Lead-based Paint Disclosure And Pamphlet

Description

How to fill out Delaware Lead Based Paint Disclosure For Sales Transaction?

Creating legal paperwork from the beginning can frequently feel somewhat daunting.

Certain situations may require extensive investigation and significant financial outlay.

If you’re looking for a simpler and more economical method of producing Lead-based Paint Disclosure And Pamphlet or any other documents without unnecessary obstacles, US Legal Forms is always available to you.

Our online database of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs.

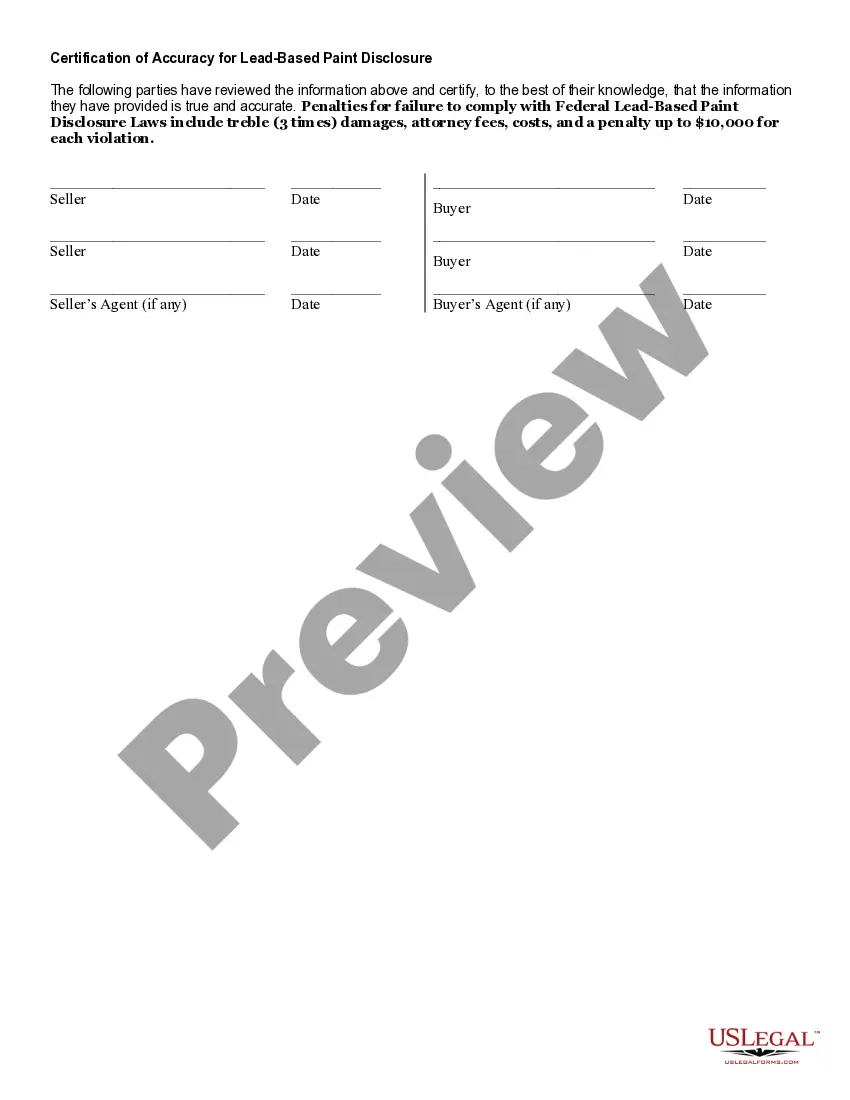

However, before hastily downloading the Lead-based Paint Disclosure And Pamphlet, heed these suggestions: Review the form preview and descriptions to ensure that you have located the document you need. Confirm the template you choose adheres to the rules and laws of your state and county. Select the appropriate subscription plan to obtain the Lead-based Paint Disclosure And Pamphlet. Download the file. Afterwards, fill it out, sign it, and print it. US Legal Forms has a solid reputation and more than 25 years of expertise. Join us today and make document execution effortless and efficient!

- With just a few clicks, you can swiftly obtain state- and county-specific templates carefully crafted by our legal professionals.

- Utilize our platform whenever you need dependable and reputable services through which you can quickly find and download the Lead-based Paint Disclosure And Pamphlet.

- If you’re not a newcomer to our services and have already established an account with us, simply Log In to your account, find the template, and download it or re-download it anytime in the My documents tab.

- Don’t have an account? No issue. It only takes a few minutes to set one up and browse the collection.

Form popularity

FAQ

Vermont Property transfer tax The amount of the transfer tax is generally 1.45 % of the purchase price. The tax is discounted to one half of one percent for the first $100,000.00 of the purchase price if you use the property as your primary residence. Learn more about tax considerations here.

To properly convey a deed the deed must be signed in front of a notary and recorded in the county clerks office. If a survey is referenced in the deed, that survey should also be recorded. If a deed divides a parcel a survey should be recorded with the deed.

In Vermont, all land records are recorded and preserved at the local level, primarily in the office of the clerk of the town where the property is located.

A primary residence in Vermont pays at a varying rate ? 0.5% on the first $100,000 in value and then 1.45% (really 1.25% transfer tax and 0.2% clean water fee) on the remaining value. Properties other than a primary residence pay the 1.45% on all value.

The preferred written instrument to convey a legal interest in land is a deed. There are two basic categories of deed used in Vermont to convey fee title and/or easements in land: the warranty deed; and the quit-claim deed.

Quitclaim Deed: A Quitclaim Deed transfers ownership from one person to another without any warranties or guarantees.