Personal Representative For Will

Description

How to fill out Colorado Warranty Deed For Personal Representative?

- Log in to your US Legal Forms account if you are an existing user. Ensure your subscription is active, or renew it accordingly.

- For new users, start by browsing the extensive library of templates. Preview form descriptions carefully to find the one that suits your local jurisdiction.

- If the right template is not found immediately, utilize the search function to explore additional options. Confirm it meets all your legal requirements before proceeding.

- Select the ‘Buy Now’ button for the form you wish to purchase and opt for your preferred subscription plan.

- Complete the payment process using either credit card details or PayPal to finalize your subscription.

- Once payment is confirmed, download your selected document to your device. It will be accessible anytime in the ‘My Forms’ section of your account.

With these simple steps, US Legal Forms ensures that you can easily navigate the complexities of selecting a personal representative for your will. The platform empowers both individuals and attorneys to execute legal documents quickly and efficiently.

Ready to get started? Visit US Legal Forms today to access the resources you need for creating legally sound documents.

Form popularity

FAQ

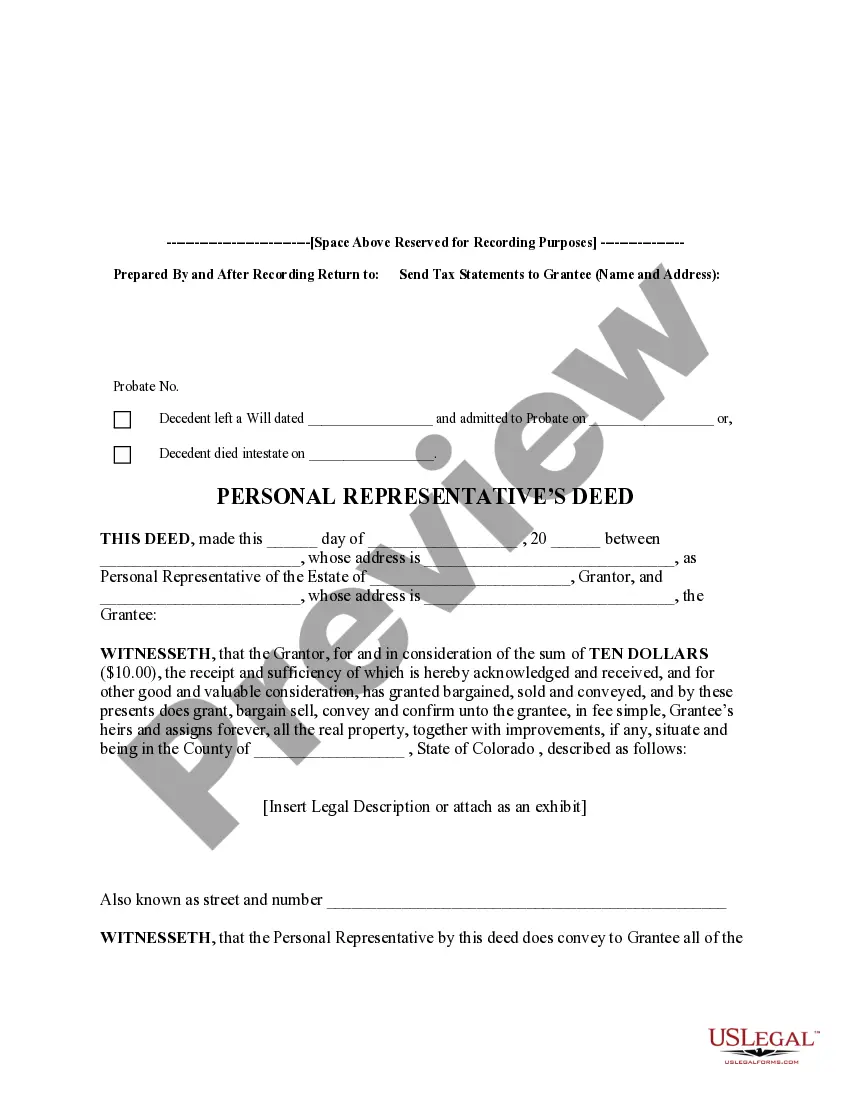

A certified personal representative is an individual officially appointed by the court to administer an estate. This certification signifies that the person has the legal authority to manage the estate's assets and fulfill the obligations defined in the will. Utilizing tools from platforms like US Legal Forms can streamline the certification process, making it more straightforward for you.

The personal representative of the deceased is the individual appointed to handle the estate's affairs after someone passes away. This role involves paying bills, filing taxes, and distributing assets to beneficiaries as outlined in the will. A personal representative for a will ensures that the deceased's wishes are honored and that legal requirements are met.

You do not necessarily need a lawyer to serve as the executor of an estate, but having one can simplify the process. Navigating probate laws can be complicated, and a legal expert can guide you through the responsibilities related to your role as a personal representative for a will. At US Legal Forms, we offer resources that can help you understand your duties and obligations.

Although many people use these terms interchangeably, the roles have specific differences. An executor is directly named in a will, responsible for executing its instructions once the maker has passed. On the other hand, a personal representative for will can include an executor or a court-appointed individual tasked with similar duties if no executor was specified in the will.

The name of the personal representative refers to the individual who is designated to carry out the terms of a will. This person is responsible for managing the deceased's estate, settling debts, and distributing assets according to the wishes expressed in the will. A clear understanding of this role can ensure a smooth administration process for the estate.

While the terms personal representative and executor are often used interchangeably, there is a subtle distinction. An executor is specifically named in the will to administer the estate. A personal representative for will can be broader, as it may include any appointed individual who oversees the estate matters, even if they are not explicitly named in the will.

The primary difference lies in the roles and responsibilities they fulfill. A power of attorney makes decisions for someone while they are alive, especially for financial or health matters. In contrast, a personal representative for will becomes involved after someone's death, ensuring that the deceased's wishes are carried out as outlined in their will.

Choosing the right personal representative for your will is essential to ensure your wishes are fulfilled. Ideally, this individual should be someone you trust, such as a family member or close friend, who can handle your affairs responsibly. It's crucial to select a personal representative who is organized, communicates well, and understands the importance of adhering to your intentions in the will.

No, a power of attorney is not the same as an authorized representative. A power of attorney grants someone the authority to make decisions on behalf of another person, typically regarding financial or medical matters. In contrast, an authorized representative can act on behalf of someone in various capacities, which may or may not include decisions related to a personal representative for will purposes.

When selecting a personal representative for will, choose someone trustworthy, responsible, and organized. This person should understand your values and wishes surrounding your estate. It’s wise to discuss the decision with them beforehand, ensuring they are willing to take on the role. Utilizing uslegalforms can provide valuable resources to aid in making this choice confidently.