Trust Deed For Educational Purpose

Description

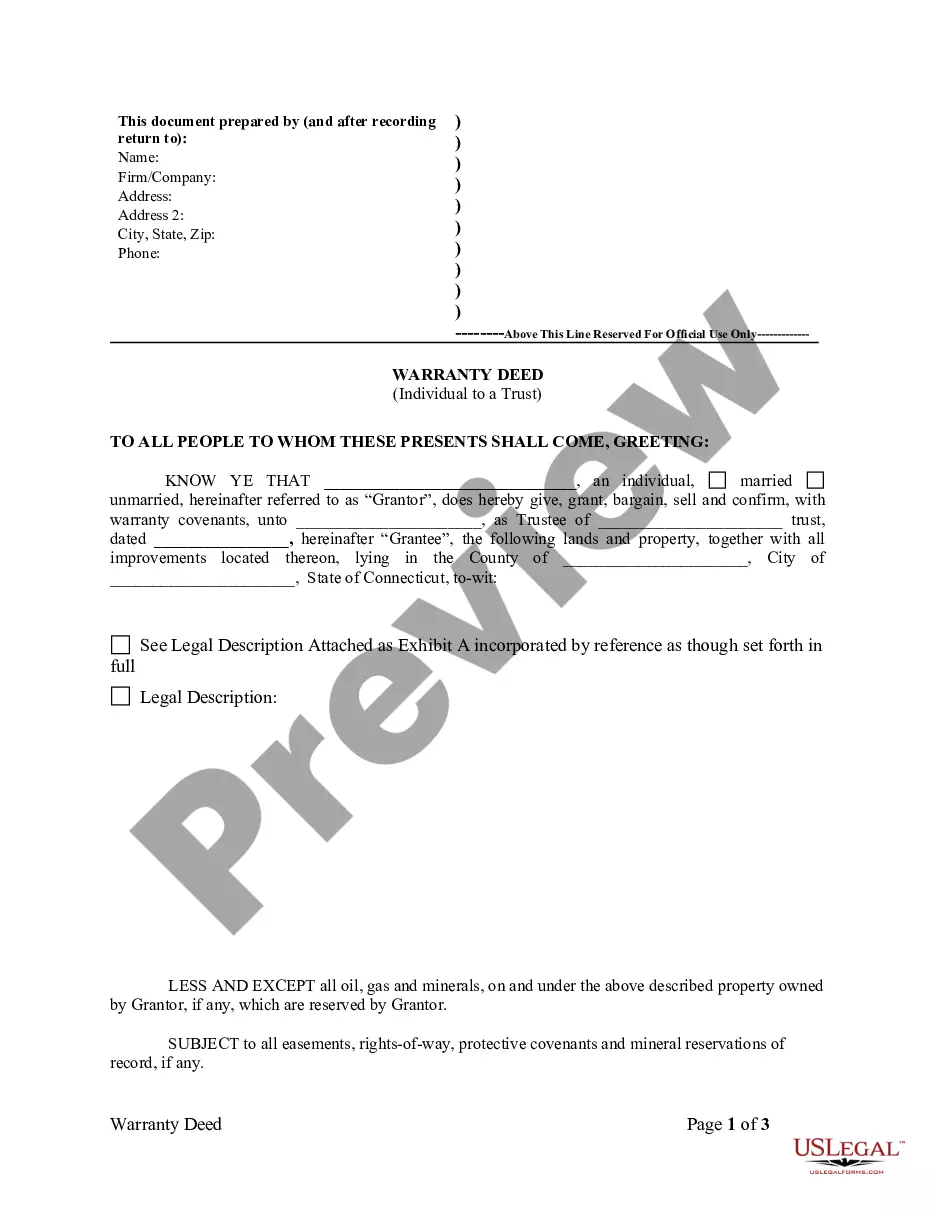

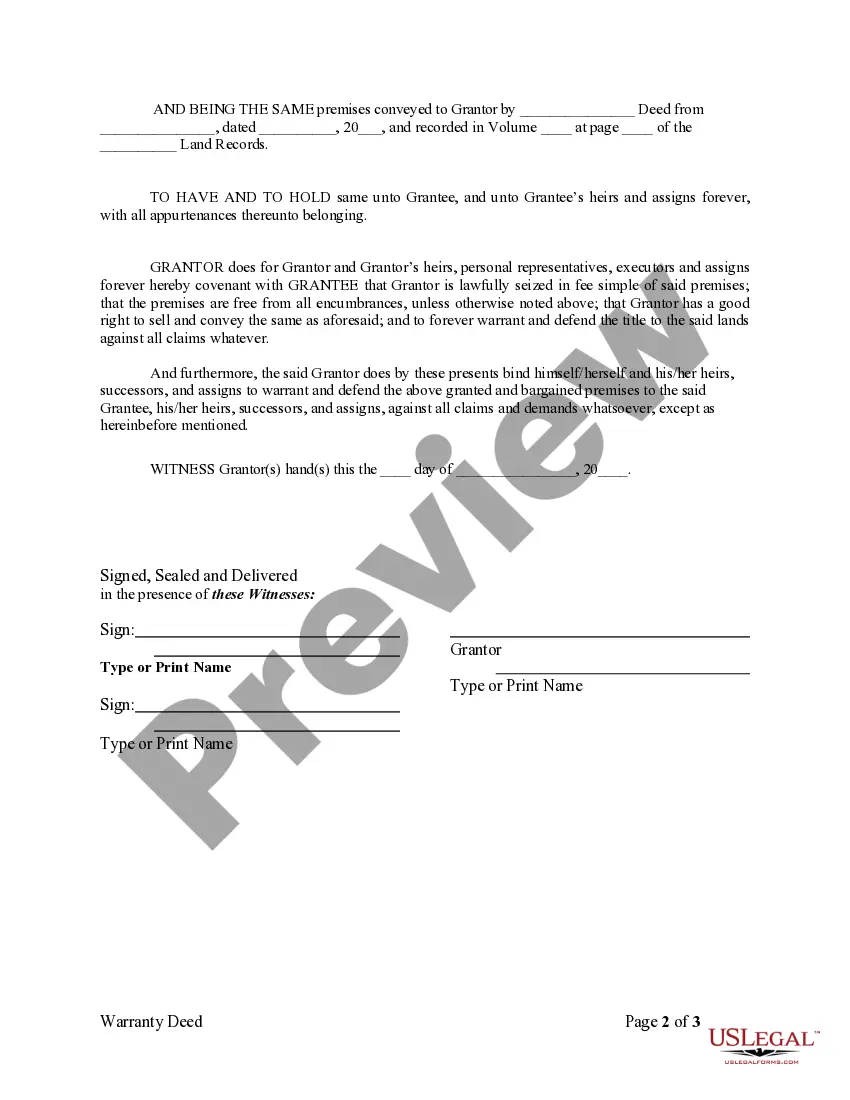

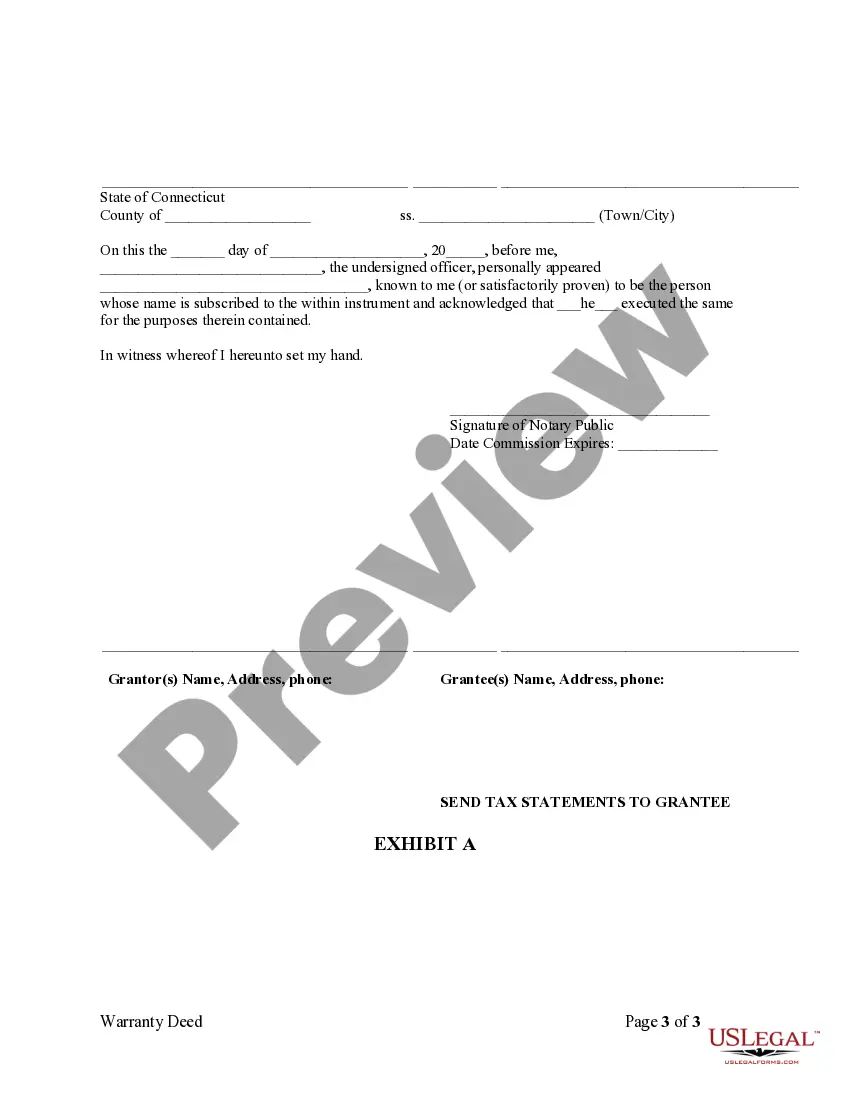

How to fill out Connecticut Warranty Deed From Individual To A Trust?

- If you are an existing user of US Legal Forms, log in to your account and locate the required form template. Ensure your subscription is current; if not, renew it following your payment plan.

- For new users, start by checking the preview mode and description of the trust deed form. Verify that it aligns with your requirements and meets local jurisdiction regulations.

- If adjustments are needed, utilize the Search bar to find alternative templates that may better suit your needs.

- Proceed to purchase the document by clicking on the Buy Now button. Select a subscription plan and create an account to gain access to the comprehensive form library.

- Complete your purchase by entering your credit card details or using a PayPal account to finalize your subscription.

- After payment, download your trust deed form and save it to your device. You can also access it anytime in the My Forms section of your profile.

US Legal Forms offers an extensive library with over 85,000 legal templates, empowering both individuals and attorneys to quickly and accurately prepare legal documents.

Experience the simplicity and efficiency of US Legal Forms today, and start securing your educational trust deed with confidence!

Form popularity

FAQ

An education trust is specifically designed to hold and manage funds for the educational needs of a beneficiary. This type of trust deed for educational purpose sets aside funds to cover expenses such as tuition, fees, and even books. By creating an education trust, you can ensure that the beneficiary has the financial resources necessary to pursue their learning without financial burden, making it a powerful tool for future success.

The objectives of a trust deed for educational purpose primarily focus on safeguarding assets and ensuring that funds are allocated for education-related expenses. This legal document outlines the terms under which assets are managed and distributed, helping to provide financial security for educational endeavors. Additionally, it may aim to establish clear guidelines regarding the use of the funds, offering peace of mind to both donors and beneficiaries.

The biggest mistake parents make when setting up a trust fund is failing to clearly define the purpose and guidelines for the trust. Without a clearly articulated trust deed for educational purposes, funds may not be used effectively or as intended. It's also important to communicate with beneficiaries about how the trust operates. Taking the time to understand how to establish and manage the trust can prevent unnecessary complications down the road.

Typically, a deed of trust is prepared by an attorney or legal professional specializing in estate planning. However, you can also create this document through platforms like US Legal Forms, which offer templates and instructions to guide you. It is crucial to ensure that the deed meets specific legal requirements, so consulting a qualified professional may enhance its validity.

Whether a trust or a 529 plan is better depends on your specific financial goals and needs. A trust deed for educational purposes offers more control over funds, whereas a 529 plan provides tax advantages for qualifying educational expenses. Evaluating both options can help you determine which aligns best with your vision for your child's education. Consulting a financial advisor can provide tailored insights.

To set up an educational trust, first identify the beneficiary and outline their educational needs. Next, draft a trust deed for educational purposes that specifies how funds will be managed and distributed. You may want to consult a legal expert to ensure the deed meets all legal requirements and to gain peace of mind. Utilizing a platform like US Legal Forms can simplify the process by providing templates and guidance for each step.

Writing a trust deed requires careful consideration of its terms and the intentions behind the trust. Start by including essential details such as the names of the trustee and beneficiaries, the purpose of the trust, and how assets will be managed. A well-structured trust deed for educational purposes can provide a clear framework for funds designated for education.

To fill out a trust certification, gather all necessary details about the trust, including its name, the trustee's information, and the beneficiaries. Follow the provided guidelines carefully, ensuring accuracy to reflect the trust's terms effectively. This document can support the trust deed for educational purposes by confirming its legitimacy.

Setting up an educational trust involves several steps. First, define your educational goals and the beneficiaries of the trust. Then, draft a trust deed for educational purposes that specifies the management of funds and the trustee's authority, ensuring compliance with state laws for the best results.

No, an educational trust and a 529 plan are different. A 529 plan is a specific type of savings account designed for educational purposes, while an educational trust is a broader legal arrangement to manage funds for educational needs. Understanding the distinctions will help you choose the best option for your educational funding goals.