Release Of Lien Form Withdrawal

Description

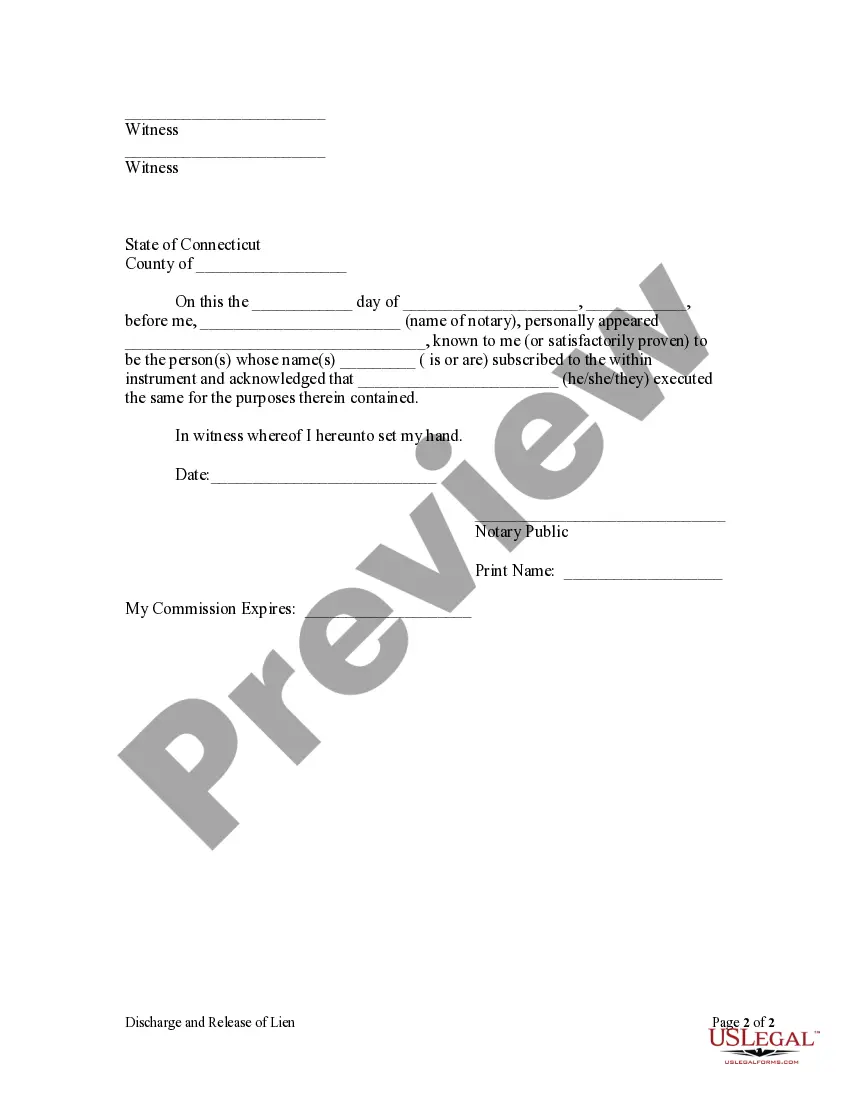

How to fill out Connecticut Discharge And Release Of Lien By Individual?

When you are required to complete the Release Of Lien Form Withdrawal in accordance with your local state's statutes and regulations, there may be numerous alternatives available.

There's no necessity to scrutinize every document to ensure it meets all the legal requirements if you are a subscriber to US Legal Forms.

It is a trustworthy service that can assist you in acquiring a reusable and current template on any topic.

Effortlessly acquire expertly drafted official documentation with US Legal Forms. Additionally, Premium users can also benefit from robust integrated solutions for online PDF editing and signing. Experience it today!

- US Legal Forms is the most extensive online repository with a collection of over 85k ready-to-use papers for business and personal legal situations.

- All templates are verified to ensure compliance with each state's laws.

- Thus, when you download the Release Of Lien Form Withdrawal from our site, you can be assured that you possess a legitimate and current document.

- Obtaining the necessary sample from our platform is incredibly straightforward.

- If you already have an account, simply Log In to the system, verify that your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile and retrieve the Release Of Lien Form Withdrawal at any time.

- If this is your first experience with our library, please follow the instructions below.

- Browse the suggested page and verify it aligns with your requirements.

Form popularity

FAQ

Taxpayers generally request the withdrawal using Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien; however, any written request that provides sufficient information may by used. Requests for withdrawals should be considered regardless of the date the NFTL was filed.

A federal tax lien expires with your tax debt after 10 years. The collection efforts the IRS pursues can only be in place for as long as your debt remains within the statute of limitations. For tax debt, this is 10 years from the date of tax assessment, as per your Notice of Deficiency, or tax bill from the IRS.

Withdrawal. A "withdrawal" removes the public Notice of Federal Tax Lien and assures that the IRS is not competing with other creditors for your property; however, you are still liable for the amount due.

The IRS can file a tax lien even if you have an agreement to pay the IRS. IRS business rules say that a tax lien won't be filed if you owe less than $10,000.

After the federal tax lien attaches to property, it remains on that property until the lien has expired, is released, or the property has been discharged from the lien.