Connecticut Llc Limited Liability Company Without A Written Operating Agreement

Description

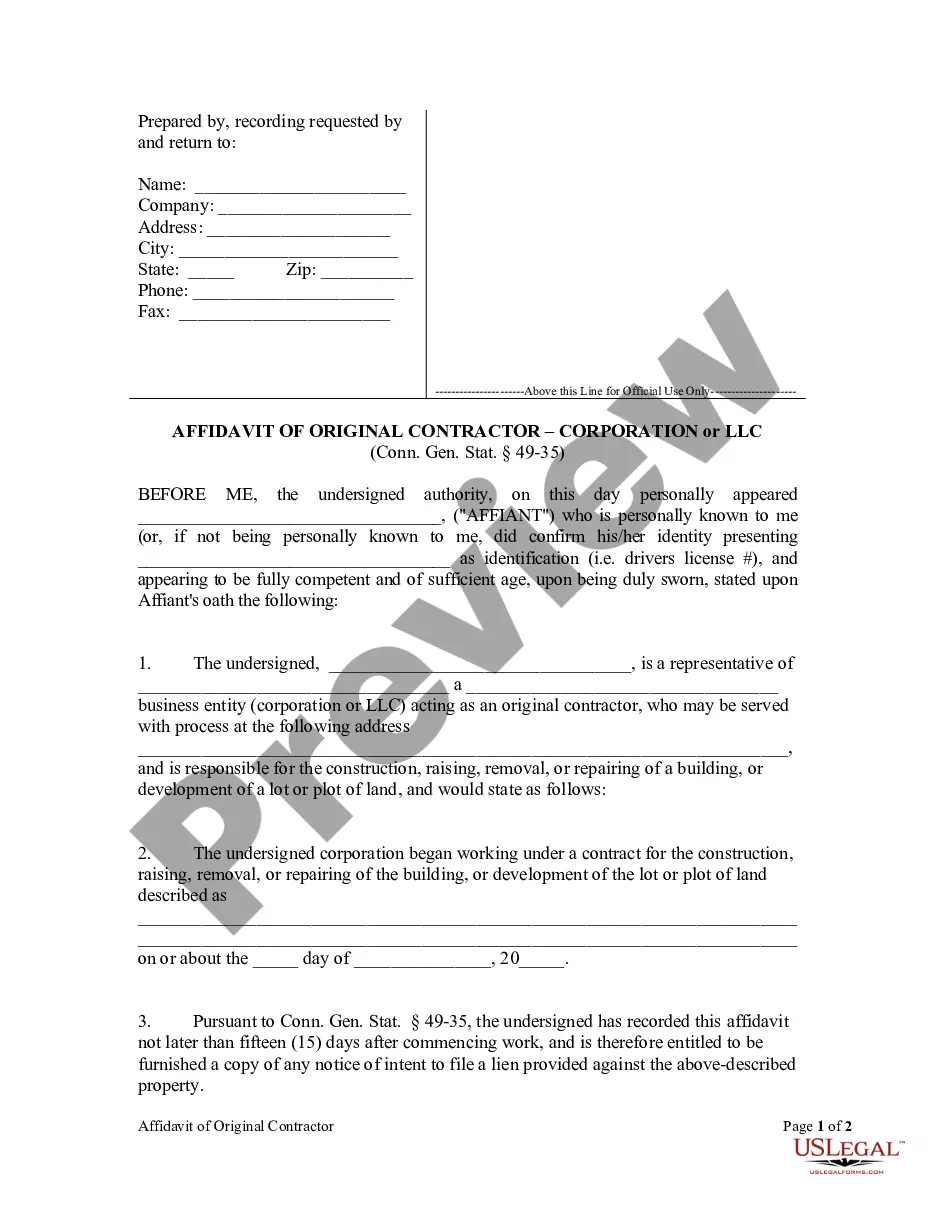

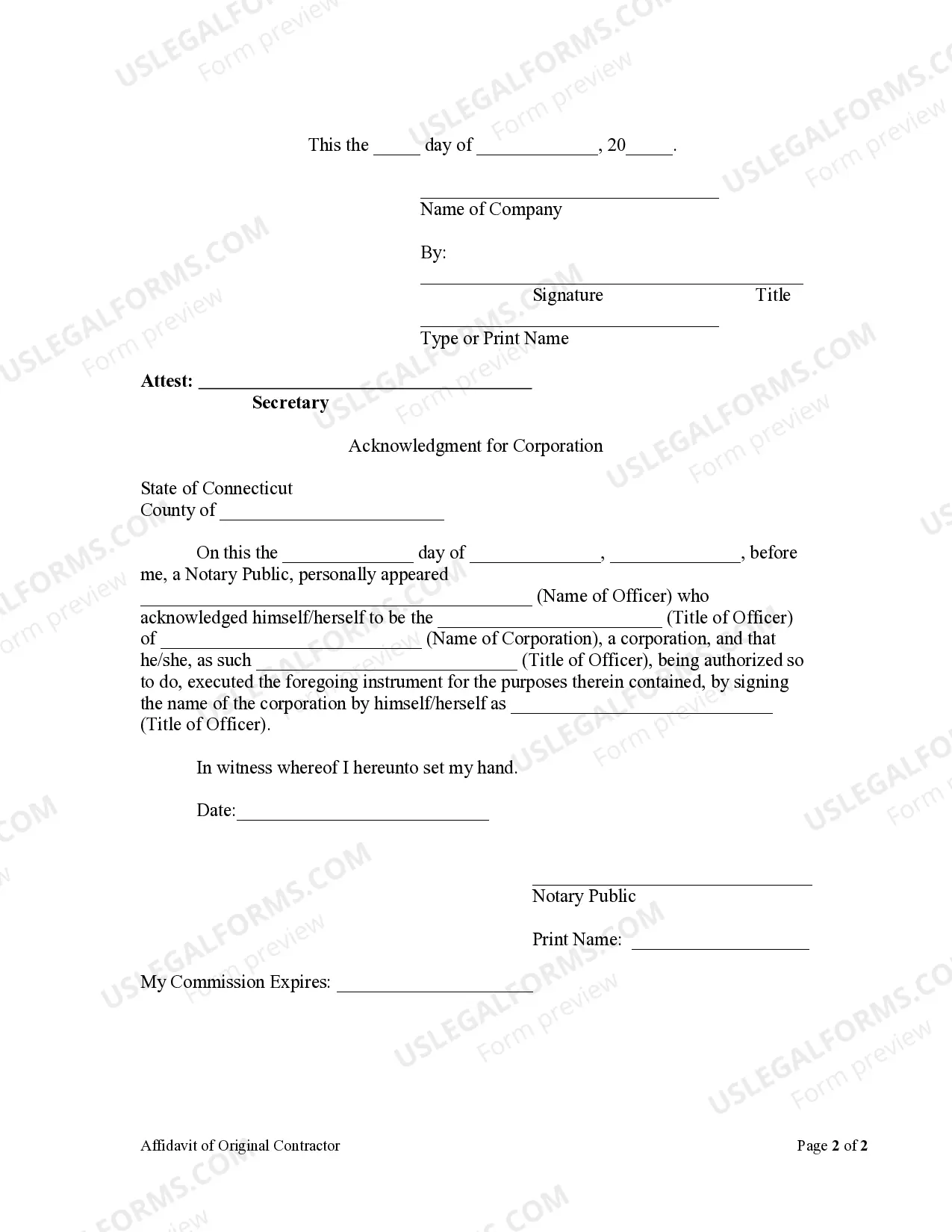

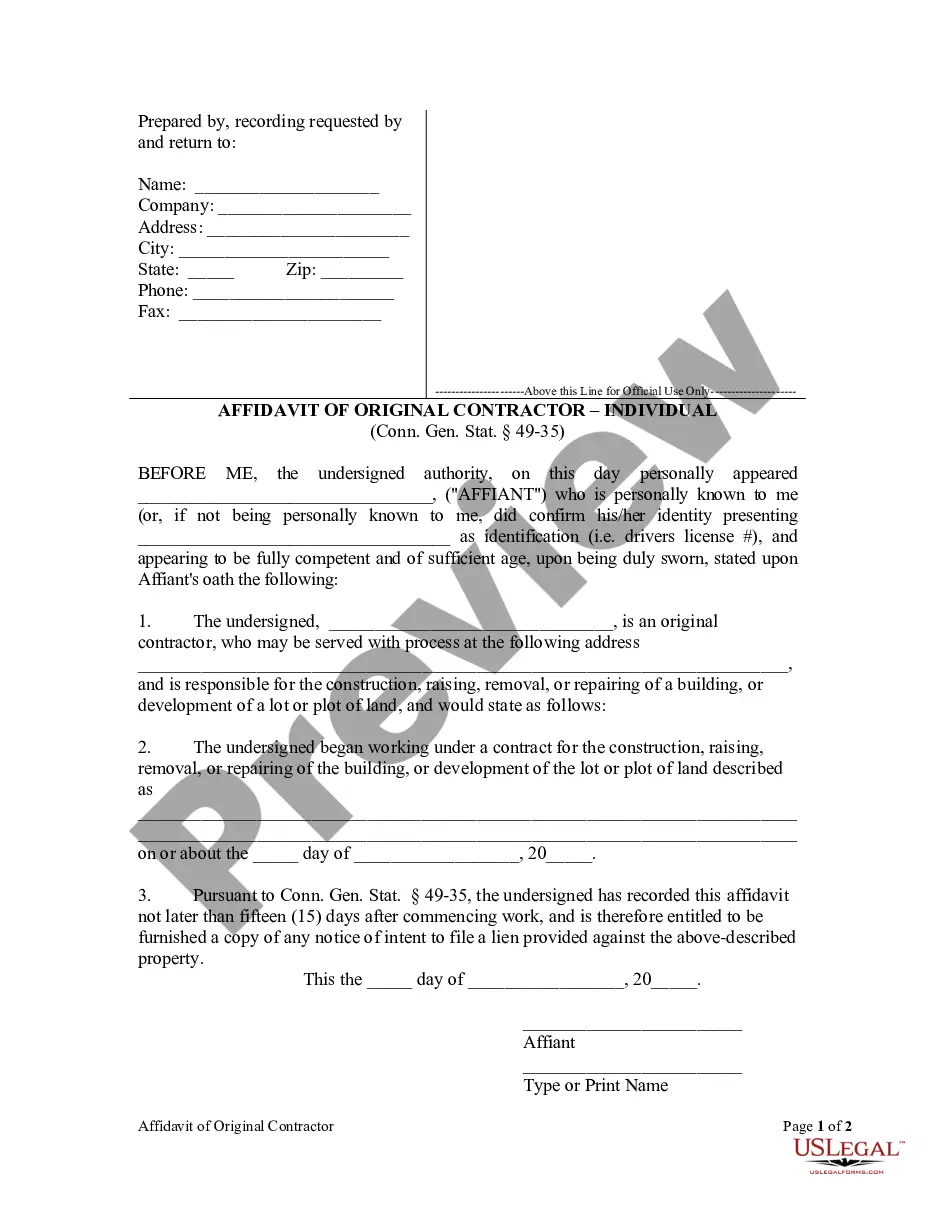

How to fill out Connecticut Affidavit Of Original Contractor By Corporation?

Steering through the red tape of official documents and formats can be difficult, particularly if one does not engage in that professionally. Even discovering the suitable format to establish a Connecticut LLC Limited Liability Company Without A Written Operating Agreement may consume considerable time, as it must be legitimate and accurate to the very last digit. However, you will need to invest significantly less time obtaining a fitting format from a source you can rely on.

US Legal Forms is a platform that streamlines the search for the appropriate documents online. US Legal Forms functions as a single location to obtain the latest examples of forms, seek guidance on their use, and download these examples for completion. It acts as a repository with over 85K forms relevant across numerous domains.

When searching for a Connecticut LLC Limited Liability Company Without A Written Operating Agreement, you won’t need to doubt its validity as all the forms are verified.

US Legal Forms can help you save time and effort determining if the form you encountered online is suitable for your needs. Create an account and gain unlimited access to all the forms you need.

- Establish an account with US Legal Forms to ensure you have all the essential examples easily accessible.

- Keep them in your history or add them to the My documents directory.

- Retrieve your saved documents from any device by clicking Log In on the library site.

- If you don't possess an account yet, you can always start a new search for the format you need.

- Acquire the correct document in a few straightforward steps.

- Input the title of the document in the search bar.

- Select the appropriate Connecticut LLC Limited Liability Company Without A Written Operating Agreement from the results list.

- Review the description of the example or open its preview.

- When the format meets your requirements, click Buy Now.

- Continue to select your subscription plan.

- Utilize your email and create a secure password to register an account with US Legal Forms.

- Choose a credit card or PayPal payment option.

- Download the format file on your device in your preferred format.

Form popularity

FAQ

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Prepare an Operating AgreementAn LLC operating agreement is not required in Connecticut, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.