Limited Liability Company With Example

Description

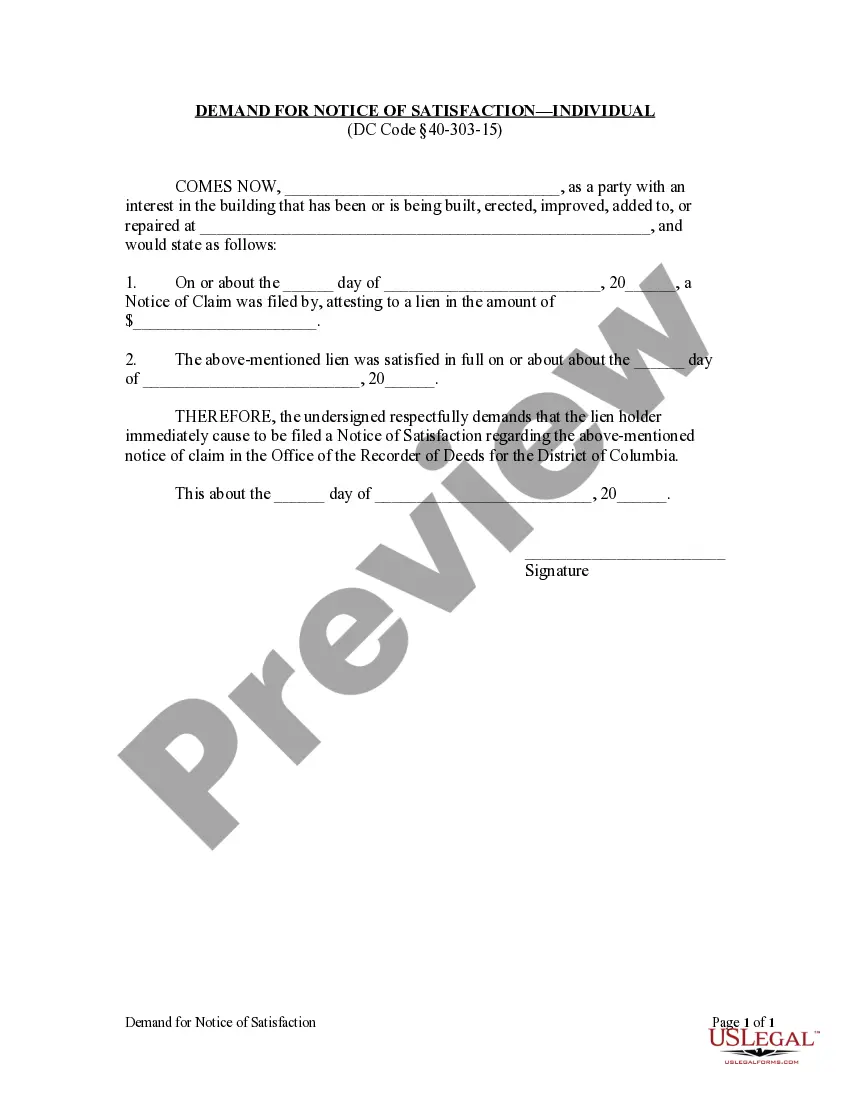

How to fill out District Of Columbia Demand For Notice Of Satisfaction By Corporation?

- Log into your US Legal Forms account if you are a returning user, ensuring your subscription is active.

- For new users, begin by reviewing the preview mode and descriptions to confirm you select the correct form that meets your state’s requirements.

- If you’re not satisfied with the options, use the search feature to find a different form that better suits your needs.

- Once you find the right document, click on the 'Buy Now' button to choose a subscription plan that fits your requirements.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- Finally, download the form to your device and access it anytime via the 'My Forms' section of your profile.

With US Legal Forms, individuals and legal professionals can easily draft and execute legal documents. Their extensive library contains over 85,000 editable forms that can cater to a variety of legal needs.

Don't hesitate! Streamline your LLC formation today with US Legal Forms and ensure your documents are precise and legally sound.

Form popularity

FAQ

A limited company in real life examples includes small businesses like local shops and service providers that operate as LLCs. For instance, a graphic design firm may choose this structure to protect its founders from personal financial risk. Such examples demonstrate the practical benefits of forming a limited liability company for business owners seeking security.

Various businesses utilize the LLC structure, including tech startups, restaurants, and consulting firms. The limited liability company with examples like these allows entrepreneurs to protect personal assets while enjoying flexible management. This makes LLCs an attractive option for many business owners across different industries.

Google is part of Alphabet Inc., a corporation, not a limited liability company. However, many startups and smaller tech companies operate as LLCs to secure personal liability protection. This distinction highlights the varied business structures available and supports entrepreneurs in choosing the right path for their ventures.

Amazon is not an LLC; it operates as a corporation. However, many smaller sellers on the Amazon platform choose to register as limited liability companies to enjoy liability protection. This structure enables them to run their businesses while shielding personal assets from potential legal issues.

The term 'LLC' specifically refers to a limited liability company that offers personal liability protection to its members. Conversely, 'limited' can pertain to various entities, including limited partnerships or limited companies in different jurisdictions. Understanding these differences helps business owners choose the appropriate structure for their needs.

A limited liability company with an example is a formal business organization that protects its owners from personal liability. For instance, if John and Jane start a bakery as an LLC, their personal assets are safeguarded from business debts incurred by the bakery. This structure enables them to manage their business while minimizing personal risk.

A limited liability company is a business structure that combines elements of partnerships and corporations. It provides owners, also known as members, with limited personal liability for business debts. To qualify as a limited liability company, a business must file the necessary paperwork with the state, adhering to local regulations.

Yes, you can start a limited liability company alone, as many states allow for a single-member LLC. This structure provides you the flexibility of running your business while protecting your personal assets. A limited liability company with example can shield you from personal liability in business debts and obligations. For assistance in setting up your LLC, consider utilizing uslegalforms to help you navigate the paperwork and requirements.

Creating a limited liability company by yourself is a straightforward process. First, select a unique name for your limited liability company with example, ensuring it complies with state regulations. Next, file the necessary paperwork with your state’s Secretary of State office, which typically includes your Articles of Organization. Lastly, obtain any required licenses or permits, and consider using uslegalforms to streamline the process.

A common example of a limited company is 'Tech Innovations Ltd.', which provides technology solutions. This company structure protects the owners’ personal assets from business debts while allowing for professional management. Limited companies benefit from tax advantages, and they can attract investment more easily.