This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantee is an individual. It is also known as a "Lady Bird" Deed. Grantor conveys the property to Grantee subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantee might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. This deed complies with all state statutory laws.

Life Estate Deed In Ct

Description

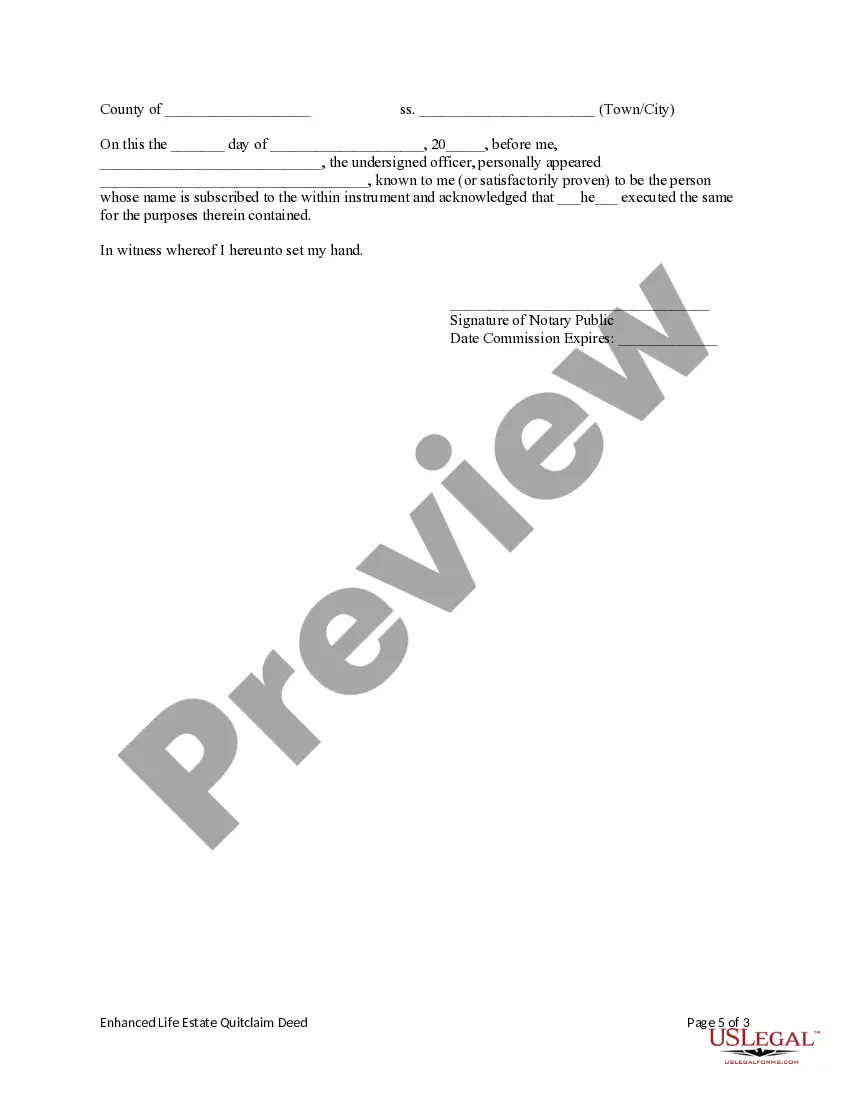

How to fill out Connecticut Enhanced Life Estate Or Lady Bird Quitclaim Deed - Individual To Individual?

The Life Estate Deed In Ct presented on this page is a versatile legal template crafted by experienced attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners more than 85,000 validated, state-specific forms for any commercial and personal event. It’s the fastest, easiest, and most reliable means to secure the documents you require, as the service ensures the utmost level of data protection and malware prevention.

Join US Legal Forms to access verified legal templates for all of life's situations at your convenience.

- Search for the document you require and examine it.

- Browse through the file you searched and preview it or review the form description to confirm it meets your requirements. If it doesn’t, use the search bar to locate the appropriate one. Click Buy Now when you have identified the template you want.

- Select and Log In.

- Choose the pricing option that works for you and sign up for an account. Use PayPal or a credit card to facilitate a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Retrieve the editable template.

- Choose the format you prefer for your Life Estate Deed In Ct (PDF, DOCX, RTF) and download the sample onto your device.

- Fill out and sign the document.

- Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to efficiently and accurately fill out and sign your form with a legally-binding electronic signature.

- Re-download your files as needed.

- Utilize the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously downloaded forms.

Form popularity

FAQ

Another name for a life estate deed in CT is a life estate. This legal document allows an individual to retain ownership of a property during their lifetime, while transferring the title to another party after their death. It helps to avoid probate, ensuring that the property passes directly to the designated recipient. By understanding the concepts surrounding life estate deeds, you can make informed decisions about your estate planning.

To claim a life estate deed in CT, you must first create a deed that outlines your intent to grant a life estate. This document should clearly describe the property and state the beneficiaries who will receive the estate after your passing. It’s essential to ensure the deed is properly executed and recorded with the local land records office. For a seamless process, consider using the US Legal Forms platform, which offers templates and guidance tailored to life estate deeds in CT.

A life estate deed in Connecticut is a specific type of legal document that divides ownership interests in real estate. It grants one person the right to use the property for life, while automatically transferring the property to another party upon the life tenant's death. This arrangement facilitates easy transfer of property while ensuring the rights of the life tenant are protected.

Negatives of a life estate just include potential limitations on the property’s use and the challenges involved in selling the property. The life tenant cannot lease or mortgage the property without consent from the remainderman, which may hinder financial flexibility. Carefully considering these drawbacks will assist you in making the right choices.

An example of a deed with a life estate in CT might involve a parent who grants their home to their child but retains the right to live in the home until death. This deed clearly establishes the parent's lifetime rights and the child's future ownership. Such arrangements can be beneficial in estate planning, ensuring that family property remains in the family.

A life estate in Connecticut is a legal arrangement where one person holds the right to use a property for their lifetime while another person, known as the remainderman, will inherit the property once the life tenant passes away. This setup is often used for estate planning purposes. Understanding this arrangement can help you make informed decisions about property ownership.

The primary benefit of a life estate deed in CT is that it allows individuals to pass their property to heirs while retaining the right to live there during their lifetime. This arrangement can help avoid probate, thus streamlining the transfer of ownership. It also provides a clear plan for the property's future, enhancing peace of mind.

Selling a home with a life estate deed in CT is possible but comes with specific conditions. The life tenant maintains the right to live in the home for their lifetime, which complicates traditional selling processes. Both the life tenant and the remainderman must agree to the sale, and it’s wise to consult legal expertise before proceeding.

One key disadvantage of a life estate deed in CT is that it limits the life tenant’s ability to make significant changes to the property without the consent of the remainderman. Additionally, a life estate cannot be used as collateral for loans since the life tenant does not hold full ownership. Potential conflicts between the parties can also arise, which makes careful planning essential.

The tax implications of a life estate deed in CT can vary based on your specific situation. Generally, while you retain the right to live in the property, the transfer of ownership upon death may trigger capital gains taxes for the beneficiaries if there is an increase in property value. However, this deed can also offer some estate planning benefits, including potential exclusions from probate taxes. For personalized advice and detailed information, using US Legal Forms to work with professionals can be beneficial.