Security Deposit With Credit Card

Description

How to fill out Colorado Letter From Landlord To Tenant Returning Security Deposit Less Deductions?

It’s clear that you cannot transform into a legal expert instantly, nor can you easily understand how to swiftly prepare Security Deposit With Credit Card without possessing a specialized skill set.

Drafting legal documents is a lengthy procedure that necessitates specific education and expertise.

So why not entrust the development of the Security Deposit With Credit Card to the professionals.

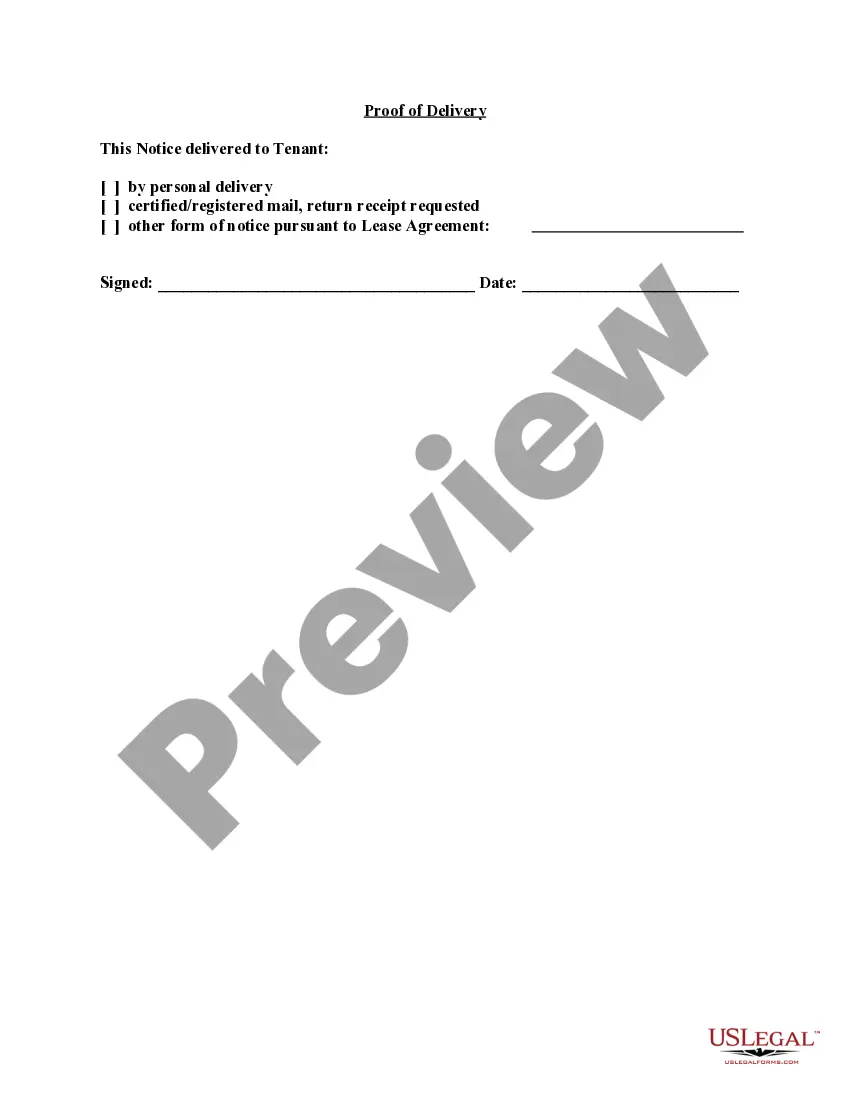

Preview it (if this option is available) and review the supporting description to determine if Security Deposit With Credit Card is what you’re seeking.

Begin your search anew if you require any additional form.

- With US Legal Forms, one of the most comprehensive legal document repositories, you can discover everything from court documents to templates for internal communication.

- We recognize the significance of compliance and adherence to both federal and local regulations.

- That’s why, on our platform, all documents are location-specific and current.

- Here’s how to get started with our platform and obtain the document you require in just a few minutes.

- Locate the document you need using the search bar at the top of the page.

Form popularity

FAQ

A security deposit on a credit card serves as collateral for the credit limit provided to you. When you make your deposit, it is held by the card issuer until you close the account or default. If you manage your payments responsibly, you may eventually transition to an unsecured card. Using a security deposit with a credit card not only protects the issuer but also helps you establish a positive credit history.

A deposit of $300 for a secured credit card acts as a guarantee for the lender. This amount typically represents your credit limit, ensuring that the card issuer has some protection in case of default. By requiring a security deposit with a credit card, issuers can extend credit to individuals who may not qualify for unsecured cards. This helps you build your credit profile over time.

When using a $200 secured credit card, you should deposit the full amount of $200 as your security deposit. This amount becomes your credit limit. Therefore, any charges you make should not exceed this limit. A security deposit with a credit card acts as a safeguard for the lender while allowing you to manage your spending.

To put a security deposit on a credit card, you typically start by applying for a secured credit card. Once approved, you will need to send a specific amount as a deposit, which serves as collateral. This deposit is usually equal to your credit limit. Using a security deposit with a credit card can help you build or improve your credit history.

Most secured credit cards require a deposit of $200 to $300. The more you deposit, the higher your credit limit will be and the more flexibility you'll have in using your card.

Myth 1: Your credit card security deposit is nonrefundable Reality: The security deposit on your secured credit card is fully refundable ? you can get your security deposit money back if you close your account, so long as you pay your balance in full.

The security deposit is used by the card issuer as collateral if a cardholder defaults on their credit card balance. The deposit is typically equal to the card's credit limit, though this can vary. As a result, you can often increase your credit limit by paying a larger security deposit.

To keep your scores healthy, a rule of thumb is to use no more than 30% of your credit card's limit at all times. On a card with a $200 limit, for example, that would mean keeping your balance below $60. The less of your limit you use, the better.

It is possible to use a credit card to transfer money into a bank account by using a cash advance or balance transfer check, but we can't recommend it. Cash advances are risky because of the high interest rates and costly one-time fees. Balance transfers can lead to more debt if they're not handled correctly.