Connecticut Deed With Mortgage

Description

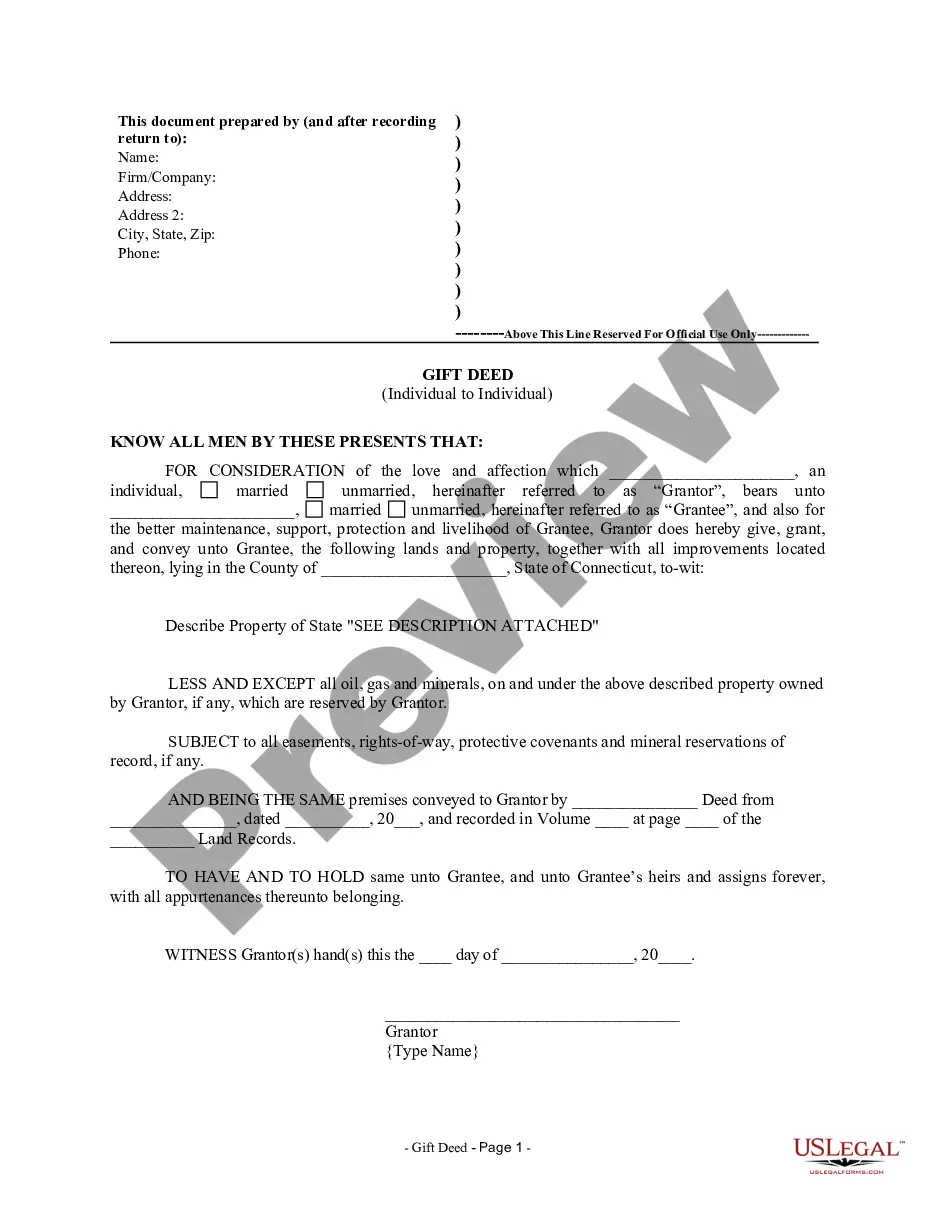

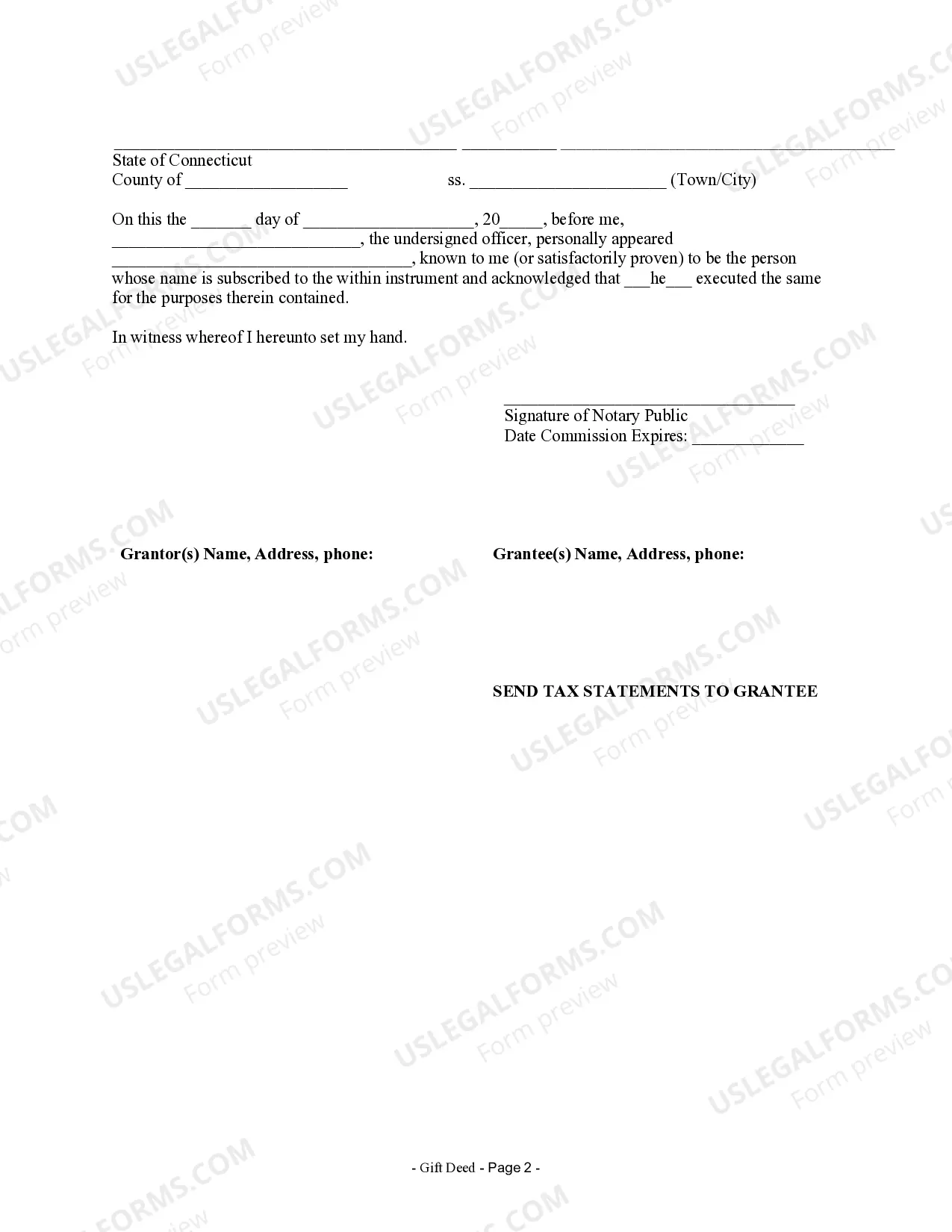

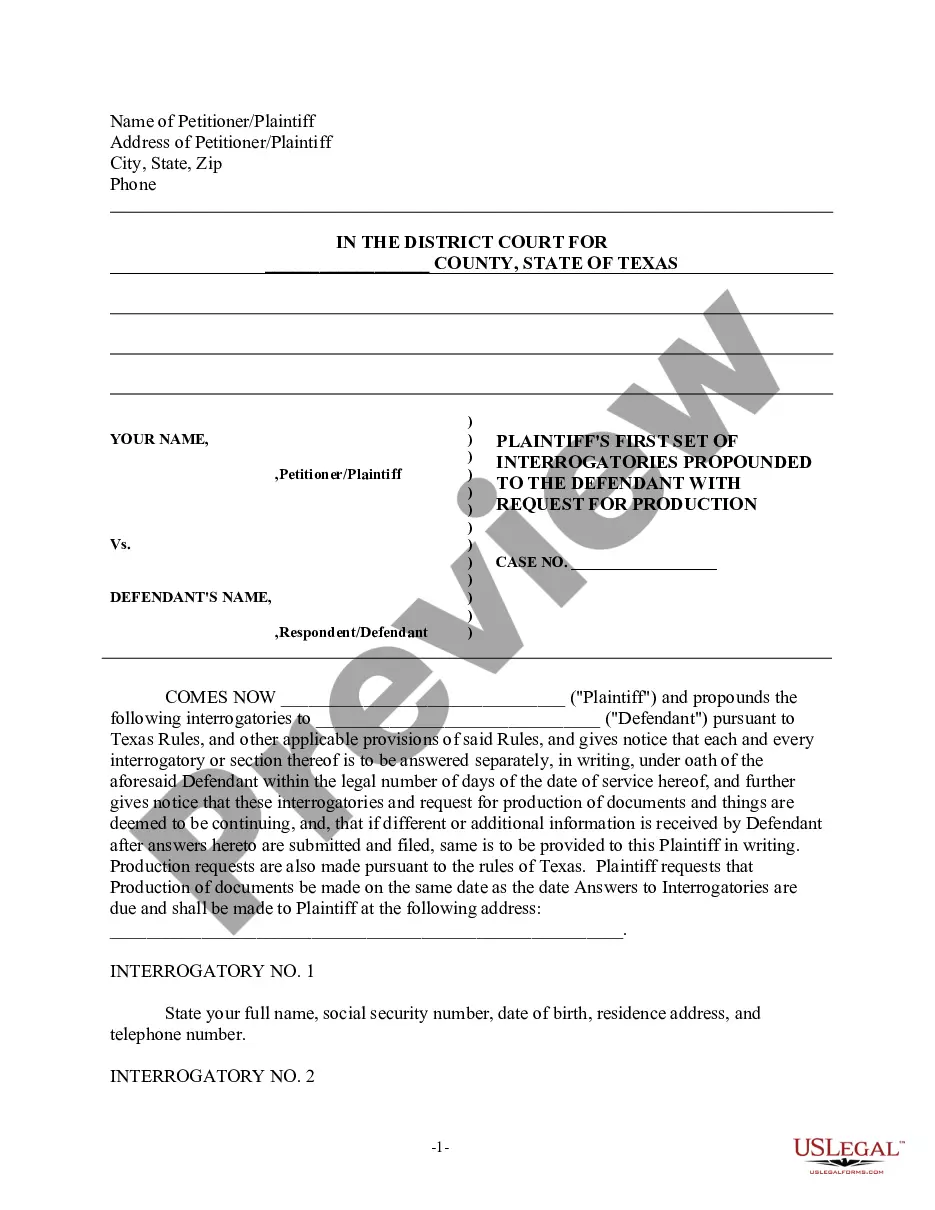

How to fill out Connecticut Gift Deed For Individual To Individual?

There's no longer any need to squander time searching for legal documents to satisfy your local state regulations.

US Legal Forms has consolidated all of them in a single location and improved their availability.

Our platform provides over 85,000 templates for various business and personal legal situations grouped by state and area of usage. All forms are expertly drafted and verified for authenticity, ensuring you can confidently acquire an up-to-date Connecticut Deed With Mortgage.

Select the most suitable pricing plan and register for an account or Log In. Process payment for your subscription via card or PayPal to continue. Select the file format for your Connecticut Deed With Mortgage and download it to your device. Print your form to fill it out manually or upload the sample if you prefer using an online editor. Completing formal paperwork under federal and state regulations is quick and straightforward with our library. Try US Legal Forms today to keep your documents organized!

- If you are acquainted with our platform and already possess an account, verify that your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents at any time by accessing the My documents section in your profile.

- If you're a new user on our platform, the process will entail additional steps to complete.

- Here's how new users can find the Connecticut Deed With Mortgage in our library.

- Examine the page content diligently to ensure it includes the sample you need.

- To assist with this, make use of the form description and preview options if available.

- Utilize the Search field above to look for another sample if the current one does not suit your needs.

- Click Buy Now adjacent to the template name once you identify the correct one.

Form popularity

FAQ

To add a name to a deed in Connecticut, you'll need to prepare a new deed that includes the new name and clearly outlines the current ownership. The deed must then be signed, notarized, and filed with the appropriate town clerk’s office. For assistance with the process, including creating a Connecticut deed with mortgage, consider using platforms like USLegalForms to ensure you have the right documentation.

In Connecticut, the different types of deeds include warranty deeds, quitclaim deeds, bargain and sale deeds, and special warranty deeds. Each type serves a distinct purpose and offers varying levels of security. For individuals navigating property transactions, understanding the nuances of a Connecticut deed with mortgage is crucial for protecting their investment.

The most powerful deed is the warranty deed, as it offers the highest level of protection to the buyer. This type of deed assures the buyer that the seller has full ownership of the property and is responsible for any claims against it. When considering a Connecticut deed with mortgage, a warranty deed is an essential choice to safeguard your investment.

Section 49-2 of the Connecticut General Statutes outlines the requirements for the recording of a deed, ensuring clarity in property ownership. This section mandates that deeds, including a Connecticut deed with mortgage, be recorded in the town where the property is located to provide public notice. This promotes transparency and protects the rights of property owners.

The four main types of deeds recognized in Connecticut are warranty deeds, quitclaim deeds, bargain and sale deeds, and special warranty deeds. Warranty deeds provide the highest level of protection, ensuring that the seller warrants good title against any claims. A Connecticut deed with mortgage typically refers to a warranty deed, which assures buyers that there are no undisclosed claims on the property.

In Connecticut, various types of deeds are used for real estate transactions, including warranty deeds, quitclaim deeds, and bargain and sale deeds. Each of these serves a unique purpose and offers a different level of protection to the buyer. For those involved in a Connecticut deed with mortgage, warranty deeds are popular because they guarantee that the seller holds clear title to the property.

Individuals who need to transfer property ownership quickly and without guarantees can benefit from a quitclaim deed. This approach is often used among family members, such as transferring a Connecticut deed with mortgage to a spouse or child. Moreover, investors may also use quitclaim deeds to streamline property acquisition. Understanding the implications fully can help ensure that all parties are protected during the transfer.

Filing a quitclaim deed in Connecticut involves several steps. First, you need to complete the deed form correctly, ensuring all necessary details are present, particularly the Connecticut deed with mortgage if applicable. Once completed, the form must be signed and notarized before filing it with the town clerk's office in the appropriate jurisdiction. Using resources from USLegalForms can provide templates and guidance, helping you navigate this process smoothly.

In Connecticut, you do not necessarily need a lawyer to add a name to a deed. However, seeking legal advice can help ensure the process aligns with your goals and complies with state laws. When handling a Connecticut deed with mortgage, it’s crucial to understand how this change may impact your property rights and any mortgage obligations. Utilizing platforms like USLegalForms can simplify the documentation process, making it clearer for you.

To add someone to the deed of a house in Connecticut, you must complete a new deed that transfers ownership rights. You typically create a quit claim deed to achieve this, ensuring it accurately lists the names of all current owners and the new party. Additionally, you will need to sign the deed in front of a notary public before filing it with the local clerk's office. Using a reliable platform like US Legal Forms can help you generate the appropriate documents for a Connecticut deed with mortgage efficiently.