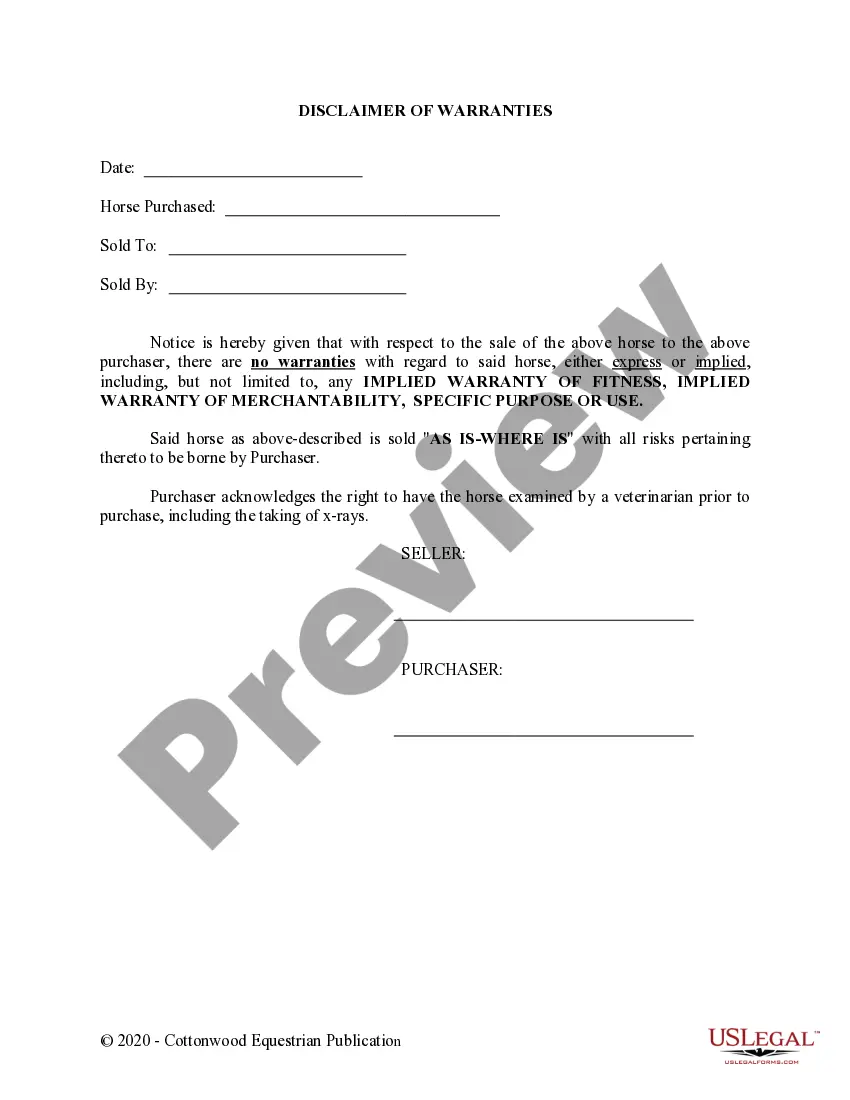

This Disclaimer of Warranties Horse Equine form is a discliamer of warranties, express and implied, in connection with the sale of a horse to be signed by the Seller and Purchaser.

Florida Disclaimer With Real Property Form

Description

How to fill out Florida Disclaimer With Real Property Form?

There's no longer a need to invest hours searching for legal documents to fulfill your local state obligations. US Legal Forms has compiled all of them in one convenient location and improved their accessibility.

Our platform provides over 85,000 templates for any business and personal legal situations categorized by state and area of application. All forms are suitably drafted and verified for authenticity, so you can trust in acquiring a current Florida Disclaimer With Real Property Form.

If you're acquainted with our service and already possess an account, ensure your subscription is active before obtaining any templates. Log In to your account, select the document, and click Download. You can also access all previously acquired documents at any time by navigating to the My documents tab in your profile.

You can print your form to complete it manually or upload the sample if you prefer to work with an online editor. Creating formal documentation under federal and state regulations is quick and easy with our platform. Experience US Legal Forms today to keep your paperwork organized!

- If you haven't used our service previously, the process will require a few additional steps to complete.

- Here's how new users can locate the Florida Disclaimer With Real Property Form in our library.

- Examine the page content carefully to verify it contains the sample you require.

- To do this, utilize the form description and preview options if available.

- Employ the Search bar above to explore for another template if the former one didn't suit your needs.

- Click Buy Now next to the template name when you identify the correct one.

- Choose the most appropriate subscription plan and register for an account or Log In.

- Proceed with payment for your subscription using a credit card or through PayPal.

- Select the file format for your Florida Disclaimer With Real Property Form and download it to your device.

Form popularity

FAQ

To create a qualified disclaimer in Florida, you must meet specific criteria outlined by state law, including submitting a Florida disclaimer with real property form. The disclaimer must be in writing, irrevocable, and must not benefit you or your estate. It's advisable to consult legal resources or professionals to ensure your disclaimer meets all necessary requirements. This attention to detail will help you avoid potential legal issues down the line.

The nine-month disclaimer rule in Florida mandates that beneficiaries must file their disclaimers within nine months of the decedent's death. This law aims to provide clarity in the estate distribution process. By adhering to this rule, you ensure that your Florida disclaimer with real property form is valid and recognized. It’s wise to stay informed and not delay your decision.

If a beneficiary chooses to refuse an inheritance, it typically passes to the next eligible heir under Florida law. This can create a ripple effect within the estate distribution. However, using a Florida disclaimer with real property form allows the beneficiary to formally decline the asset, ensuring clarity and reducing potential disputes. Consulting resources like uslegalforms can help you navigate this process smoothly.

Beneficiaries in Florida have up to nine months from the date of the decedent’s death to disclaim their inheritance. It’s essential to understand that the timeframe is not flexible; adhering to this deadline is vital to protecting your legal rights. By using a Florida disclaimer with real property form, you can clearly communicate your decision to the court and avoid potential complications.

To disclaim a property in Florida, you need to file a Florida disclaimer with real property form with the appropriate authority, usually the probate court. First, make sure to ensure you qualify for a qualified disclaimer. After preparing the required documentation, submit it within the allowed timeframe. This process allows you to formally refuse your interest in the property.

In Florida, you generally have nine months from the date of the decedent's death to file a disclaimer. This timeframe is crucial to ensure that your Florida disclaimer with real property form is recognized. If you miss this deadline, you might unintentionally accept the inheritance. Therefore, it’s important to act promptly.

An example of an estate disclaimer would be if a person inherited a rental property but decided to disclaim it to avoid landlord responsibilities. They could complete a Florida disclaimer with real property form to officially refuse the property. This choice helps them sidestep potential issues associated with property management while allowing the estate to pass to another beneficiary.

A qualified disclaimer in estate planning allows beneficiaries to refuse assets they inherit, helping them to avoid unintended financial consequences. This legal tool is essential for those who wish to plan their estates effectively, ensuring the right distribution of assets without extra burdens. The Florida disclaimer with real property form is a practical method for implementing this strategy.

A beneficiary may choose to disclaim property for several reasons, including tax considerations or the burden of maintaining the property. For instance, if property comes with significant debts or estate taxes, disclaiming it might preserve the beneficiary's financial stability. Utilizing the Florida disclaimer with real property form can help beneficiaries navigate these decisions easily.

An example of a disclaimer of estate occurs when a beneficiary decides to refuse an inheritance of real estate, such as a house. By executing a Florida disclaimer with real property form, the beneficiary formally declines the property. This action can help them avoid tax burdens or complications associated with maintaining the estate.