Odometer Statement Form For Food Stamps

Description

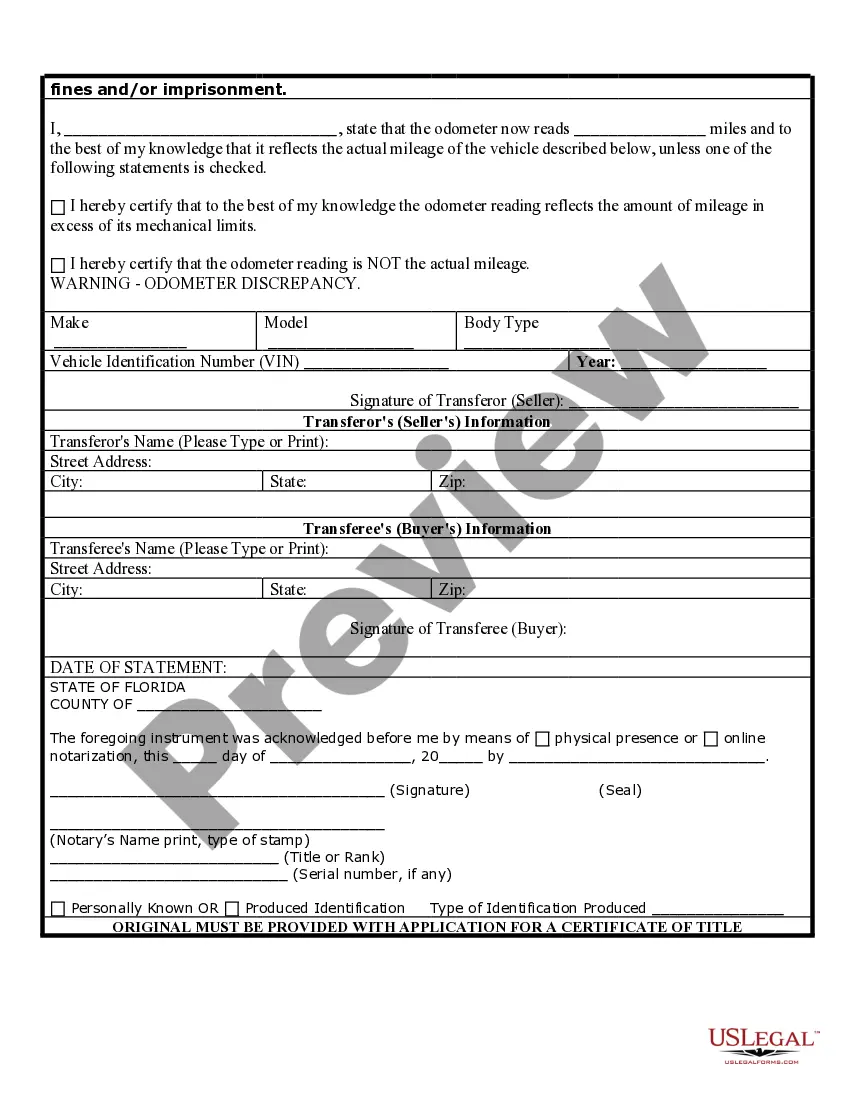

How to fill out Florida Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

The Odometer Statement Form for Food Stamps displayed on this site is a reusable legal template created by experienced attorneys in adherence to federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 verified forms tailored for various business and personal needs. It’s the fastest, easiest, and most dependable method to acquire the documents you require, as the service ensures the utmost level of data security and protection against malware.

Choose the file type you prefer for your Odometer Statement Form for Food Stamps (PDF, DOCX, RTF) and save the document on your device. Complete and sign the documents. Print the template to fill it out by hand. Alternatively, use an online PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature. Download your documents again. Reuse the same document whenever necessary. Access the 'My documents' tab in your account to redownload any previously saved forms. Register with US Legal Forms to have verified legal templates available for all of life's situations.

- Browse for the document you need and check it over.

- Review the sample you located and preview it or examine the form description to ensure it meets your requirements. If it does not, utilize the search bar to find the suitable one. Click 'Buy Now' once you have identified the template you require.

- Register and Log Into your account.

- Select the pricing option that works for you and create an account. Use PayPal or a credit card to complete a quick payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the fillable template.

Form popularity

FAQ

An odometer statement is a document that verifies the mileage on a vehicle at a specific point in time. This statement is often required for legal and financial transactions, such as vehicle sales or applications for assistance programs. For food stamps, the odometer statement form for food stamps helps ensure that your reported expenses are accurate and verifiable.

To obtain an odometer statement, contact your vehicle's manufacturer or your local DMV. They may require specific details about your vehicle, such as the VIN and your personal information. If you're applying for food stamps, completing an odometer statement form for food stamps is crucial for accuracy.

To find your original odometer reading, look at your vehicle's title or its first registration documents. If you have kept maintenance records, they may also include the original reading. Ensure you have the correct information documented when filling out the odometer statement form for food stamps.

You can find your odometer history by checking your vehicle's maintenance records or any previous sales documents. Many states also maintain a vehicle history report that includes odometer readings. For food stamp applications, you may need to complete an odometer statement form for food stamps to provide accurate information.

To obtain proof of your SNAP benefits, you can request an official document from your local SNAP office. Additionally, many states offer online portals where you can access your benefit statements. Utilizing the Odometer statement form for food stamps may also be necessary if you need to verify vehicle-related expenses.

To apply for WA food stamps, you should gather several key documents. These include your Social Security number, income statements, and proof of residency. If you own a vehicle, be prepared to submit the Odometer statement form for food stamps to help assess its value as part of your application.

To prove eligibility for an Electronic Benefits Transfer (EBT) card, you will need to provide specific documents. These often include your identification, proof of income, and residency evidence. Furthermore, if applicable, the Odometer statement form for food stamps may be necessary to validate any vehicle's worth during the application process.

When applying for food stamps, you should bring several important documents. Typically, you need proof of identity, income verification, and residency documentation. Additionally, if you are required to submit an Odometer statement form for food stamps, ensure you have that ready to confirm the value of any vehicle you own.

To renew your Washington state food stamps, you must complete the renewal application before your current benefits expire. You can conveniently do this online through the state's DSHS portal or by visiting your local Community Services Office. As part of the process, you may need to submit the Odometer statement form for food stamps, especially if it involves verifying your vehicle's value.

Filling out the odometer statement form for food stamps is straightforward. Begin by providing your vehicle's details, including the make, model, and year. Next, enter the current odometer reading and sign the form to certify the accuracy of the information. For further assistance, consider using US Legal Forms, which offers user-friendly templates and step-by-step instructions to simplify the process.