Enhanced Life 7

Description

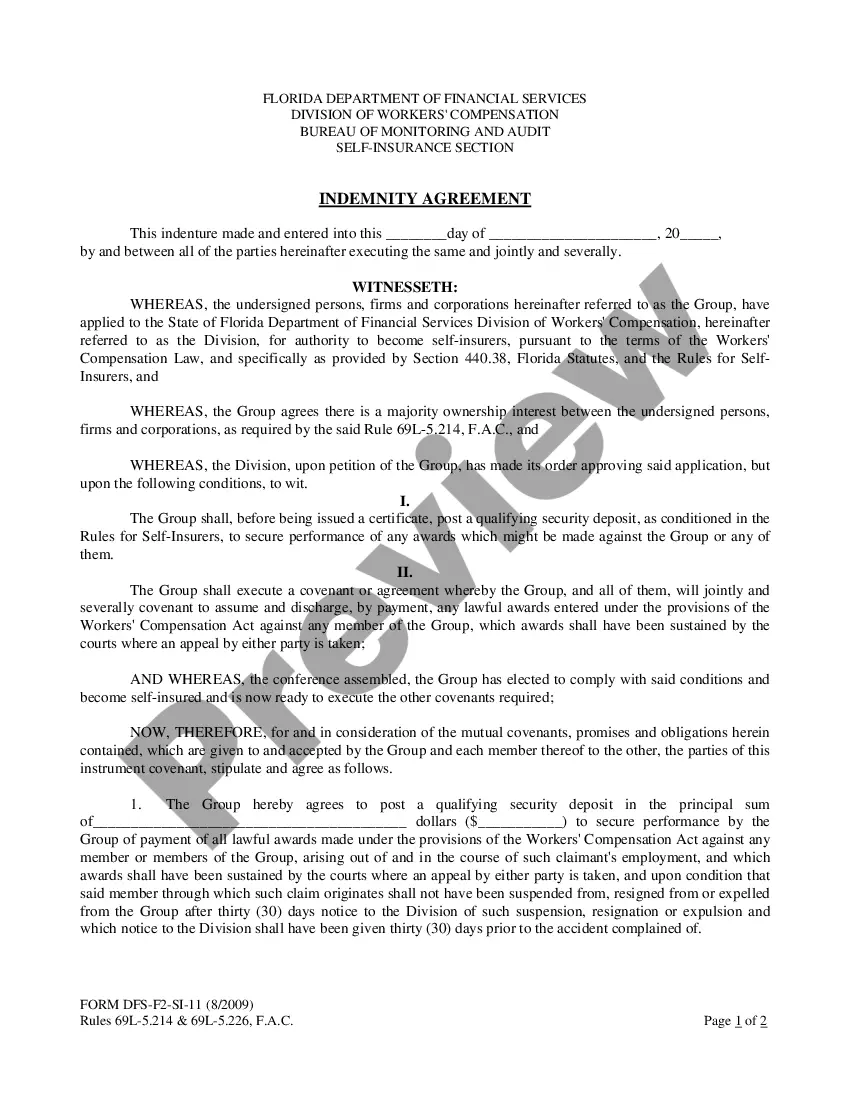

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Individual To Two Individuals / Husband And Wife?

- Log in to your account at US Legal Forms, ensuring your subscription is active. If not, renew it based on your payment plan.

- Browse through the Preview mode and document descriptions to select the appropriate form that fits your legal requirements.

- If necessary, use the Search tab to find an alternative template that better suits your needs.

- Once the correct document is identified, click the Buy Now button and choose your preferred subscription plan. You’ll need to create an account to access the library.

- Complete your transaction by entering your payment details, using either a credit card or PayPal.

- Download the form to your device and access it anytime through the My Forms section of your profile.

By following these simple steps, you can easily navigate through the vast resources offered by US Legal Forms.

Start your legal document journey today with US Legal Forms and ensure your forms are accurate and ready for use!

Form popularity

FAQ

The downside of a lady bird deed includes potential limitations on eligibility and implications for property tax assessments. It can restrict your ability to easily sell or refinance the property, as the deed establishes a future interest for beneficiaries. Understanding these aspects will help you make informed decisions regarding enhanced life 7 and whether this option aligns with your goals.

The lady bird deed is often regarded as one of the best deeds to avoid probate. Its unique structure allows property to transfer directly to beneficiaries without going through the probate court. By using an enhanced life estate deed, you can ensure your estate avoids the delays and expenses typically associated with probate.

Enhanced life estate deeds, commonly referred to as lady bird deeds, are recognized in several states across the U.S. States like Florida, Texas, Michigan, and others have laws in place that allow for such deeds. It is important to verify your state's regulations as they can vary, affecting how enhanced life 7 is implemented in your estate plan.

Yes, a lady bird deed effectively avoids probate, allowing for a smoother transfer of property upon the owner's death. The enhanced life estate deed ensures that the property passes directly to the named beneficiaries without the often lengthy probate process. This streamlined transfer can save your heirs time and costs, making a lady bird deed a popular choice for estate planning.

While a lady bird deed offers numerous benefits, it has its disadvantages. One key concern is that it may limit your control over the property once it is transferred, potentially complicating future decisions. Furthermore, if not properly executed, the deed might not achieve the intended outcomes regarding enhanced life 7, leading to unexpected legal challenges.

Yes, you can prepare your own lady bird deed in Florida, but it requires careful attention to detail. Utilizing templates and resources available online can simplify the process, but it is essential to ensure that all legal requirements are met. Alternatively, a legal professional can help ensure that your enhanced life 7 deed is drafted correctly, providing peace of mind.

A lady bird deed can help protect your property from capital gains tax under certain circumstances. When you transfer the property via an enhanced life estate deed, the transfer may not trigger a taxable event for the original owner during their lifetime. This makes it an attractive option for those seeking to minimize taxes on appreciated property. Always consider consulting a tax professional to evaluate your specific situation related to enhanced life 7.

A Lady Bird deed does not necessarily trump a will but operates as a separate legal instrument. The deed can facilitate the transfer of property outside of probate, which might create confusion if the will states otherwise. It is essential to ensure that both documents are consistent to preserve your intentions. Embracing Enhanced Life 7 can help clarify your estate plan and solidify your wishes.

Filling out a Lady Bird deed requires clear identification of the property, the owner, and the beneficiaries. Ensure all parties' names and property descriptions are accurate. It's wise to consult with a legal professional to verify the document adheres to state laws. Utilizing Enhanced Life 7 can streamline this process and enhance your peace of mind.

Medicaid could potentially claim your property even with a Lady Bird deed in place. If you sell the property or qualify for Medicaid, the state may seek recovery if you don't plan properly. This emphasizes the need for careful estate planning. Exploring Enhanced Life 7 can help you navigate these complexities effectively.