Release Of Lien Form Connecticut For Material Supplier

Description

How to fill out Connecticut Discharge And Release Of Lien By Individual?

Regardless of whether it is for commercial reasons or personal issues, everyone must deal with legal circumstances eventually in their lifetime. Finalizing legal forms demands meticulous consideration, beginning with selecting the correct form template.

For example, if you opt for an incorrect edition of a Release Of Lien Form Connecticut For Material Supplier, it will be denied once submitted. Hence, it is crucial to obtain a reliable source for legal documents such as US Legal Forms.

With an extensive US Legal Forms catalog available, you won't need to waste time searching for the suitable template online. Take advantage of the library’s user-friendly navigation to find the ideal template for any circumstance.

- Locate the template you require by using the search bar or browsing the catalog.

- Review the form’s details to verify it aligns with your situation, state, and county.

- Select the form’s preview to inspect it.

- If it is the wrong form, return to the search tool to find the Release Of Lien Form Connecticut For Material Supplier template you need.

- Acquire the template if it fulfills your requirements.

- If you already possess a US Legal Forms account, click Log in to access any previously saved templates in My documents.

- If you do not yet have an account, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment option: either a credit card or a PayPal account.

- Select the file format you wish and download the Release Of Lien Form Connecticut For Material Supplier.

- Once saved, you can complete the form using editing software or print it out to finish it by hand.

Form popularity

FAQ

When you have the correct template for the conditional progress payment waiver, simply fill in the required information: Name of Claimant. Write your full business name. Name of Customer. Write the full name of the party who hired you. Job Location. ... Owner. ... Through Date. ... Maker of Check. ... Amount of Check $ ... Check Payable to.

The UCC-1 form, or Financing Statement, is a form you must file to place a lien on property or assets belonging to someone you have made a loan to. This creates a public record and serves as evidence in any legal dispute over liability.

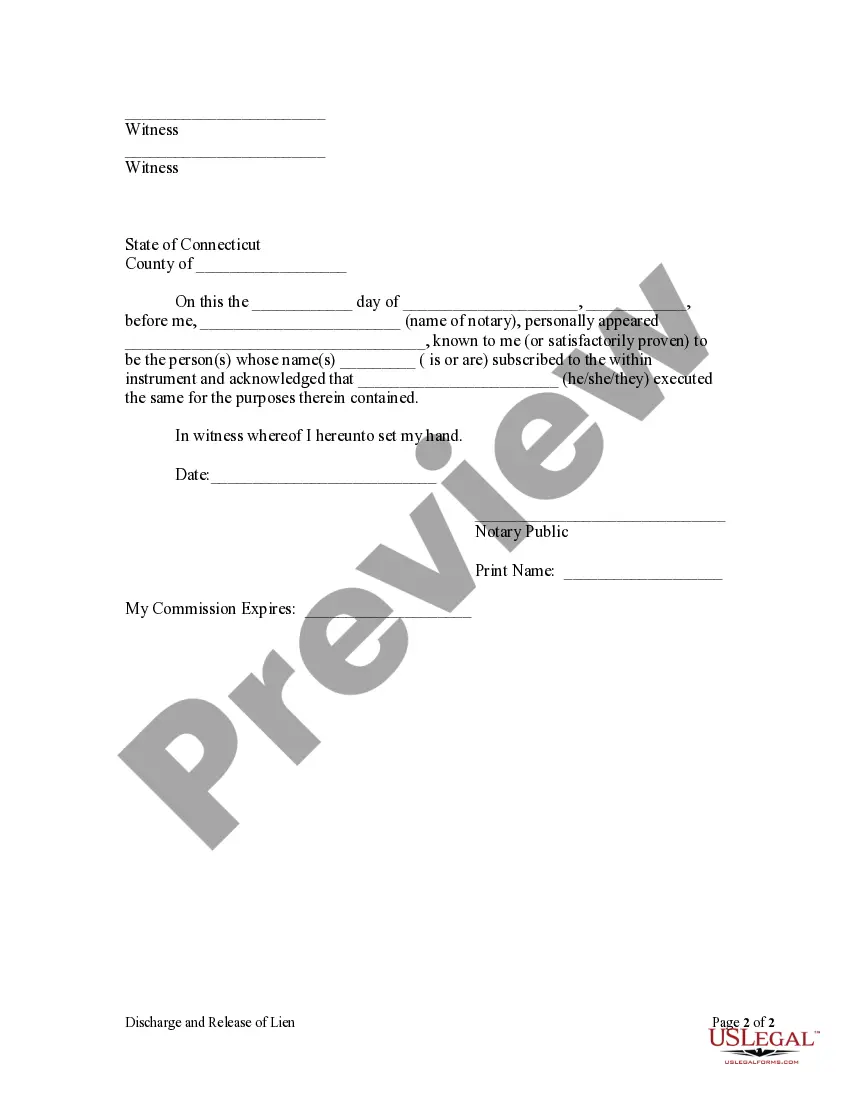

Special note on mechanics lien signatures. Connecticut law says that liens must be attested to under oath and must be notarized to be valid. ... Prepare the lien form. ... Sign & notarize the form. ... Deliver the lien to the town clerk. ... Serve a copy on the property owner.

Release details: Provide a statement confirming that the borrower has fully repaid the debt and that the lienholder is relinquishing their legal claim on the property or asset. Include the date when the borrower paid off the debt.

A Connecticut taxable estate must file Form CT-4422 UGE with DRS to request the release of a lien. A separate Form CT-4422 UGE must be filed for each property address requiring a release of lien. Form CT-4422 UGE will be considered incomplete if an affirmation box agreeing to payment is not checked.