Florida Incorporate With Another State

Description

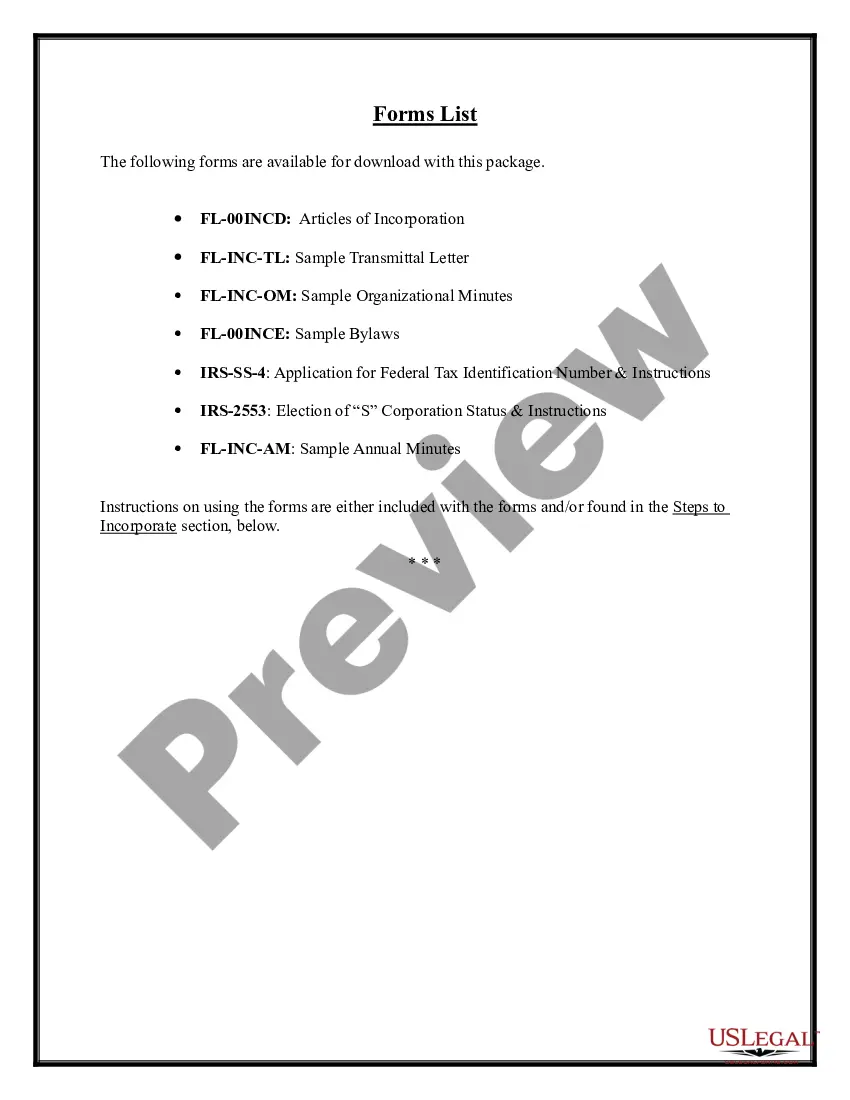

How to fill out Florida Business Incorporation Package To Incorporate Corporation?

It’s clear that you cannot transform into a legal authority instantly, nor can you swiftly master how to prepare Florida Incorporate With Another State without possessing a unique set of abilities.

Assembling legal documents is a lengthy endeavor that demands specific training and expertise. So why not entrust the development of the Florida Incorporate With Another State to the experts.

With US Legal Forms, which boasts one of the largest legal template collections, you can discover anything from court records to templates for internal corporate communication.

If you need a different template, initiate your search again.

Create a free account and choose a subscription plan to buy the template.

- We understand the significance of compliance and adherence to federal and state laws and regulations.

- That’s why, on our platform, all forms are region-specific and current.

- To start, visit our website and acquire the form you need in just minutes.

- Locate the document you require using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to establish whether Florida Incorporate With Another State is what you are looking for.

Form popularity

FAQ

Yes, you are allowed to operate a Florida LLC for any legal business in every state in the USA. Under the US Constitution, your Florida LLC is viewed as a legal ?person? and other states cannot discriminate against this ?person? based on where he/she/it was born or incorporated.

How to Register Your Out-of-State Corporation in Florida Obtain a Certificate of Existence. ... Choose a Registered Agent. ... Complete the Application. ... Submit the Necessary Documents and Fees. ... File an Annual Report.

Florida and Delaware, in particular, are two of the best options where you can incorporate your company. They have business, tax, and privacy laws that are beneficial for your business. Learn how to incorporate in these friendly states, so you can make a wiser decision in establishing your business entity.

How to Incorporate in Florida Choose an organization name ing to Florida's rules. File your organization's articles of incorporation with the Department of State. Request a Federal Employer Identification Number (FEIN) from the IRS. Obtain all necessary licenses from the state, city, and county.

When you register a new business in Florida, you will be able to benefit from the highly stable as well as favorable tax climate the state offers. Some of the benefits include: No corporate income tax on subchapter S-corporations and Limited Partnerships. Exemption of capital stock from corporate franchise tax.