Delaware Disclosure Sales Force

Description

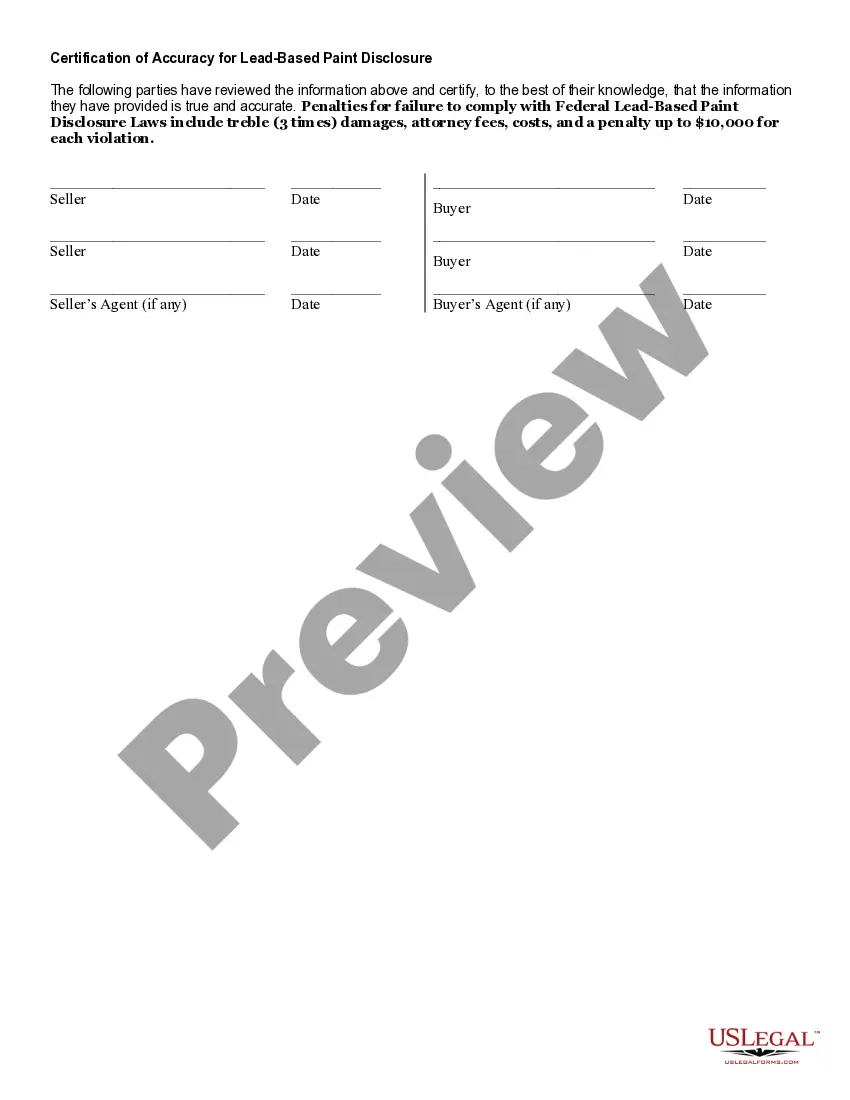

How to fill out Delaware Lead Based Paint Disclosure For Sales Transaction?

Creating legal documents from the ground up can frequently be daunting. Certain situations may require extensive investigation and considerable financial investment.

If you’re looking for a simpler and more economical method of generating Delaware Disclosure Sales Force or any other documentation without navigating through obstacles, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can immediately access state- and county-specific templates meticulously crafted for you by our legal experts.

Utilize our platform whenever you require reliable and trustworthy services through which you can effortlessly find and download the Delaware Disclosure Sales Force. If you’re already familiar with our services and have set up an account, just Log In to your account, find the template, and download it or re-download it anytime from the My documents section.

Ensure that the selected form complies with the regulations and laws of your state and county. Choose the most appropriate subscription option to buy the Delaware Disclosure Sales Force. Download the form, then complete, certify, and print it. US Legal Forms has a flawless reputation and over 25 years of experience. Join us today and make form completion an easy and efficient process!

- Don’t have an account? No problem.

- It takes minimal time to create one and browse the catalog.

- Before proceeding to download Delaware Disclosure Sales Force, adhere to these guidelines.

- Examine the form preview and descriptions to confirm that you are on the correct form.

Form popularity

FAQ

Seller's disclosure exemptions in Delaware primarily include properties sold at foreclosure, government-owned properties, and transfers between family members. These exemptions provide sellers with relief from extensive disclosure requirements. Being aware of these exemptions can help streamline your selling process. Consider using US Legal Forms to access the necessary legal documents and resources.

Certain sellers in Delaware are exempt from providing a seller's property disclosure statement, including those selling inherited properties or properties under court order. Knowing your obligations can help you navigate the selling process more efficiently. US Legal Forms offers tools and templates to assist you in understanding these exemptions and keeping your sale compliant.

In Delaware, specific parties are exempt from providing a transfer disclosure statement, including personal representatives of deceased owners and those selling foreclosure properties. Understanding these exemptions can simplify the selling process for many. If you find yourself in this situation, consulting US Legal Forms can help clarify your obligations and ensure you meet all legal requirements.

Delaware has specific exemptions from real estate transfer tax that include transfers between spouses, certain government entities, and properties sold for less than a specified amount. These exemptions can significantly reduce costs during transactions. It's essential to familiarize yourself with these exemptions to ensure compliance and maximize savings. US Legal Forms can guide you through the process seamlessly.

In Delaware, certain exemptions exist for sellers regarding disclosure obligations. For instance, properties sold at foreclosure or government entities may not require the standard disclosures. Understanding these exemptions can save sellers time and effort in the selling process. US Legal Forms offers comprehensive resources to ensure you comply with Delaware disclosure sales force requirements.

You can find your seller's disclosure by asking your real estate agent or directly contacting the seller. It is typically provided during the home-buying process, but if it's missing, your agent should be able to assist you in obtaining it. Utilizing the Delaware disclosure sales force can also help you access necessary forms and templates, ensuring you have all required disclosures for a transparent transaction. This proactive approach can enhance your buying experience.

Yes, realtors can obtain a copy of the closing disclosure as part of their role in the transaction. They often receive this document from the lender or settlement agent to ensure they are informed of all final terms and costs related to the closing. By leveraging the Delaware disclosure sales force, realtors can efficiently manage these communications and ensure all parties are kept in the loop. This helps facilitate a smoother closing process.

Yes, realtors must disclose any familial relationship with the seller to avoid conflicts of interest. This transparency helps maintain trust in the transaction and ensures all parties are aware of potential biases. A realtor using the Delaware disclosure sales force can easily manage these disclosures, ensuring compliance with ethical standards. This practice protects both buyers and sellers from misunderstandings during the sale.

You can obtain a copy of the seller's disclosure by requesting it directly from the seller or through your real estate agent. The seller is obligated to provide this document, which details property conditions and any known issues. If you are using the Delaware disclosure sales force, you can access templates and forms that ensure you receive complete and accurate disclosures. This can simplify your home-buying process significantly.

To obtain a copy of a closing disclosure, you should contact your lender or the settlement agent involved in the transaction. They are responsible for providing this document, which outlines the final terms of your mortgage and all closing costs. Additionally, using the Delaware disclosure sales force can streamline communication and ensure you receive this important document promptly. Always ensure you have your transaction details on hand for easier access.