Llc Operating Agreement Florida With S Corp Election

Description

How to fill out Florida Limited Liability Company LLC Operating Agreement?

It’s obvious that you can’t become a legal professional immediately, nor can you learn how to quickly draft Llc Operating Agreement Florida With S Corp Election without the need of a specialized background. Creating legal forms is a long process requiring a particular training and skills. So why not leave the preparation of the Llc Operating Agreement Florida With S Corp Election to the specialists?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court paperwork to templates for in-office communication. We understand how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our website and obtain the form you need in mere minutes:

- Discover the form you need with the search bar at the top of the page.

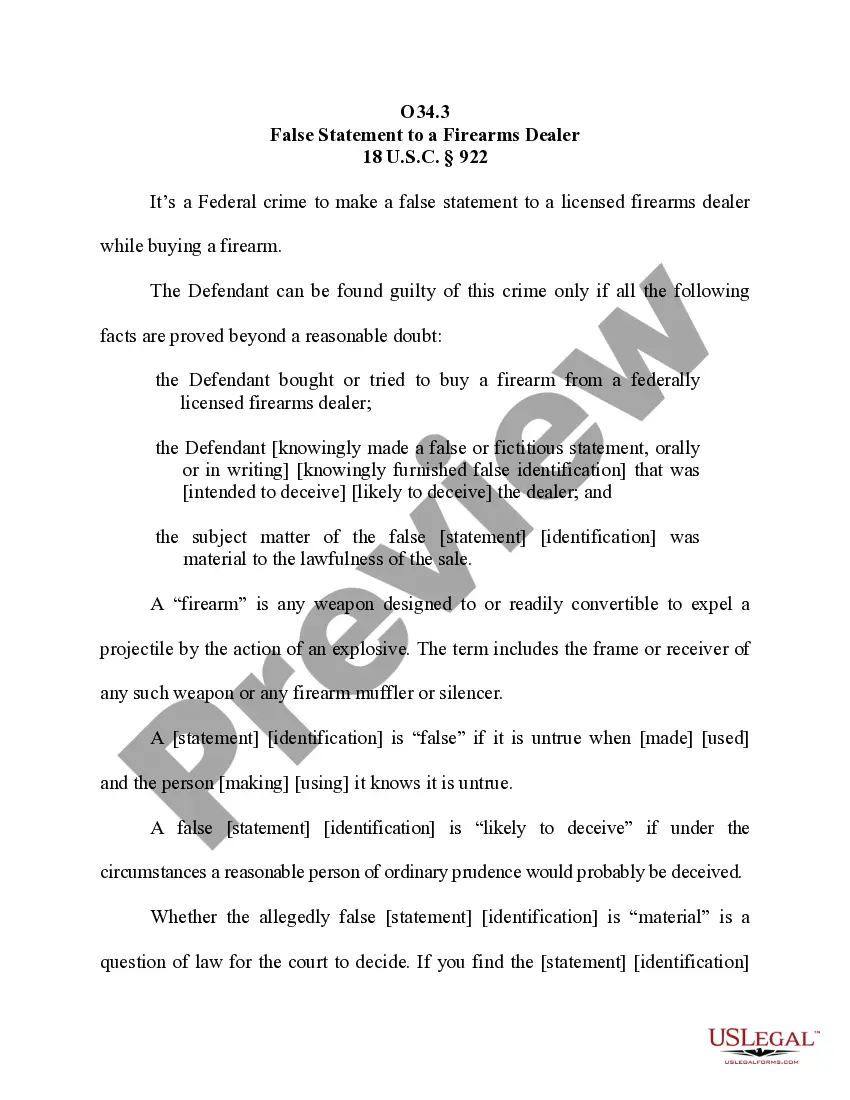

- Preview it (if this option available) and check the supporting description to determine whether Llc Operating Agreement Florida With S Corp Election is what you’re searching for.

- Start your search again if you need any other template.

- Set up a free account and select a subscription plan to buy the form.

- Choose Buy now. As soon as the transaction is complete, you can download the Llc Operating Agreement Florida With S Corp Election, fill it out, print it, and send or mail it to the necessary individuals or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

The laws in Florida don't require an LLC to use an Operating Agreement. Instead, the owners of the LLC can operate the business as they choose, as long as they follow the requirements and limitations of business laws in the state.

A properly drafted Florida LLC operating agreement should include: The names of the LLC members. The members' duties to contribute money or services to the LLC. The members' economic interest in LLC property and profit. Provisions for the distributions to members of LLC profit.

Step 1: Name Your Florida LLC. ... Step 2: Choose a Registered Agent. ... Step 3: File the Florida Articles of Organization. ... Step 4: Create an Operating Agreement. ... Step 5: File Form 2553 to Elect Florida S Corp Tax Designation.

Florida doesn't require that you have an Operating Agreement for your Limited Liability Company (LLC), but it is recommended that you have one. When setting up your company, it's beneficial to seek legal advice from a Florida LLC Business litigation attorney.

An S corporation is simply a Florida corporation that has elected a special tax status. Most Florida businesses elect S corporation status when filing. S corporation status permits the income of the corporation to be passed through to the shareholders.