Limited Company Meaning

Description

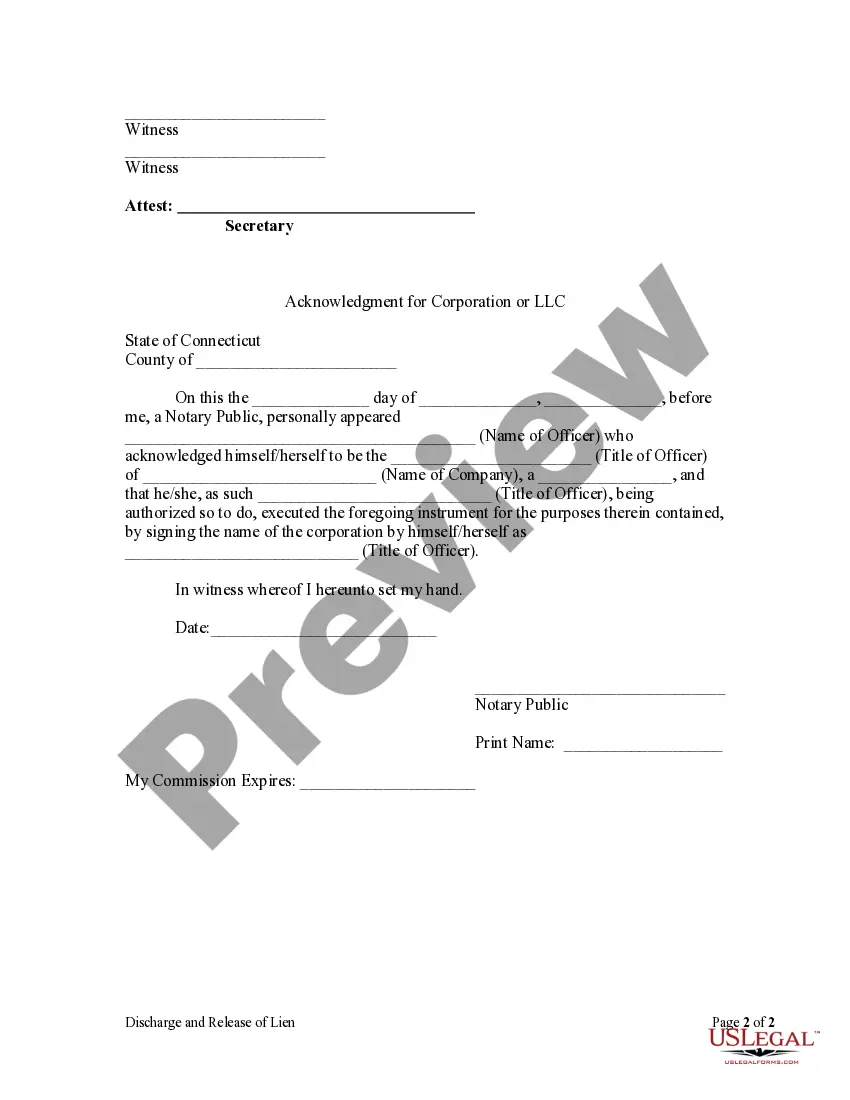

How to fill out Connecticut Discharge And Release Of Lien By Corporation Or LLC?

- If you're a returning user, log in to your account to download the required form template by clicking on the Download button. Ensure your subscription is active—renew as necessary according to your payment plan.

- For newcomers, begin by reviewing the Preview mode and form description to confirm you've selected the correct document that aligns with your needs and local jurisdiction requirements.

- If you need a different template, utilize the Search tab to find the appropriate form. Once satisfied, proceed to the next step.

- Purchase the document by clicking on the Buy Now button and select your desired subscription plan. You'll need to create an account for complete library access.

- Complete your transaction by entering your credit card details or using your PayPal account to finalize your subscription.

- Download your form and save it to your device. You can access it anytime from the My Forms section of your profile.

US Legal Forms makes it easy to navigate legal complexities with its robust collection of over 85,000 customizable legal forms. By simplifying the documentation process, you can focus on managing your business effectively.

Don't hesitate to take advantage of US Legal Forms today for a hassle-free legal document experience!

Form popularity

FAQ

A limited company is required to file several important documents, including the annual return and financial statements. These filings provide the government and shareholders with insight into the company’s financial health and operations. Compliance with these requirements is essential to maintain good standing and avoid penalties. Utilizing platforms like uslegalforms can streamline these filing processes, ensuring accurate submissions.

The purpose of a limited company is to provide a legal framework that protects owners while facilitating business activities. It allows multiple stakeholders to invest in and share the organization's profits without risking personal assets beyond their investment. Moreover, it cultivates a transparent and accountable management structure, essential for growth. Essentially, understanding limited company meaning can direct strategic decisions.

One disadvantage of a limited company is the requirement for public disclosure of certain financial information. This transparency can expose business strategies to competitors. Additionally, as a formal entity, operating as a limited company involves higher startup and operational costs compared to sole proprietorships. Recognizing the full scope of limited company meaning will help you weigh your options carefully.

A significant disadvantage of a Limited Liability Company (LLC) is the complex regulations and requirements involved. These include ongoing compliance obligations, which can be time-consuming and costly. Furthermore, depending on your state's laws, owners might face self-employment taxes on their earnings. Thus, comprehending the limited company meaning helps clarify these potential hurdles.

The main purpose of a limited company revolves around facilitating business operations with limited liability. This structure promotes growth by enabling better access to funding and skilled personnel. Additionally, it provides a clear delineation of responsibilities, ensuring structured management. By understanding the limited company meaning, businesses can position themselves for success in a competitive market.

The primary objective of a limited company is to conduct business while insulating its owners from personal liability. This setup allows for efficient management and investment flexibility. Entrepreneurs often leverage this structure to raise capital, expand operations, and enhance their brand. Therefore, grasping the limited company meaning is essential for aspiring business owners.

Deciding to register as a limited company can offer significant benefits. This structure limits personal liability, protecting your assets from company debts. Furthermore, it can enhance your business's credibility while attracting potential investors. Overall, understanding your business needs is key to determining if the limited company meaning aligns with your goals.

If a company has 'limited' in its name, it signifies limited liability for its shareholders. This means that the financial responsibility of the company is separate from the personal finances of its owners. Thus, in the event of insolvency, owners risk losing only their investment and not personal assets. Understanding this concept is vital when exploring limited company meaning.

When considering limited company meaning, it's crucial to note some disadvantages. One significant drawback is the administrative burden, as limited companies must maintain detailed records and file annual returns. Additionally, profit distributions may be taxed twice: at the corporate level and again as personal income. These factors might deter some entrepreneurs from selecting this structure.

An example of a limited company is Microsoft Corporation. It operates as a publicly traded entity, allowing investors to buy shares while limiting their financial risk. By understanding the example of a limited company, you can see how this structure provides both growth opportunities and protection for shareholders.