Commercial Rental Application Form

Description

How to fill out Colorado Commercial Rental Lease Application Questionnaire?

Individuals frequently connect legal documentation with a level of intricacy that only an expert can handle. In some respects, this is accurate, as composing a Commercial Rental Application Form necessitates considerable expertise in the subject matter, including state and local statutes.

Nevertheless, with US Legal Forms, the process has become simpler: a comprehensive online collection of ready-to-use legal templates designed for various life and business scenarios, tailored to state regulations, is now accessible to everyone.

US Legal Forms features over 85,000 current documents categorized by state and application, making the search for a Commercial Rental Application Form or other specific samples quick and efficient.

All templates in our repository are reusable: once obtained, they remain stored in your profile. You can access them at any time via the My documents tab. Discover all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- Review the content of the page carefully to confirm it meets your requirements.

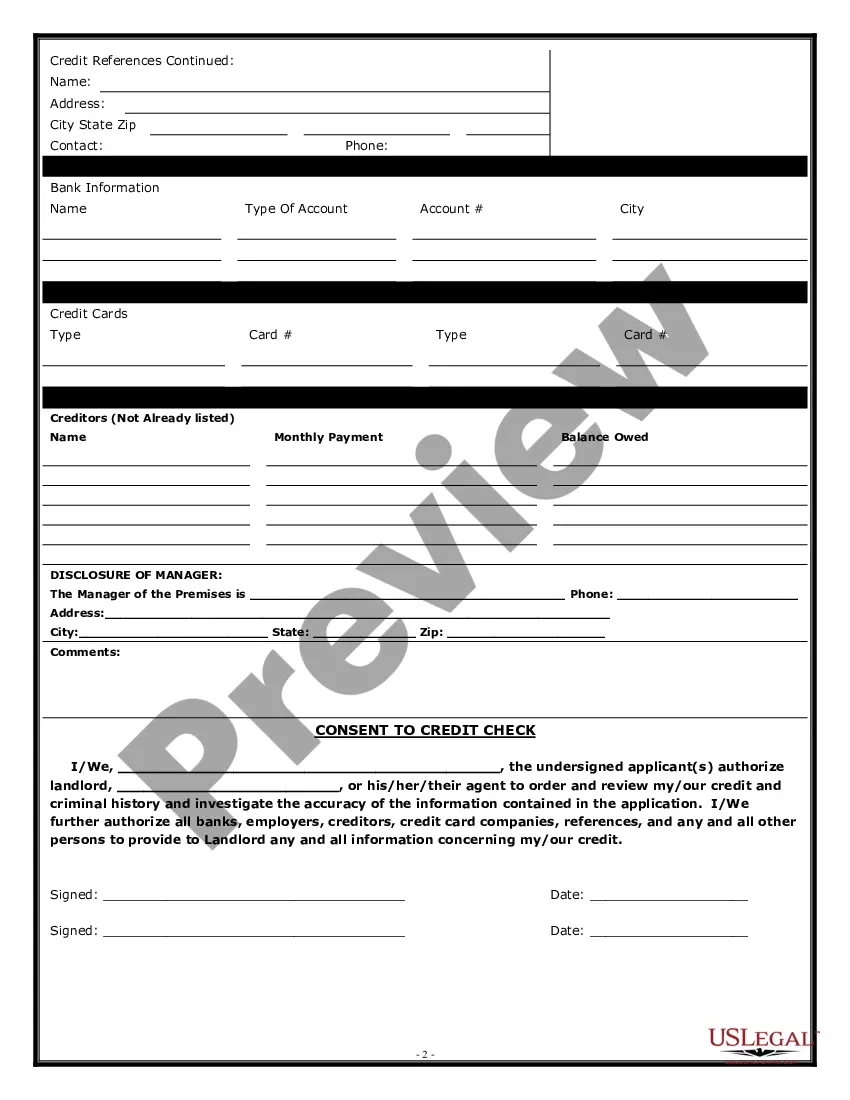

- Examine the form's description or check it through the Preview option.

- If the previous option isn't suitable, search for another example using the Search field in the header.

- Once you locate the correct Commercial Rental Application Form, click Buy Now.

- Choose a pricing plan that aligns with your needs and budget.

- Create an account or Log In to advance to the payment page.

- Complete your subscription payment using PayPal or a credit card.

- Select the format for your document and click Download.

- Print your file or upload it to an online editor for quicker completion.

Form popularity

FAQ

The approval process for a commercial lease typically takes anywhere from a few days to several weeks, depending on various factors. These factors include the completeness of the submitted commercial rental application form, tenant background checks, and negotiations regarding lease terms. To expedite the process, ensure you provide all required documentation and information upfront. This approach can help both you and the landlord move forward quickly.

To create a rental application form, begin by outlining all the necessary information needed from your applicants, such as their contact details, rental history, and employment information. You can utilize online platforms like US Legal Forms, which offer customizable templates for commercial rental application forms. This simplicity allows you to easily gather the essential details in one place, ensuring you don’t miss any critical information. Once your form is prepared, you can easily distribute it to prospective tenants.

Yes, renting to own commercial property is a viable option for some businesses. This arrangement allows tenants to rent a space with the possibility of purchasing the property later, providing a pathway to ownership. If you're interested, make sure to mention this during the commercial rental application process, and clarify the terms with your landlord.

The most common commercial lease agreement is the triple net lease, where the tenant pays rent along with property expenses such as maintenance, insurance, and taxes. This type of lease is favored because it provides landlords with a predictable income stream while offering tenants flexibility. When completing the commercial rental application form, be prepared to discuss your preference for lease types.

Starting a commercial lease involves several steps, beginning with identifying a suitable property. Once you find a location, you will need to fill out a commercial rental application form which may require detailed financial and business information. After your application is approved, you can negotiate lease terms before signing the agreement and securing your new space.

The minimum term for a commercial lease often ranges from one to five years, depending on the property type and landlord preferences. This duration provides stability for both the tenant and the landlord, ensuring the space remains occupied. When considering leasing options, review the commercial rental application form to understand the terms associated with your desired property.

To rent commercial property, you will need specific documentation and information. This usually includes a completed commercial rental application form, proof of income, and business financials. Additionally, landlords may request personal guarantees, business plans, and bank statements to ensure that you can meet the rental obligations.

The minimum credit score for a commercial lease typically varies by location and property type. Generally, landlords prefer a credit score of at least 650, though some may accept lower scores depending on other qualifications. As you prepare your commercial rental application form, it's essential to understand the specific criteria established by the landlord or leasing agent.

Filling out a rental application template involves several steps. First, gather necessary information such as personal identification, employment details, and financial history. Next, accurately complete each section of the commercial rental application form, ensuring that all information is clear and truthful. Finally, review the completed application for any errors before submitting it to the landlord or property manager.

The most important part of a rental application is the financial information provided by the applicant. This section typically includes income, credit history, and background information. Accurately completing the commercial rental application form with comprehensive financial details can enhance your chances of securing a favorable lease arrangement.