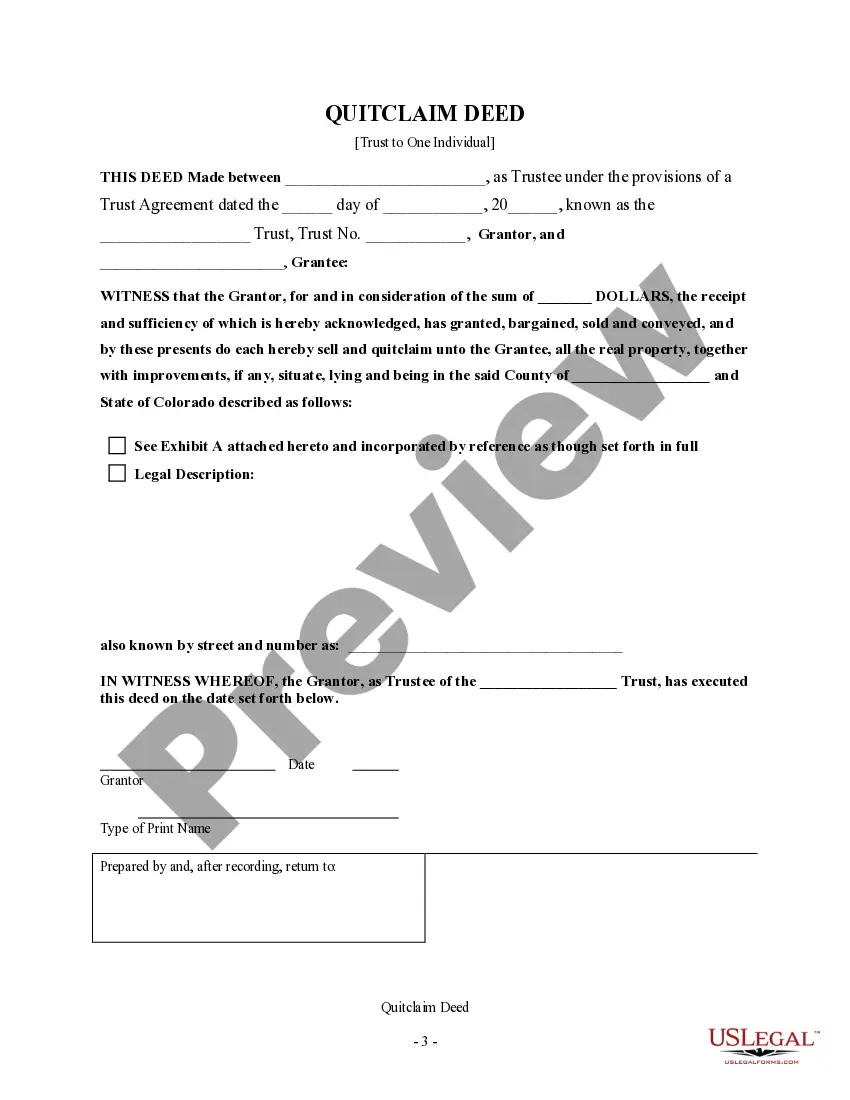

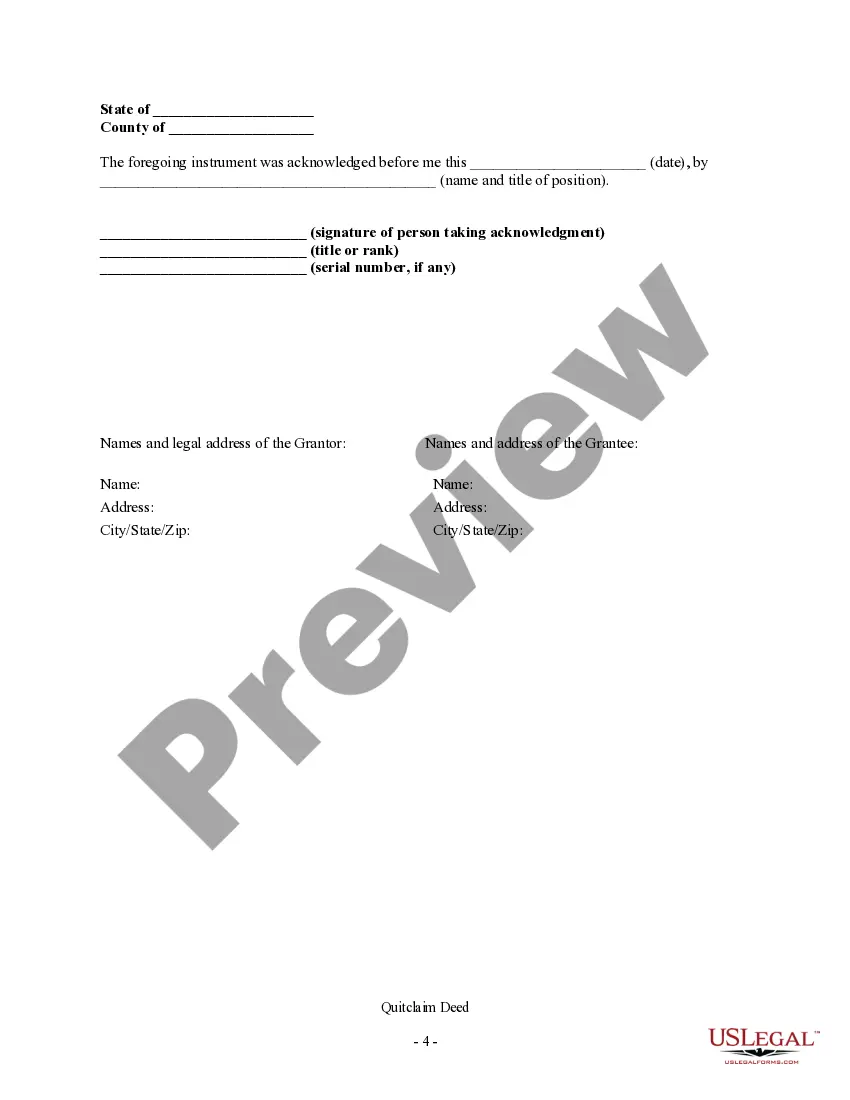

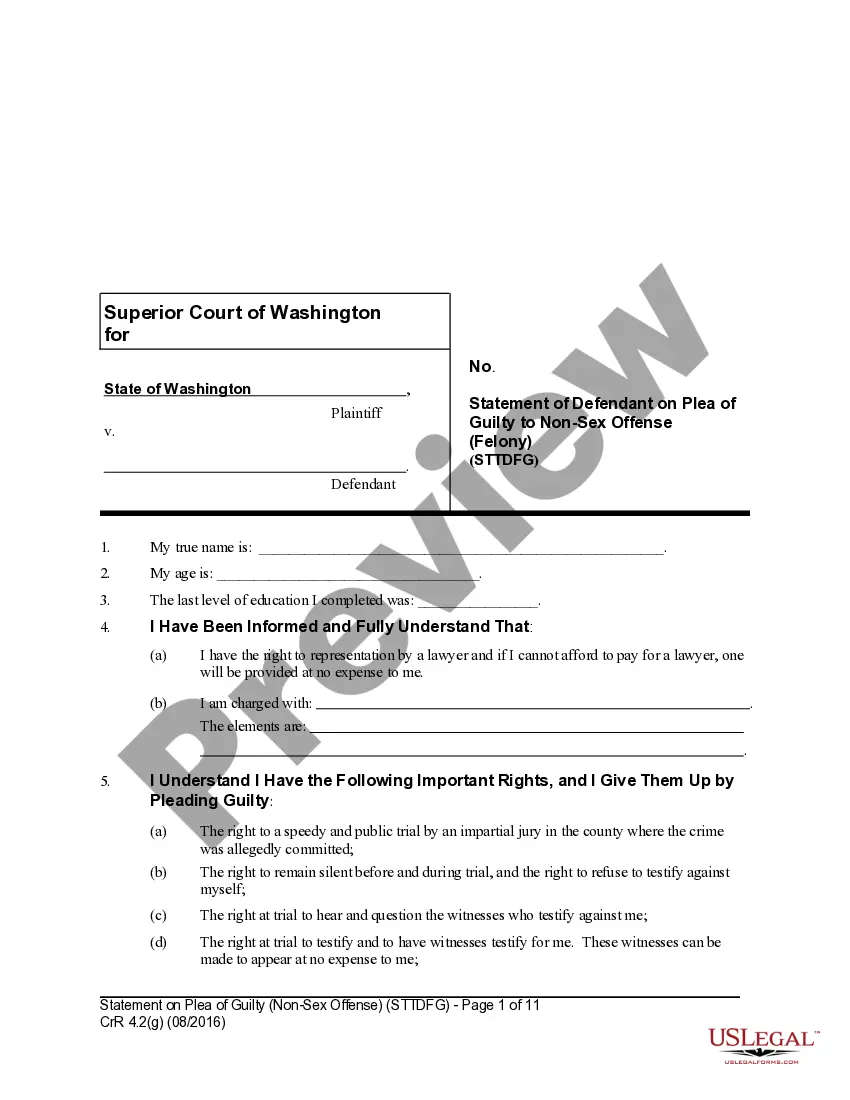

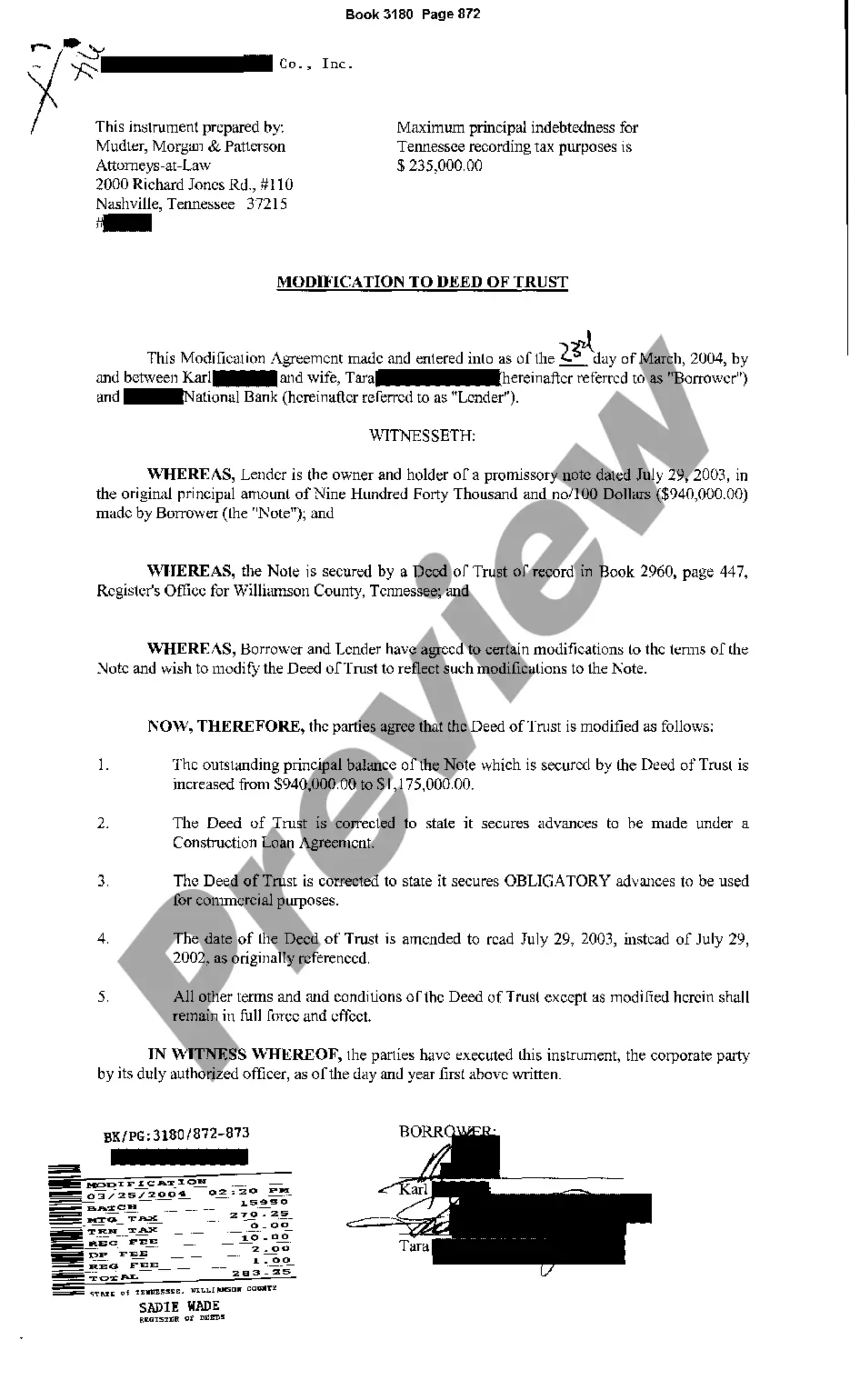

This form is a Quitclaim Deed where the grantor is the trustee of a trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Deed With No Warranty

Description

How to fill out Deed With No Warranty?

How to obtain professional legal forms that adhere to your state’s regulations and prepare the Deed Without Warranty without hiring a lawyer.

Numerous online services offer templates to address various legal matters and formalities. However, it may require time to discover which of the available samples fulfill both use case and legal requirements for you.

US Legal Forms is a trustworthy platform that assists you in locating official documents drafted in accordance with the latest state law updates and enables you to save money on legal support.

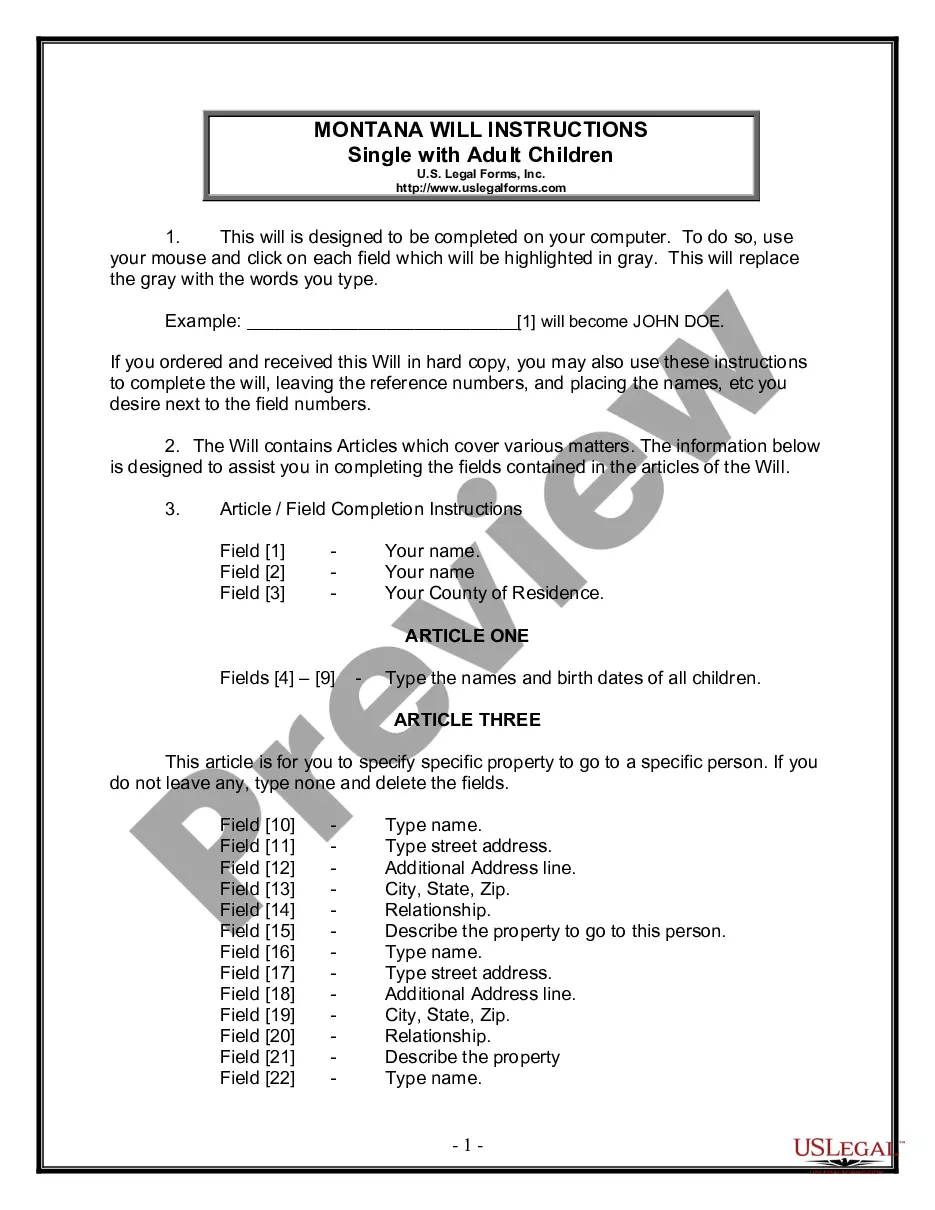

If you lack an account with US Legal Forms, then follow these instructions: Navigate through the web page you have opened and see if the form meets your requirements. To do this, utilize the form description and preview options if accessible. Look for another template in the header indicating your state if necessary. Click the Buy Now button when you identify the suitable document. Choose the most appropriate pricing plan, then sign in or register for an account. Select your payment method (by credit card or through PayPal). Modify the file format for your Deed Without Warranty and click Download. The acquired documents will remain in your possession: you can always revisit them in the My documents tab of your profile. Subscribe to our library and prepare legal documents independently like a seasoned legal professional!

- US Legal Forms is not just a typical online catalog.

- It's a compilation of over 85,000 verified templates for different business and personal scenarios.

- All documents are categorized by field and state to expedite your search process and enhance convenience.

- Additionally, it integrates with robust tools for PDF editing and eSignature, allowing users with a Premium subscription to quickly complete their documents online.

- It requires minimal effort and time to acquire the needed paperwork.

- If you already possess an account, Log In and ensure that your subscription is current.

- Download the Deed Without Warranty using the relevant button next to the file name.

Form popularity

FAQ

The weakest form of deed is the quitclaim deed, which provides the least protection to the buyer. A quitclaim deed only transfers whatever interest the seller has in the property, without warranties or guarantees regarding the title. Comparatively, a deed with no warranty offers some assurances, but it also places more risk on the buyer. Assess your needs and risks before choosing a deed type.

The strongest form of deed is the general warranty deed due to its extensive protections and guarantees. This deed assures buyers that they are receiving full ownership and that the seller has clear title to the property. While a deed with no warranty offers fewer protections, it may be suitable for specific transactions where risk mitigation is not as crucial. Always consult legal guidance when navigating these options.

A general warranty deed provides the most protection to the buyer. It assures that the property has no encumbrances and the grantor guarantees against future claims. Conversely, a deed with no warranty offers limited protection, meaning the buyer accepts the property 'as-is.' Thus, understanding the implications of each type of deed is essential for making informed decisions.

The most powerful deed typically refers to a general warranty deed. This deed offers the highest level of protection to the buyer, as it guarantees that the grantor holds clear title to the property and has the right to sell it. However, a deed with no warranty can serve specific purposes, such as when the seller is uncertain about the property's title. In such cases, the buyer should conduct thorough inspections and title searches.

One disadvantage of a warranty deed is that it may involve a more extensive and possibly costly title search and insurance. While it provides strong protection to the buyer, the seller must guarantee clear ownership and may be liable for any title defects. If urgency is a concern, a deed with no warranty might expedite the process but at the risk of assurances.

The safest kind of deed is usually a warranty deed because it assures buyers that the seller holds clear title to the property and will protect against future claims. A deed with no warranty lacks these protections, which can leave buyers vulnerable. Always evaluate your risk tolerance and property details when choosing the best deed for your situation.

In Texas, a deed without warranty can offer more protection than a quitclaim deed. While a quitclaim deed simply transfers whatever interest the seller has without guarantees, a deed with no warranty may imply some level of intent to transfer a legitimate title. To ensure you make the best choice, it’s wise to understand the differences and consult with professionals.

Generally, a warranty deed is considered the safest type because it provides the highest level of protection to the buyer. In contrast, a deed with no warranty offers less protection regarding the title history. If safety is a priority, reviewing all options and considering potential risks with an expert can help you make an informed decision.

When a deed is described as 'without warranty', it means that the seller makes no guarantees about the property’s title. This type of deed, known as a deed with no warranty, transfers ownership without ensuring that the seller holds clear title or that there are no encumbrances. Buyers should be aware that this may carry risks, so understanding the implications is crucial.

The best type of deed often depends on the specific situation of the property transaction. A deed with no warranty can be suitable for transferring property quickly and efficiently, especially when dealing with motivated sellers or properties with uncertain histories. However, it is important to consult with a legal expert to ensure that the chosen deed aligns with your needs and protects your interests.