Personal Representative For Deceased

Description

How to fill out Colorado Warranty Deed For Personal Representative?

- Log into your existing account on US Legal Forms to download the required document. Ensure your subscription is active to access the form.

- If you are a new user, start by reviewing the available templates. Use the Preview mode to examine the form description and confirm it aligns with your local jurisdiction.

- In case of discrepancies or if you require a different document, utilize the Search tab to find the appropriate template.

- After identifying the suitable form, proceed to purchase it by clicking on the Buy Now button. Choose your preferred subscription plan and create an account for full access.

- Complete your purchase using your credit card or PayPal to finalize the subscription and gain entry to the forms library.

- Finally, download the form and save it to your device. You can access these documents anytime from the My Forms menu in your profile.

Using US Legal Forms not only streamlines your paperwork but also ensures you have access to a robust collection of templates, surpassing those of competitors.

Don’t navigate the complexities of legal documentation alone. Start your journey with US Legal Forms today and secure your legal needs with confidence!

Form popularity

FAQ

To become a personal representative for a deceased individual, you typically need to be appointed by the probate court. This usually involves filing a petition that includes details about the deceased and your relationship to them. Engaging with a legal platform such as USLegalForms can provide essential templates and guidance in this process.

An executor can live in the house of the deceased for as long as is necessary to fulfill their responsibilities but must manage the property in the best interests of the estate. They should avoid making significant changes or decisions without consulting the heirs or legal advisors. Understanding the implications of living in the estate property is crucial for an executor.

A personal representative for a deceased individual and an executor of a will are effectively the same roles but may have different titles depending on the state. Both undertake the responsibility of managing the deceased's estate. It’s important for individuals involved to understand their rights and roles in these matters.

If a house representative passes away, and this individual is handling estate matters, the court will likely appoint a new representative. It’s essential to ensure the estate continues to be managed according to the deceased person's wishes. Utilizing legal resources can aid in smoothing the transition process.

When the personal representative for a deceased person dies, the responsibilities of managing the estate may shift to an alternate representative or a new appointment. The court oversees this process to maintain proper estate administration. Engaging an attorney can simplify the situation and ensure that all legal requirements are met.

If a personal representative for a deceased individual dies, the court may appoint a new representative. This appointment usually follows a legal process to ensure the estate is managed properly. It’s crucial for the heirs to seek legal guidance to navigate this situation effectively.

Yes, a personal representative for the deceased can also be a beneficiary of the estate. This arrangement can simplify processes, as the representative may already have an understanding of the deceased’s wishes. However, it's important to maintain transparency to prevent conflicts of interest. If you're facing this situation, US Legal Forms provides resources and templates to help navigate these complexities with ease.

Yes, a personal representative for the deceased is often required to file form 1310 when claiming tax refunds on behalf of the deceased. This form allows the personal representative to show their authority to act in financial matters for the estate. Filing form 1310 ensures compliance with tax regulations, which helps avoid potential legal issues. It’s advisable to consult with a tax professional to ensure all forms and filings are correctly managed.

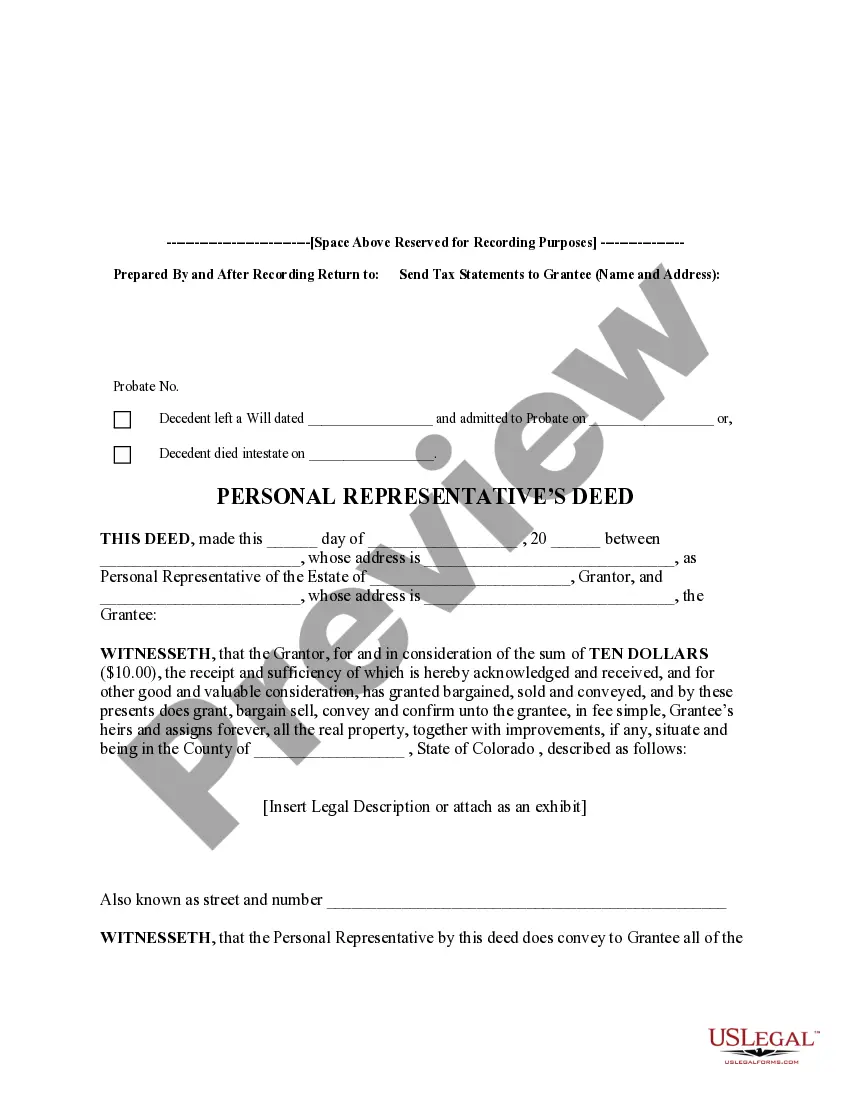

A personal representative for the deceased is an individual appointed to manage the estate and ensure the wishes of the deceased are fulfilled. This role typically includes gathering assets, paying debts, and distributing property to beneficiaries. The personal representative acts on behalf of the deceased, ensuring legal obligations are met during estate administration. Choosing the right personal representative is crucial; it can greatly affect how smoothly the process unfolds.

The 3-year rule refers to the consideration of gifts made by the deceased within three years of death when calculating estate tax. Such gifts can affect the total value of the estate and may lead to additional tax liabilities. As a personal representative for deceased, being aware of this rule will assist you in handling the estate's financial matters accurately and responsibly.