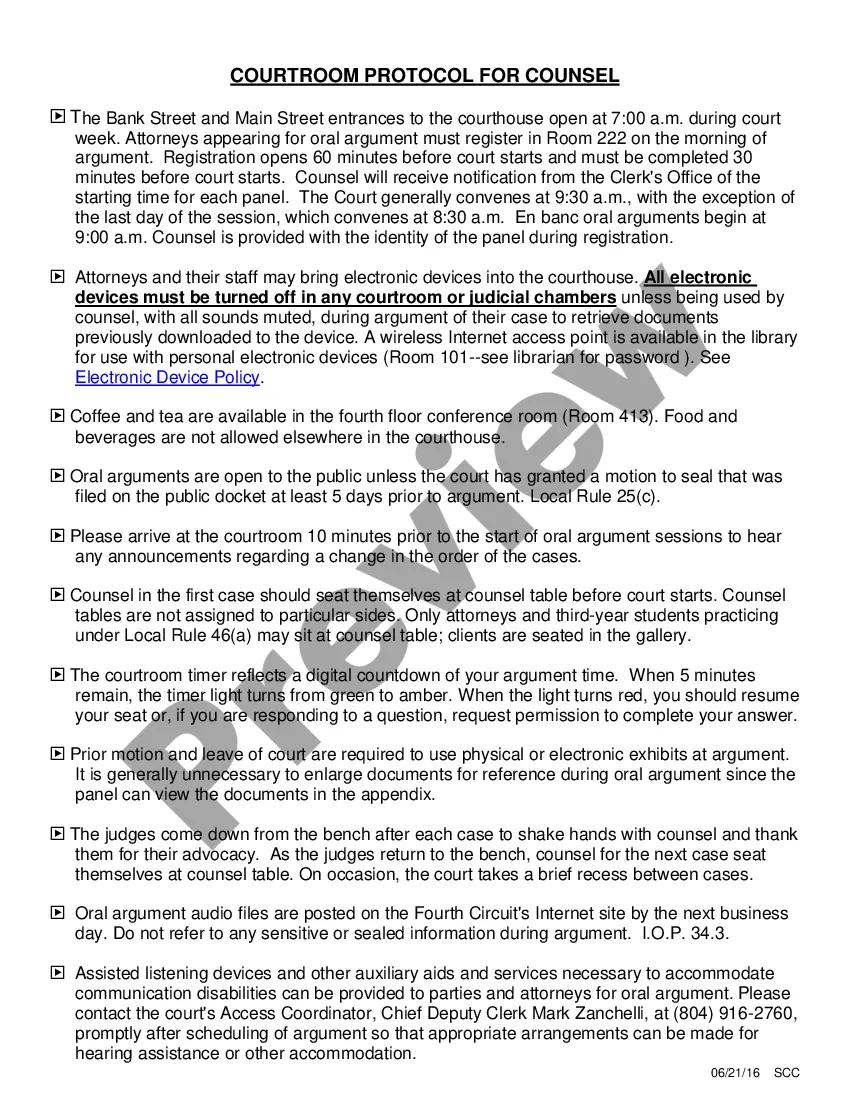

This is the Notice to Owner required to be given by liens of corporate or limited liability entities not in privity with the owner.

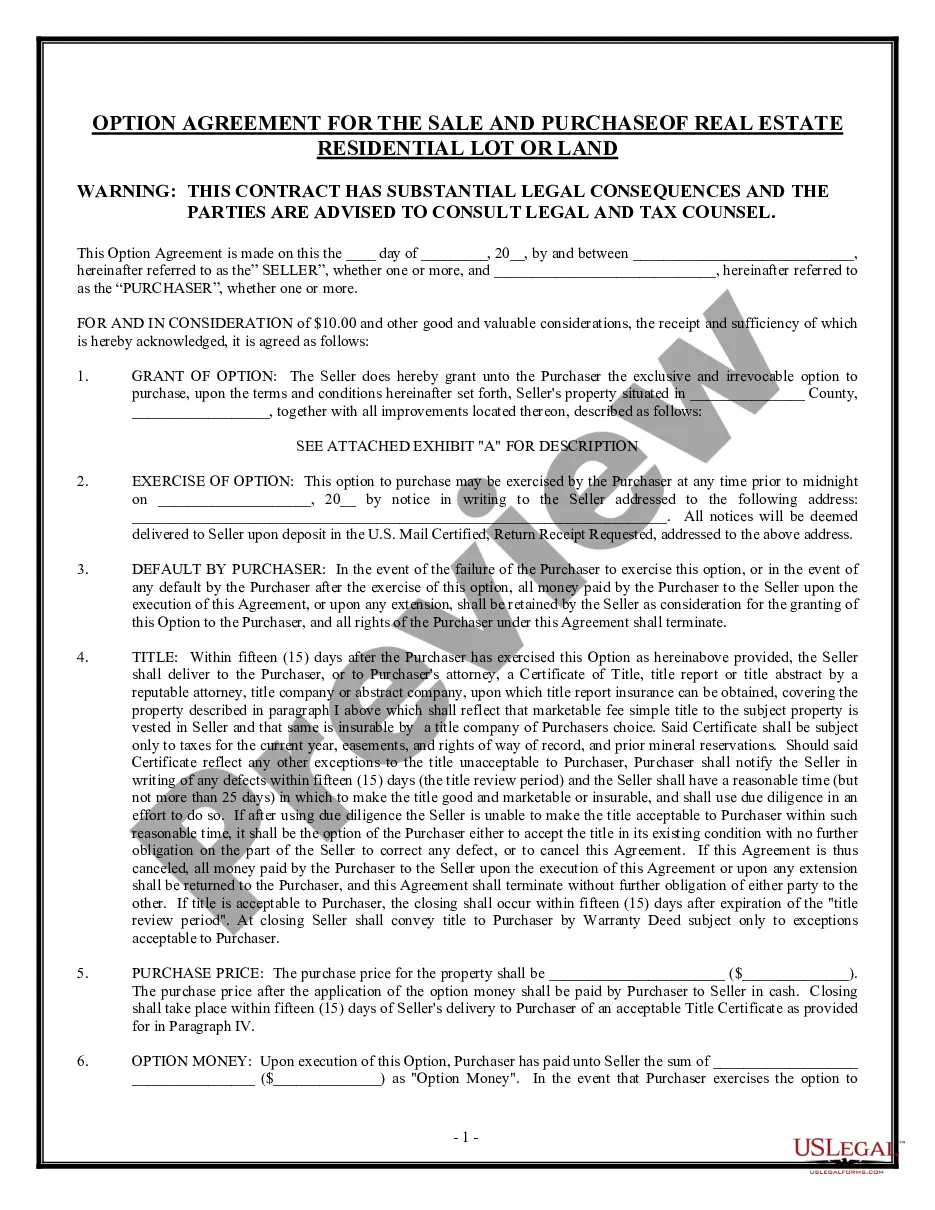

Corporation Limited Liability Form With Tax Id Number

Description

How to fill out Florida Notice To Owner Form - Construction - Mechanic Liens - Corporation?

Legal document managing can be mind-boggling, even for experienced specialists. When you are searching for a Corporation Limited Liability Form With Tax Id Number and don’t get the time to spend searching for the right and up-to-date version, the processes could be stress filled. A strong web form catalogue might be a gamechanger for everyone who wants to take care of these situations effectively. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and business forms. US Legal Forms handles any needs you may have, from individual to business paperwork, all in one spot.

- Employ advanced resources to complete and handle your Corporation Limited Liability Form With Tax Id Number

- Access a resource base of articles, guides and handbooks and materials relevant to your situation and requirements

Save effort and time searching for the paperwork you will need, and employ US Legal Forms’ advanced search and Preview tool to locate Corporation Limited Liability Form With Tax Id Number and download it. In case you have a subscription, log in to the US Legal Forms account, look for the form, and download it. Take a look at My Forms tab to view the paperwork you previously saved as well as to handle your folders as you see fit.

If it is the first time with US Legal Forms, create an account and get unlimited use of all benefits of the platform. Here are the steps for taking after downloading the form you need:

- Confirm it is the right form by previewing it and reading through its description.

- Be sure that the sample is accepted in your state or county.

- Pick Buy Now once you are all set.

- Select a subscription plan.

- Pick the formatting you need, and Download, complete, sign, print out and send your papers.

Benefit from the US Legal Forms web catalogue, backed with 25 years of experience and stability. Enhance your day-to-day papers managing into a smooth and user-friendly process right now.

Form popularity

FAQ

We recommend you form your LLC before you get your EIN. One of the main reasons is that when you apply for your EIN, the IRS application asks you to submit the approved legal name of your business and the date it was formed. So, it is helpful to have your LLC formed and registered before you try to get your EIN.

Disregarded entities are the simplest tax classification with straightforward tax reporting. Your LLC is not taxed or required to file a tax return. Instead, the business profits and losses pass to you as the sole owner to be reported on your personal income tax return.

An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business entity. It is also used by estates and trusts which have income which is required to be reported on Form 1041, U.S. Income Tax Return for Estates and Trusts.

An EIN is not the same as an LLC (Limited Liability Company). An EIN, also known as a federal identification number or business tax ID, is a tax identity. The IRS assigns EINs to distinguish unique business entities, including sole proprietors, LLCs, corporations, partnerships, and nonprofit organizations.

Completing the W-9 Form On the first two lines of the form, enter your full name and the legal name of your LLC. ... Next, check the box for your tax classification as described in the section above. ... If you have an EIN (employer identification number), you should enter it on the W-9. ... Next, enter your full address.