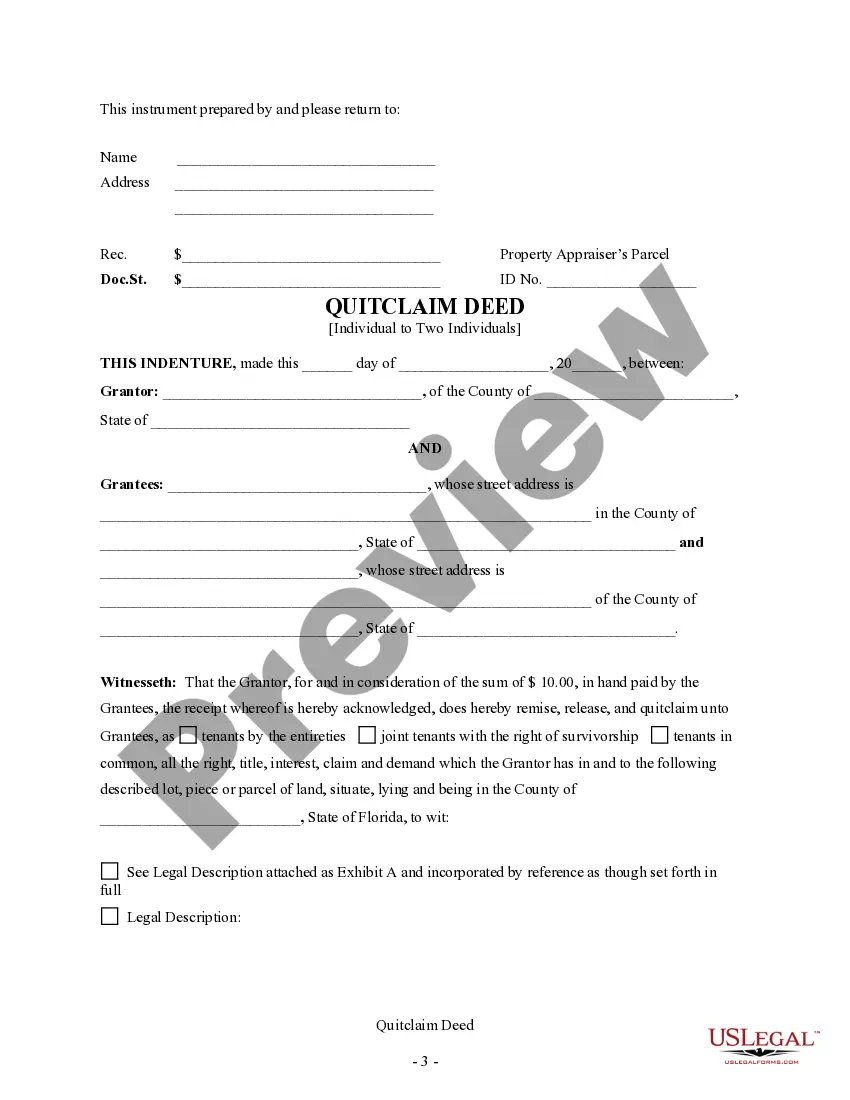

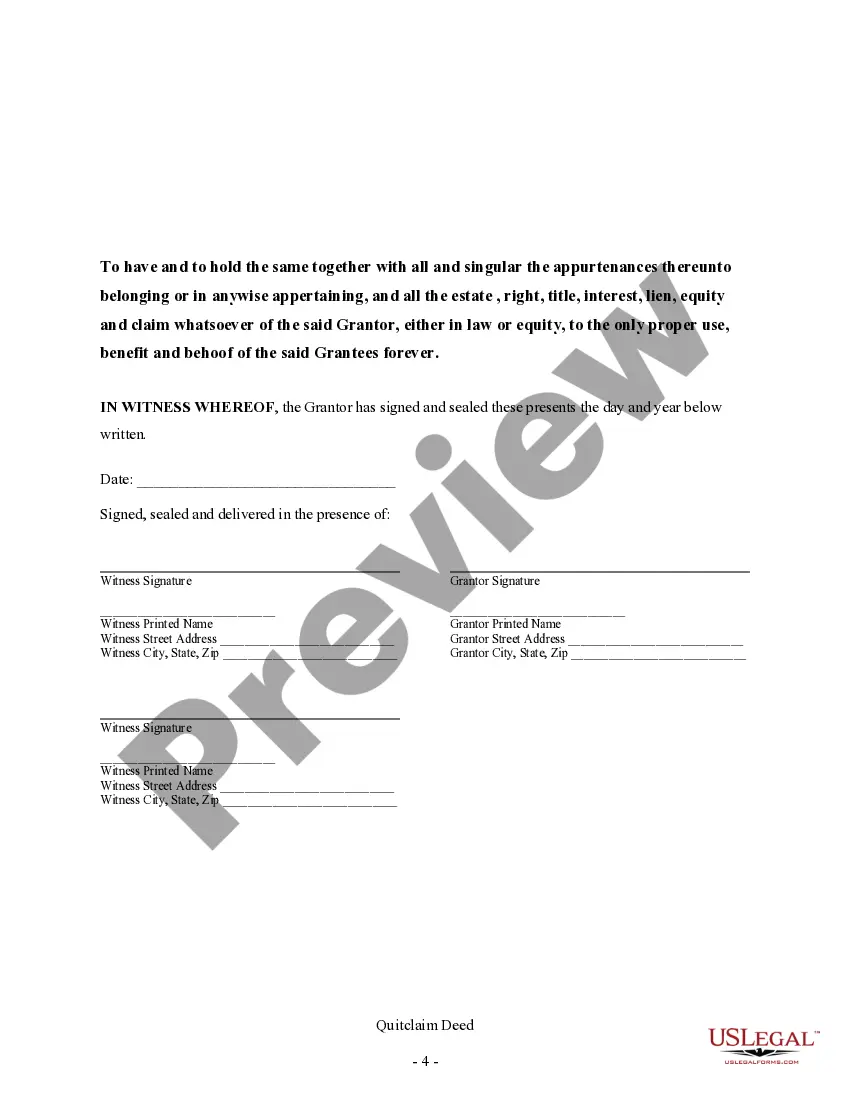

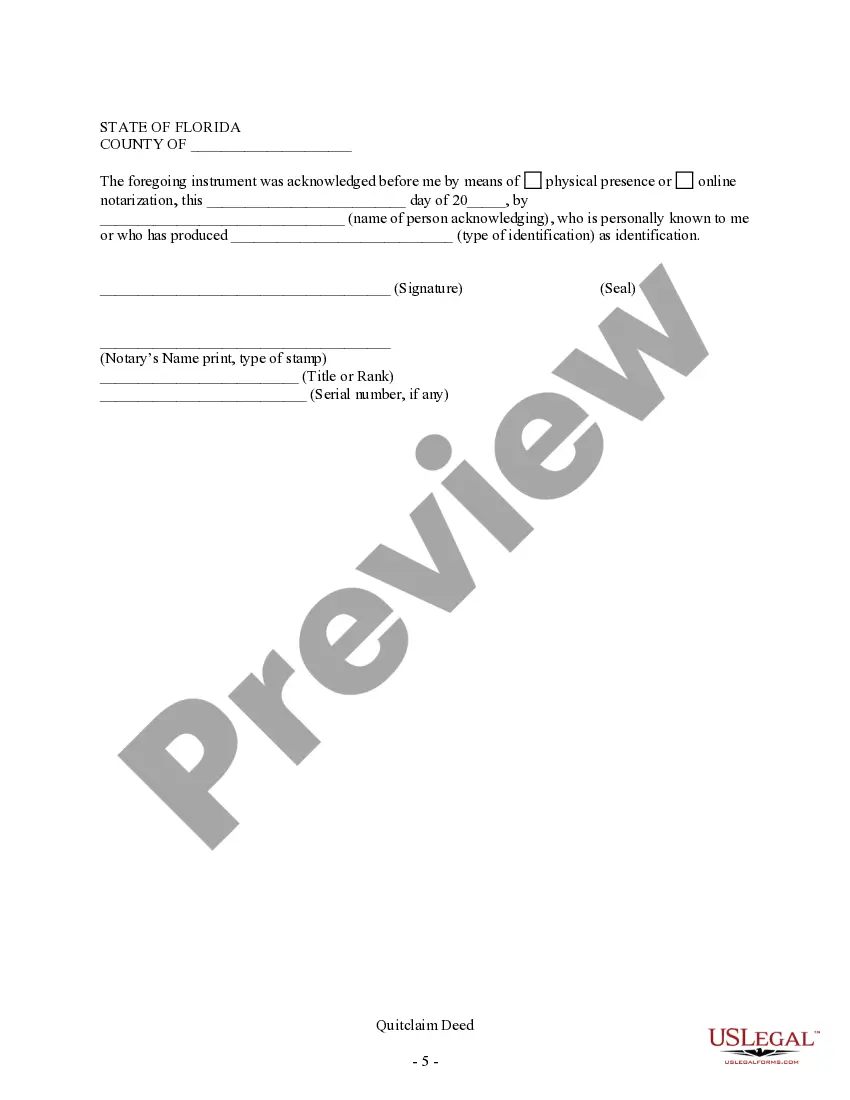

This Quitclaim Deed from Individual to Two Individuals in Joint Tenancy form is a Quitclaim Deed where the Grantor is an individual and the Grantees are two individuals. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This form complies with all state statutory laws.

Florida Deed In Lieu Of Foreclosure

Description

How to fill out Florida Deed In Lieu Of Foreclosure?

There's no longer a need to waste time looking for legal documents to adhere to your local state requirements.

US Legal Forms has gathered all of them in a single location and streamlined their accessibility.

Our platform offers over 85,000 templates for any business and individual legal situations organized by state and category of use.

Prepare your official paperwork in accordance with federal and state laws and regulations quickly and efficiently with our library. Experience US Legal Forms today to maintain your documentation organized!

- All forms are correctly drafted and verified for accuracy, so you can trust in acquiring a current Florida Deed In Lieu Of Foreclosure.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also retrieve all saved documents any time necessary by visiting the My documents section in your profile.

- If you have never used our service before, the process will involve a few additional steps to finalize.

- Here's how new users can locate the Florida Deed In Lieu Of Foreclosure in our catalog.

- Examine the page content closely to confirm it features the sample you require.

- To assist, use the form description and preview options if available.

Form popularity

FAQ

A bank can initiate foreclosure proceedings soon after you fall behind on payments, often starting within a few months of missed payments. However, the total foreclosure process can be lengthy, as it must comply with legal requirements and court schedules. To expedite your escape from this situation, consider a Florida deed in lieu of foreclosure, which allows for faster resolution compared to typical foreclosure routes.

Home foreclosure in Florida can take anywhere from several months to over a year, depending on the circumstances of each case. Factors that influence this timeline include court delays and varying legal processes. If time is of the essence for you, a Florida deed in lieu of foreclosure might be a quicker resolution, helping you avoid the prolonged stress associated with traditional foreclosure.

Closing on a property in Florida usually takes 30 to 45 days from the time you enter into a contract. This timeframe allows for necessary inspections, title searches, and financing arrangements. If you are transitioning from a property due to a Florida deed in lieu of foreclosure, it could be beneficial to streamline this process to find your next home.

In Florida, you can generally miss about three mortgage payments before the lender initiates the foreclosure process. However, this can vary based on the lender's policies and your communication with them. If you're facing difficulty, exploring a Florida deed in lieu of foreclosure can provide a viable alternative to missing payments and facing foreclosure.

The timeline for foreclosure in Florida typically ranges from several months to over a year. This duration depends on various factors, such as the court's schedule and the complexity of your case. If you are considering a Florida deed in lieu of foreclosure, this process can potentially save you time and assist in avoiding lengthy court proceedings.

Several disadvantages come with a Florida deed in lieu of foreclosure. One major concern is that it generally does not relieve you of any remaining mortgage debt unless specifically negotiated. Additionally, you may face taxes on the forgiven debt, and relinquishing your home can be emotionally difficult. It’s prudent to explore these implications thoroughly, potentially with the help of platforms like uslegalforms.

A Florida deed in lieu of foreclosure is not ideal, but it can be less detrimental than a full foreclosure. While it will impact your credit score, it often leads to a faster resolution of your housing situation. Many homeowners find that taking action through a deed in lieu allows them to regain control over their finances sooner than waiting through a prolonged foreclosure.

A significant disadvantage for lenders accepting a Florida deed in lieu of foreclosure is the risk of a property having underlying issues that they may inherit. If the property requires extensive repairs or has title disputes, the lender may face unexpected costs. Additionally, lenders may lose a substantial amount of potential recovery from the sale of the property through traditional foreclosure.

Foreclosure laws in Florida require lenders to file a lawsuit to obtain a judgment before proceeding with a foreclosure. The process typically involves a court hearing to determine the validity of the claim. Understanding these laws can help you navigate your options effectively, especially if you are considering alternatives like a Florida deed in lieu of foreclosure.

In some cases, a foreclosure can be reversed in Florida, but it usually requires specific legal actions. If you can prove that the foreclosure process was flawed or that you are in a position to catch up on payments, you might have a chance to challenge it. Consulting with a legal expert can help clarify your options regarding your situation.