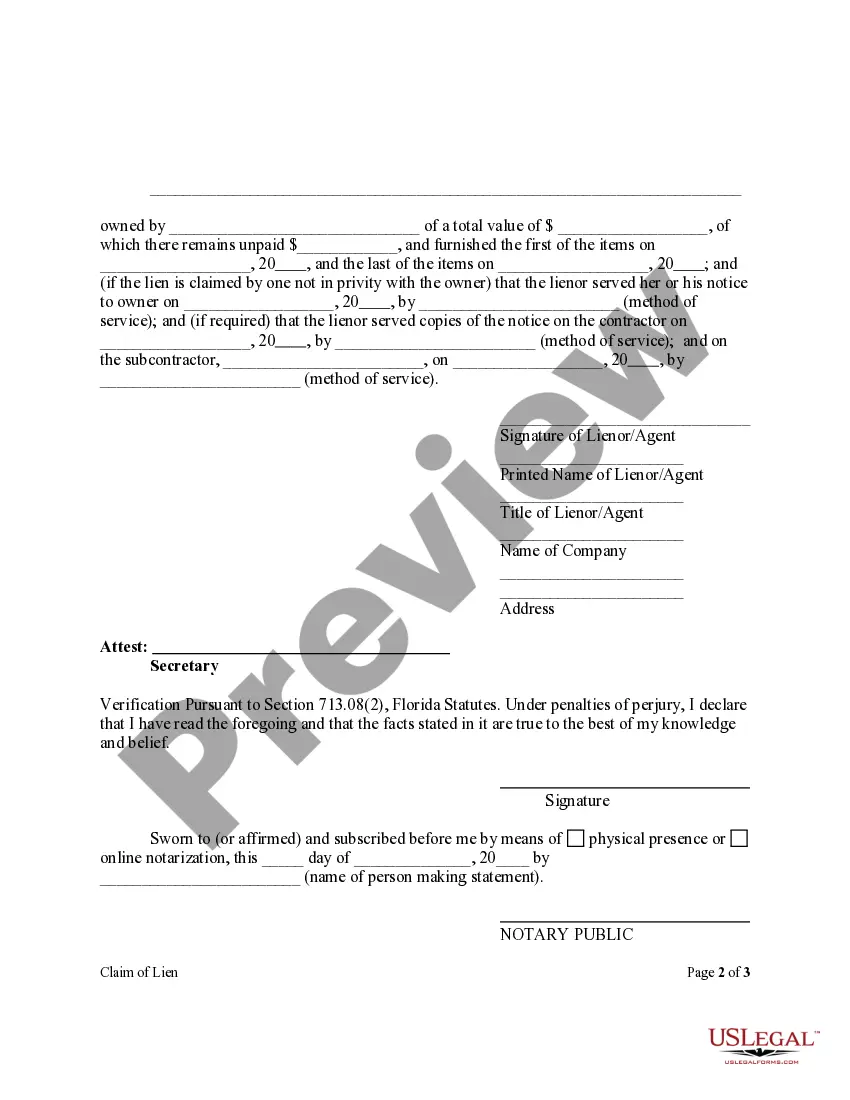

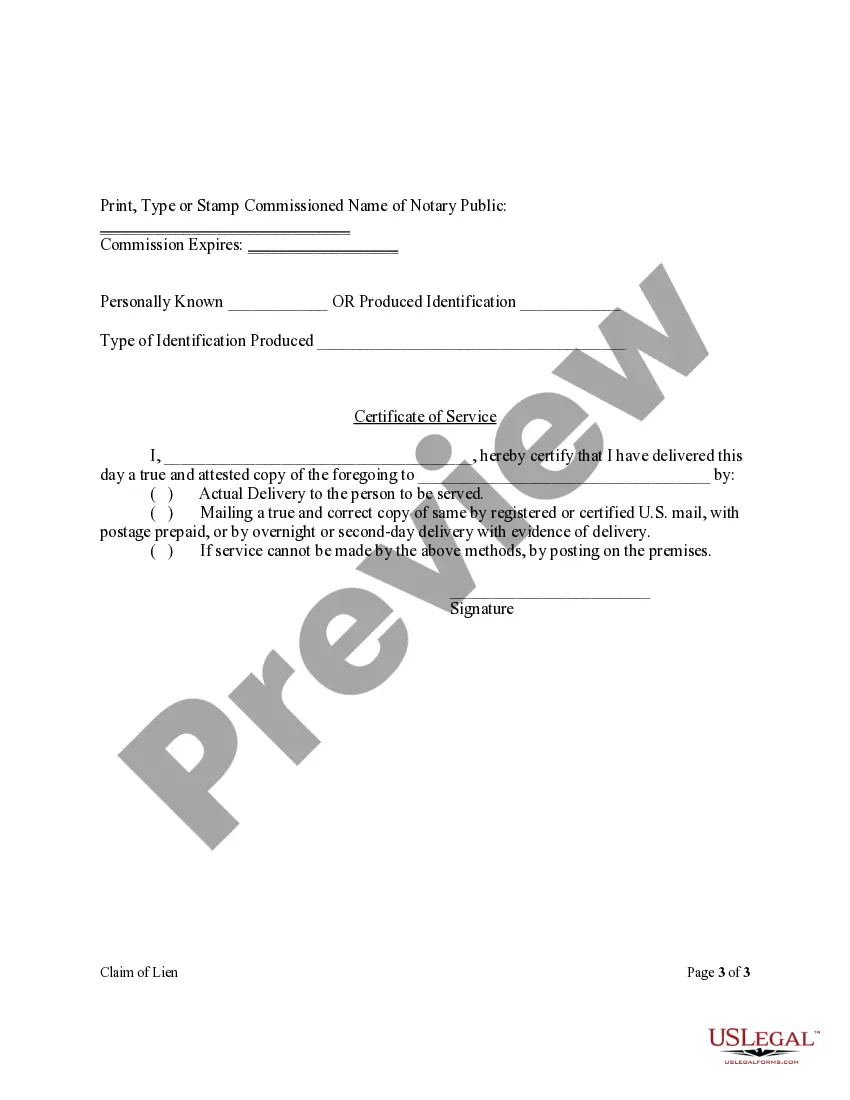

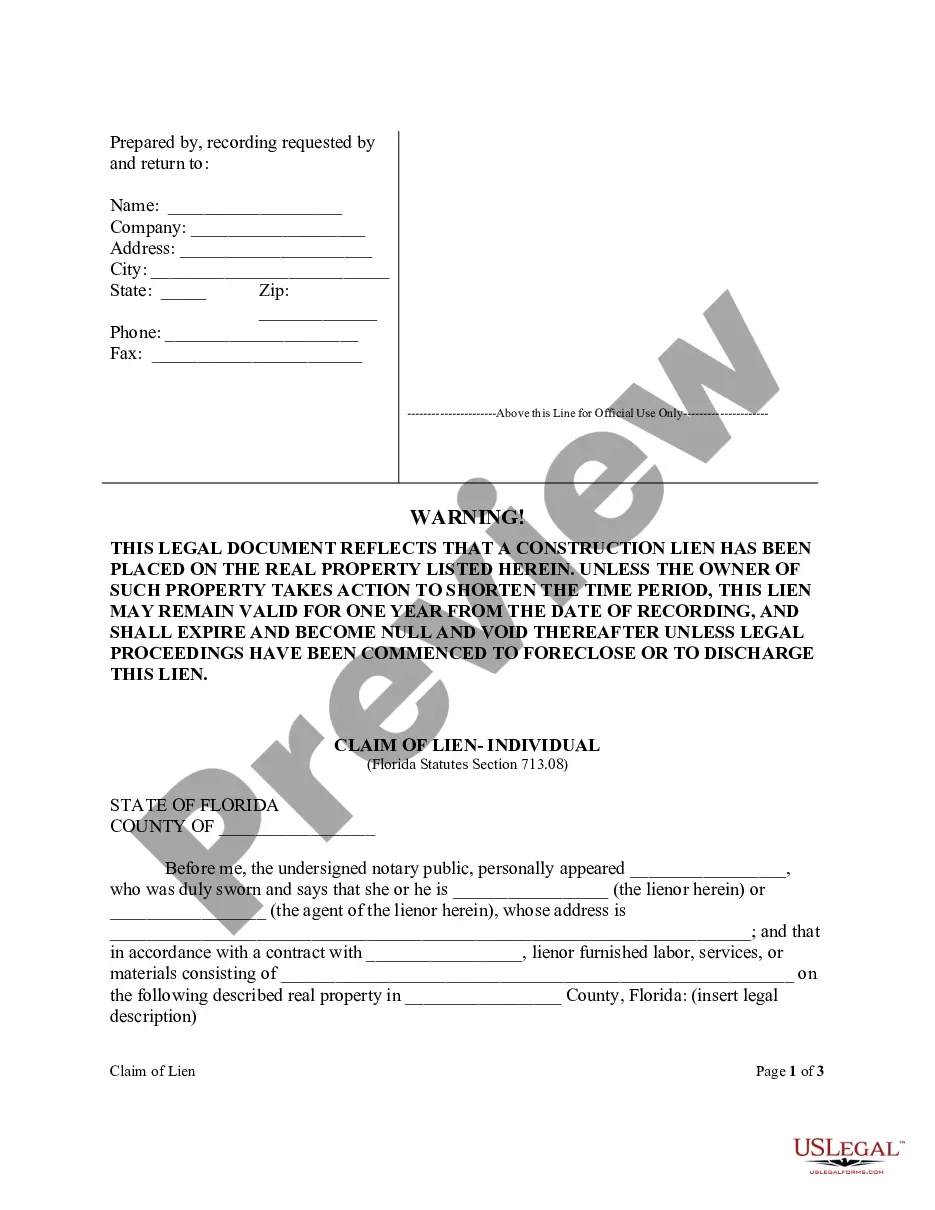

How to fill out Florida Claim Of Lien Form - Construction - Mechanic Liens - Corporation Or LLC?

- If you are a returning user, simply log in to your account and click the Download button for your desired template, ensuring your subscription is active.

- For first-time users, start by reviewing the Preview mode and detailed form description to find the template that meets your needs and aligns with your local jurisdiction.

- If you encounter any discrepancies, utilize the Search feature to locate a suitable alternative form.

- Once you’ve found the right document, click the Buy Now button and choose your preferred subscription plan, registering for an account to access the resources.

- Complete your purchase by entering your credit card information or using your PayPal account to finalize the subscription.

- Download your form to your device, and access it anytime from the My Forms section of your profile.

US Legal Forms empowers not only individuals but also attorneys by providing swift access to essential legal documents through a user-friendly library.

Take control of your legal needs today by exploring the extensive resources available at US Legal Forms. Get started now!

Form popularity

FAQ

Yes, you need articles of organization to legally form your LLC. This document registers your business with your state and provides essential information about your company. It's a critical step in establishing your LLC and protecting your personal assets. Using a form mechanic LLC blank for sale can streamline this filing process and ensure accuracy.

An operating agreement for an LLC typically includes sections on member contributions, management structure, and procedures for adding new members. For practical examples, you can find templates that illustrate these components. Having a clear example helps ensure you cover all necessary aspects for your business operations. Companies often refer to a form mechanic LLC blank for sale for great examples.

Yes, you can write your own operating agreement for your LLC. This document can be tailored to your specific business needs, making it a valuable way to outline responsibilities and guidelines. Just ensure that it aligns with your state’s regulations. If you prefer a structured approach, a form mechanic LLC blank for sale might be the ideal solution for you.

To write a simple operating agreement for your LLC, start by outlining the business structure and management protocols. Clearly define the roles of each member, including their responsibilities and voting rights. It’s helpful to include provisions for handling disputes and member withdrawals. For added convenience, consider using a form mechanic LLC blank for sale as your template.

Certain vendors are exempt from providing a W9, most commonly corporations and some government entities. If you are working with tax-exempt organizations, they typically do not need to submit a W9 either. Understanding these exemptions helps avoid unnecessary paperwork. Utilizing Form mechanic llc blank for sale can streamline your vendor documentation process.

Filing Form 720 for your LLC depends on your business activities and whether you owe certain excise taxes. Generally, this form is required for businesses involved in specific activities, such as wagering or indoor tanning services. To determine your obligation, review your operations carefully. Leveraging a Form mechanic llc blank for sale can simplify your filing process.

Yes, issuing a 1099 to your mechanic is necessary if you have made payments exceeding $600 for their services during the year. This process helps document their earnings and your expenses. Ensuring compliance with tax regulations supports smooth operations for both parties. Consider how Form mechanic llc blank for sale can help you manage such documentation effectively.

Certain entities do not need to provide a W9 form, including corporations and tax-exempt organizations. If the vendor is registered as a corporation, you typically do not need their W9. This exemption simplifies your documentation process. However, always ensure you check the specific requirements for using Form mechanic llc blank for sale.

You should require a W9 from a vendor if you are making payments of $600 or more within the year. Additionally, if the vendor provides services rather than goods, a W9 is often necessary. Knowing this helps ensure that you fulfill your tax obligations. Consider using a Form mechanic llc blank for sale to streamline your vendor documentation.

Yes, you can place a vehicle under your LLC if it is used for business purposes. This can provide additional tax benefits and asset protection. Using a Form mechanic llc blank for sale can guide you in properly documenting and structuring the vehicle in your LLC.