Trust Deed For School

Description

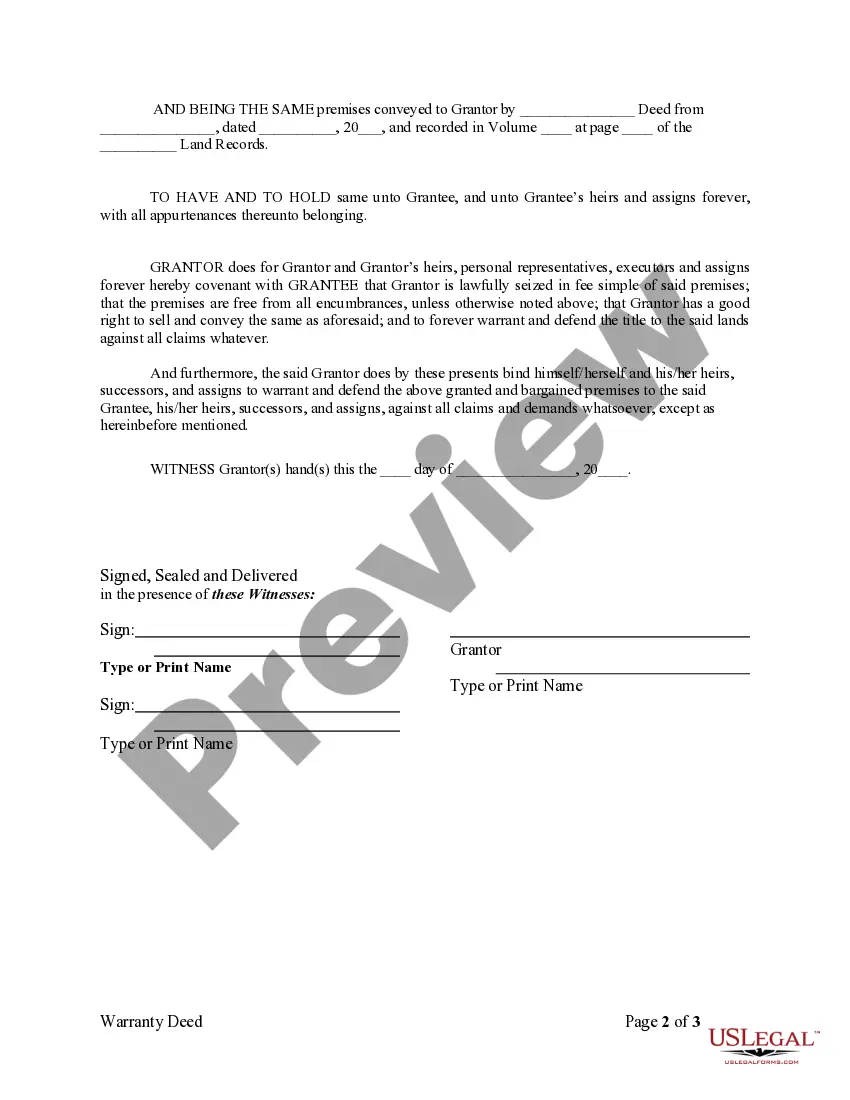

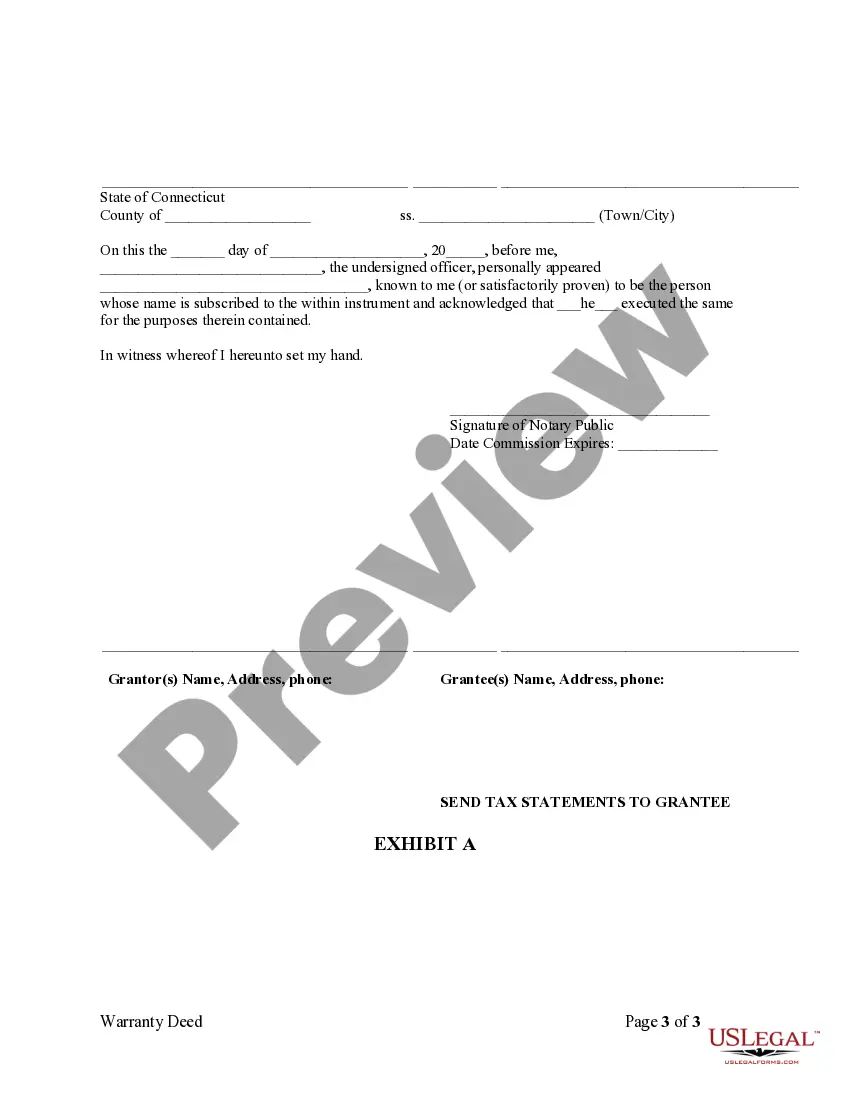

How to fill out Connecticut Warranty Deed From Individual To A Trust?

- Log in to your US Legal Forms account if you're a returning user, ensuring your subscription is active. Click the Download button to retrieve your trust deed for school.

- For first-time users, browse through the extensive collection. Check the Preview mode and form descriptions to find the right trust deed that aligns with your needs and jurisdiction.

- If the selected template doesn't quite fit, use the Search tab to explore alternative options until you find a suitable form.

- Once you're satisfied, click the Buy Now button and select your desired subscription plan. You’ll need to create an account for library access.

- Complete your purchase by entering payment details via credit card or PayPal, ensuring you have proper access to the resources.

- Finally, download your trust deed for school. Save the document to your device and find it anytime in the My Forms section of your profile.

With US Legal Forms, obtaining your trust deed for school has never been easier. Their comprehensive library and user-friendly interface allow for quick access to over 85,000 legal forms, surpassing competitors in both quantity and quality.

Get started today and simplify your legal documentation process with US Legal Forms—your reliable partner in executing precise and legally sound documents.

Form popularity

FAQ

Drafting a trust deed for school involves outlining the trust's terms clearly and logically. Include details about the trustee, beneficiaries, and how assets will be managed. You can use online resources or templates from platforms like uslegalforms to ensure compliance with legal requirements.

To obtain a trust deed for school, you can start by drafting one with the help of a legal expert or utilizing platforms like uslegalforms. These resources can guide you through the required steps and templates to create a valid deed. Remember to consider your specific needs and consult with an attorney if necessary.

Typically, the deed of trust is provided by the lender in a real estate transaction. However, in the context of a trust deed for school, the grantor or settlor can also issue it. Working with experienced legal services, like uslegalforms, ensures that you obtain a robust and compliant deed of trust.

The trust deed for school is usually created by the person establishing the trust, known as the grantor or settlor. This critical document outlines the terms, beneficiaries, and powers of the trustee. Skilled legal professionals can assist you in drafting a trust deed that meets your specific needs and complies with state laws.

Setting up a trust for a child involves creating a trust deed for school that outlines your wishes for their future. You should define the trust's terms, select a trustee, and mention how the assets will be distributed. Consulting with a legal professional can help ensure everything is correctly set up to protect your child's interests.

In a trust deed for school, the trustee holds the legal title to the property. This arrangement allows the trustee to manage the property according to the trust terms. As the beneficiary, you retain equitable title, providing you with the right to enjoy the property's benefits.

In a trust deed for school, the process is typically managed by a trustee. This person acts on behalf of the beneficiary, ensuring that the terms of the trust are followed. It's crucial to choose someone trustworthy and reliable to handle this process, as they will manage important decisions regarding the property.

Writing a trust deed involves several important steps. First, identify the trustor, trustee, and beneficiaries clearly. Then, outline the purpose of the trust and how the assets will be managed, especially if it involves a trust deed for school. To ensure your document adheres to legal requirements, consider using online platforms like USLegalForms, which offer templates and guidance on creating a trust deed that suits your needs effectively.

When considering a trust for children, a custodial trust or a revocable living trust is often the most beneficial. A trust deed for school can set aside funds specifically for educational expenses, ensuring that children receive the financial support they need. This helps parents manage how and when the funds are accessed, providing peace of mind for their children's future. Always consult a qualified professional to determine the best option for your situation.

A trust property can include various assets such as real estate, bank accounts, or investment portfolios. For instance, a trust deed for school can designate a property that will serve educational purposes. This makes it a valuable resource for maintaining school facilities or funding educational programs. By placing these assets in a trust, you ensure they are used for the intended benefit of students.