Connecticut Gift Form For Ma

Description

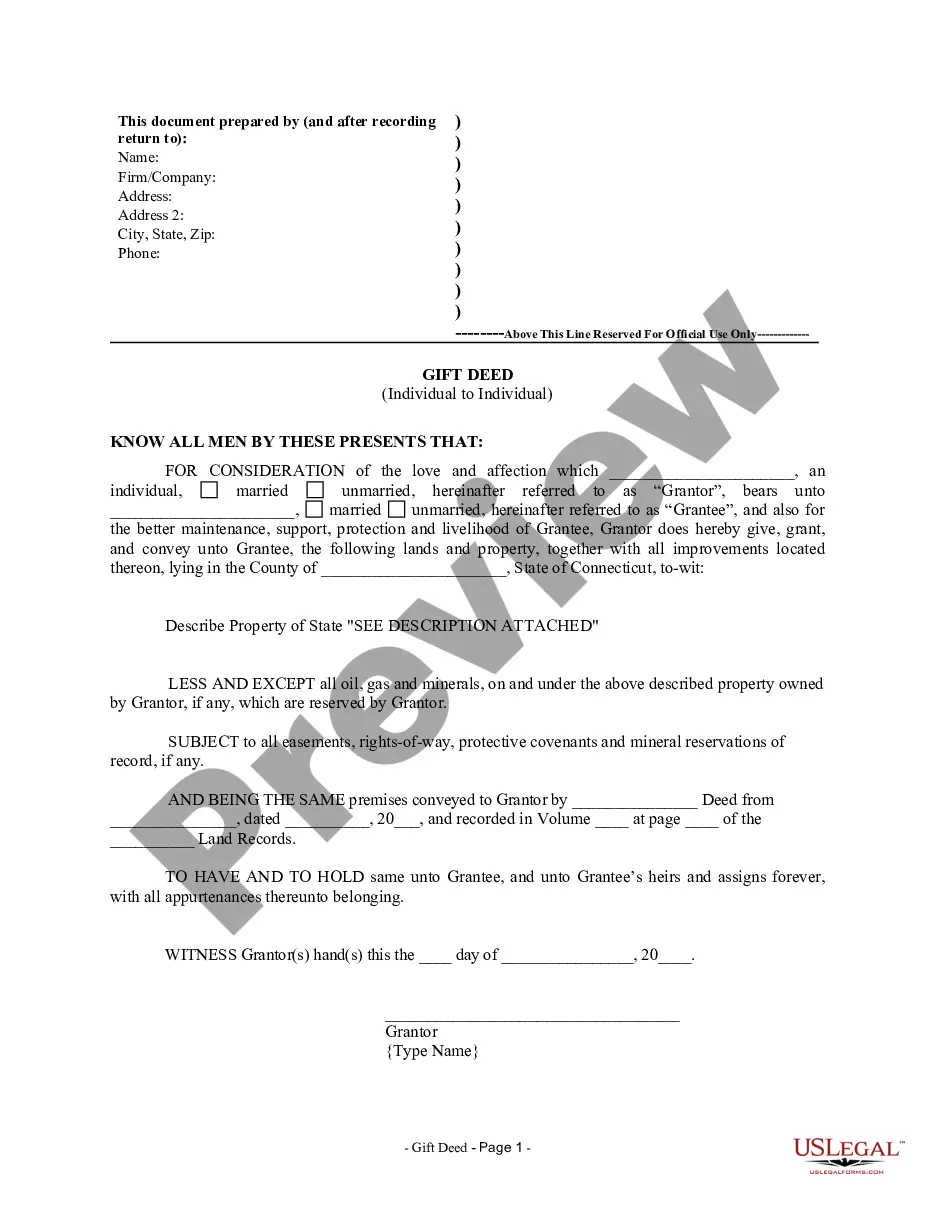

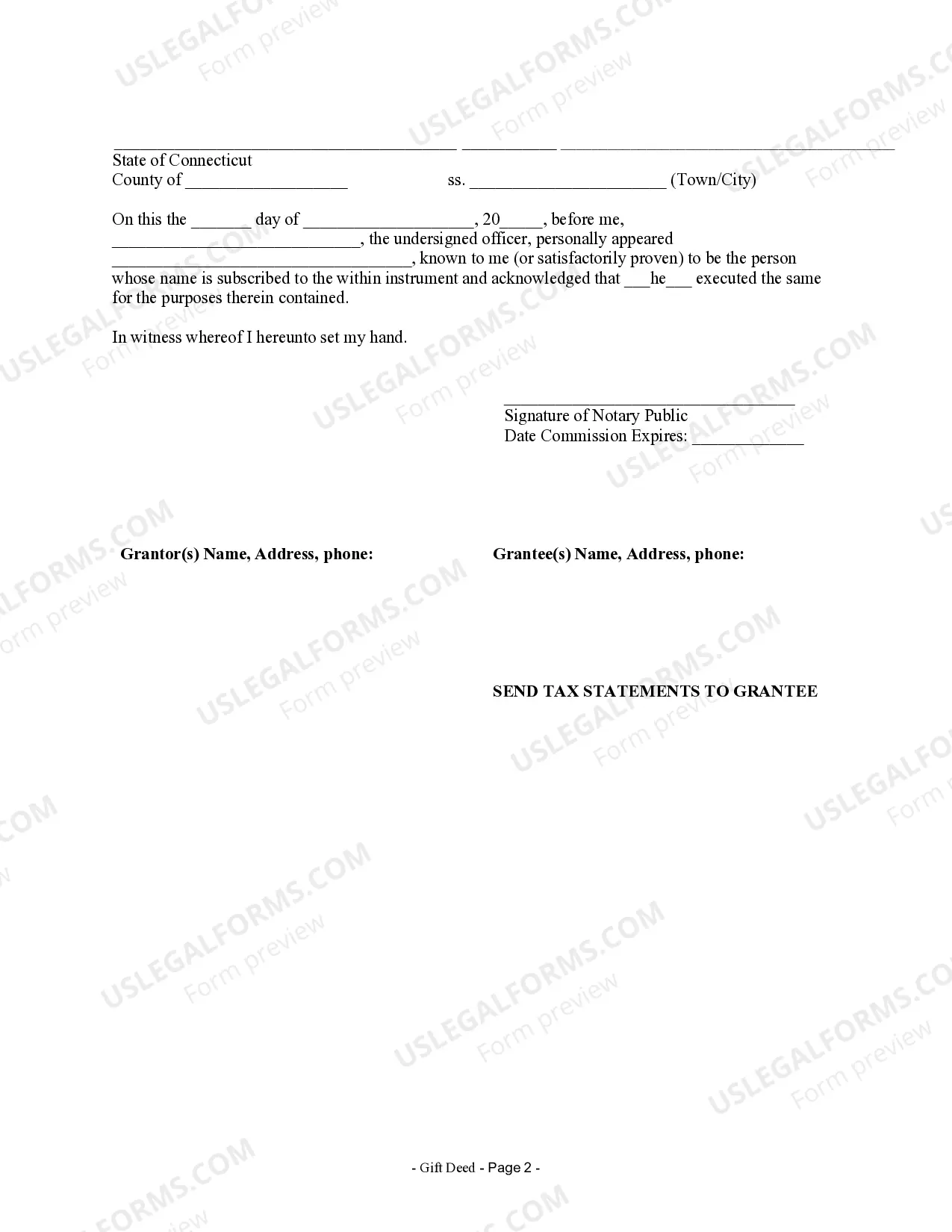

How to fill out Connecticut Gift Deed For Individual To Individual?

Dealing with legal documents and processes can be a lengthy addition to your whole day.

Connecticut Gift Form For Ma and similar forms typically necessitate that you locate them and comprehend how to fill them out correctly.

Consequently, if you are managing financial, legal, or personal affairs, having a comprehensive and functional online directory of forms readily available will be extremely beneficial.

US Legal Forms is the leading online source of legal templates, offering over 85,000 state-specific documents and various tools to help you complete your paperwork effortlessly.

Is it your first time using US Legal Forms? Register and create your account in just a few minutes, and you’ll gain access to the form directory and Connecticut Gift Form For Ma. Then, follow the steps below to complete your document: Ensure you have found the correct form by utilizing the Review feature and examining the form description. Select Buy Now when ready, and choose the subscription plan that suits you best. Click Download then fill out, sign, and print the document. US Legal Forms has twenty-five years of experience assisting users in managing their legal documents. Acquire the form you need today and simplify any process without breaking a sweat.

- Explore the directory of pertinent documents accessible with just one click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Enhance your document management procedures with a top-notch service that enables you to prepare any form in a matter of minutes without extra or concealed fees.

- Simply Log In to your account, find Connecticut Gift Form For Ma, and download it instantly from the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

The CT DMV defines a family member as a parent, spouse, child, or sibling. The procedure is similar to selling a vehicle, but you'll also need to complete a Motor Vehicle or Vessel Gift Declaration (Form AU-463). You and the family member must complete and sign the AU-463.

A Connecticut title transfer requires a bill of sale that includes the following information: The names and addresses of both the new owner and seller. The vehicle identification number (VIN) The vehicle, year, make, model, and color. The purchase price and purchase date. The seller's signature.

Get a bill of sale Vehicle information (make, year, model, vehicle identification number, and an odometer reading) Buyer information (name, address, and signature) Seller information (name, address, and signature) Selling price and date sold.

Gifting a Vehicle You and the family member must complete and sign the AU-463. Once the paperwork is complete, you and your family member must visit a CT DMV office with paperwork and photo identification. Once this step is complete, the CT DMV will post the new certificate of title to your family member in a few days.

Can you sell a car for $1? In short, yes. But while selling a car for $1 will allow you to avoid capital gains and gifts taxes, the recipient of the car will have to pay whatever rate of sales tax your state charges on used vehicles when they transfer the title.