Revocation Full

Description

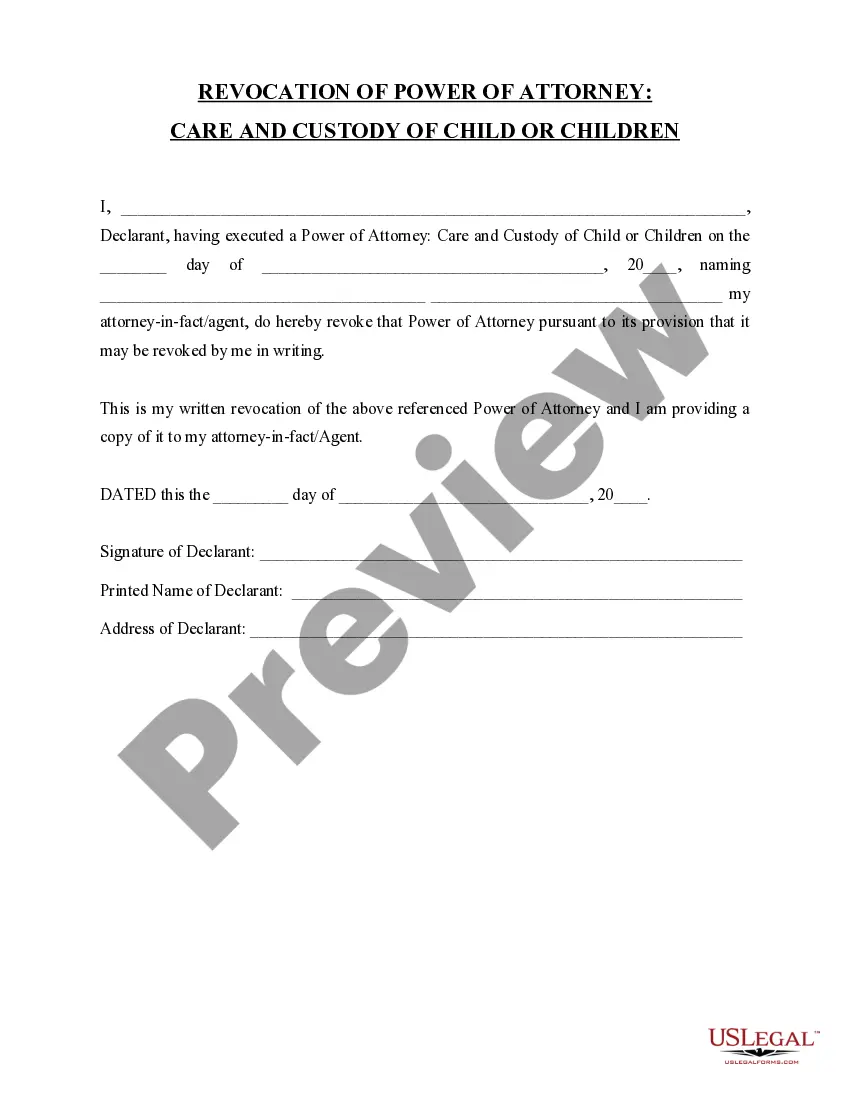

How to fill out Colorado Revocation Of Power Of Attorney For Care Of Child Or Children?

- Log in to your US Legal Forms account if you're a returning user and click the Download button to access your form template. Verify your subscription is active; if not, renew it as necessary.

- For first-time users, begin by browsing the extensive online library. Check preview modes and descriptions of the forms to ensure you select one that aligns with your needs and local jurisdiction.

- If required, utilize the Search tab to find alternative templates that meet your criteria accurately. Proceed to the next step once you find a suitable match.

- Purchase the document by clicking on the Buy Now button, selecting your preferred subscription plan, and creating an account for full access.

- Complete your order by entering your payment information via credit card or PayPal and finalize your subscription.

- Download your form and save it to your device for completion. You can always revisit your saved documents in the My Forms section of your profile.

In just a few simple steps, US Legal Forms facilitates the legal documentation process, ensuring that you have access to a robust collection of forms, expert assistance, and the capability to obtain precise legal documents tailored to your needs.

Start your journey today—visit US Legal Forms and unlock the power of efficient legal document management!

Form popularity

FAQ

Filing a revocation of election involves submitting the appropriate form to the IRS that clearly states your intention to revoke the previous election. This process outlines your name and the election you wish to revoke. Ensure the form is filled out accurately to avoid potential issues or delays. Using a revocation full will give clarity and efficiency in completing this process.

To remove yourself as someone's power of attorney, you must submit a revocation full to the relevant authority or agency. This document informs others that your authority to act on their behalf has ended. It's essential to ensure that all parties, including the IRS if applicable, are notified. Providing a clear revocation helps prevent any misunderstandings.

To remove yourself from a power of attorney with the IRS, you need to complete and submit a revocation full. This will formally notify the IRS that you no longer wish for your representative to handle your tax affairs. It's important to act quickly and ensure the revocation is sent to the correct IRS office. Keeping a copy of your submission can help confirm the revocation process.

An IRS power of attorney remains valid until you revoke it or until the representative's authority is no longer authorized by the IRS. Typically, the authority ends upon your death or when the POA is expressly revoked. To revoke this power formally, submit a revocation full to the IRS. This clarity helps ensure that your tax matters are managed appropriately.

To submit Form 56, which informs the IRS of a fiduciary relationship, you can mail it to the address specified in the form instructions. Ensure you complete all sections accurately, including your identification and the description of your authority. This submission will help the IRS understand your status when acting on behalf of another. To withdraw this authority, a revocation full is required.

The best way to submit a Power of Attorney (POA) to the IRS is by using Form 2848 and sending it to the appropriate IRS office. You can also submit it electronically through authorized tax software. Ensuring accuracy in the details provided will prevent delays in processing. Always keep a copy for your records, and in case you wish to revoke the authority, a revocation full is necessary.

The IRS authorization form for releasing information is Form 2848, also known as the Power of Attorney and Declaration of Representative. This form authorizes your representative to receive confidential tax information on your behalf. Completing this form ensures the IRS communicates directly with your representative, simplifying tax matters. If you need to revoke this authority, a revocation full must be submitted.

Yes, the IRS recognizes power of attorney when properly executed. A power of attorney allows someone to act on your behalf regarding tax matters. This document gives your designated representative the authority to make decisions, sign forms, and access information, thereby ensuring your tax affairs are managed seamlessly. To revoke a power of attorney, you can submit a revocation full.

Driving after a revocation can bring significant legal issues, including hefty fines and possible jail time. Any traffic stops may lead to further complications, extending your revocation or triggering new legal actions. The revocation full clearly indicates that you should not be behind the wheel. Instead of risking penalties, consider working towards re-establishing your driving privileges legally.

To recover your license after a revocation in Illinois, start by fulfilling all required penalties, such as completing a treatment program or paying outstanding fines. Then, you can request a hearing for reinstatement through the Secretary of State’s office. It's highly beneficial to prepare for this hearing with proper documentation and legal guidance. Platforms like uslegalforms can provide forms and information essential for your reinstatement journey.