Fiduciary Probate Certificate For Trust

Description

How to fill out Connecticut Fiduciary's Probate Certificate?

Whether for corporate reasons or personal issues, everyone must handle legal circumstances at some stage in their life.

Completing legal paperwork demands meticulous attention, starting with selecting the correct form template.

With an extensive US Legal Forms collection available, you no longer have to waste time searching for the right template online. Utilize the library’s user-friendly navigation to find the suitable template for any situation.

- Obtain the template you require by using the search bar or catalog browsing.

- Review the form’s description to verify it aligns with your circumstances, state, and locality.

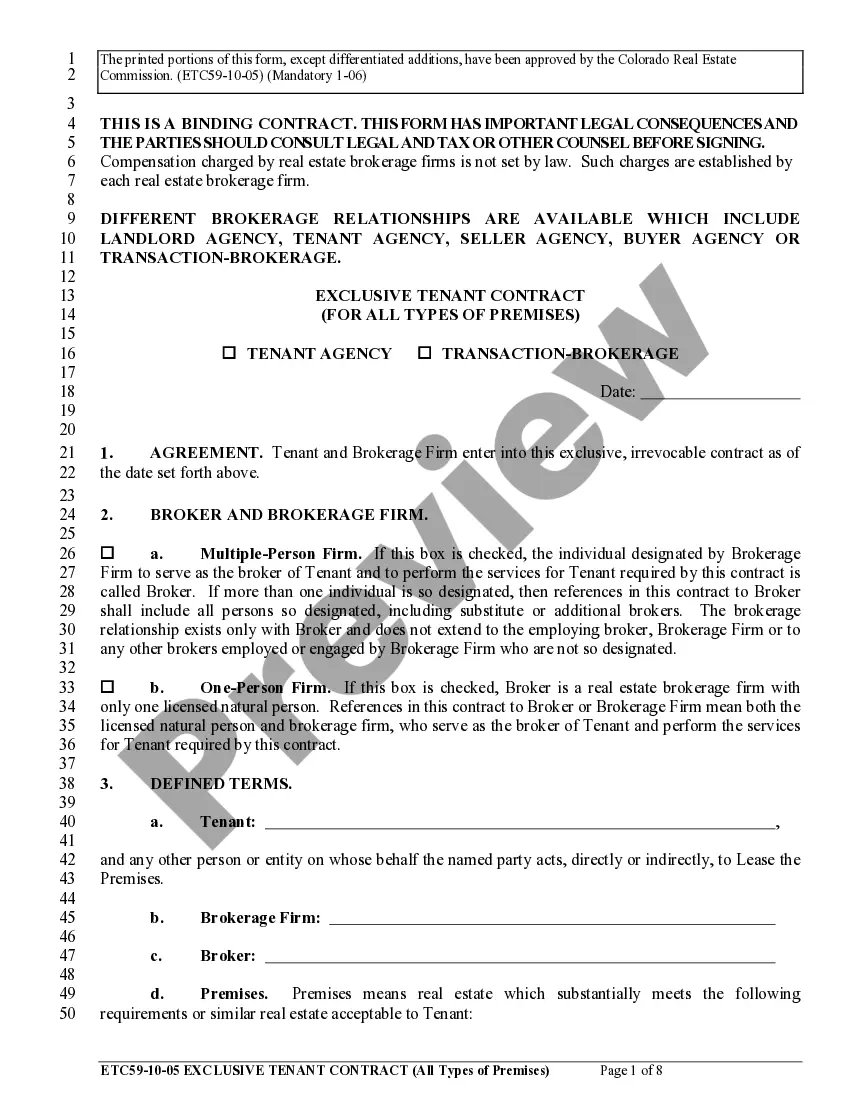

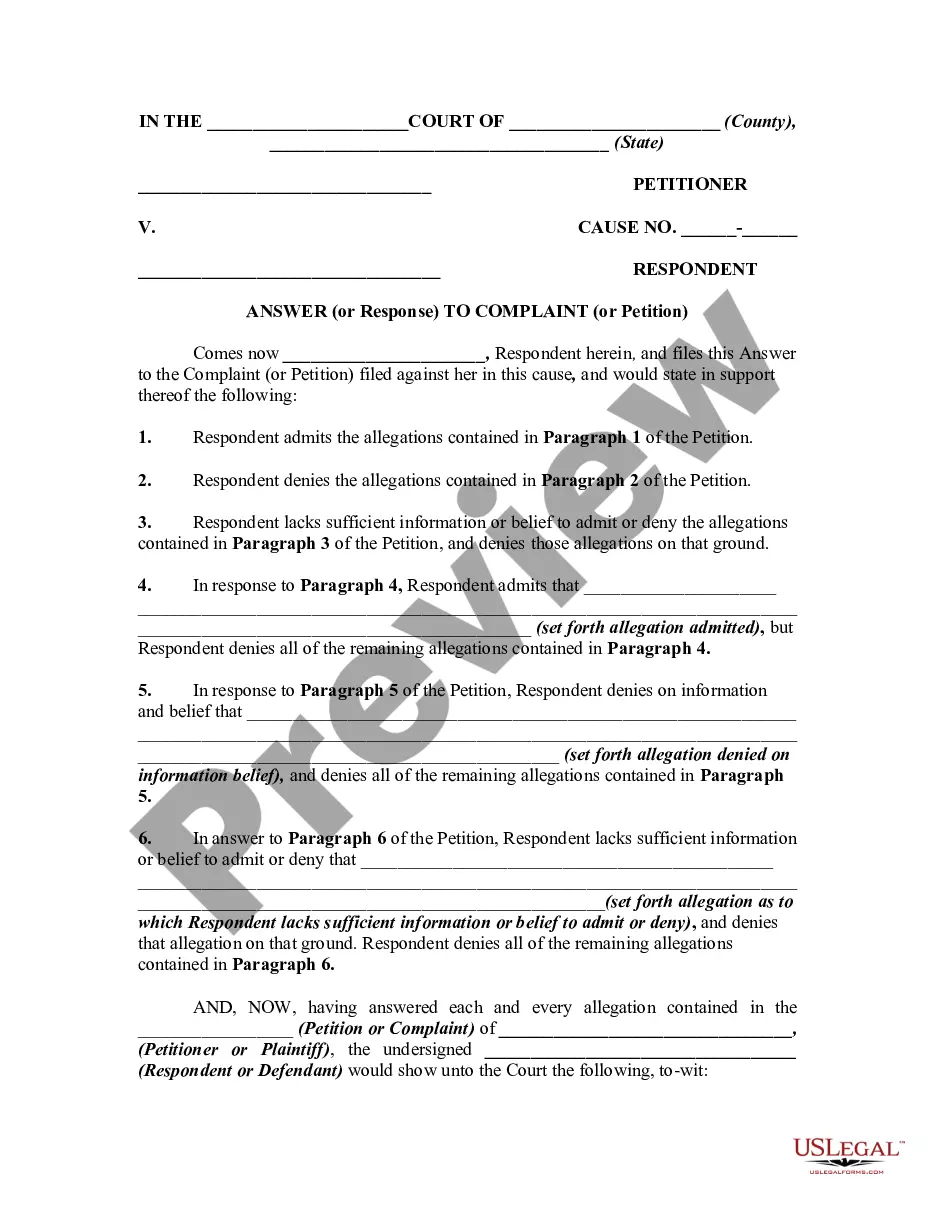

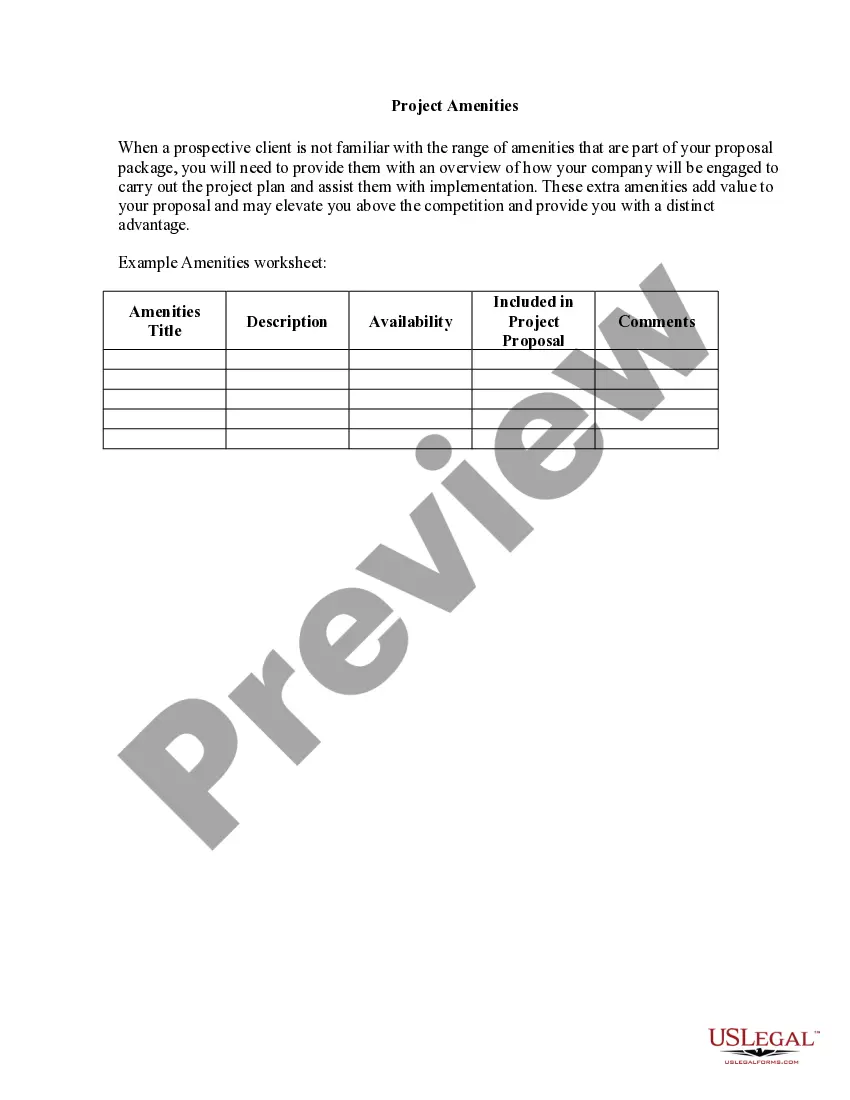

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search option to find the Fiduciary Probate Certificate For Trust template you need.

- Acquire the template once it meets your needs.

- If you already possess a US Legal Forms account, simply click Log in to access documents previously saved in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you desire and download the Fiduciary Probate Certificate For Trust.

- Once it is saved, you can fill out the form with the help of editing software or print it and complete it manually.

Form popularity

FAQ

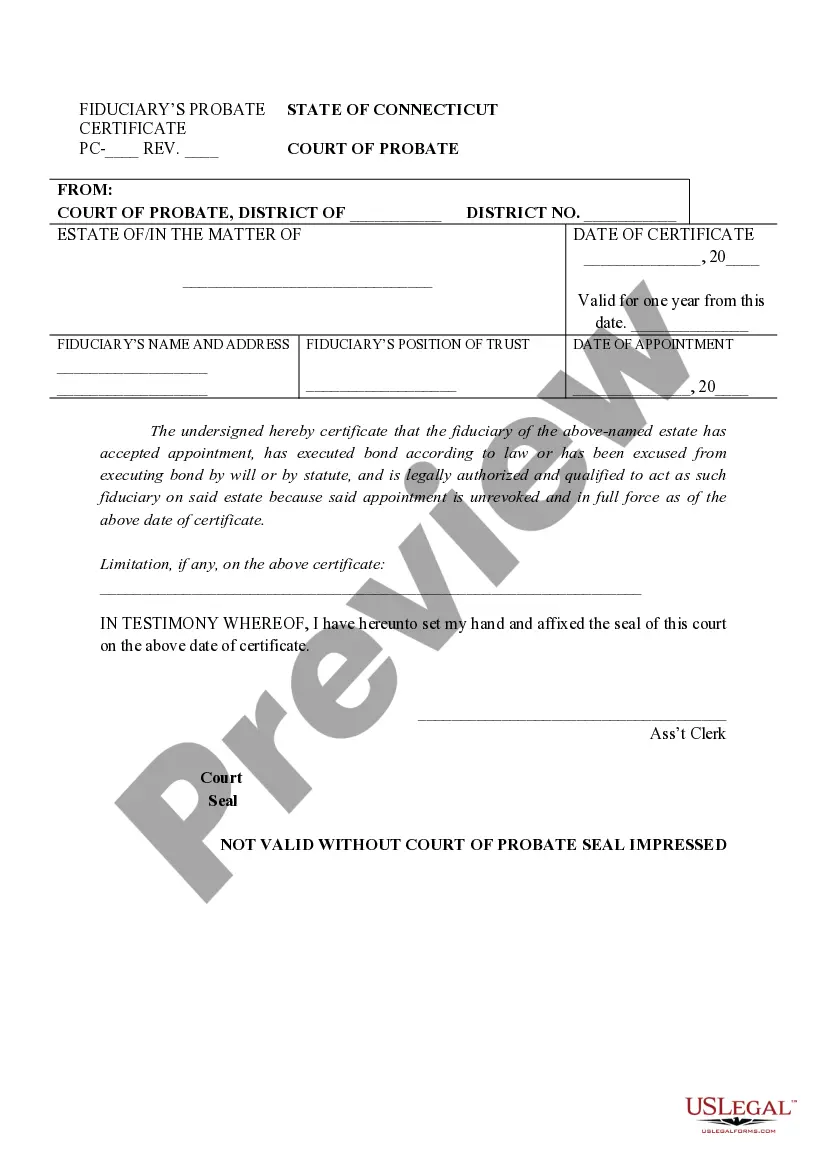

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

The fiduciary is the individual that is responsible for the filing of the tax return and would be the executor or personal representative for an estate or a trustee or their designee in the case of a trust. This information is required and must be entered in order to electronically file the return.

As a trustee or administrator, you are the fiduciary of the trust or estate.

An individual named as a trust or estate trustee is the fiduciary, and the beneficiary is the principal. Under a trustee/beneficiary duty, the fiduciary has legal ownership of the property or assets and holds the power necessary to handle assets held in the name of the trust.

A trustee is a fiduciary, which means that the trustee is held to a high standard of care and may be expected to pay more attention to the trust's investment and management than he/she generally would pay to his/her own personal accounts or assets.