Lease Guarantor Companies Form

Description

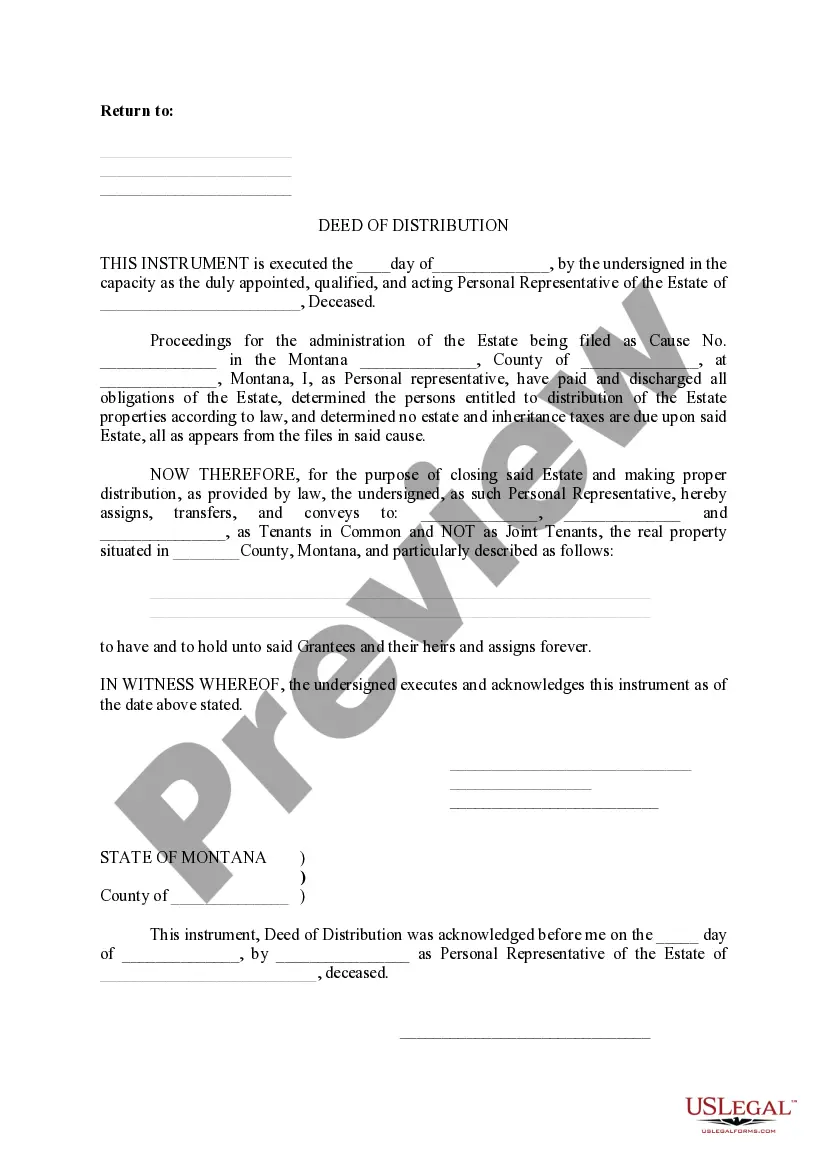

How to fill out Connecticut Guaranty Attachment To Lease For Guarantor Or Cosigner?

Red tape necessitates exactness and meticulousness.

Unless you manage filling out documents like Lease Guarantor Companies Form on a daily basis, it could lead to some misunderstanding.

Choosing the appropriate template from the outset will ensure that your document submission proceeds without issues and avert any inconveniences of re-submitting a file or repeating the same task from the beginning.

Locating the correct and up-to-date templates for your documentation is a matter of minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and simplify your paperwork.

- Find the template by utilizing the search bar.

- Confirm that the Lease Guarantor Companies Form you’ve discovered is applicable for your state or area.

- Access the preview or review the description outlining the specifics regarding the use of the template.

- If the result aligns with your search, click the Buy Now button.

- Select the appropriate option from the suggested subscription plans.

- Log In to your account or create a new one.

- Complete the purchase using a credit card or PayPal payment option.

- Receive the form in the file format of your preference.

Form popularity

FAQ

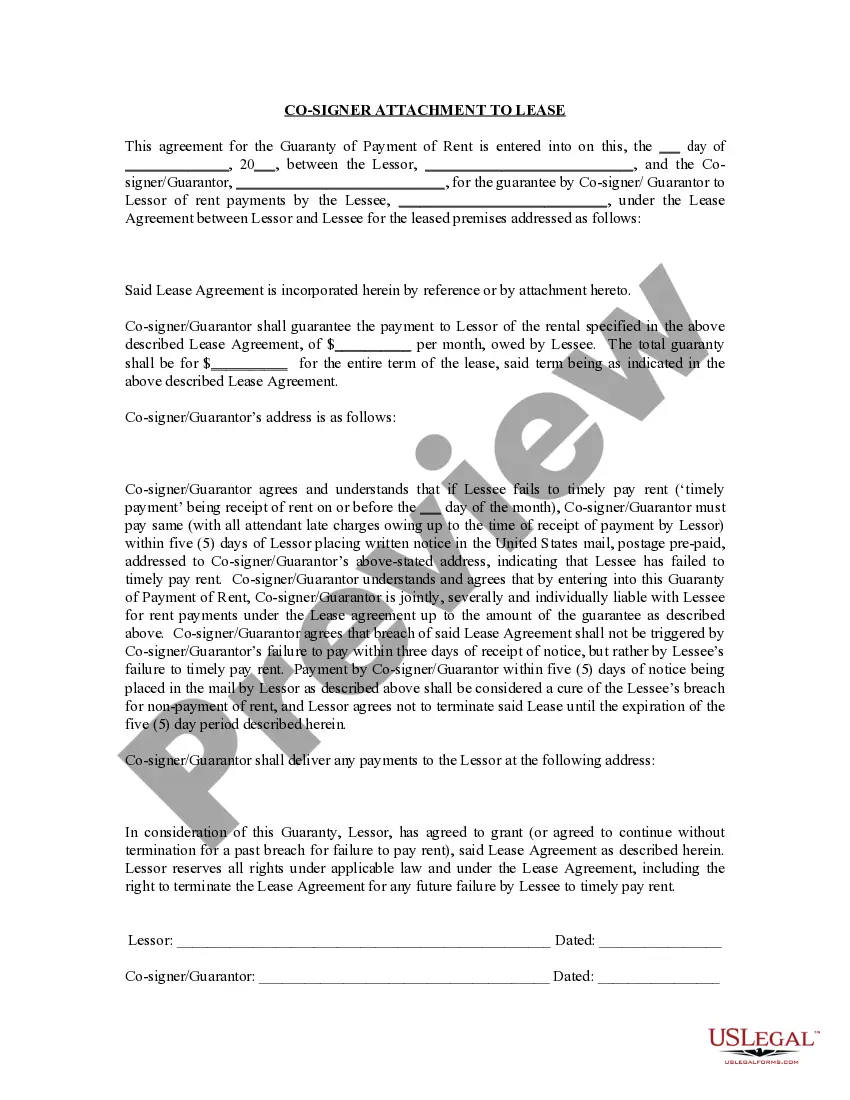

The most important difference between a cosigner and a guarantor is that a cosigner is immediately responsible for paying rent, just as the tenant is. A guarantor is only responsible for paying rent when the tenant fails to do so themselves.

Adding a Guarantor AgreementTypically, a Guarantor Agreement is appended to the end of a lease agreement as an addendum. If, for whatever reason, you need to add a guarantor to a lease that has already been signed, be sure to have all tenants sign the agreement as well as the guarantor.

To be a guarantor you'll need to be over 21 years old, with a good credit history and financial stability. If you're a homeowner, this will add credibility to the application.

To write a guarantor letter, start by writing the date at the top of the paper, followed by your full name and address. Below your information, address the letter to the company you're dealing with and begin the letter by identifying yourself and the person you're guaranteeing.

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.