Limited Liability Company With One Member

Description

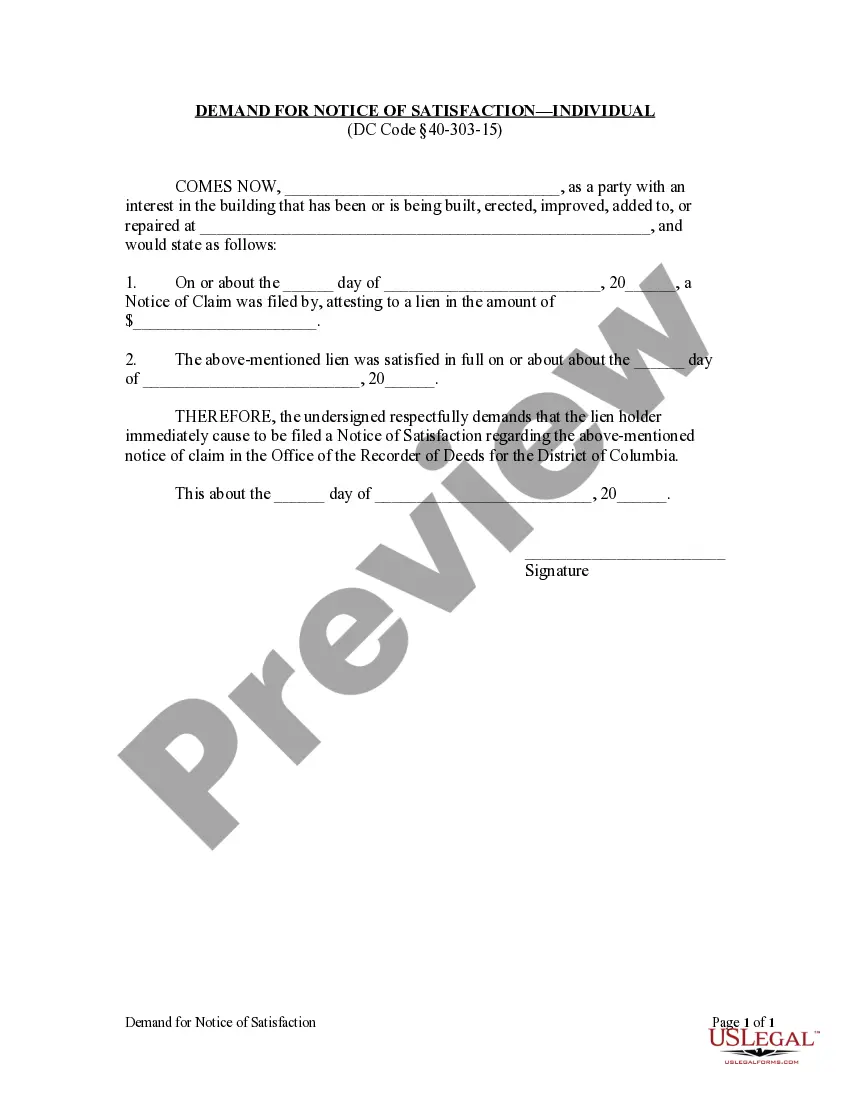

How to fill out District Of Columbia Demand For Notice Of Satisfaction By Corporation?

- Log into your US Legal Forms account if you are a returning user. Ensure your subscription is active, or renew it as per your payment plan.

- In the library, preview the form description to confirm it meets your requirements exactly. This is crucial for adhering to your local jurisdiction's stipulations.

- Utilize the Search tab to find alternative forms if necessary. Once you locate a suitable document, proceed to the next step.

- Select the desired subscription plan and click the Buy Now button. Registration is required to access the extensive form library.

- Enter your payment information, either via credit card or PayPal, and complete your purchase.

- Download the document directly to your device. You can later access it anytime through the My Forms section in your profile.

With US Legal Forms, individuals and attorneys can navigate the complexities of legal documentation with ease. The platform hosts a rich collection of over 85,000 fillable legal forms, ensuring you can find what you need without hassle.

Start your journey towards forming your Limited Liability Company today. Visit US Legal Forms and take advantage of their exceptional resources!

Form popularity

FAQ

Yes, a limited liability company with one member is entirely legal and quite common. This structure allows a single individual to form a business while enjoying liability protection. As the sole member, you have complete control over business decisions, facilitating easier management. This setup offers flexibility and can help you grow your business without the complexities of a larger organization.

A limited liability company with one member can streamline your tax process significantly. The IRS treats it as a disregarded entity, which means you report income and expenses on your personal tax return. Consequently, you can avoid double taxation that often occurs with traditional corporations. Additionally, you can deduct business expenses, making it financially efficient for single-member operations.

Filling out a W-9 for a limited liability company with one member is quite straightforward. First, enter your LLC’s name in the first line, and then include your business's trade name if it differs. Next, in the 'Tax Classification' section, check the box for 'Limited Liability Company' and include 'Disregarded Entity' next to it, as this identifies it as a single-member LLC for tax purposes. Finally, provide your taxpayer identification number, which can be your Social Security Number or employer identification number, depending on how your limited liability company with one member is set up.

Yes, a limited liability company with one member can be owned by another company. This arrangement can be particularly advantageous for businesses looking to consolidate their operations. It allows for efficient management and helps limit liability. If you require personalized assistance in setting up such an LLC, uslegalforms is here to help with all your legal needs.

Absolutely, a limited liability company with one member can indeed be owned by a corporation. This structure can offer various advantages, such as enhanced liability protection and tax benefits for the owners. Utilizing a corporation as the single member can streamline operations based on your business strategy. For guidance through the process, uslegalforms can simplify the necessary steps.

Yes, you can hire someone while operating a limited liability company with one member. As the owner, you can appoint employees or contractors to help manage your business tasks. Be sure to comply with all employment laws and regulations relevant to your area. For streamlined processes in hiring, consider utilizing resources from uslegalforms.

To establish a limited liability company with one member, you first need to choose a unique name for your business. Next, file the necessary formation documents with your state’s business filing office. You may also need an operating agreement to outline the management structure and responsibilities. For assistance with the paperwork, uslegalforms offers user-friendly services to help you set up your LLC.

A limited liability company with one member is often a smart choice for solo entrepreneurs. This structure combines liability protection with the benefits of pass-through taxation, making it appealing for many business owners. It allows for personal asset protection while providing flexibility in management. Consulting with uslegalforms can clarify if this structure suits your specific needs.

Yes, a holding company can own a limited liability company with one member. This arrangement can help facilitate asset protection and streamline management. Owners often use this structure to isolate risk and enhance their overall business operations. If you’re interested in forming a single-member LLC under a holding company, uslegalforms can provide the necessary documentation.

A limited liability company with one member does not require a partnership representative. This is because it doesn't operate as a partnership for tax purposes. Instead, it is treated as a disregarded entity, allowing the owner to report income directly on their tax return. For personalized guidance on setting up your LLC, you might consider using the services of uslegalforms.