Nevada Closing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Nevada Closing Statement?

US Legal Forms is really a special system to find any legal or tax template for submitting, such as Nevada Closing Statement. If you’re fed up with wasting time looking for ideal samples and paying money on record preparation/legal professional fees, then US Legal Forms is exactly what you’re trying to find.

To enjoy all the service’s advantages, you don't need to install any application but simply select a subscription plan and create your account. If you have one, just log in and find the right template, download it, and fill it out. Saved documents are stored in the My Forms folder.

If you don't have a subscription but need to have Nevada Closing Statement, check out the guidelines listed below:

- check out the form you’re checking out applies in the state you want it in.

- Preview the sample and look at its description.

- Click Buy Now to reach the sign up page.

- Select a pricing plan and carry on registering by providing some information.

- Select a payment method to complete the registration.

- Download the document by choosing the preferred file format (.docx or .pdf)

Now, complete the document online or print it. If you feel uncertain regarding your Nevada Closing Statement template, contact a attorney to check it before you decide to send or file it. Begin hassle-free!

Form popularity

FAQ

Dissolving the Corporation The Nevada statutes covering voluntary dissolution of corporations provide for voluntary dissolution through a stockholder vote at a stockholder meeting. Before the vote, your board of directors must submit a proposal to dissolve to the stockholders.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office.

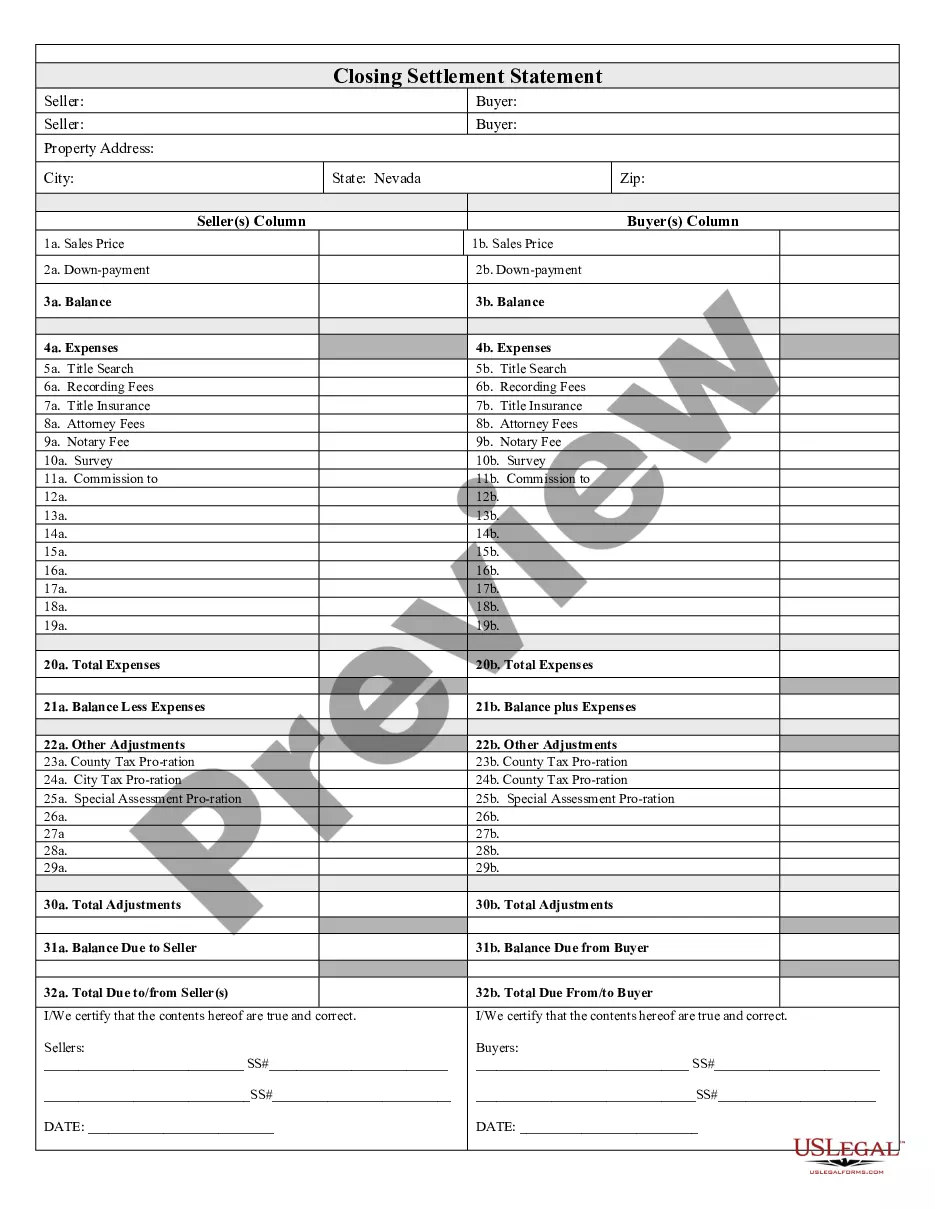

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

A closing statement, also called a HUD1 or settlement sheet, is a legal form your closing or settlement agent uses to itemize all of the costs you and the seller will have to pay at closing to complete a real estate transaction.

Voter Approval. Before you begin the process of dissolving your business, you must get an approval by vote from your shareholders, directors, or managers. IRS Forms. The IRS requires certain forms to be filed when you go through the process of dissolving your business. Certificate of Dissolution.

Credits and debits appear on the closing statement. Which of the following will appear as a buyer debit and seller credit at closing?

The deed and mortgage documents are filed with the county recorder and these become public record. 3feff You can always obtain copies of these from the recorder's office or from a title company. Most documents are digitized in some form, especially those related to the transaction.

Close Account For any other account updates including location changes, contact the Call Center: 1-866-962-3707.