Lien Release Letter For House

Description

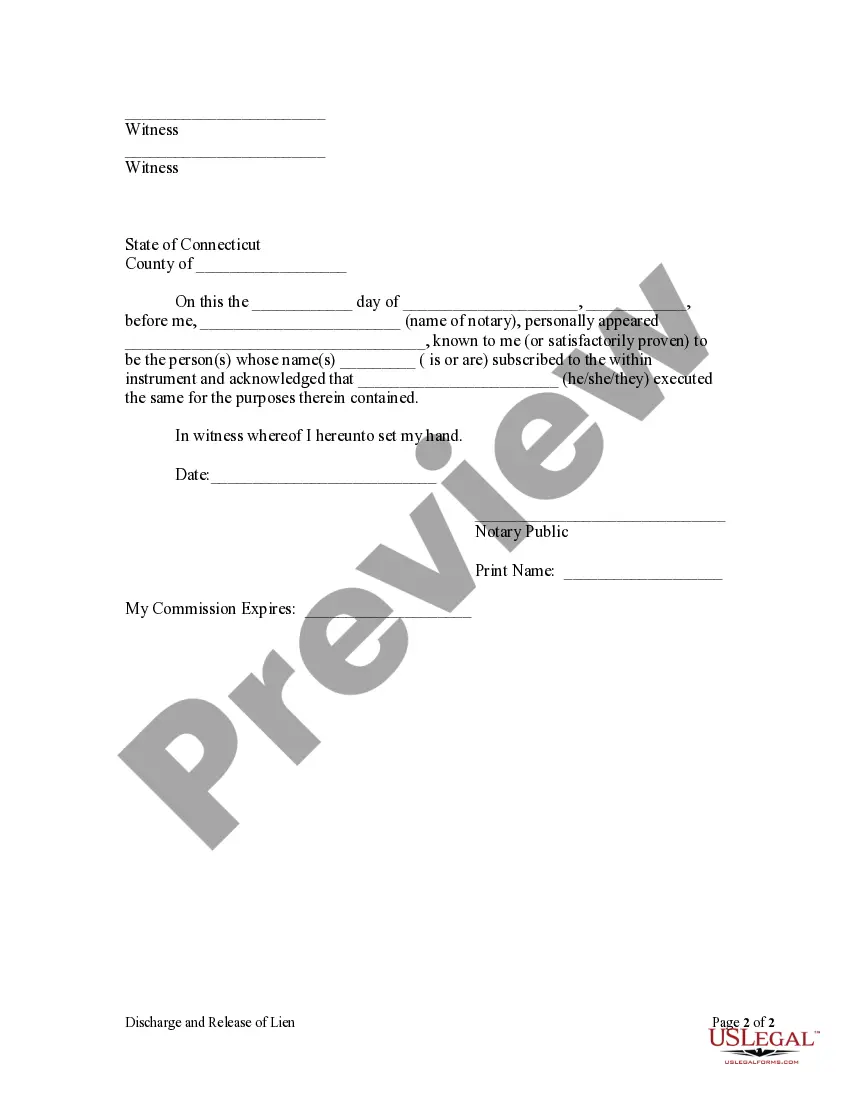

How to fill out Connecticut Discharge And Release Of Lien By Individual?

- Log in to your US Legal Forms account if you're a returning user and ensure your subscription is active. If needed, renew your plan.

- If you're new, start by reviewing the preview mode and descriptions of available templates to find the lien release letter that fits your jurisdiction.

- Utilize the search feature for alternative templates if you find any discrepancies.

- Select the appropriate document by clicking the 'Buy Now' button, then choose your subscription plan and create an account.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Once the transaction is completed, download the form directly to your device, accessible anytime via the 'My Forms' section.

By following these steps through US Legal Forms, you can quickly generate a legally sound lien release letter tailored to your needs.

Start today and enjoy the benefits of having access to over 85,000 legal forms at your fingertips!

Form popularity

FAQ

Writing a lien release letter for your house is straightforward when you follow a few simple steps. Begin by stating your intent to release the lien and include any relevant details like the property address and lien number. Then, provide your name, contact information, and a formal request to confirm the release. Finally, include a space for the lienholder's signature, indicating their acceptance of the release.

To obtain a lien release letter for your house, you typically need several key documents. First, ensure you have proof of payment for the debt associated with the lien. Next, gather any original lien documents, as these will help verify its validity. Lastly, it is beneficial to include a written request for the lien release to streamline the process.

The speed at which you can obtain a lien release letter for your house largely depends on the lender’s processing times. Once your final payment is received and processed, the lender typically issues the release in a week or two. However, it’s wise to follow up with your lender to ensure that no delays occur. Being proactive can help you receive your lien release sooner.

To obtain a copy of your mortgage lien release, reach out to the lender or financial institution that issued it. They may ask for your account details or other identifying information to process your request. In many cases, lenders can quickly provide a copy via email or postal service. Keeping a copy of the lien release letter for your house is vital to maintain clear ownership records.

The time it takes to receive a mortgage lien release can vary depending on the lender and the specific situation. Generally, it may take anywhere from a few days to a few weeks after your final payment is made. To expedite the process, ensure that your payments are up to date and follow up with the lender. A lien release letter for your house can be an essential document for future real estate transactions.

To get proof of a lien release, contact the lender or entity that issued the release letter for your house. They can provide you with documentation to confirm that the lien has been released. If you cannot locate the lien release letter, ask for a statement or certification from the lender that verifies the release. This proof is important for your records and any future transactions.

If you lose a lien release letter for your house, it is essential to act quickly. You can request a duplicate from your lender or the issuing authority. Keep in mind that some institutions may require you to provide proof of payment or other documentation before issuing a new letter. Having a copy is crucial, especially if you plan to sell the property.

To obtain a lien release letter for your house, start by contacting your lender or the entity that placed the lien. They will provide you with the necessary documents to complete the process. Typically, you may need to provide proof of payment and complete any required forms. Once your request is approved, the lender will issue the lien release letter.

Filling out a lien affidavit involves detailing the lien, its origin, and confirming that it is valid and enforceable. Begin by entering your personal information and describe the lien accurately in the document. You will also need to attach any supporting documents, such as the lien release letter for your house if available. To ensure accuracy, consider utilizing a platform like USLegalForms, where you can find templates and guidance to make the process easier.

To complete a lien release letter for your house, you first need to gather the necessary information, such as the lien holder's details and any relevant property information. Next, you will draft the lien release document, clearly stating that the debt has been satisfied and providing the original lien details. Ensure you sign and date the document, as your signature shows the lien holder's consent to remove the lien. Once complete, you can file the lien release letter with your local county office for official record.