Deed In Lieu Of Foreclosure Forms For Reverse Mortgage

Description

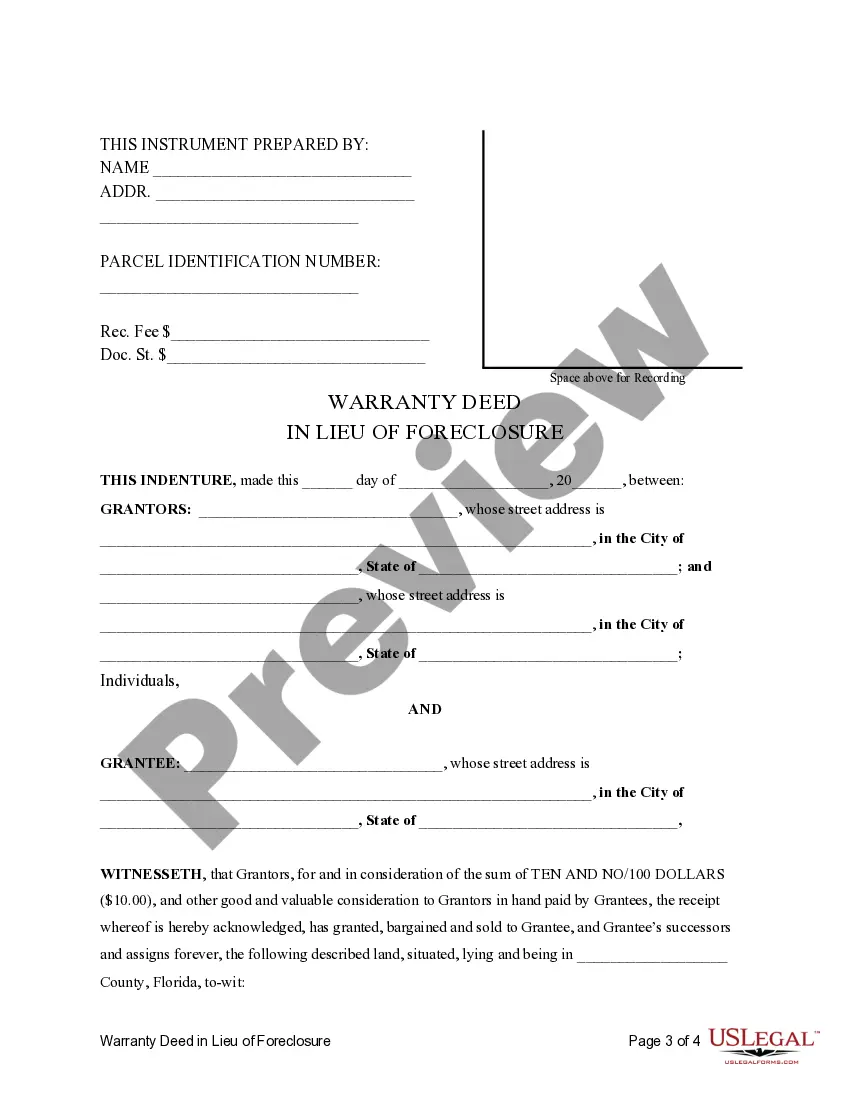

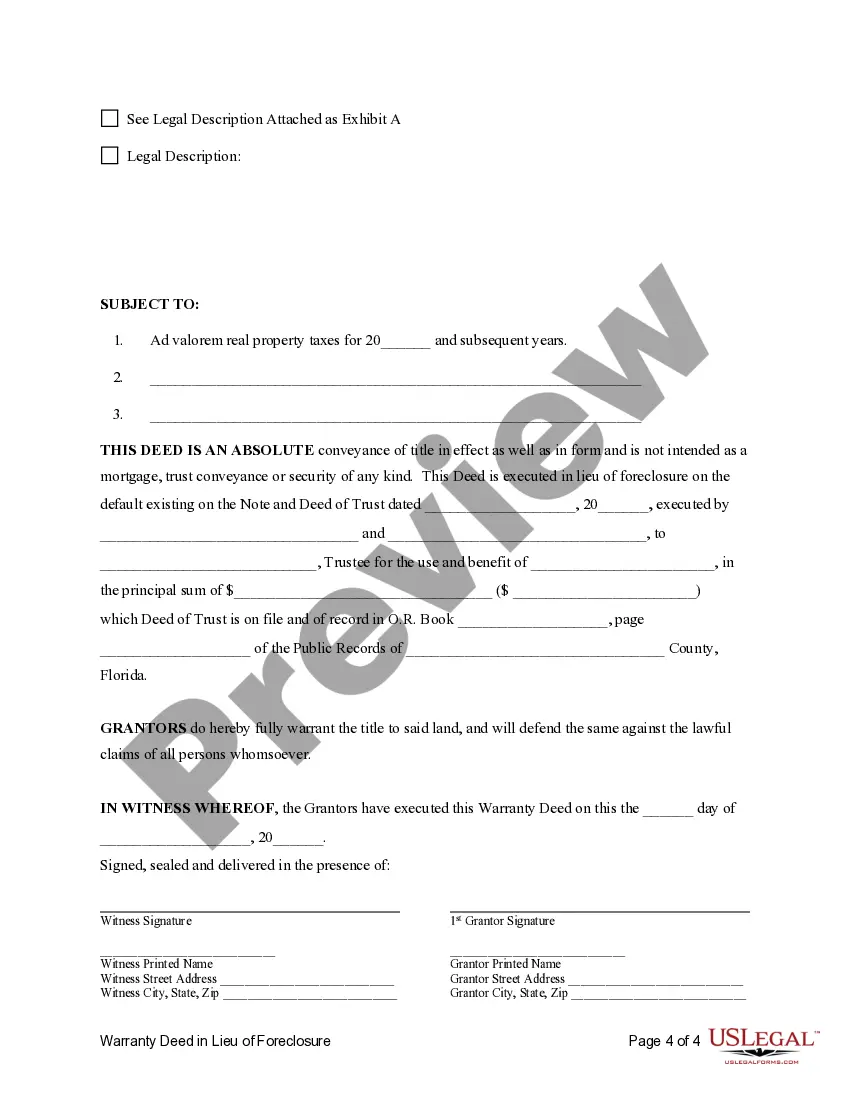

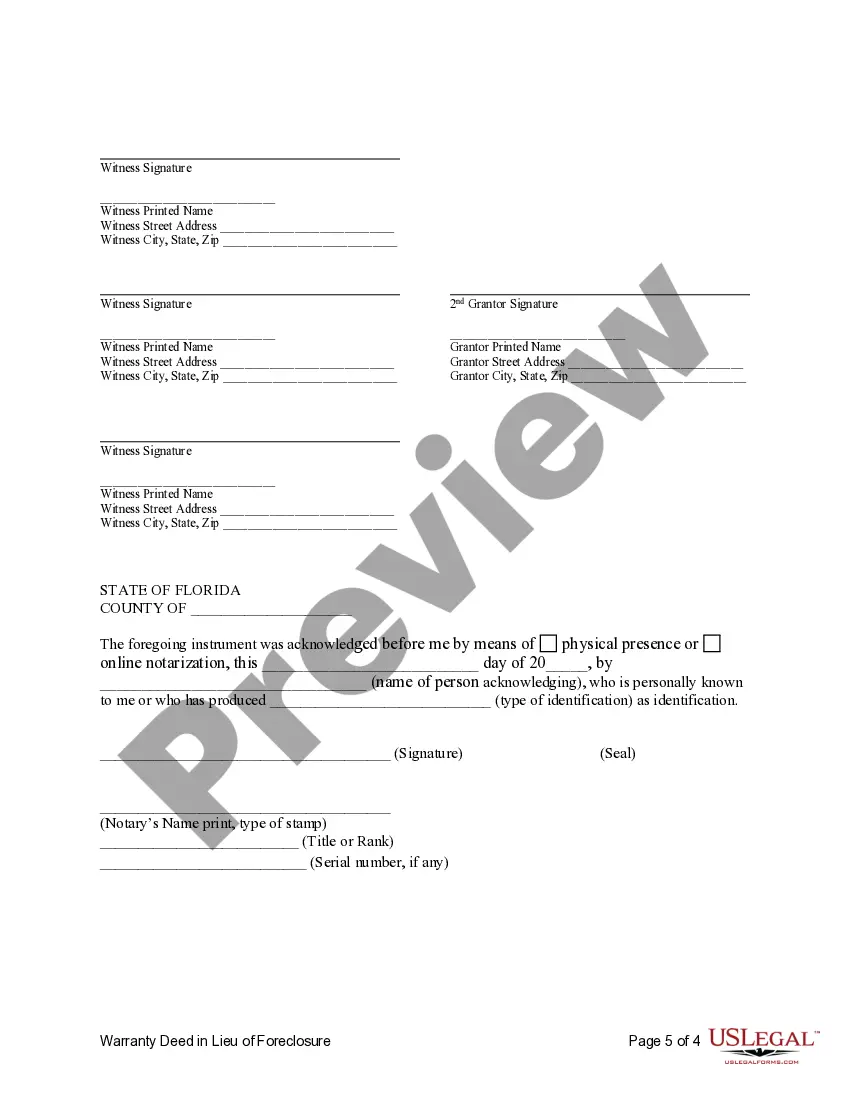

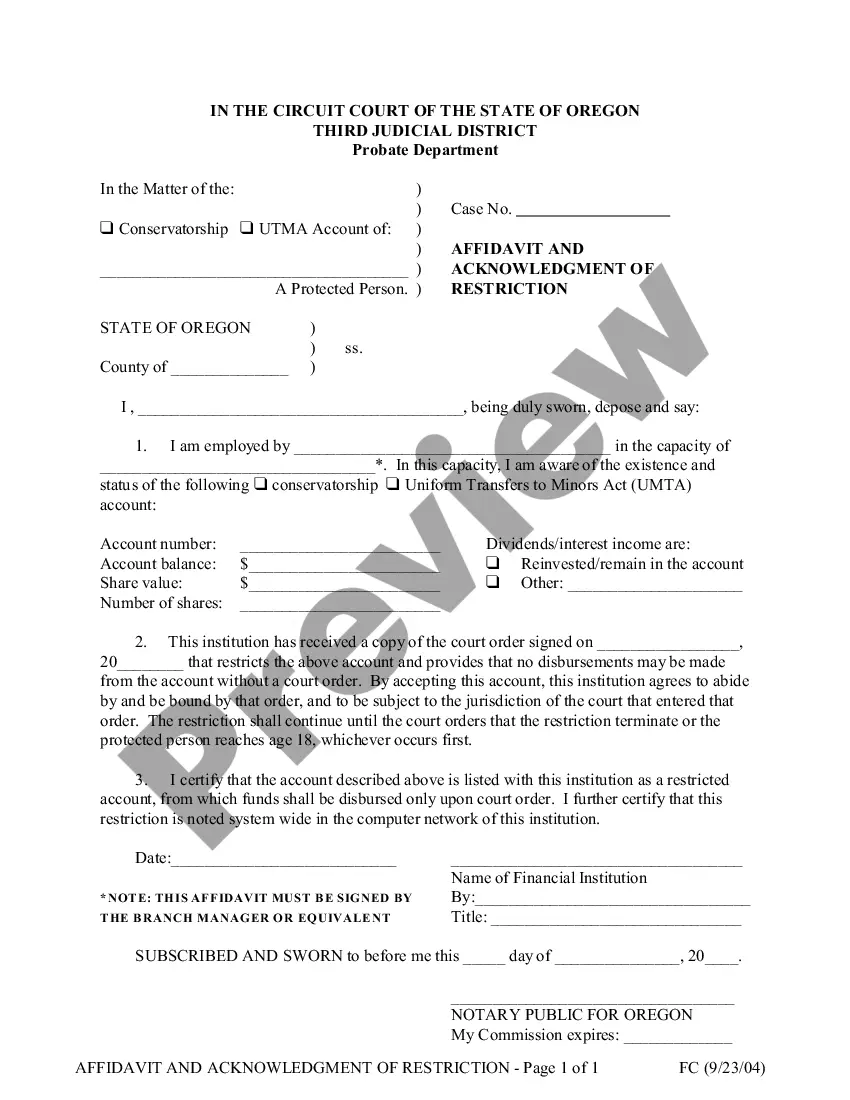

How to fill out Florida Warranty Deed In Lieu Of Foreclosure?

Dealing with legal documents and procedures could be a time-consuming addition to your day. Deed In Lieu Of Foreclosure Forms For Reverse Mortgage and forms like it typically need you to search for them and understand how to complete them effectively. For that reason, whether you are taking care of financial, legal, or personal matters, having a thorough and convenient web library of forms when you need it will go a long way.

US Legal Forms is the top web platform of legal templates, boasting more than 85,000 state-specific forms and numerous tools that will help you complete your documents quickly. Discover the library of appropriate papers open to you with just a single click.

US Legal Forms provides you with state- and county-specific forms available at any moment for downloading. Protect your papers management operations with a high quality services that lets you make any form within a few minutes without extra or hidden fees. Just log in to the account, identify Deed In Lieu Of Foreclosure Forms For Reverse Mortgage and download it right away in the My Forms tab. You can also gain access to previously downloaded forms.

Would it be the first time making use of US Legal Forms? Register and set up a free account in a few minutes and you will gain access to the form library and Deed In Lieu Of Foreclosure Forms For Reverse Mortgage. Then, adhere to the steps listed below to complete your form:

- Make sure you have the correct form by using the Review feature and looking at the form information.

- Pick Buy Now when ready, and choose the subscription plan that suits you.

- Press Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of expertise helping users deal with their legal documents. Obtain the form you want right now and streamline any operation without breaking a sweat.

Form popularity

FAQ

If you fail to meet your responsibilities under the loan, you may default on your loan, which could result in foreclosure.

There are still considerable cons to reverse mortgages, and borrowers may be unaware of the finer points. One important fact: It is possible to lose one's home if you don't comply with all the loan terms.

Home Equity Conversion Mortgages (HECMs), the most common type of reverse mortgage loan, require that you keep current on your property taxes and homeowners insurance. Failure to pay either may lead to foreclosure.

So, if you do the paperwork right with the reverse mortgage company, you have up to one year before they will start the foreclosure process. The foreclosure process takes about 4 months minimum and usually longer.

A reverse mortgage is a ?non-recourse? loan, meaning that in the event of a default, a lender can take action against only the home subject to the mortgage.