File A Lien

Description

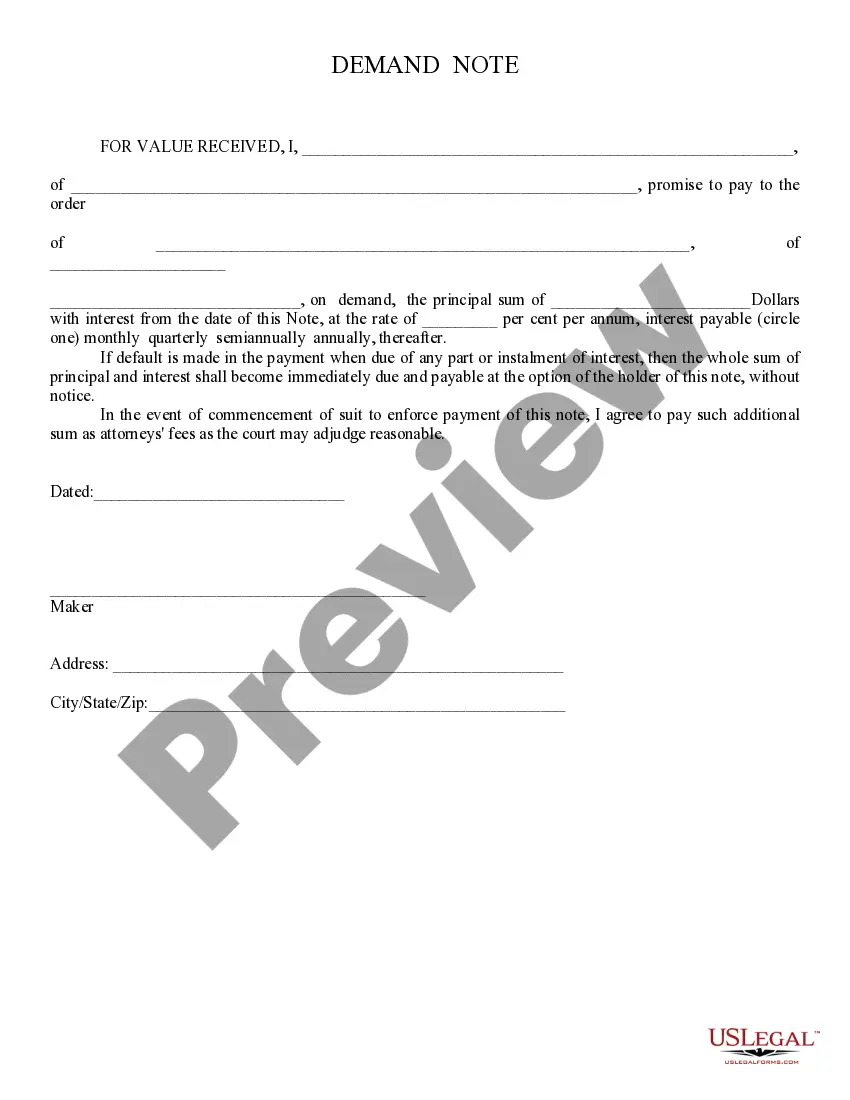

How to fill out Colorado Affidavit Of Service Of Notice Of Intent To File Lien Statement?

- Log in to your US Legal Forms account if you’ve used the service before. Ensure your subscription is active; renew if necessary.

- Explore the Preview mode to view the form's description. Confirm that you have selected the correct lien form that aligns with your local jurisdiction requirements.

- If the selected forms do not meet your needs, utilize the Search tab to find alternative templates that better suit your situation.

- Proceed to purchase the document by selecting the Buy Now button and selecting a suitable subscription plan. You will need to create an account for full access.

- Complete your transaction by entering your credit card details or using your PayPal account to finalize the subscription.

- Download your form to your device for easy access, and find it later via the My Forms section in your profile.

US Legal Forms streamlines the process of filing a lien by providing an extensive library of over 85,000 fillable and editable legal documents. This means you can quickly find the forms you need while ensuring compliance with your local laws.

In conclusion, using US Legal Forms simplifies the filing of a lien. Don't hesitate to take advantage of our comprehensive service today to ensure your legal documents are accurate and well-prepared.

Form popularity

FAQ

In Minnesota, individuals and organizations who have provided services or materials for property improvements can file a lien. This typically includes contractors, subcontractors, and suppliers. To file a lien effectively, it is essential to follow specific legal procedures and deadlines. If you need assistance with this process, consider using US Legal Forms to ensure you file a lien correctly and avoid potential pitfalls.

In Indiana, you generally have a limited time frame to file a lien, which is often 90 days from the date the debt arises. If you miss this window, you may lose your right to secure your claim. Understanding these deadlines is vital, and utilizing resources like USLegalForms can help ensure you complete this process timely and correctly.

To file a lien on a title, you must first gather the required documentation detailing the debt you are securing. Then, you can complete the lien filing forms, which may vary by state. Submit these documents to your local title office or agency that governs liens. Using USLegalForms can guide you through this process, ensuring you don’t miss any crucial steps.

Yes, you can file a lien online using various legal service platforms, including USLegalForms. Filing a lien online typically involves filling out the necessary forms and submitting them electronically to the appropriate authorities. This method is fast, efficient, and convenient, saving you time and effort. However, ensure you follow all legal guidelines to protect your interests.

Yes, you can file a lien on property that you own, but it is essential to understand the legal requirements involved. Generally, a lien can be placed on real estate or personal property to secure a debt. This process varies by state, so you may want to check local laws. Using a platform like USLegalForms can simplify this process for you.

When you choose to file a lien, you may face several disadvantages. One significant drawback is that it can affect your credit score, making it harder for you to secure loans in the future. Additionally, liens can complicate the sale of your property, as buyers may be hesitant to proceed with a lien in place. It's important to weigh these factors carefully before deciding to file a lien.

Filing a lien involves several conditions, including having a valid debt, providing proper documentation, and adhering to legal filing procedures. You must demonstrate that services rendered or materials provided have not been compensated. Each state has its specific laws governing these conditions, so it is crucial to research and comply with them. Platforms like UsLegalForms can help guide you through these requirements and ensure that you file a lien correctly.

The minimum amount required to file a lien generally depends on state laws and the specific type of lien being filed. Some states do have a minimum threshold, while others may not specify a minimum amount. It's essential to research your local regulations and understand the financial implications before filing a lien. This knowledge helps you prepare appropriately and makes the process smoother.

In Virginia, the timeframe to file a lien typically spans from 30 to 60 days after the last date of service or delivery. This timeframe can vary depending on the nature of the lien and the contractual agreements involved. It’s critical to file a lien within this period to secure your right to claim. Be sure to consult proper resources to ensure you file a lien correctly.

To file a lien in Texas, you must have a valid reason, such as unpaid services or materials related to property improvement. You'll need to complete a lien form, include specific details about the debt, and submit it to the county clerk's office. Additionally, serving the property owner with a copy of the lien is vital to ensure they are aware of your claim. Following these requirements will help you effectively file a lien in Texas.