Ct Joint Tenants With Rights Of Survivorship

Description

Form popularity

FAQ

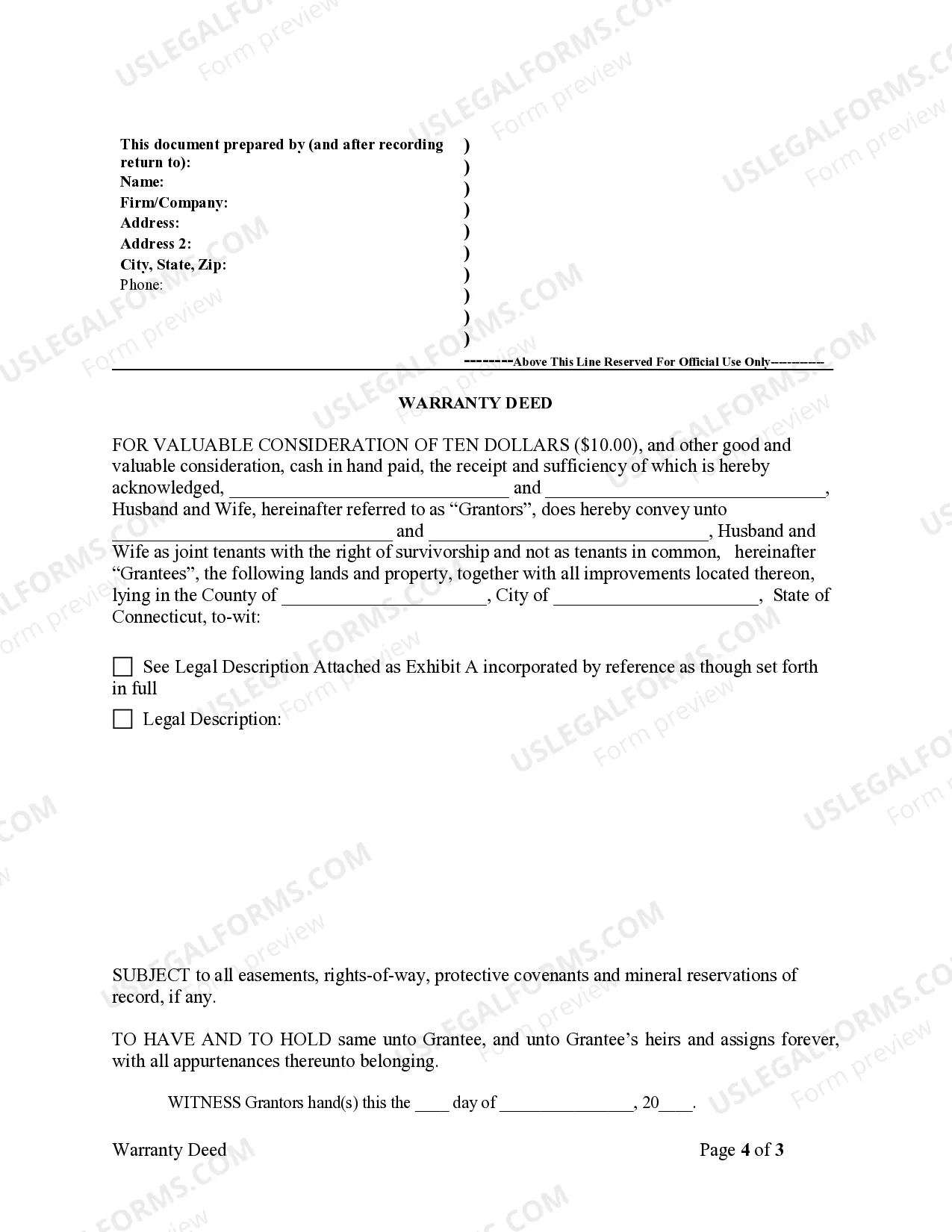

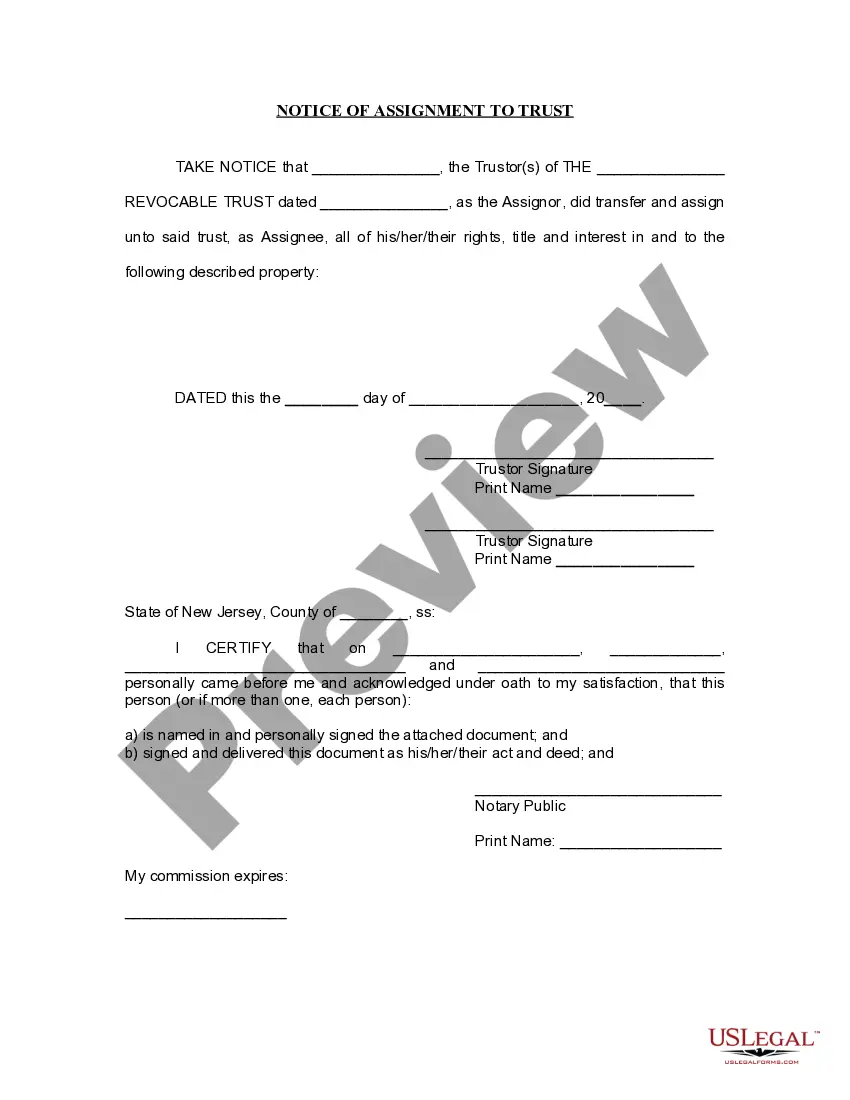

To file for joint tenancy with the right of survivorship in Connecticut, you typically need to draft and sign a deed that clearly states your intention. The deed should list all joint tenants and explicitly mention the right of survivorship. After completing the deed, you must record it with your local land records office to ensure legal recognition. For those unfamiliar with the process, UsLegalForms provides resources and guidance to help you navigate filing as a Ct joint tenant with rights of survivorship.

Joint tenancy refers to a shared ownership arrangement where two or more people hold equal interests in a property. The key feature of joint tenancy with rights of survivorship is that if one owner passes away, their share automatically transfers to the surviving owners, avoiding probate. In contrast, in a tenancy in common, each owner can will their share to anyone, meaning it doesn't guarantee the right of survivorship. Understanding these differences is crucial for those considering Ct joint tenants with rights of survivorship.

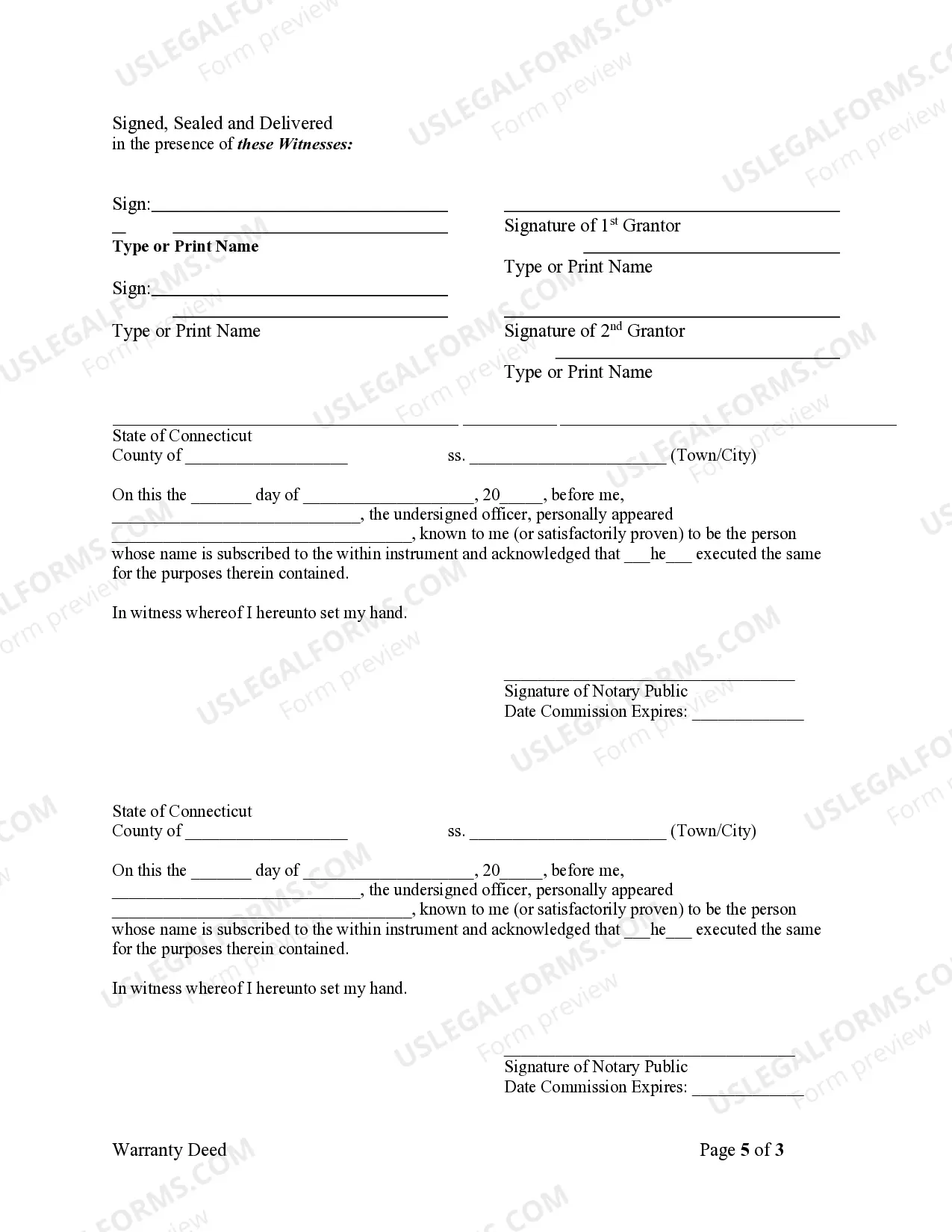

To write a deed with rights of survivorship, you must specify the type of joint tenancy in the deed’s language. Clearly indicate that both parties hold equal rights to the property and that in the event of one owner’s death, the other will inherit their share automatically. Be sure to include essential details such as the property description and the names of all joint tenants. For assistance with drafting an effective deed, consider using uslegalforms for easy-to-follow templates and guidance.

The step-up basis for joint tenants with rights of survivorship allows the property to be valued at its current market rate upon the death of one joint tenant. This adjustment helps to minimize capital gains taxes when the surviving tenant sells the property, making it an essential component of estate planning. Understanding this concept is crucial for joint tenants, as it significantly impacts the financial implications of inherited property. For more detailed information, uslegalforms can provide useful resources.

To file a joint tenancy with rights of survivorship in Connecticut, you must first have a deed that expressly states the joint tenancy arrangement. Both owners need to be clear about their intention to hold the property together. You should then sign and date the deed, and file it with the local land records office. Using uslegalforms can simplify this process, ensuring that all legal requirements are met efficiently.

The step-up basis for joint tenants with rights of survivorship refers to the adjustment of the property's tax basis to its fair market value at the time of the owner's death. This means that the surviving joint tenant can benefit from a potentially reduced capital gains tax when they sell the property. It's important to understand this concept when considering estate planning and how it impacts the assets of joint tenants in Connecticut. For detailed guidance, you can rely on platforms like uslegalforms to navigate your specific situation.

Yes, the right of survivorship can be challenged under certain circumstances. Issues such as undue influence or lack of mental capacity during the creation of the joint tenancy can lead to disputes. If you find yourself in a challenging situation, seeking advice from legal experts or using resources like UsLegalForms can provide clarity.

One disadvantage of the right of survivorship in Ct joint tenants with rights of survivorship is the potential for conflict among joint owners. Decisions regarding the property must be mutually agreed upon, which can lead to disagreements. Furthermore, if one tenant incurs debts, creditors could claim their share of the property.

To establish joint tenancy with the right of survivorship in Connecticut, you must create a deed that clearly specifies this arrangement. All owners must sign the deed, which typically includes language indicating the intent to hold the property as joint tenants with rights of survivorship. Utilize services like UsLegalForms, which can guide you through the necessary documentation smoothly.

Yes, certain legal arrangements can supersede a will, including the right of survivorship in Ct joint tenants with rights of survivorship. Properties owned jointly with this designation transfer directly to the surviving tenant(s), eliminating the influence of a will. Additionally, beneficiary designations on assets like life insurance can also take precedence.