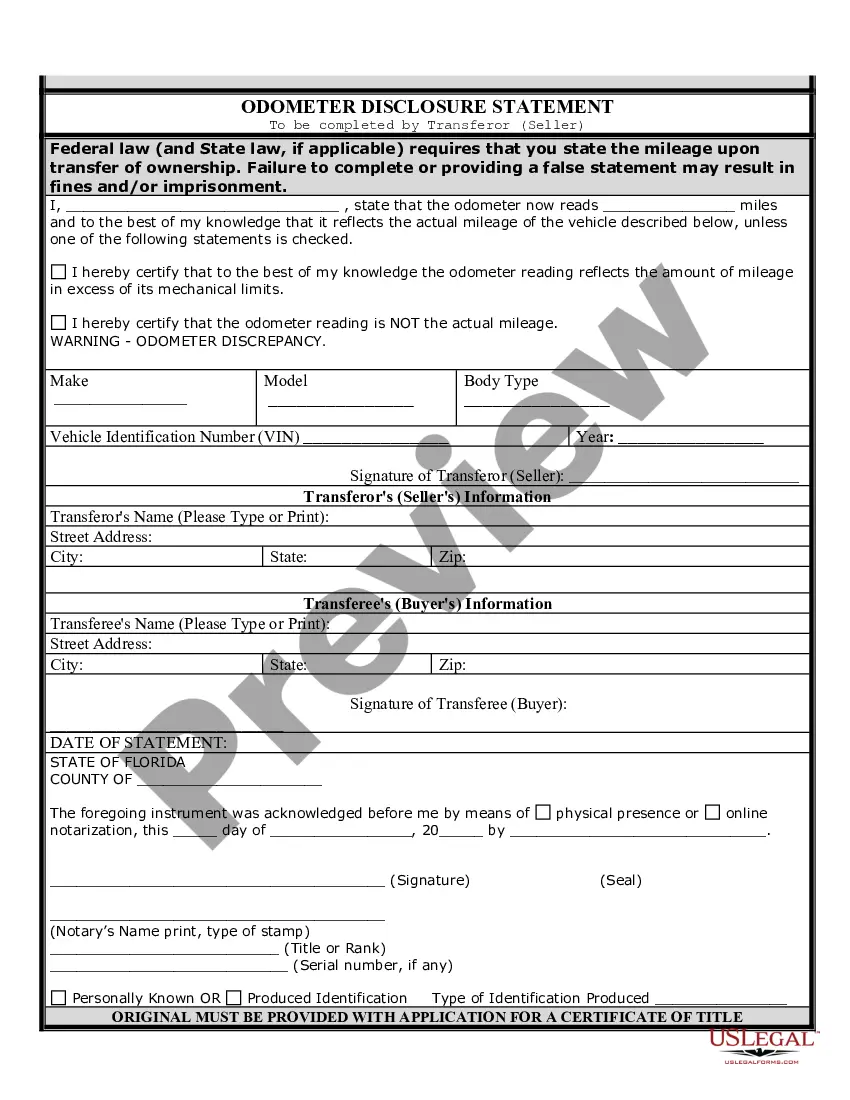

Florida Odometer Disclosure With Lien Release

Description

How to fill out Florida Bill Of Sale Of Automobile And Odometer Statement?

The Florida Odometer Disclosure With Lien Release displayed on this page is a reusable official template crafted by qualified attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 authenticated, state-specific forms for any business or personal situation. It’s the quickest, simplest, and most dependable method to acquire the documents you require, as the service ensures the highest level of data protection and anti-malware safeguards.

Access your documents again whenever necessary. Navigate to the My documents tab in your profile to redownload any forms that you have previously downloaded. Register for US Legal Forms to have verified legal templates for all aspects of life at your fingertips.

- Explore the document you require and review it.

- Browse through the preview of the sample you searched and examine the form description to verify it meets your needs. If it does not, use the search feature to find the suitable one. Click Buy Now after you have found the template you need.

- Choose a pricing plan that fits you and create an account. Make an immediate payment using PayPal or a credit card. If you already possess an account, Log In and verify your subscription to proceed.

- Select your desired format for the Florida Odometer Disclosure With Lien Release (PDF, Word, RTF) and download the sample to your device.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to swiftly and accurately complete and sign your form with a legally-recognized electronic signature.

Form popularity

FAQ

Federal law requires an odometer disclosure statement for all vehicle transactions involving motor vehicles under certain circumstances, particularly when there is a title transfer. This law is designed to prevent odometer fraud and ensure accurate vehicle histories. The statement must include the vehicle's mileage at the time of sale and details about any liens. Compliance with these regulations protects both buyers and sellers.

In Hawaii, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

In addition to written wills, Hawaii recognizes holographic (handwritten) wills so long as the signature and material portions of the document are in the testator's handwriting. A handwritten will does not have to be witnessed in order to be valid in Hawaii.

No, in Hawaii, you do not need to notarize your will to make it legal. However, Hawaii allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that. A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.

Who Gets What in Hawaii? If you die with:here's what happens:spouse and parentsspouse inherits $200,000 of intestate property plus 3/4 of the balance parents inherit everything elseparents but no spouse or descendantsparents inherit everythingsiblings but no spouse, descendants, or parentssiblings inherit everything5 more rows

The general requirements for a valid Will are usually as follows: (a) the document must be written (meaning typed or printed), (b) signed by the person making the Will (usually called the ?testator? or ?testatrix?, and (c) signed by two witnesses who were present to witness the execution of the document by the maker ...

No, you are not required to use a lawyer to make a Will in Hawaii. There are some situations, like a complex estate or difficult family relationships, where it may be beneficial to consult a lawyer.

What is a simple will? State that the document is your will and reflects your final wishes. ... Name the people you want to inherit your property after you die. ... Choose someone to carry out the wishes in your will. ... Name guardians to care for your minor children or pets, if you have them. Sign the will.

Steps to Create a Will in Hawaii Decide what property to include in your will. Decide who will inherit your property. Choose an executor to handle your estate. Choose a guardian for your children. Choose someone to manage children's property. Make your will. Sign your will in front of witnesses. Store your will safely.