Living Trusts

Description

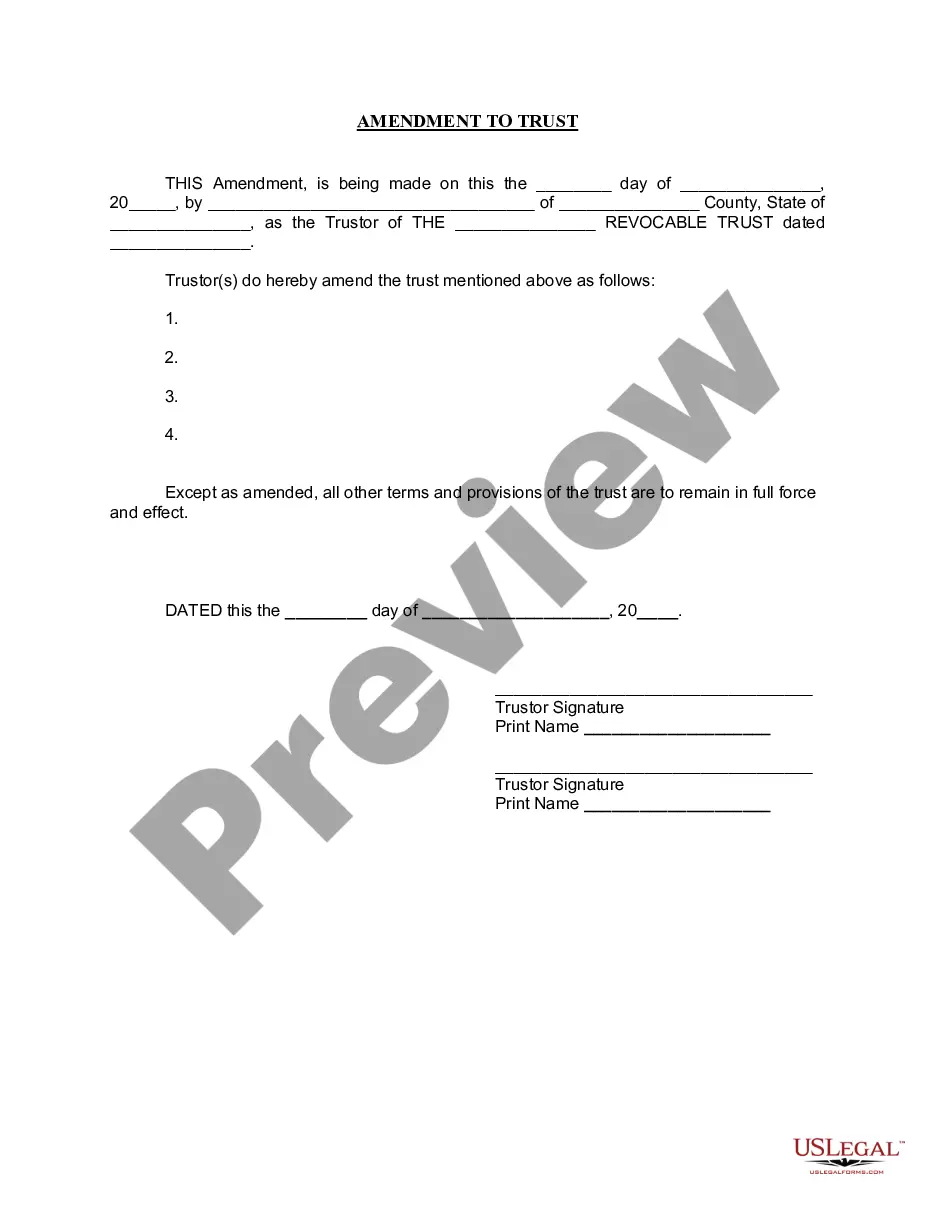

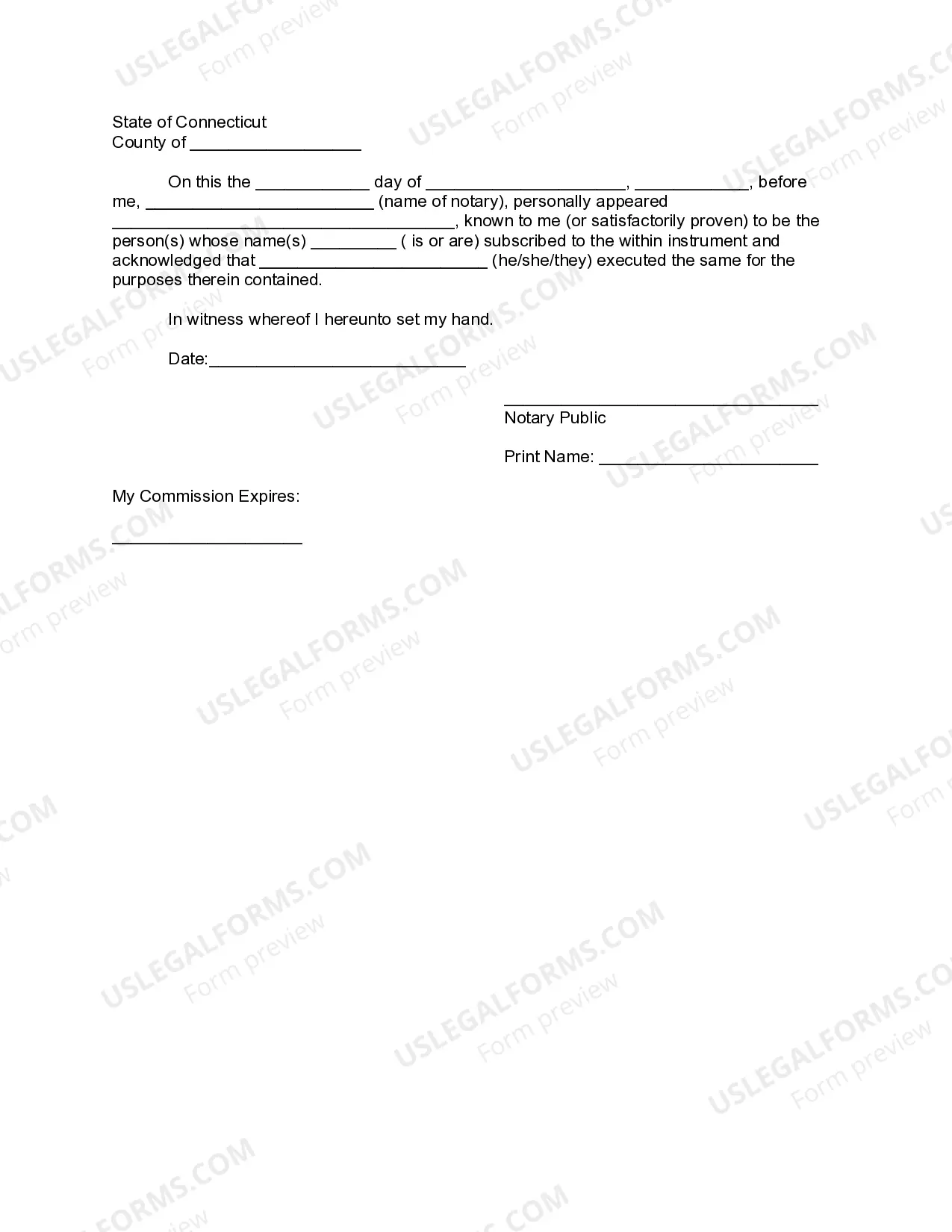

How to fill out Connecticut Amendment To Living Trust?

- If you are a returning user, log in to your account and locate your desired living trust form. Make sure your subscription is active; renew it if necessary.

- Browse through the preview mode and form description to select the living trust that aligns with your specific requirements and local jurisdiction.

- If you need additional templates, utilize the Search tab to find the appropriate forms. Confirm that your selected trust matches your criteria and proceed.

- Click the Buy Now button to purchase the document, opting for the subscription plan that best suits your needs. Registration is mandatory to access the library.

- Complete your transaction by entering your credit card details or using PayPal to finalize your subscription.

- Once purchased, download your living trust form and save it on your device. Access it anytime via the My Forms section of your profile.

US Legal Forms provides an extensive collection of over 85,000 customizable legal documents, making it easier than ever to create precise and legally binding forms.

In conclusion, using US Legal Forms not only simplifies the creation of living trusts but also empowers you with valuable resources and expert assistance. Start your journey today and ensure your assets are protected.

Form popularity

FAQ

Suze Orman emphasizes the importance of living trusts as a means to protect your assets and ensure a smooth transition for your beneficiaries. She points out that living trusts can help you avoid the complications and costs associated with probate. Orman advocates for using living trusts to maintain control of your carefully planned estate, granting you peace of mind. Overall, her perspective reinforces the value of living trusts in effective financial planning.

When considering living trusts, one should note that there are disadvantages to placing your house in trust. First, the process can involve upfront costs, including legal fees and potential tax implications. Second, once your home is in the trust, you might lose some control over it since the trust dictates how it is managed. Lastly, if the trust is not properly funded, it may not provide the intended benefits, leading to complications for your heirs in the future.

One downside of a living trust is that it does not offer the same level of asset protection as other estate planning tools. If you face legal issues or creditor claims, your assets in living trusts may still be vulnerable. Additionally, establishing a living trust involves upfront costs, which can be a consideration for some individuals. However, many find that the long-term benefits, such as avoiding probate and maintaining privacy, outweigh these concerns. For those looking to set up a living trust, the US Legal Forms platform can provide resources and templates to help streamline the process.

Filling a living trust involves transferring ownership of assets into the trust. This process typically includes changing titles for real estate, bank accounts, and other valuables to reflect the trust's name. Many people find using a platform like uslegalforms to be helpful, as it provides guides and documents and ensures the process goes smoothly.

Living trusts can have downsides, such as the potential for higher initial costs and the need for careful planning. If the trust creator moves to another state, they may need to revise the trust to comply with local laws. Additionally, some assets, like retirement accounts, might not be suitable for inclusion in a trust, which can complicate the estate plan.

One common mistake is failing to fully fund the trust with their assets. Without proper funding, a living trust may not provide the intended benefits, such as avoiding probate. It's also essential for parents to communicate their plans with family members to prevent misunderstandings.

While living trusts can simplify asset management, there are some potential downsides. One key issue is that transferring assets to a trust may require time and effort, particularly if the assets include real estate or other complex holdings. Furthermore, the trust may need ongoing management and maintenance, which can be an added responsibility.

If your parents are considering how to manage their estate, living trusts can be a valuable tool. They provide flexibility and help avoid probate, which can be a lengthy process. However, it's wise for them to assess their specific situation and consult with a legal expert before making a decision.

Living trusts offer many benefits, but they are not without drawbacks. One significant issue is the upfront costs associated with creating the trust, including legal fees and administrative expenses. Additionally, if not properly funded, the trust may fail to operate as intended, leading to complications during estate settlement.