Filing Quit Claim Deed In Florida

Description

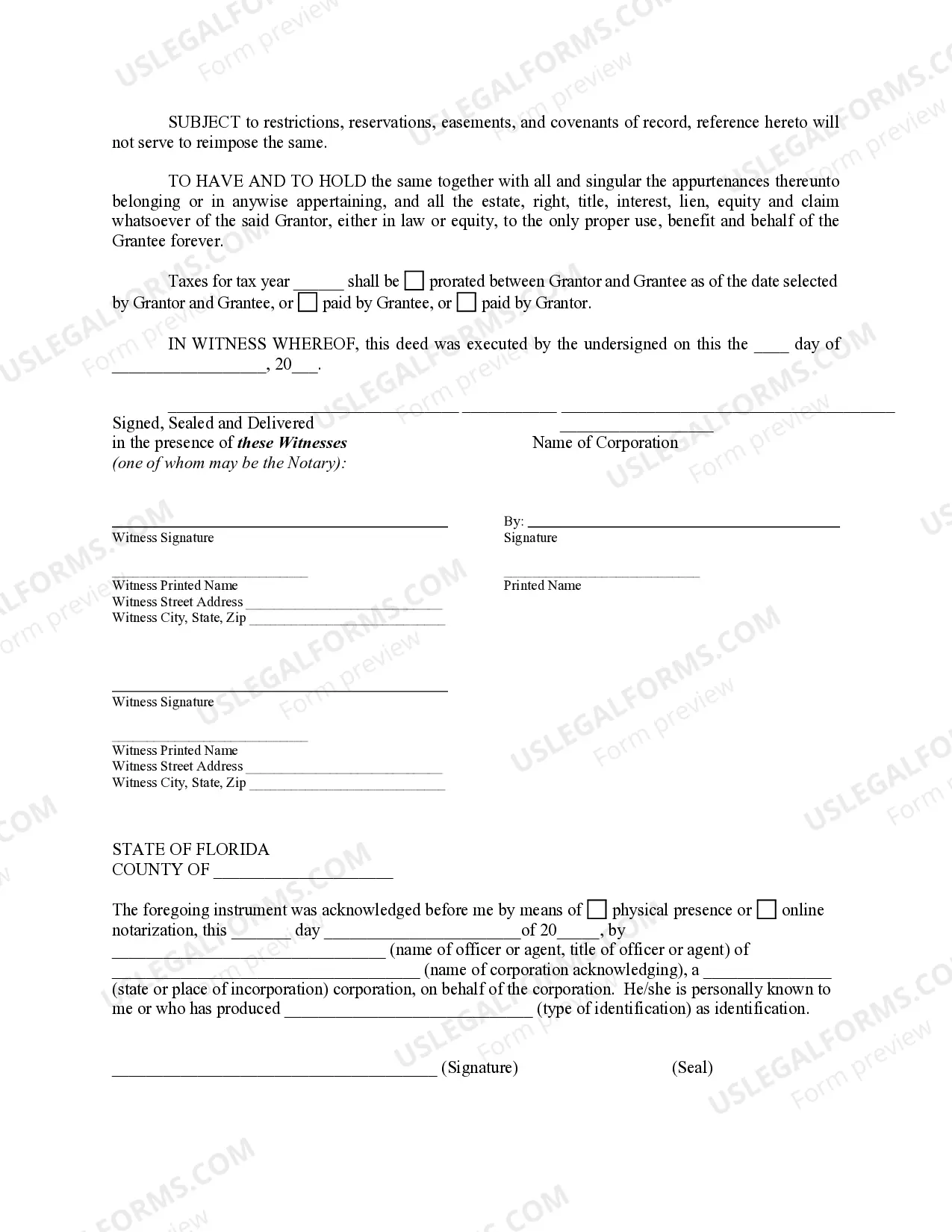

How to fill out Florida Quitclaim Deed From Corporation To Individual?

Legal administration can be exasperating, even for the most adept professionals.

When you wish to file a Quit Claim Deed in Florida and lack the time to search for the correct and current version, the process can become overwhelming.

Obtain state- or county-specific legal and business documents. US Legal Forms caters to all requirements you might have, from personal to business paperwork, all in one location.

Utilize sophisticated tools to complete and manage your Quit Claim Deed in Florida.

Here are the steps to follow after acquiring the form you need.

Verify it is the correct form by previewing it and reviewing its description.

Ensure that the template is valid in your state or county.

- Access a resource library of articles, guides, and materials pertinent to your situation and requirements.

- Save time and effort by searching for the documents you need, and utilize US Legal Forms' advanced search and Review feature to find the Quit Claim Deed in Florida and download it.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Review your My documents section to view the documents you have previously saved and to manage your folders as desired.

- If it’s your first time using US Legal Forms, create a free account and gain unlimited access to all the platform's benefits.

Select Buy Now when you are ready.

Choose a subscription plan.

Choose the format you need, and Download, complete, sign, print, and submit your documents.

Take advantage of the US Legal Forms online catalog, supported by 25 years of experience and reliability. Improve your daily document management through a simple and user-friendly process today.

- A robust online form repository could be transformative for anyone aiming to navigate these circumstances effectively.

- US Legal Forms is a frontrunner in the domain of web-based legal documents, offering over 85,000 state-specific legal forms accessible to you at any time.

- With US Legal Forms, you can.

Form popularity

FAQ

You do not need a lawyer to file a quit claim deed in Florida; however, consulting one can be beneficial. A legal professional can provide valuable insights and ensure that all required details are correctly captured. If you feel confident in handling the process yourself, you can use resources from USLegalForms to guide you through the preparation and filing steps effectively.

Filing a quit claim deed in Florida involves preparing the deed document, signing it in front of a notary, and submitting it to the appropriate county office. You must include proper information about the property and the grantor(s) and grantee(s). After filing, you should keep a copy of the recorded deed for your records. For convenience, consider using USLegalForms to access templates and instructions tailored to your needs.

When filing a quit claim deed in Florida, the recording process typically takes a few days to a couple of weeks. The timeline can vary based on the county's workload and their specific operations. After you submit the deed, it is essential to check with the local recording office for updates. Using a platform like USLegalForms can help streamline your filing process and ensure accurate submissions.

Yes, you can prepare your own quit claim deed in Florida. The form is accessible, and as long as you provide accurate details, you can complete it without professional help. However, to ensure all legal requirements are met and to avoid mistakes, you may want to explore the templates offered on US Legal Forms, making your filing quit claim deed in Florida much easier.

To fill out a quit claim deed form in Florida, start by entering the names of the parties involved, the legal description of the property, and the property address. Make sure to include the effective date and sign the deed in front of a notary. For additional guidance and to access state-specific forms, you can visit US Legal Forms, which simplifies the process of filing quit claim deeds in Florida.

Yes, you can fill out a quit claim deed yourself when filing in Florida. It is a straightforward process that involves completing the form with specific information about the property and the parties involved. However, be aware that errors can delay the filing. For a seamless experience, consider using the resources available at US Legal Forms.

Although you can make a quitclaim deed yourself, we suggest hiring a real estate lawyer to ensure your deed is done right and meets the legal and filing requirements for Flordia and the local country recorders office where the property is located.

If properly executed, a Florida quitclaim deed usually requires two weeks to three months to be recorded. The parties involved in real estate transactions generally seek to record the deed immediately after the closing process is concluded.

Ing to Florida Statute 695.26, a quitclaim deed must contain these certain elements: Name and address of person preparing the deed. Grantor's name and address. Grantee's name and address. Signatures of the grantors. Two witnesses for each signature/ Notary acknowledgment with signature.