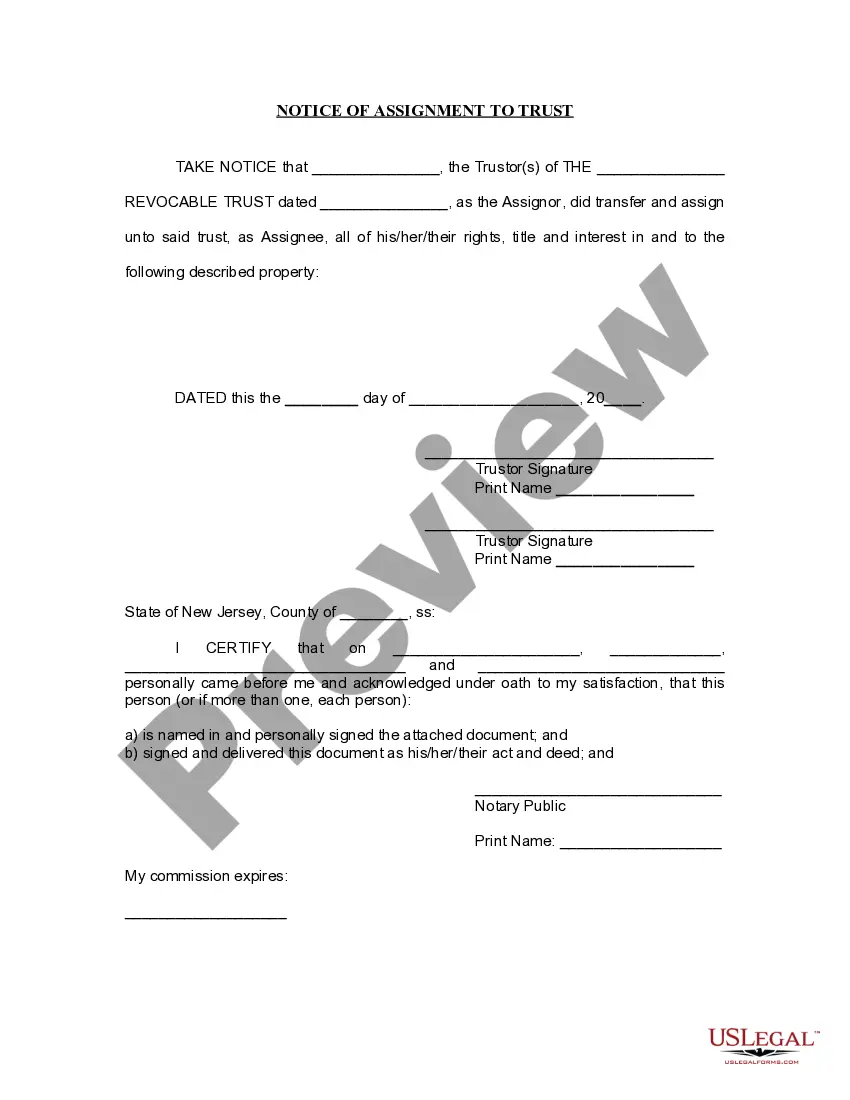

Nevada Notice of Assignment to Living Trust

Description

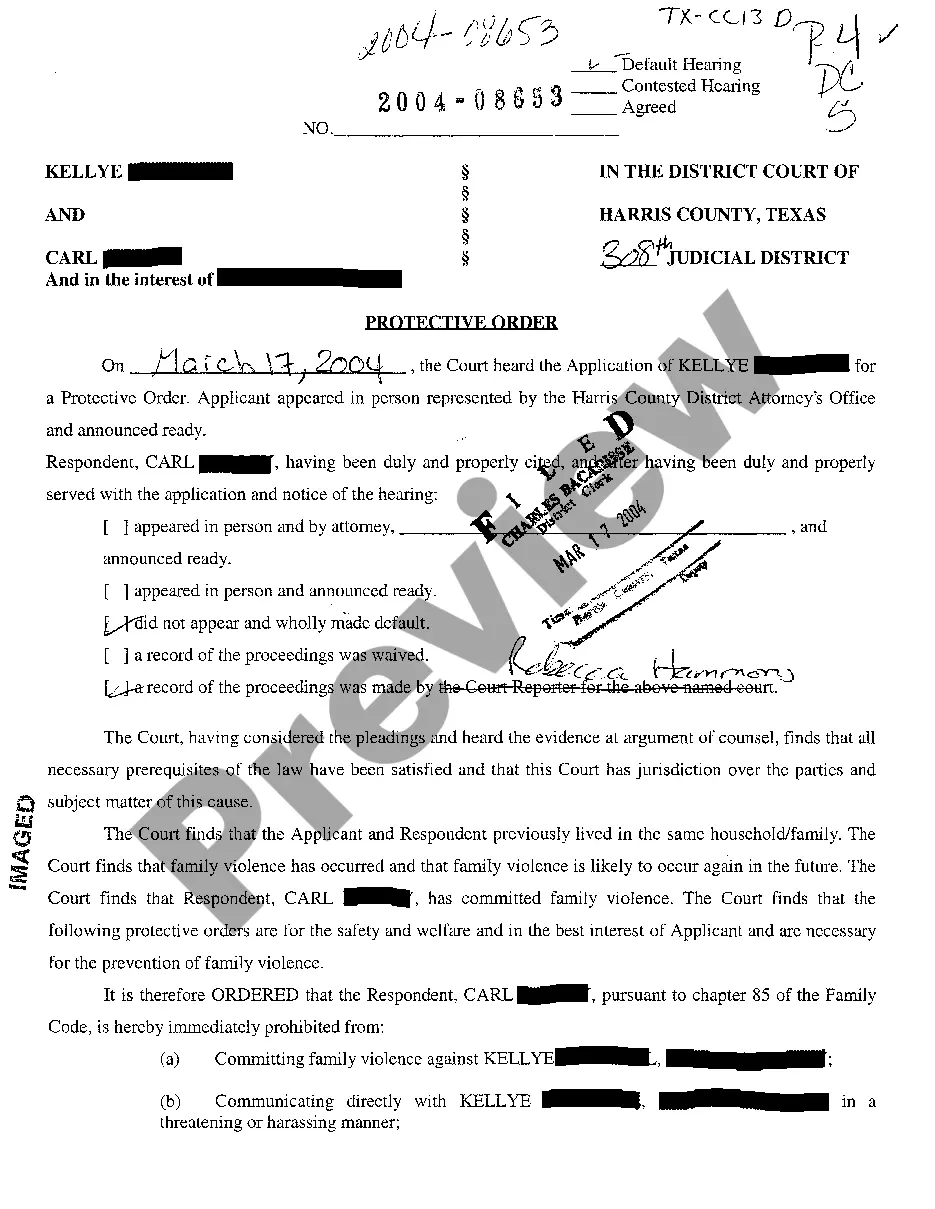

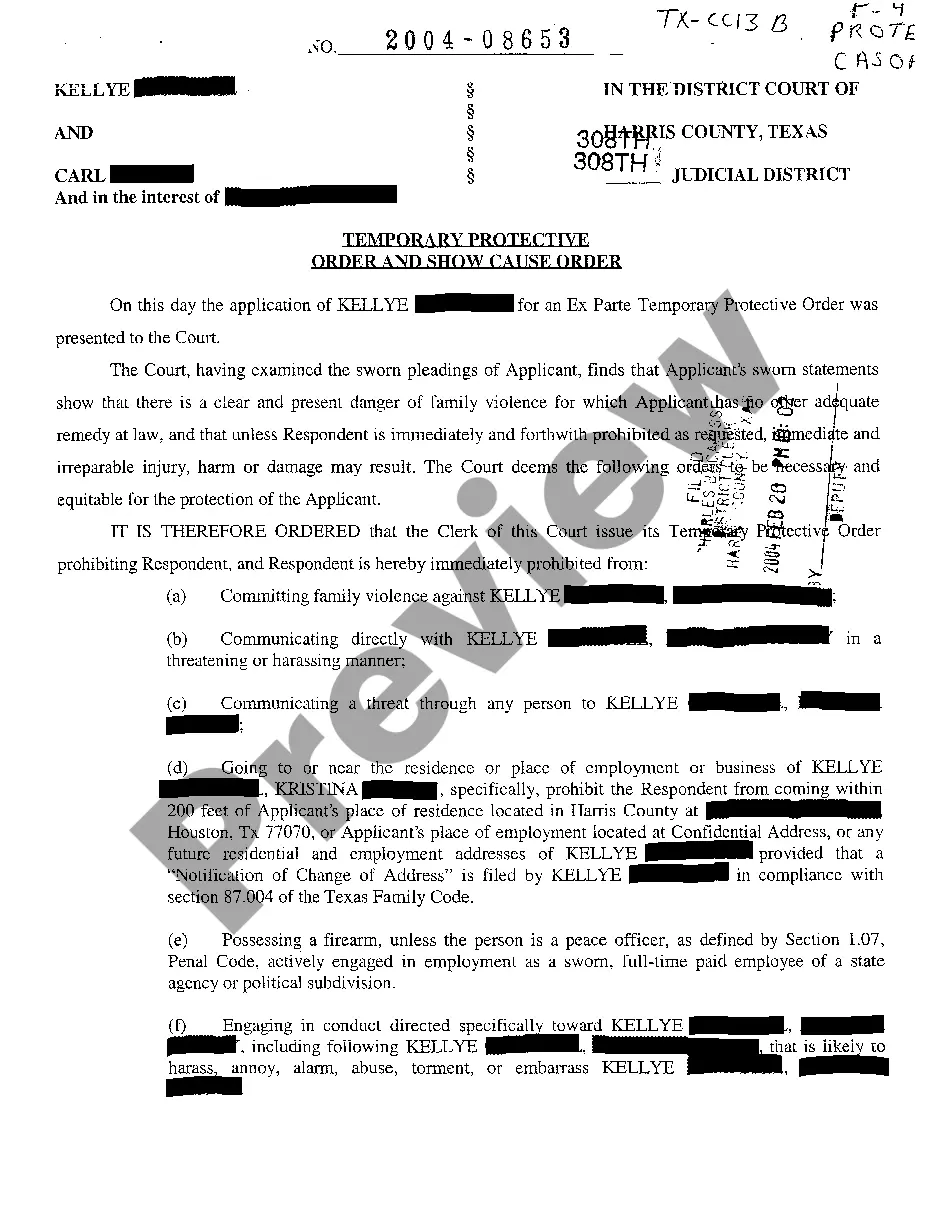

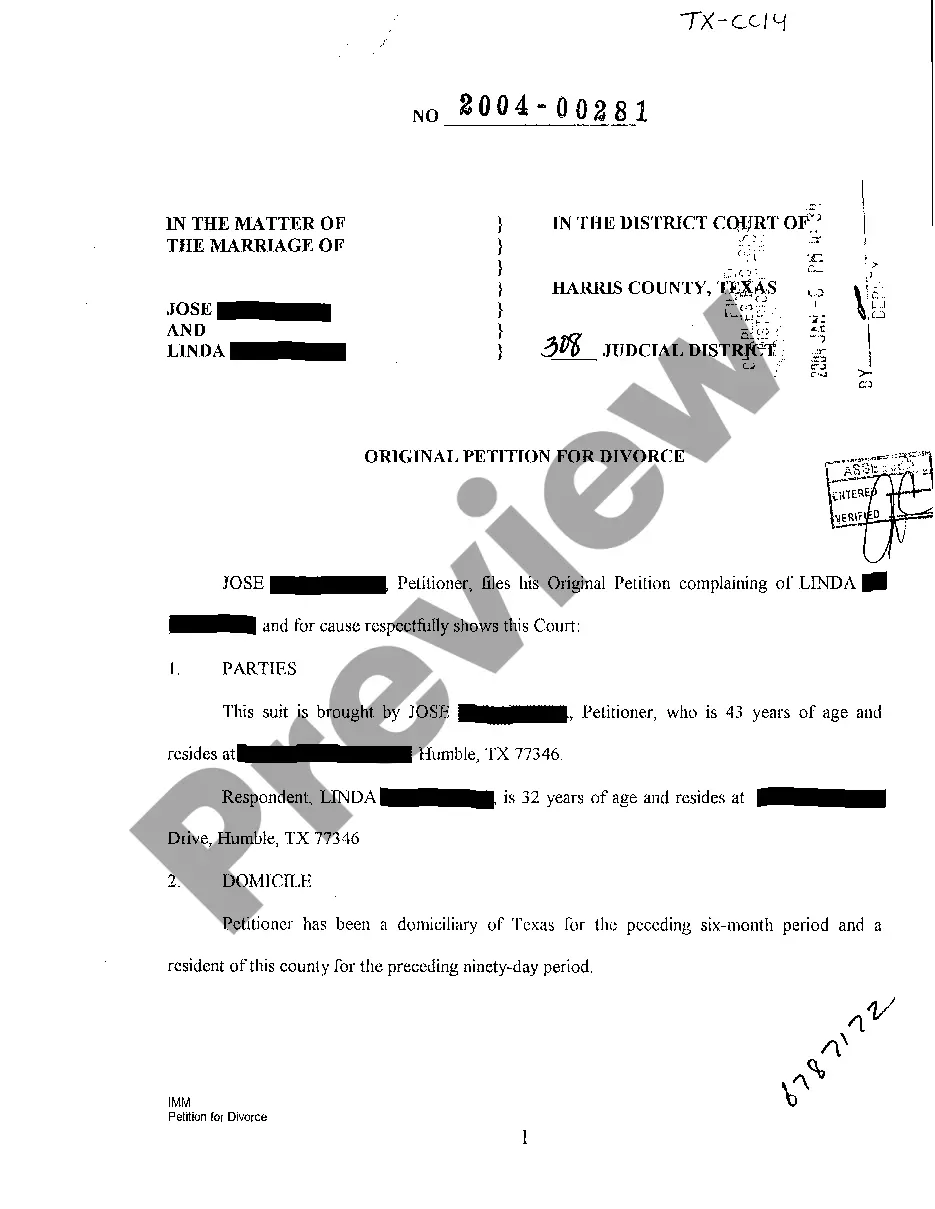

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Nevada Notice Of Assignment To Living Trust?

US Legal Forms is actually a special platform to find any legal or tax form for submitting, including Nevada Notice of Assignment to Living Trust. If you’re tired of wasting time searching for perfect samples and spending money on file preparation/attorney service fees, then US Legal Forms is precisely what you’re seeking.

To experience all of the service’s benefits, you don't have to download any software but just choose a subscription plan and sign up an account. If you have one, just log in and look for an appropriate sample, download it, and fill it out. Saved files are all saved in the My Forms folder.

If you don't have a subscription but need to have Nevada Notice of Assignment to Living Trust, check out the recommendations listed below:

- Double-check that the form you’re taking a look at is valid in the state you want it in.

- Preview the example and look at its description.

- Click on Buy Now button to access the register page.

- Pick a pricing plan and keep on registering by providing some information.

- Pick a payment method to complete the sign up.

- Save the document by choosing the preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you are unsure about your Nevada Notice of Assignment to Living Trust sample, contact a attorney to review it before you send or file it. Start hassle-free!

Form popularity

FAQ

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust. However, if real estate is involved, the trust may be recorded in the local office of the county clerk.

In most places, a living trust document, unlike a will, does not need to be signed in front of witnesses.But you do need to sign your living trust document in front of a notary public for your state. If you create a shared living trust, both of you need to sign the trust document in front of the notary.

A revocable living trust isn't subject to the same kind of rules as a will; it should be valid in any state, no matter where you signed it.If you acquire real estate in your new state, you'll probably want to hold it in the trust, so that it doesn't have to go through probate at your death.

No. Trust does not need to be filed in California. Trusts are private documents and usually there are compelling reasons not to file the trust.

Normally a Nevada trust only requires a notary public affirmation; that is, witnesses are not required. If however the trust is likely to be administered in a state that requires witnesses, sound discretion would mandate that witnesses and a notary public be used in executing the trust.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.