Llc Operating Agreement Florida With Non Voting Members

Description

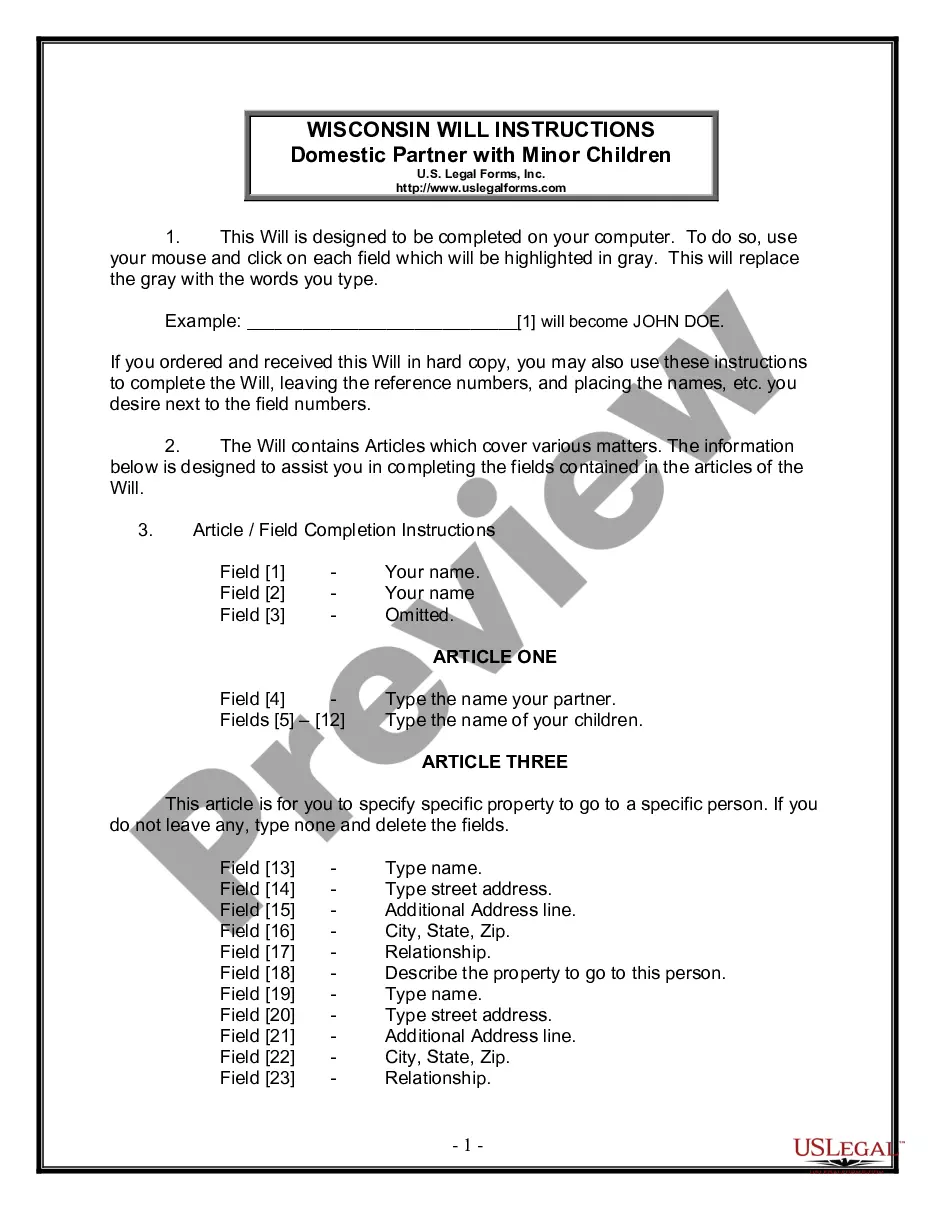

How to fill out Florida Limited Liability Company LLC Operating Agreement?

Creating legal documents from the beginning can frequently feel a bit daunting.

Certain situations may require extensive research and substantial financial investment.

If you're in search of a more straightforward and budget-friendly method for drafting Llc Operating Agreement Florida With Non Voting Members or any other documentation without the hassle, US Legal Forms is consistently available for you.

Our online collection of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal affairs.

However, before proceeding directly to download the Llc Operating Agreement Florida With Non Voting Members, adhere to these recommendations: Review the form preview and descriptions to confirm that you are viewing the document you need. Verify if the form you choose aligns with the regulations of your state and county. Select the most appropriate subscription option to buy the Llc Operating Agreement Florida With Non Voting Members. Download the file. Then complete, sign, and print it out. US Legal Forms has a flawless reputation and over 25 years of expertise. Join us today and make form completion a simple and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously prepared by our legal experts.

- Utilize our platform whenever you require dependable and trustworthy services through which you can effortlessly find and acquire the Llc Operating Agreement Florida With Non Voting Members.

- If you're already familiar with our website and have set up an account previously, simply Log In to your account, choose the template, and download it or re-download it later anytime in the My documents section.

- Not registered yet? No worries. It only takes a few minutes to create an account and explore the catalog.

Form popularity

FAQ

Like most states, Florida doesn't require SMLLCs to have an operating agreement. While not required, having an operating agreement that establishes rules for the SMLLC is important. The agreement typically covers the member's rights, duties, and obligations, as well as the SMLLC's management structure.

Florida doesn't require that you have an Operating Agreement for your Limited Liability Company (LLC), but it is recommended that you have one. When setting up your company, it's beneficial to seek legal advice from a Florida LLC Business litigation attorney.

The laws in Florida don't require an LLC to use an Operating Agreement. Instead, the owners of the LLC can operate the business as they choose, as long as they follow the requirements and limitations of business laws in the state.

A properly drafted Florida LLC operating agreement should include: The names of the LLC members. The members' duties to contribute money or services to the LLC. The members' economic interest in LLC property and profit. Provisions for the distributions to members of LLC profit.

An operating agreement should include the following: Percentage of members' ownership. Meeting provisions and voting rights. Powers and duties of members and management. Distribution of profits and losses. Tax treatment preference. A liability statement. Management structure. Operating procedures.