The dissolution package contains all forms to dissolve a LLC or PLLC in Connecticut, step by step instructions, addresses, transmittal letters, and other information.

Connecticut Dissolve Llc Form

Description

Form popularity

FAQ

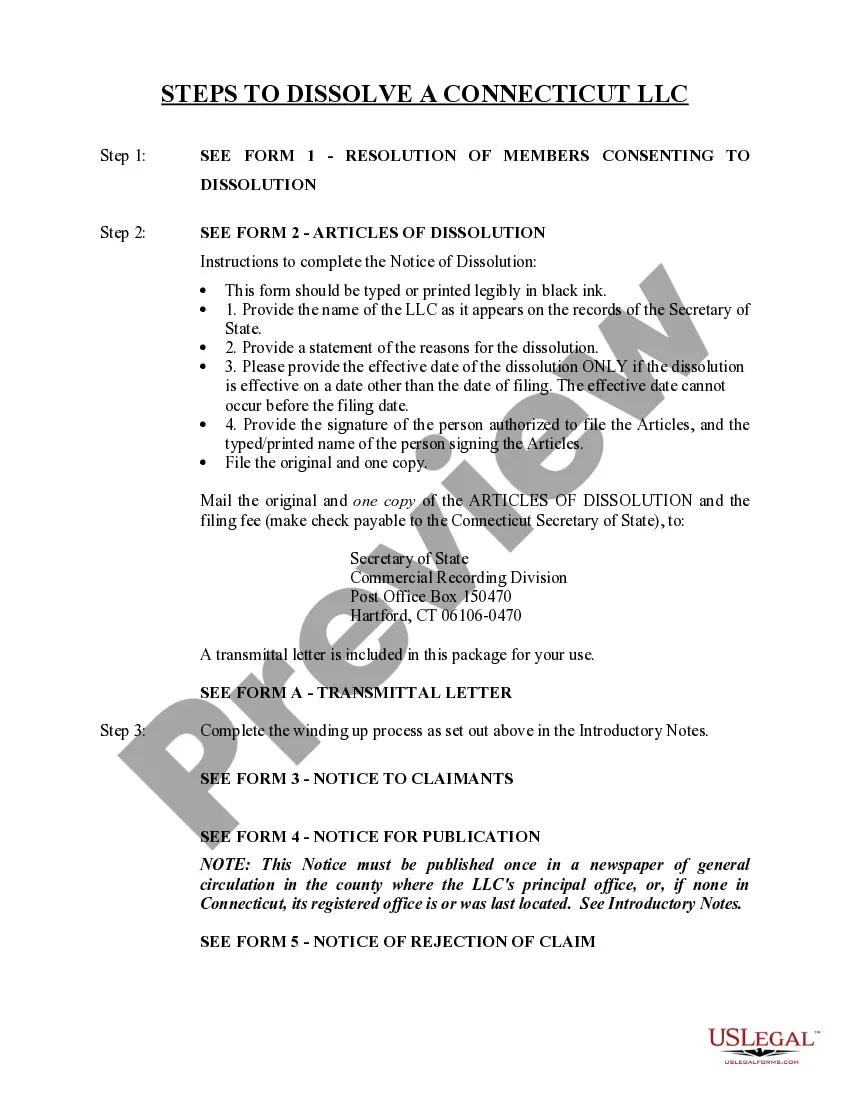

To dissolve your LLC in Connecticut, you must complete and file the Certificate of Dissolution with the Secretary of the State. It's crucial to follow the correct procedures to avoid any issues. By utilizing the Connecticut dissolve LLC form available on USLegalForms, you can ensure that you have all the necessary information and documentation to successfully dissolve your LLC without complications.

A letter of dissolution is a formal document indicating that an LLC is ceasing its operations and wishes to dissolve. This letter usually specifies the reasons for dissolution and includes important details about the LLC's status. When using the Connecticut dissolve LLC form, this document can often be integrated into your dissolution process to maintain clarity and compliance.

Dissolving an LLC in the USA generally requires filing the appropriate dissolution documents with the state where your LLC is registered. Each state may have its specific requirements, so it's vital to review these details carefully. Using the Connecticut dissolve LLC form from USLegalForms can simplify this process, guiding you through the necessary steps to ensure a smooth and lawful dissolution.

Typically, forming an LLC in Connecticut can take about 3 to 5 business days if you file online. However, using services like USLegalForms can streamline the process, providing you easy access to the necessary Connecticut dissolve LLC form. This ensures that your application is accurate and submitted promptly, potentially reducing wait times.

Yes, in Connecticut, LLCs must file an annual report to maintain good standing. This annual report is essential for keeping your business registered and can be easily completed through the Connecticut dissolve LLC form. Failing to submit this report may lead to penalties or even dissolution of your LLC.

To dissolve a partnership in Connecticut, you typically need to follow the terms outlined in your partnership agreement. If no agreement exists, state law will guide the process. Like dissolving an LLC, you will likely need to notify creditors and settle any obligations. Utilizing resources such as uslegalforms can assist you in filing the necessary documents and ensuring a smooth dissolution process.

Dissolving an LLC can be straightforward, particularly if you follow the required steps. You must file the Connecticut dissolve LLC form, settle any outstanding debts, and ensure that all members agree on the dissolution. While it may seem daunting at first, using a reliable platform like uslegalforms can help you navigate the process efficiently. This way, you can focus on your next chapter.

Yes, you should notify the IRS if you decide to close your LLC. You will need to file your final tax returns and provide relevant information regarding the closure. This helps to ensure that you fulfill your federal tax obligations. A properly completed Connecticut dissolve LLC form can simplify the process by confirming that you have officially dissolved your business.

To change ownership of an LLC in Connecticut, you typically need to update your operating agreement and file any necessary documents with the state. If you are transferring ownership to another person or entity, make sure to follow the guidelines in your agreement. You may need to submit specific forms to the Connecticut Secretary of State. This process is separate from filling out a Connecticut dissolve LLC form, which is for closing the business entirely.

Dissolving your LLC often makes sense if it is no longer active in business. Keeping an LLC inactive can lead to unnecessary fees or compliance requirements. By filing the Connecticut dissolve LLC form, you eliminate these obligations and ensure a clean break. Make sure to weigh the benefits of dissolution against the nature of your business needs.